MicroStrategy buys another 786 million USD in Bitcoin

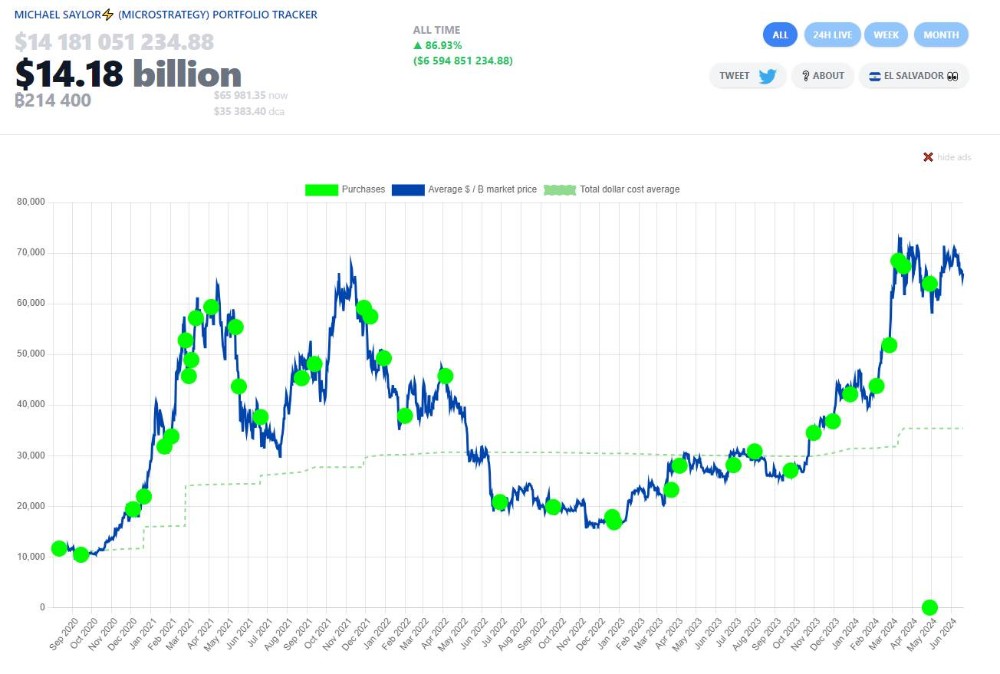

On the evening of June 20, 2024 (Vietnam time), MicroStrategy announced to buy an additional 11,931 BTC worth 786 million USD. This is the amount of money raised after the company offered 800 million USD in bonds.

MicroStrategy has acquired an additional 11,931 BTC for ~$786.0M using proceeds from convertible notes & excess cash for ~$65,883 per #bitcoin. As of 6/20/24, $MSTR hodls 226,331 $BTC acquired for ~$8.33B at average price of $36,798 per bitcoin.https://t.co/jE9dGqqnON— Michael Saylor⚡️ (@saylor) June 20, 2024

Previously on June 13, MicroStrategy announced plans to offer 500 million USD in convertible bonds, then re-announced 700 million USD. But in the end, it closed at $800 million.

MicroStrategy Completes $800 Million Offering of Convertible Notes at 2.25% Coupon and 35% Conversion Premium $MSTR https://t.co/qJ6awPbKjO— Michael Saylor⚡️ (@saylor) June 20, 2024

With the latest purchases, this public company is holding 226,331 BTC with an average purchase price of 36,798 USD/BTC. Thus, billionaire Michael Saylor's company is making a profit on nearly 80% of its investment portfolio.

Following MicroStrategy's example, many large companies and organizations around the world began to see Bitcoin as an effective investment tool. Most recently, there is the company specializing in developing and operating the Metaplanet hotel or the medical equipment manufacturer Semler Scientific.

![[LIVE] Engage2Earn: McEwen boost for Rob Mitchell](https://cdn.bulbapp.io/frontend/images/c798d46f-d3b8-4a66-bf48-7e1ef50b4338/1)

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)