Reasons to Trade BUSD-Margined Futures on Binance

Photo: Courtesy of Binance

Photo: Courtesy of Binance

1.Main Takeaways 2.Introduction 3.What is a Stable coin? 4.What is BUSD? 5. What is Binance BUSD-M futures contract? 5.Why You Should Choose BUSD as Your Collateral 6.Benefits of Holding BUSD 7.How to Start Trading BUSD-Margined Futures on Binance 8.How to Use the Multi-Assets Mode to Trade BUSD-M Futures 9.Using Binance Mock Trading to Sharpen Trading Skills 10. Final Thought 11. Disclaimer.

Main Takeaways.

Stability in the value of BUSD over time coupled with its huge liquidity are reasons why BUSD is popular amongst crypto-traders.. You can choose to hold BUSD as your collateral while trading BUSD-Margined Futures. BUSD is the 7th largest crypto-coin with 18 Billion coins in circulation and a market capitalization of 18 Billion USD as at 11 June, 2022. Binance Multi-assets mode could be used to place more than one trade at a time.. You do not just go into futures trading all of a sudden because there is Binance futures testnet that you can use to practice trades with in order to perfect your trading skills.

Introduction

The blockchain has continued to improve the financial ecosystem for the better but the application of the blockchain is seen in almost every industry across the globe ranging from agriculture to architecture and health.

Using the blockchain to create a store of value without a central authority control is one of the foremost aims of cryptocurrency which is one of the earliest applications of the blockchain. Only of recent, the world learnt of the Luna crash and many who lost their investments in the Terra Luna project are yet to recover from it.

Has this event deter crypto enthusiasts from trusting in the blockchain? No, they know that Innovations are not always perfected at the first go. Though the losses incurred by the incredible crash of the Terra Luna and its twin stable coin, UST are quite enormous, we must boost the morale of the financial companies, crypto-exchanges and all individuals who invested in the project to continue having solid trust in the blockchain technology.

In this piece of writing we shall examine the reasons why you should trade BUSD-M Futures on Binance. We shall also briefly explain some terms such as BUSD and stable coin and then go ahead to touch on how we can trade BUSD-M Futures, use the Binance Multi-asset mode and mock trading.

Binance has been at the forefront to ensuring that the best hybrid products and services between the centralized and decentralized finance are created to facilitate financial freedom for the common people in streets across the world. It has a whole lot of innovative products and services in its ecosystem and the only requirement to access these products is a verified Binance user account and you are good to go.

What is a Stable coin?

A stable coin is a crypto coin or token which has sufficient resistance to market volatility as a result of a pegged value to a fiat currency unit, a physical asset like gold and even an Algorithmic crypto-asset. Examples of stable coins include BUSD, USDC, TUSD, USDT, DAI, and PAXG. What do we mean by pegging the value of a stable coin to a fiat currency, gold or another crypto-coin?

To ensure the continuous stability of a stable coin, the market value of this coin is equated to the value of a paper money. This is done practically by staking a fiat currency in a bank reserve. For example, if there are 10 billion BUSD in circulation, Binance is required by law to have 10 billion USD in a bank reserve because the value of 1BUSD is pegged to 1 USD.

The above scenario is also true in situations where a particular crypto-currency is pegged to either Gold and another crypto-coin. PAXG is an example of a stable coin tied to Gold and this means the quantity of PAXG in circulation is practically possible if Paxos makes a Gold deposit that equate the value of PAXG.

As at the time of writing, the market price of 1 PAXG is $1,882.94 which is corresponding to the price of 1 ounce of Gold in the Gold market today. UST is a good example of a stable coin tied to another crypto-coin in order to retain price stability. A stable coin is often preferred by traders because it makes their trade values stable, with little or no volatility to worry about. A stable coin can insulate its users against inflation and deflation. Most people are turning to stable coins because of their resemblance to fiat currency but most importantly because they sense that it is the future of global finance and economy.

What is BUSD?

BUSD means Binance USD. It is a USD-backed coin deployed on several blockchain protocols which include Ethereum chain, Binance smart chain, Tron chain, Polygon chain. As at June 10, 2022, there are about 18 billion BUSD in circulation with a market capitalization of an estimated $18 Billion and a market dominance of 1.56%, making it the 7th largest coin on the global cryptocurrency exchanges.

BUSD is being regulated by several financial firms, Paxos being one of them. Licensed Auditors usually audit BUSD on a monthly basis and send their report to New York financial regulators. BUSD is mainly traded on Binance but few other quality crypto-exchanges trade it too.

What is the BUSD operational mechanism? If you need 1 USD on the Binance exchange, your 1 BUSD is sent to Paxos where it is burnt and then 1 USD released for you in order to maintain the 1:1 ratio of the BUSD to the USD. When a mild de-pegging occurs, traders tend to buy more of BUSD to resell it at 1 USD. This triggers a demand for BUSD and a higher demand reverses this de-pegging to 1:1 ratio.

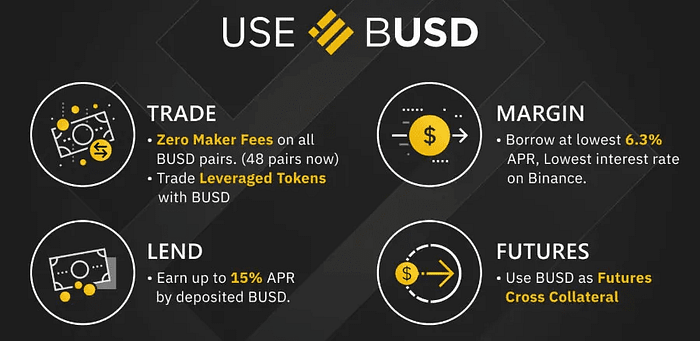

This mechanism ensures that the price of BUSD remain always as 1 USD. Staking and lending services by Binance has led to the rapid growth of BUSD market capitalization. Other BUSD-related incentives such as zero withdrawal fees for BUSD BEP20 withdrawals on Binance smart chain, zero maker fees on all BUSD trading pairs and zero trading fees for four BUSD-based trading pairs(USDC/BUSD, USDT/BUSD, TUSD/BUSD and PAX/BUSD) have made BUSD Popular amongst all manner of crypto-traders. The benefits of holding BUSD are highlighted in this piece. Read on.

What is Binance BUSD-M Futures contract?

BUSD-M contract is a form of crypto-assets trading where all the processes are carried out using BUSD as the only coin. BUSD-M future presents as perpetual contracts only and permits traders to hold on infinite trading positions.

Funding fees for every perpetual trade is imposed on traders who either receive or pay one. BUSD-M means Binance USD margin. There are two margin modes with which futures traders can trade their crypto-assets. These are cross margin and isolated margin. Each margin has its advantages and disadvantages.

For the advantages, Binance futures cross-margin has more trading pairs and leverage level while Binance isolated margin is advantageous when it comes to liquidation, only the assets with in the confines of your cross-margin can get liquidated if you suffer any trade losses. The benefits of trading BUSD-M futures include fee discounts, maker rebates, high liquidity and simple settlement of trading profits which are usually done in BUSD.

Why You Should Choose BUSD as Your Collateral?

The fact that BUSD is a quality, stable and trusted coin is a good reason why you should prefer holding your Binance futures collateral in BUSD. There are other reasons which are listed under the benefits of holding BUSD in whatever manner, be it collateral, staking, dual investment, savings etc.

Benefits of Holding BUSD

There are several merits to holding BUSD especially on the Binance exchange and this includes:1. It has a very large market capitalization of about 18 Billion Dollars.2. It has a very large liquidity and this facilitate speedy transactions with little or no waiting time.

3. It is equal to 1 USD in actual value and completely backed by cash .4. It is strictly regulated by legal financial bodies in New York USA and has stringent compliance.5. It has two ongoing promotions: zero transaction fee for BUSD stable coin pairs and zero maker fee.6. It has over 20 crypto-wallets and 36 crypto-exchanges supporting it.

7. It is reliable with more 1 million people holding it and trusting it as a genuine store of value.8. It is the stable coin of choice in decentralized finance activities.9. It bridges the gap between traditional finance and DeFi(Decentralized Finance).10. The best stable coin to use in liquidity pools and yield farms because of its stability.

11. It can be used as an offline mode of payment between parties e.g. some private businesses accept BUSD in place of the USD.12. Many reputable companies have partnered with Binance thanks to the BUSD reputation.13. Transactions in BUSD are very fast, extremely flexible and accessible by any body without geographical restriction except in countries where there is complete ban on crypto-activities.

14. BUSD has several blockchain protocol versions for ease of transactions and lower transaction and withdrawal fees consideration. Versions include BUSD ERC20, BUSD TRC-30, BUSD BEP2, BUSD-BEP20 etc. and these, can easily be swapped by users on Binance or using the Binance Bridge feature.

How to Start Trading BUSD-Margined Futures on Binance

Trading Binance futures can be down any one who has the knowledge, adequate practice and psychology to trade responsibly. Here are few steps to accessing and trading BUSD-M futures:1. Get a Binance account and then verified it to tier 2 level.2. Fund your Binance futures account by moving funds from your spot account to Futures account.

3. Select your choice of BUSD-M futures contracts 4. Adjust your leverage to your convenient level or use the default leverage level5. Place your buy or sell order using either limit or market order. To get started, readers can visit Binance futures trading here: https://www.binance.com/en/futures/homeref=11515767

How to Use the Multi-Assets Mode to Trade BUSD-M Futures on Binance?

Multi-Assets mode is a recent Binance addition to Binance futures and allows trader to buy and sell BUSD-based pairs in addition to those of USDT-based which prior to this time was the only stable coin used in trading Binance Margined futures.

The Multi-assets mode uses only Binance futures cross margin and you should be conscious of this. Futures traders can gain access into BUSD-M futures either via Binance website (desktop) or Binance mobile App using your android or IOS phone. We shall be highlighting the steps to access the multi-assets mode on the Binance app:

1.Log into your verified Binance user account2. You should click on [futures]3.You should choose [Multi-Assets mode]4. You should switch your multi-assets mode to ‘Cross Margin’ by tapping the switch button which will turn to yellow from Ash.5. Secure your trading positions(Long or Buy and Short or Sell)6. Enter other important trading details, confirm the same details and click on [Long/Short) position7. Tick the grey box to accept Binance trading terms8. Click on the submit button.

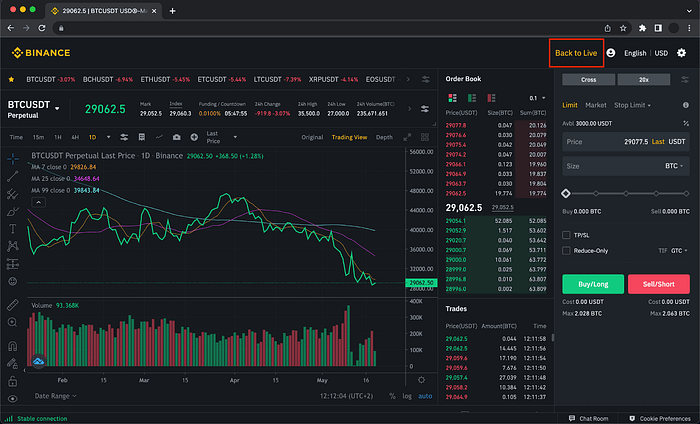

Using Mock Trading to Sharpen Trading Skills Photo: Courtesy of Binance

Photo: Courtesy of Binance

Binance Futures testnet enables you to perform mock live trading non-withdrawable USDT. It requires no starting fund from your end because you will be practicing with up to 10,000 USDT for free. When you persistently practice on Binance testnet, you can perfect your trading skill, understand how futures trading works and prepare yourself for a real trading experience in the actual Binance futures market.

How to access Mock trading on Binance Futures testnet.

1. Log into Binance user account2. Access [Binance Futures].3. Create a Binance futures account if you don’t have one.4. Tap the profile icon.5. Click [Mock Trading].6. [Continue] to create a testnet account. You can decide to go directly to Binance futures testnet and sign up for a test trading account. Binance futures testnet can be accessed via: https://testnet.binancefuture.com/en/futures/BTCUSDT

Final Thought

Binance provides every product and service that can get you started with BUSD-M Futures trading and those which can enhance your trading experience to harvesting modest profits. The multi-assets mode feature spares you the time used in placing single trades repeatedly while the Binance testnet acclimatizes you to the actual trading environment and enables you to develop sufficient skills before you start trading in real time using your own funds. Trading futures on Binance can be rewarding when you know your onions. With reasons deduced why you need to trade BUSD-M futures on Binance, it is worthwhile you get started soon.

Disclaimer

Crypto-trading and investment in crypto derivatives could be risky activities because of the volatile nature of cryptocurrencies. Do your own research before engaging in crypto related activities and in case you are in doubt, consult your finance adviser. Nothing in this piece of writing should be construed as a financial advice.

NB

I featured this article on LinkedIn and medium. It could also be accessed in those places via: https://medium.com/@mikhailikpoma/reasons-to-trade-busd-margined-futures-on-binance-534016330115

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)

![[LIVE] Engage2Earn: McEwen boost for Rob Mitchell](https://cdn.bulbapp.io/frontend/images/c798d46f-d3b8-4a66-bf48-7e1ef50b4338/1)