$PENGU Where Are Thy Gains

This article was compiled from a long-form Twitter thread. To read the original, visit this link: https://x.com/inv515/status/1885336511706784173

Where Are Thy Gains $PENGU? A Thread

Recently we looked at the Pengu-JITOSOL LP to park your airdrop. With the recent downturn though, the Penguin had a fall.

LPs do a lot to protect you behind the scenes when the dips hit.

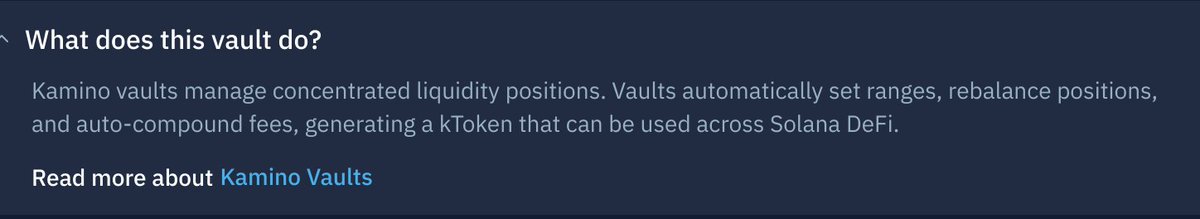

Let's see what the @KaminoFinance pool did 1/10

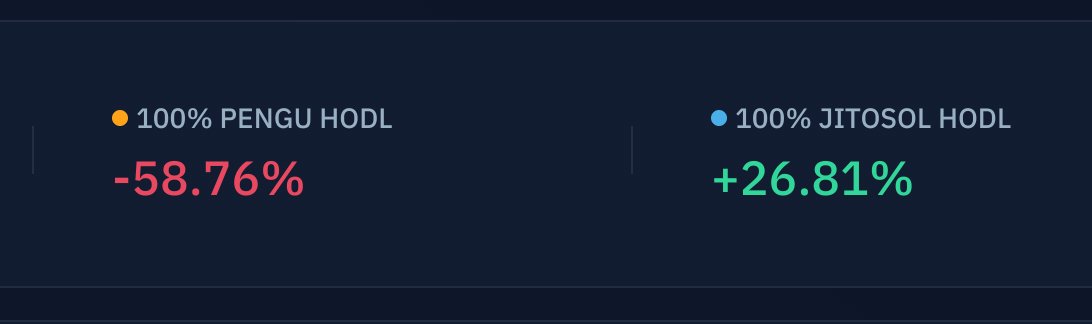

We'll use this chart from the toolkit to give an overall comparison of performance.

With good analytics, we can compare the Kamino strategy against the token pair HODL & individual token HODL.

You can also compare that against a strategy focusing entirely on the JITSOL LST 2/10

LSTs typically stay well pegged to the price of $SOL but meme coins are volatile.

We can see this by looking at the recent $PENGU chart data.

When these sorts of adjustments occur, the automatic liquidity vaults are doing their thing. 3/10

Ratios

Firstly, they help by maintaining optimal liquidity ratios.

They do this by automatically rebalancing assets within the pool.

During the downturn, when $PENGU's value dropped significantly, some of the other features are also useful. 4/10

Impermanent Loss Protection.

By keeping the liquidity provision within specific ranges, Kamino minimizes the risk of IL during volatile market conditions.

This ensures that liquidity providers are not overly exposed to the price swings of individual assets. 5/10

Efficient Capital Use: Automation ensures that liquidity is concentrated where needed.

This reduces the impact of one asset's price drop on overall performance.

The -37.6% from the Kamino Strategy, while negative, still performed better than holding 100% PENGU -58.76% 6/10

LST Benefits The JitoSOL LST strategy (+26.81%) outperformed holding $PENGU significantly.

You'd expect this, given it's pegged to the price of $SOL but it still goes to show they can be a useful strategy for reducing exposure.

As always, choose what works for you, NFA 7/10

Considerations The strategies work well, but at the end of it all, Defi comes with market risks that are outside the control of one provider.

You can still explore, but the protections only help with risk levels to a certain point.

At the end of it all, crypto is crypto. 8/10

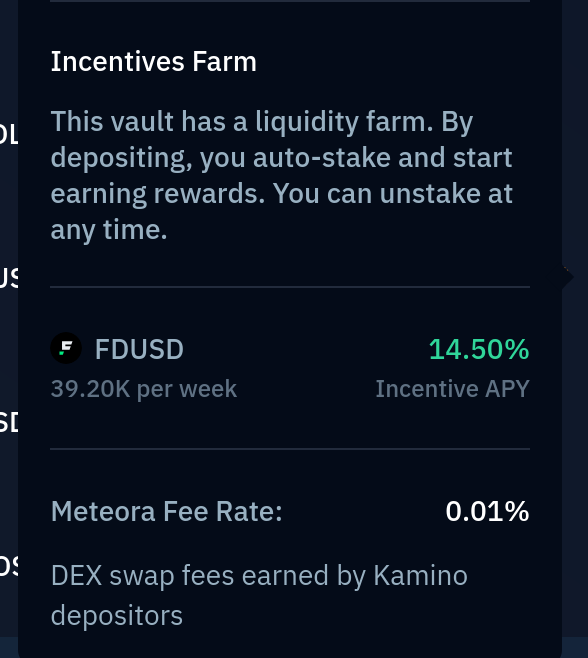

Check it Out Each week you get extra incentives for contributing to pools.

This week, you can earn bonuses for FDUSD/USDC contributions.

These will also give you Kamino points and you know what that means in the middle of airdrop season. 9/10

Like this thread? Follow @gimme_crypto_ for more crypto-related threads.

If you're working on layer three quests you should also check out & join the guild.

Find the details on Telegram http://t.me/gimme_crypto

End of Thread 10/10

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - How To get Rich Quick In Crypto! (1)](https://cdn.bulbapp.io/frontend/images/ae260165-52b4-47cf-a20a-ebeaf50fdb08/1)