Sustainable Growth for Bitcoin with No FOMO Signs

Sustainable Growth for Bitcoin with No FOMO Signs

By AZC News | Feb 16 2024

Bitcoin continues to demonstrate resilience even in the face of traders eschewing leverage. The cryptocurrency has surged over 20% from February 7th to February 15th as traders sought to establish a support level around $52,000. This week's uptick is attributed to increased capital inflows into immediately settled Bitcoin ETFs, coupled with economic macro uncertainty. However, Bitcoin derivatives data diverges from the market optimism, indicating skepticism among professional traders about the sustainability of the upward momentum.

The influx of $2.4 billion into Bitcoin ETFs in the past 7 days may be indicative of early signs of a slowdown in the U.S. economy, particularly in the consumer sector.

The sponsorship rate for Bitcoin perpetual contracts remained relatively stable at 0.25% over the past week, indicating a balanced demand and a neutral market. In contrast, at the end of 2023, this index stood at 1%, signaling excessive optimism. Interestingly, despite this, the price of Bitcoin at the end of the year essentially remained unchanged from two weeks prior, hovering around $42,500.

Data also reveals that traders shifted towards a bullish trend after Bitcoin surpassed $48,000 on February 11th, with the basic interest rate surging over 10%. However, this movement pales in comparison to the observed disparity at the beginning of 2024. This suggests that this time, there is no excessive leverage being used to support the market, indicating a healthy signal.

Related: Bitcoin (BTC) Hits New All-Time High in Japan

In summary, all Bitcoin derivative indicators point to a moderate price increase, with no signs of FOMO or high leverage usage as traders remain cautious. Furthermore, bearish sentiment has little incentive to restrain the price of Bitcoin, as capital continues to flow into Bitcoin ETFs, paving the way for potential profits above $52,000.

Disclaimer. This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when Sustainable Growth for Bitcoin with No FOMO Signs

By AZC News | Feb 16 2024

Bitcoin has surged to $52,000, yet signals from the derivatives market indicate that this is a sustainable growth, with no signs of FOMO from traders.Sustainable Growth for Bitcoin with No FOMO Signs

Bitcoin continues to demonstrate resilience even in the face of traders eschewing leverage. The cryptocurrency has surged over 20% from February 7th to February 15th as traders sought to establish a support level around $52,000. This week's uptick is attributed to increased capital inflows into immediately settled Bitcoin ETFs, coupled with economic macro uncertainty. However, Bitcoin derivatives data diverges from the market optimism, indicating skepticism among professional traders about the sustainability of the upward momentum.

The influx of $2.4 billion into Bitcoin ETFs in the past 7 days may be indicative of early signs of a slowdown in the U.S. economy, particularly in the consumer sector.

The sponsorship rate for Bitcoin perpetual contracts remained relatively stable at 0.25% over the past week, indicating a balanced demand and a neutral market. In contrast, at the end of 2023, this index stood at 1%, signaling excessive optimism. Interestingly, despite this, the price of Bitcoin at the end of the year essentially remained unchanged from two weeks prior, hovering around $42,500.

Data also reveals that traders shifted towards a bullish trend after Bitcoin surpassed $48,000 on February 11th, with the basic interest rate surging over 10%. However, this movement pales in comparison to the observed disparity at the beginning of 2024. This suggests that this time, there is no excessive leverage being used to support the market, indicating a healthy signal.

Related: Bitcoin (BTC) Hits New All-Time High in Japan

In summary, all Bitcoin derivative indicators point to a moderate price increase, with no signs of FOMO or high leverage usage as traders remain cautious. Furthermore, bearish sentiment has little incentive to restrain the price of Bitcoin, as capital continues to flow into Bitcoin ETFs, paving the way for potential profits above $52,000.

Disclaimer. This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when Sustainable Growth for Bitcoin with No FOMO Signs

By AZC News | Feb 16 2024

Bitcoin has surged to $52,000, yet signals from the derivatives market indicate that this is a sustainable growth, with no signs of FOMO from traders.Sustainable Growth for Bitcoin with No FOMO Signs

Bitcoin continues to demonstrate resilience even in the face of traders eschewing leverage. The cryptocurrency has surged over 20% from February 7th to February 15th as traders sought to establish a support level around $52,000. This week's uptick is attributed to increased capital inflows into immediately settled Bitcoin ETFs, coupled with economic macro uncertainty. However, Bitcoin derivatives data diverges from the market optimism, indicating skepticism among professional traders about the sustainability of the upward momentum.

The influx of $2.4 billion into Bitcoin ETFs in the past 7 days may be indicative of early signs of a slowdown in the U.S. economy, particularly in the consumer sector.

The sponsorship rate for Bitcoin perpetual contracts remained relatively stable at 0.25% over the past week, indicating a balanced demand and a neutral market. In contrast, at the end of 2023, this index stood at 1%, signaling excessive optimism. Interestingly, despite this, the price of Bitcoin at the end of the year essentially remained unchanged from two weeks prior, hovering around $42,500.

Data also reveals that traders shifted towards a bullish trend after Bitcoin surpassed $48,000 on February 11th, with the basic interest rate surging over 10%. However, this movement pales in comparison to the observed disparity at the beginning of 2024. This suggests that this time, there is no excessive leverage being used to support the market, indicating a healthy signal.

Related: Bitcoin (BTC) Hits New All-Time High in Japan

In summary, all Bitcoin derivative indicators point to a moderate price increase, with no signs of FOMO or high leverage usage as traders remain cautious. Furthermore, bearish sentiment has little incentive to restrain the price of Bitcoin, as capital continues to flow into Bitcoin ETFs, paving the way for potential profits above $52,000.

Disclaimer. This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when Sustainable Growth for Bitcoin with No FOMO Signs

By AZC News | Feb 16 2024

Bitcoin continues to demonstrate resilience even in the face of traders eschewing leverage. The cryptocurrency has surged over 20% from February 7th to February 15th as traders sought to establish a support level around $52,000. This week's uptick is attributed to increased capital inflows into immediately settled Bitcoin ETFs, coupled with economic macro uncertainty. However, Bitcoin derivatives data diverges from the market optimism, indicating skepticism among professional traders about the sustainability of the upward momentum.

The influx of $2.4 billion into Bitcoin ETFs in the past 7 days may be indicative of early signs of a slowdown in the U.S. economy, particularly in the consumer sector.

The sponsorship rate for Bitcoin perpetual contracts remained relatively stable at 0.25% over the past week, indicating a balanced demand and a neutral market. In contrast, at the end of 2023, this index stood at 1%, signaling excessive optimism. Interestingly, despite this, the price of Bitcoin at the end of the year essentially remained unchanged from two weeks prior, hovering around $42,500.

Data also reveals that traders shifted towards a bullish trend after Bitcoin surpassed $48,000 on February 11th, with the basic interest rate surging over 10%. However, this movement pales in comparison to the observed disparity at the beginning of 2024. This suggests that this time, there is no excessive leverage being used to support the market, indicating a healthy signal.

Related: Bitcoin (BTC) Hits New All-Time High in Japan

In summary, all Bitcoin derivative indicators point to a moderate price increase, with no signs of FOMO or high leverage usage as traders remain cautious. Furthermore, bearish sentiment has little incentive to restrain the price of Bitcoin, as capital continues to flow into Bitcoin ETFs, paving the way for potential profits above $52,000.

Disclaimer. This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when Sustainable Growth for Bitcoin with No FOMO Signs

By AZC News | Feb 16 2024

Bitcoin has surged to $52,000, yet signals from the derivatives market indicate that this is a sustainable growth, with no signs of FOMO from traders.Sustainable Growth for Bitcoin with No FOMO Signs

Bitcoin continues to demonstrate resilience even in the face of traders eschewing leverage. The cryptocurrency has surged over 20% from February 7th to February 15th as traders sought to establish a support level around $52,000. This week's uptick is attributed to increased capital inflows into immediately settled Bitcoin ETFs, coupled with economic macro uncertainty. However, Bitcoin derivatives data diverges from the market optimism, indicating skepticism among professional traders about the sustainability of the upward momentum.

The sponsorship rate for Bitcoin perpetual contracts remained relatively stable at 0.25% over the past week, indicating a balanced demand and a neutral market. In contrast, at the end of 2023, this index stood at 1%, signaling excessive optimism. Interestingly, despite this, the price of Bitcoin at the end of the year essentially remained unchanged from two weeks prior, hovering around $42,500.

Data also reveals that traders shifted towards a bullish trend after Bitcoin surpassed $48,000 on February 11th, with the basic interest rate surging over 10%. However, this movement pales in comparison to the observed disparity at the beginning of 2024. This suggests that this time, there is no excessive leverage being used to support the market, indicating a healthy signal.

Related: Bitcoin (BTC) Hits New All-Time High in Japan

In summary, all Bitcoin derivative indicators point to a moderate price increase, with no signs of FOMO or high leverage usage as traders remain cautious. Furthermore, bearish sentiment has little incentive to restrain the price of Bitcoin, as capital continues to flow into Bitcoin ETFs, paving the way for potential profits above $52,000.

Disclaimer. This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a

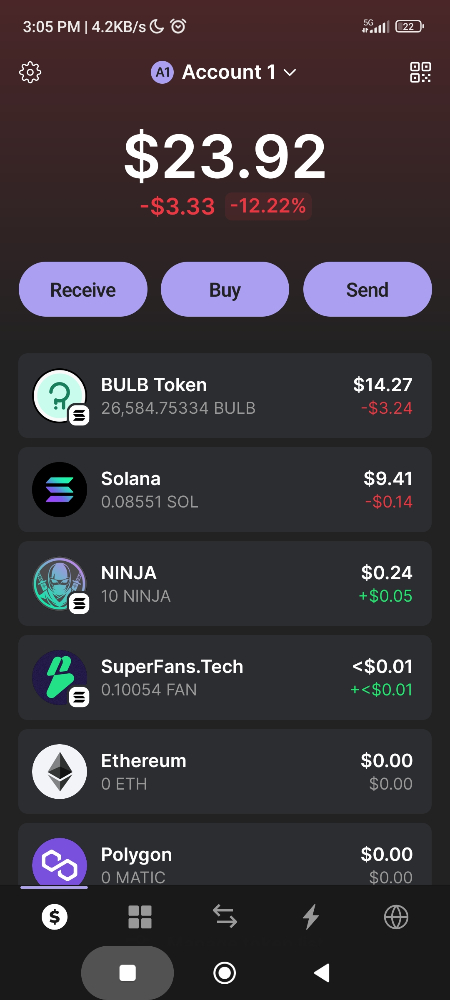

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - I Think I Have Crypto PTSD](https://cdn.bulbapp.io/frontend/images/819e7cdb-b6d8-4508-8a8d-7f1106719ecd/1)