Futarchy — where democracy and markets meet

What is futarchy?

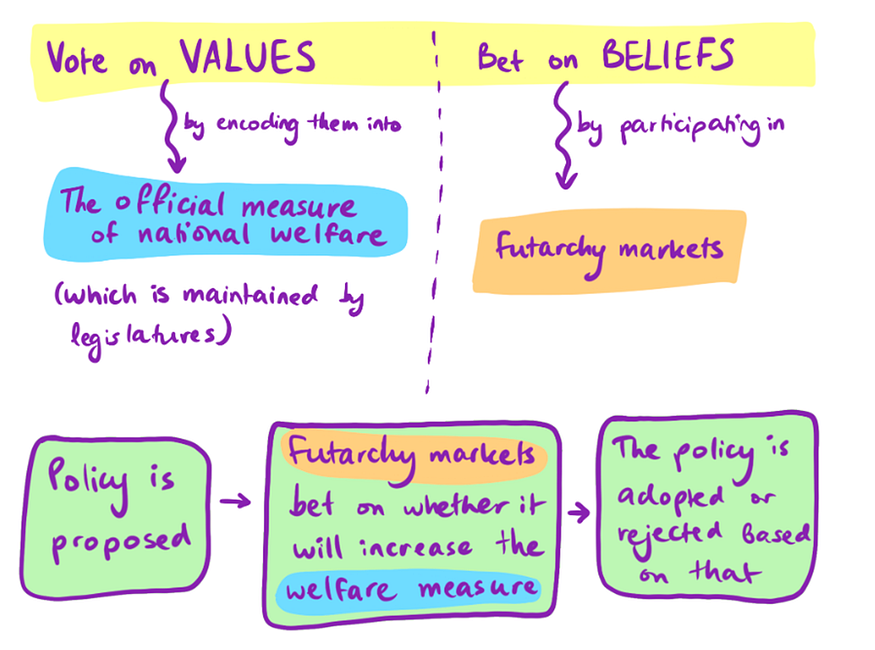

Futarchy was proposed by Robin Hanson as a futuristic form of government in 2000. It delegates decision making on major questions, such as whether a particular policy will be approved or declined to markets. Under this system individuals vote not on a policy itself but bet on a metric best approximating that policy. It’s like democracy powered by relative accuracy and objectivity of betting markets. Futarchy

Futarchy

Though betting markets are not perfect and can be prone to extreme price deviations, such as bubbles which are then followed by large drawdowns, our concern should be not their absolute accuracy. Instead, as Hanson correctly states, the crucial questions ought to be how a particular institution performs in comparison to alternative institutions which do almost the same thing. Hanson mentions several examples where speculative markets — to which betting markets belong — have been better than other entities in aggregating formation and forecasting. For example, orange juice futures markets beat official weather forecasts. Likewise, horse racing market odds predict racetrack results better than racetrack experts.

How it works

Once a policy has been put forward, two prediction markets are created where participants can bet on the outcome of the policy. They can bet on approval or decline of the policy (proposal) in question. A decision is made at maturity when the prediction period is over. If the price of the approval (yes / pass / confirm — the exact wording doesn’t matter) market is higher than that of reject market, the proposal is considered passed. Otherwise, it is rejected.

Futarlandia

Let me illustrate how futacrhy works with an example. Imagine a country Futarlandia that is being governed by futards, i.e., who believe in futarchy and practice it. Let’s say, the country votes on the ban of import and production of cigarettes. Average human lifespan over a 5-year period in that country is selected as a metric (or a welfare asset). Two markets, “yes” tokens and “no” tokens, are created for this policy. “Yes” tokens are being traded at 79.3 which refers to human years, while “no” tokens can be bought for 77.4 at the end of the period. This means that the market participants collectively think that if the ban on cigarettes is imposed, people on average will live 79.3 years. Which is almost 2 years longer than the markets thinks how long people would have lived if cigarettes weren’t made illegal.

If you start thinking about this example, some arguments against futarchy will come to your mind. Arguably the most glaring one is that the metric we selected — average human lifespan — may not be the factor best approximating the policy. Certainly, cigarettes do have a negative impact on the length of human lifespan. But smoking is only one factor among others influencing how long we live.

We cannot ignore market manipulation either. Some groups, e.g., lobbyists of tobacco industry are interested in a certain outcome, “no”. These actors can aggressively buy “no” tokens and/or short “yes” tokens. This may distort the information the market conveys.

Arguments against futarchy

Now that we understand what futarchy is and what its benefits are. We also saw that futarchy is not without its issues. Let’s look at some of practical and theoretical shortcomings of futarchy in more detail.

Market manipulation. Someone interested in “yes” tokens can buy aggressively and/or simultaneously short “no” tokens. However, this can be counterbalanced by individuals wishing to profit from mispricing. If market participants realize that the current state doesn’t reflect the market’s best knowledge, they will take an opposite position to the manipulator which will neutralize the market. Therefore, it takes a lot of financial resources to dominate the market; the problem is not dissimilar to 51% attack.

Likewise, suggestion that hedging, as surmised by several authors, distorts market prices is not a strong counter-argument. If an entity wishes to hedge against a policy that they expect will make them lose money if accepted, they will hedge their positions in the prediction market. This sceptics of futarchy claim that leads to misrepresentation of information aggregated by markets. In our example, cigarette makers (i.e., tobacco companies) would buy “yes” tokens in the market because they would be worse off if this scenario happens in the real world.

But this is actually what we’d like to see because we believe this will increase national welfare. Unless you somehow benefit from a shorter human lifespan, I assume you wish humans live longer rather than succumb to the limitations of mortality earlier. Furthermore, hedgers thicken the market, i.e., they add liquidity to it which makes the decisions markets a better institution in aggregating information.

Markets are volatile. They are self-referential and reflexive. What this means is that people tend to buy because others buy. Accepting this basic human behavior implies that most traders’ decisions don’t matter and they distort the information contained in speculative markets.

Frankly, I’m not sure if my response to this argument will convince you but here is what I think. Given a sufficiently long period for trading, e.g., 5 years, I believe the market will self-correct itself. Bubbles don’t last for years after all! And the same argument with market manipulation can work here as well. If some traders start to see the state of the market differently than others, they will short an uptrending market or will buy the one which incessantly had been falling.

Human values are complex, it’s hard to summarize and express them in one number. Yes, but all major political questions are complex in some ways but we (or legislators representing us) vote on them. This argument cannot negate the benefits of delegating decision making to prediction markets.

There may be cases when “causality diverges from conditionality”. Suppose a company governed in a futarchial way is running a market which will decide whether to fire or keep the current CEO. If price of the tokens conditional on CEO leaving the company higher than of the tokens conditional on CEO staying, then CEO will be fired. But in most cases when the company decides if to fire or not the CEO, some terrible things, such as poor performance have already happened to the company. So, traders might trade the CEO-leaves stocks at a low price, not necessarily because they believe the CEO’s competence directly affects stock prices, but because they anticipate that the decision to fire the CEO is correlated with recent negative events within the company. Though this argument is not insignificant and as such shouldn’t be dismissed immediately, I believe setting up cleverer markets can fix it.

Finally, I want to note that if it seems that I shed more light on arguments against than arguments for futarchy, this is not because I think it is a doomed idea. Au contraire, I truly believe futarchy with its shortcomings is still superior to other kinds of governance. And emphasizing its drawbacks or the strongest arguments against it is only for countering these arguments and attempting to underline the robustness of futarchy.

Meta-DAO

How Meta-DAO works

Meta-DAO is the first entity implementing futarchy in the world. DAO (decentralized autonomous organization) is a management structure leveraging blockchain technology and smart contracts to distribute decision-making and ownership among community members. All issues, voting and treasure management among others, are governed by smart contracts and are stored on a blockchain.

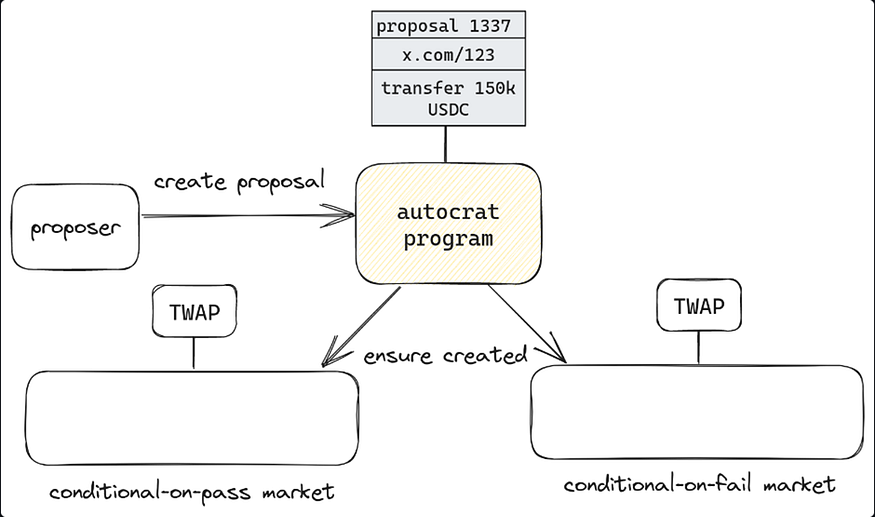

We understand what the concept of futarchy is about and what a DAO is, let’s look at specifically Meta-DAO. At the core of the Meta-DAO lie proposals. Proposals are at the core of Meta-DAO. Anyone can come with a proposal to Meta-DAO. You interact with the autocrat program — which is at the center of the image below — to create a proposal which contains several details, such as proposal number, a URL of the description of the proposal, and an SVM (Solana Virtual Machine)-executable instruction. Once a proposal has been created, the autocrat program generates two conditional markets for that proposal — conditional-on-pass market and conditional-on-fail market. Meta-DAO

Meta-DAO

After a preset time (which is 10 days at the time of this writing) has elapsed, any participant can finalize start the proposal finalization. How do we know which of the two markets “won”? This is what TWAP (time-weighted average price) program does. If at the maturity TWAP of the conditional-on-pass market is trading higher than TWAP of conditional-on-fail market, an SVM instruction is executed which marks the proposal “passed”. Pass market is finalized and fail market is called off. Exactly opposite happens when TWAP of the fail market is higher than that of the pass market: the proposal is considered “failed”, an SVM instruction finalizes the fail market, and the pass market is reverted.

If at the maturity, the pass market wins, i.e., its TWAP is higher than that of the fail market, conditional-on pass tokens called pUSDC (pMETA) are converted into USDC (or META), and conditiona-on-fail tokens called fUSDC (or fMETA) are burned. If the fail market wins, then fUSDC (or fMETA) tokens are converted into USDC (or META) tokens, and pUSDC (or pMETA) tokens are burned.

Let’s look at the real proposal, namely proposal 5 to see how Meta-DAO actually works. Proposal 5 was triggered in order to raise money and launch a liquidity pool on a DeFi protocol built on Solana, presumably Meteora. We see that TWAP of the pass market was higher than TWAP of the fail market when the proposal was finalized. Therefore, this proposal has been marked “passed” and the fail market has been reverted. To revert means that those trades are made void, it is as if these trades were never executed.

How to get started

If you, like me, find the concept of futarchy and its implementation by Meta-DAO amazing and this piece of writing could convince you to participate in the future of decentralized governance, I’m more than happy. Now you think “all this sounds cool in theory but how to get started with Meta-DAO?”

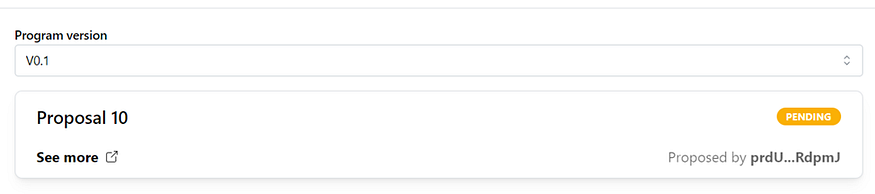

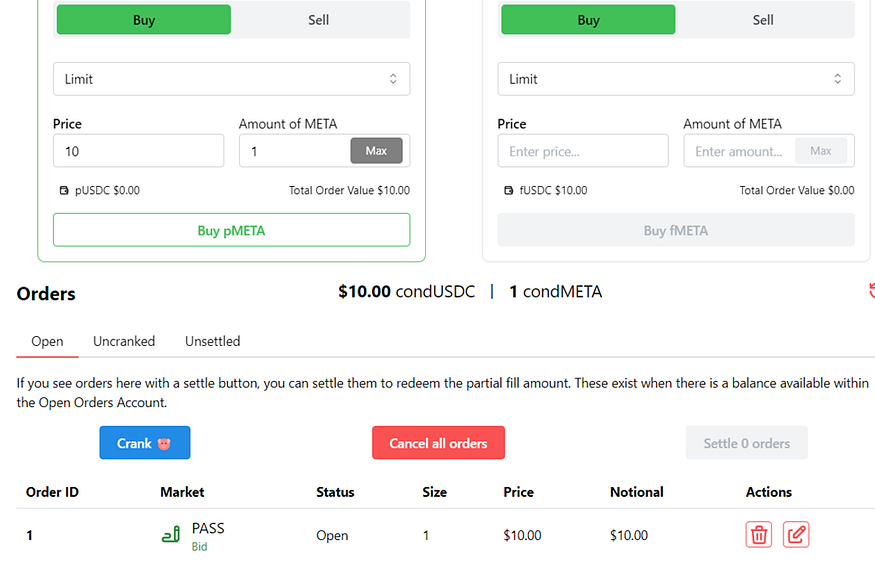

Whitepaper and distribution channels, such as Discord and Twitter are helpful but I believe a real understanding of something comes doing that thing. So, in what follows I describe step-by-step what I did. Go to an active proposal on https://app.themetadao.org/. Enter an amount you want to mint META or USDC. For every USDC or META deposit we’ll receive conditional tokens. If, for example, we deposit 10 USDC, 10 pUSDC and 10 fUSDC tokens will be minted. As already mentioned, they are deployed to trade pass and fail markets respectively.

Enter an amount you want to mint META or USDC. For every USDC or META deposit we’ll receive conditional tokens. If, for example, we deposit 10 USDC, 10 pUSDC and 10 fUSDC tokens will be minted. As already mentioned, they are deployed to trade pass and fail markets respectively. Once I got received my pUSDC and fUSDC tokens, I swapped my 10 pUSDC with 1 pMETA because I want this proposal to be passed.

Once I got received my pUSDC and fUSDC tokens, I swapped my 10 pUSDC with 1 pMETA because I want this proposal to be passed. So, now I have 100 fUSDC and 1 conditional-on-pass META which is denoted condMETA in the screenshot above. The end of any proposal is a binary event — it’ll either pass or fail. If proposal 10 passes, I can swap my conditional-on-pass META tokens with the “real” META token. If it fails, I’ll get my 10 USDC back.

So, now I have 100 fUSDC and 1 conditional-on-pass META which is denoted condMETA in the screenshot above. The end of any proposal is a binary event — it’ll either pass or fail. If proposal 10 passes, I can swap my conditional-on-pass META tokens with the “real” META token. If it fails, I’ll get my 10 USDC back.

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)

![[LIVE] Engage2Earn: McEwen boost for Rob Mitchell](https://cdn.bulbapp.io/frontend/images/c798d46f-d3b8-4a66-bf48-7e1ef50b4338/1)