Crypto News Today: BTC-Spot ETF Activity and Binance Grab the Headlines

TC enjoyed a positive session as BTC-spot ETF issuers file amendments before the January 5-10 approval window opens.

Key Insights:

- BTC rallied 3.09% on Monday, ending the session at $42,639.

- On Monday, BTC-spot-ETF-related updates drove buyer demand for BTC and the broader market.

- BTC-spot ETF-related news, the SEC, and US lawmakers remain the market focal points.

Bitcoin Rallies 3.09% as Investor Focus Returns to Spot-ETF News

Bitcoin (BTC) rallied 3.09% on Monday. After a 2.01% slide on Sunday, BTC ended the day at $42,639. Significantly, BTC fell short of the $43,000 handle for the third consecutive session.

BTC-spot ETF-related updates drove buyer demand for BTC and the broader market. Several spot ETF-related updates warranted investor attention after meetings between issuers and the SEC on In-kind/Cash creations/redemptions.

Know where the Market is headed? Take advantage now with

Start Trading

Trading Derivatives carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Derivatives may not be suitable for all investors, so please ensure that you fully understand the risks involved, and seek independent advice if necessary. A Product Disclosure Statement (PDS) can be obtained either from this website or on request from our offices and should be considered before entering into a transaction with us. Raw Spread accounts offer spreads from 0.0 pips with a commission charge of USD $3.50 per 100k traded. Standard account offer spreads from 1 pips with no additional commission charges. Spreads on CFD indices start at 0.4 points. The information on this site is not directed at residents in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

BlackRock (BLK) submitted an S-1 amendment for the iShares Bitcoin Trust. Significantly, BlackRock excluded In-kind creation and redemptions. BlackRock and Fidelity were among the issuers meeting with the SEC to discuss In-kind Creations. Last week, Invesco filed an updated S-1, committing to Cash Creates.

With the January 5-10 approval window approaching, other issuers also filed updated S-1 forms.

Bloomberg Intelligence ETF Analyst James Seyffart shared the updates. Wisdom Tree filed an updated S-1 for the Wisdom Tree Bitcoin Fund. ArkInvest and 21Shares also filed an updated S-1 for the ARK 21Shares Bitcoin ETF, switching to Cash Creations.

There was even a new ETF filing for a 7RCC Spot Bitcoin & Carbon Credit Futures ETF. The Fund will hold 80% BTC and 20% carbon credit futures. Considering the continued focus on Bitcoin mining and the environment, more ESG (Environment, Social, and Governance) filings are likely.

Binance Settles with the CFTC

On Monday, the CFTC announced the court formalized the Binance US, Binance, and CZ settlement with the CTFC. Former Binance CEO CZ must pay $150 million, with Binance paying $2.7 billion. Binance will pay $1.35 billion to the CFTC, with a further $1.35 billion as penalty for ill-gotten transaction fees.

Significantly, Binance’s former Chief Compliance Officer Samuel Lim must pay a $1.5 million penalty “for aiding and abetting Binance’s violations and engaging in activities outside of the US to willfully evade or attempt to evade US law.”

In November, Binance agreed to a $4.3 billion settlement with the US Department of Justice.

The SEC is next in line after filing charges against Binance US, Binance, and CZ in the summer. Significantly, the SEC plans to pursue legal proceedings despite the $4.3 billion payout to the DoJ.

Technical Analysis

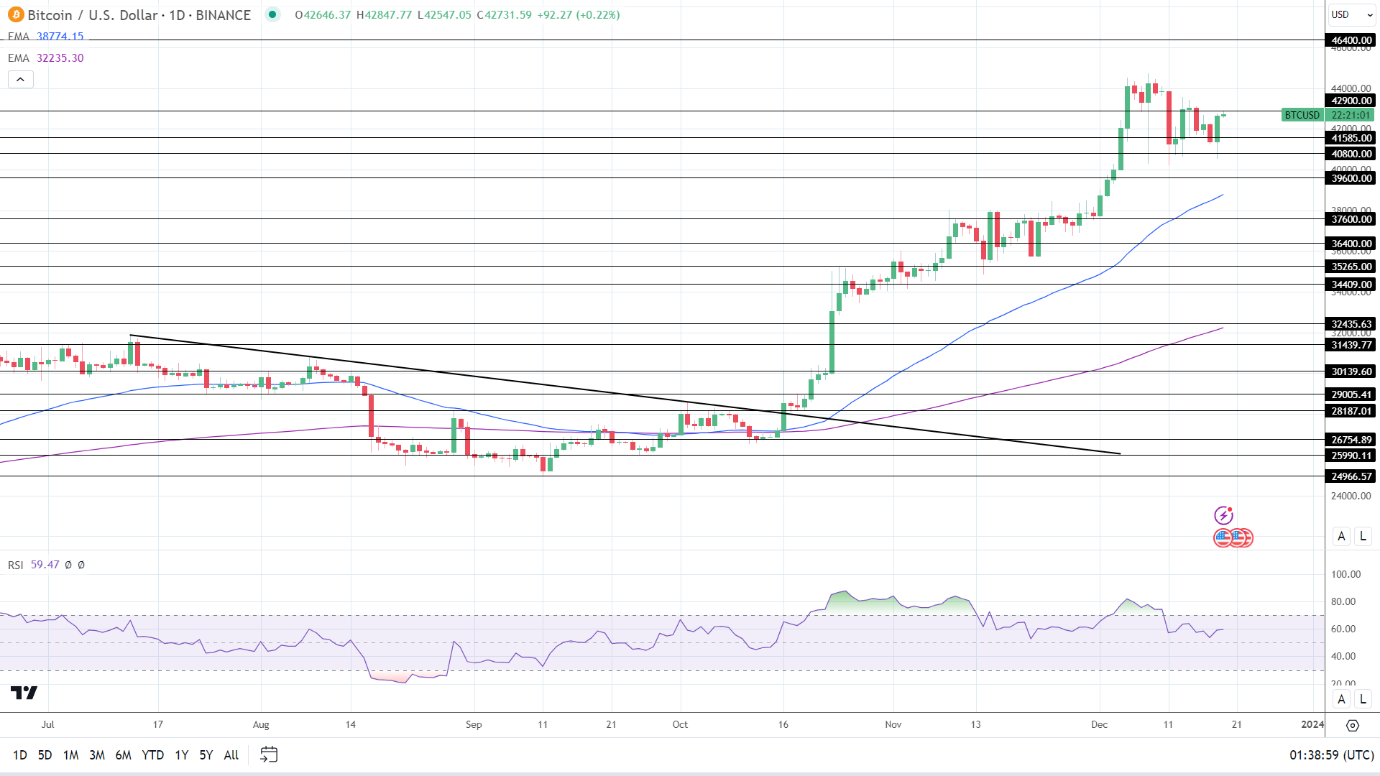

Bitcoin Analysis

BTC sat above the 50-day and 200-day EMAs, sending bullish price signals.

A BTC break above the $42,900 resistance level would give the bulls a run at the 2023 high of $44,747. A move through the December 8 high would bring the $46,400 resistance level into view.

Focal points include BTC-spot ETF-related news and SEC activity.

However, a drop below the $42,000 handle would give the bears a run at the $41,585 support level and sub-$41,000.

The 14-Daily RSI reading, 59.47, suggests a BTC break above the $42,900 resistance level before entering overbought territory. BTCUSD 191223 Daily Chart

BTCUSD 191223 Daily Chart

Ethereum Analysis

ETH held above the 50-day and 200-day EMAs, sending bullish price signals.

An ETH move to the $2,250 handle would bring the $2,300 resistance level into play.

However, a fall through the $2,150 handle would support a break below the $2,143 support level. A drop below the $2,143 support level would bring the 50-day EMA into play.

The 14-period Daily RSI at 53.96 indicates an ETH move to the $2,300 resistance level before entering overbought territory. ETHUSD 191223 Daily Chart

ETHUSD 191223 Daily Chart

Trader Nets $1.60 Million as New Solana Meme Coin Soars 500%

In Brief

- A new meme coin within the Solana ecosystem distributed tokens to over a million addressees.

- A trader capitalized on WEN's popularity, making around $1.60 million in profits within 14 hours.

- The meme coin experienced a remarkable 500% surge in value, reaching a peak of $0.0001378.

- PROMO

- Take advantage of AI to diversify your investment portfolio.Empower your strategy with AlgosOne

Solana has welcomed the emergence of a new meme coin called WEN. This digital asset generated significant community interest after being distributed to over a million wallets.

Solana has welcomed the emergence of a new meme coin called WEN. This digital asset generated significant community interest after being distributed to over a million wallets.

Capitalizing on WEN’s heightened excitement, a savvy trader successfully amassed approximately $1.60 million in profits within 14 hours.

Solana Meme Coin Trader Wins

Blockchain investigator LookOnChain disclosed that the trader initially purchased 20 billion WEN tokens at the launch for $125,500. Subsequently, the trader strategically offloaded 12.5 billion WEN for $807,000, raking in an impressive profit of $682,000.

Despite this substantial sale, the trader still holds 7.6 billion WEN at an unrealized profit of $941,000.

This profit realization coincides with a remarkable surge in the meme coin’s value within 24 hours. According to CoinGecko, the WEN token experienced an extraordinary 500% price increase since its launch on January 26, peaking at $0.00013781 before retracing to $0.00009401.

Read more: 7 Hot Meme Coins and Altcoins That Are Trending in 2024 WEN Market Capitalization. Source: CoinGecko

WEN Market Capitalization. Source: CoinGecko

This surge propelled WEN’s market capitalization to an initial $135 million, which has since adjusted to $95.8 million. Notably, trading data indicates substantial community activity surrounding the Solana-based meme coin.

Data from CoinMarketcap reveals that trading pairs linked to WEN, such as USDC/WEN and SOL/WEN, contributed to over 30% of the trading activity on Solana’s leading decentralized exchange, Jupiter.

What Is the WEN Meme Coin?

The community conceived WEN as a tribute to Weremeow and the prevalent crypto question of “when.”

Usually, “wen” shows anticipation for a token launch or the release of a new feature in the crypto space. On the other hand, the pseudonymous developer of Jupiter, Meow, wrote a fractionalized NFT poem that serves as the genesis of the WEN memecoin.

“I f*cking love wens. Wens mean you are wanted. Even if it is anon internet bros. Wens means they look forward to my sh*t. Even if some just want to dump my ass. Wens mean I am blessed enough to give. Even if most of them don’t give a damn. So to all you wen bros. I am sorry if I get pissed. Just like you to me. This annoyance is born from love. Yes I know you love me. Even if you don’t say it. So keep the wens coming. I will dance along. And you will play with me. Hopefully we will tango and. Wen forever more,” Meow wrote.

The project adopted a strategic distribution approach to its fixed supply of one trillion tokens. Specifically, it airdropped 70% of the tokens to eligible Jupiter users who actively traded a minimum of $5 volume between July 2023 and January 2024. Any tokens not claimed by January 29 will be burnt, according to the project’s official X handle.

DISCLAIMER

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

![[LIVE] Engage2Earn: McEwen boost for Rob Mitchell](https://cdn.bulbapp.io/frontend/images/c798d46f-d3b8-4a66-bf48-7e1ef50b4338/1)

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)