What’s Bitcoin ETF? Two fake news surges BTC by 25 points?

There has been a lot of discussion about Bitcoin ETFs recently, and false news comes out from time to time, which makes a few points. There is no official announcement on whether the information is true or false, but there is no doubt that the market has been stirred up.

In this article, let’s learn what Bitcoin ETF is. Only by understanding the concepts can we maintain rational thinking in the fomo information and avoid being led by market sentiment. Bitcoin ETF is a Bitcoin spot fund

Bitcoin ETF is a Bitcoin spot fund

First, you need to understand what ETFs are, namely Exchange Traded Funds.

ETF is an open-end fund that is listed and traded on an exchange and has variable fund shares. It has the advantages of low fees, convenient and fast transactions, and transparent portfolio. It also has a special subscription and redemption mechanism.

ETF is an index fund, a basket of stocks that tracks the trend of the stock market. It can be understood as a package. When a user invests in an ETF, it is equivalent to purchasing every product in the package.

A basket of stocks can effectively prevent investors from stepping into the trap and diversify risks; purchasing this package is equivalent to purchasing the entire sector, saving time in researching each stock. ETF is a fund

ETF is a fund

Bitcoin ETF is a trading platform trading fund based on Bitcoin.

By purchasing a Bitcoin ETF, you are indirectly purchasing Bitcoin. The user owns a fund that can track Bitcoin rather than owning Bitcoin. The income from both is the same.

When purchasing Bitcoin ETFs, you don’t have to worry about the Bitcoins in your wallet being stolen or how to use the wallet, which greatly lowers the threshold for ordinary users to access and purchase Bitcoin; it also provides institutional investors with a channel to invest in Bitcoin, bringing more The entry of funds provides market liquidity and will also stimulate more demand for derivatives.

More importantly, if the Bitcoin ETF application is approved, it means that Bitcoin is included in supervision and its legal compliance is officially recognized, which will also bring new opportunities and promotion to the entire encryption market. Many institutions are applying for Bitcoin ETFs

Many institutions are applying for Bitcoin ETFs

These two fake news about the approval of Bitcoin ETFs have brought about the restoration of market confidence and also brought about an increase in BTC prices.

The first news was that Cointelegraph, a major media outlet, posted false news on Twitter, saying that “the US SEC approved the ISHARES Bitcoin spot ETF”, and the price of Bitcoin quickly rose from US$27,000 to US$30,000;

The second news is that BlackRock released the CUSIP number prepared for the Bitcoin spot ETF review on its official website.

CUSIP, which stands for Committee on Uniform Security Identification Procedures, is the Committee on Uniform Security Identification Code of the American Bankers Association.

Although this is the ETF listing process, it is a pre-listing preparation, which means that BlackRock is beginning to prepare to inject capital into this fund, which means that the Bitcoin ETF is about to be approved, which shows that BlackRock is full of confidence.

After the announcement on the official website, Bitcoin continued to rise, once exceeding $35,000; but then BlackRock deleted the CUSIP number from the official website, and it seemed that everything was back to the starting point.

The price of Bitcoin is currently fluctuating around $34,000, and we don’t know how the market outlook will continue.BlackRock announces BTC ETF code on official website

In addition to BlackRock, the king of global funds, many institutions in the United States have applied to submit Bitcoin spot ETFs, but there has been no clear approval result.

Judging from the key time points for Bitcoin spot ETF application review compiled by BlockBeats, the earliest SEC final review deadline is January 10, 2024, which also means that various recent news are just groundless rumors, and there is no official official announcement from the SEC.

Maybe it’s just the user’s self-pleasure, or the organization’s marketing strategy.

All kinds of good news in the crypto market are released in advance, but will be bad after they are implemented. The news that these two Bitcoin ETFs have been approved is just fake news, but market sentiment is high and prices continue to rise. Critical time for review of Bitcoin spot ETF application

Critical time for review of Bitcoin spot ETF application

An industry leader said that the logic of entrusting the future of the decentralized industry to the regulatory policies of centralized institutions is a bit untenable. It is also expressing the market’s high expectations for Bitcoin ETF.

The blockchain is decentralized, and the Bitcoin spot ETF has returned to the supervision of a central agency, which does sound a bit contradictory. I don’t know if Satoshi Nakamoto considered the issue of supervision when he designed Bitcoin.

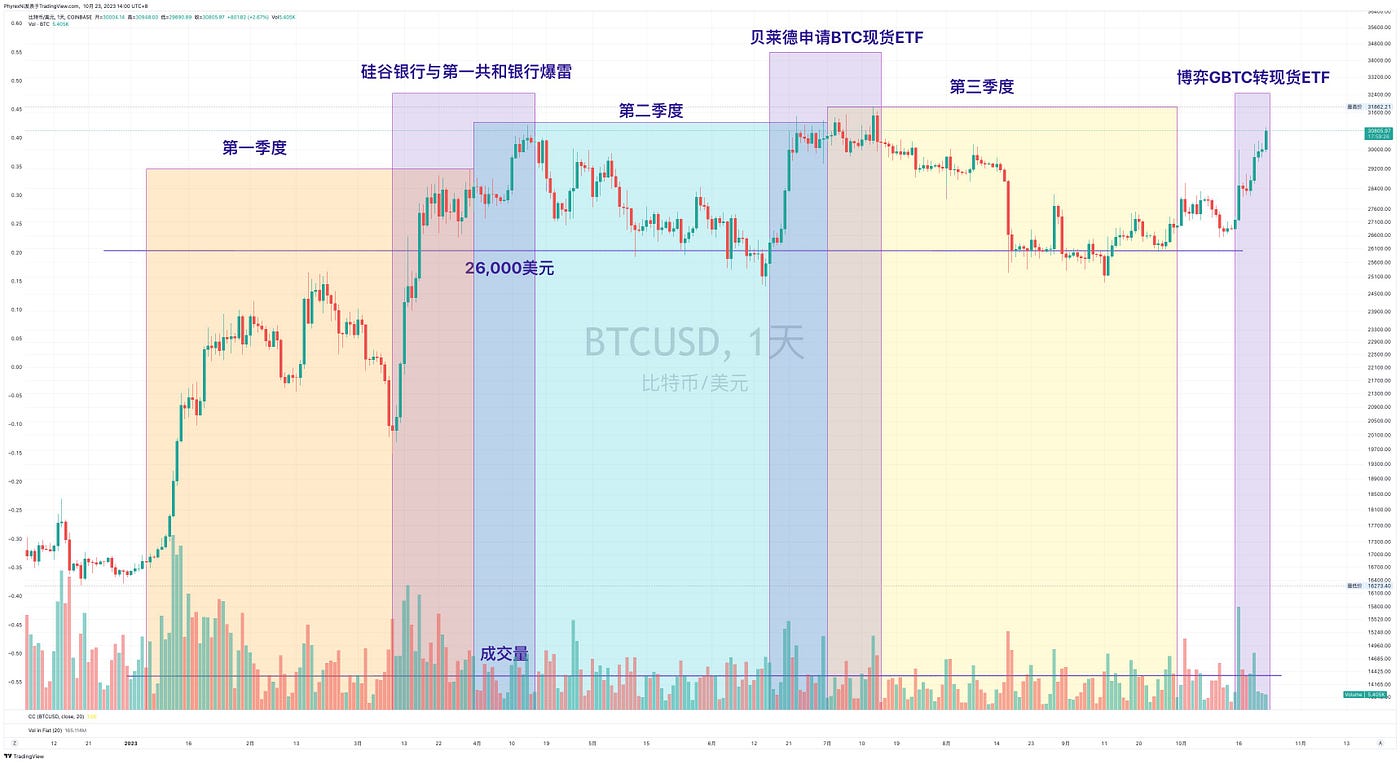

On the one hand, the market hopes that the Bitcoin ETF will pass the review, allowing more ordinary users to participate in the encryption market, bringing more liquidity and benefits to the market; on the other hand, it is worried about how to achieve decentralization if it really returns to institutional supervision. . Bitcoin price yearly trend

Bitcoin price yearly trend

For ordinary individual players, they may not have the energy to think about macro policies such as decentralization and institutional supervision. They just hope to ambush in advance when the market rises, buy at low prices and sell at high points.

At the same time, we must also be careful not to be coerced by the market’s FOMO sentiment, chase prices higher or cut off the market; do not add or reduce positions, cut off the market and increase leverage when stimulated by true or false news. Maybe you just want to seize the opportunity to make a swing, and the makers just want to ship or harvest at a high level.

When the market becomes emotional, it is better to let the bullets fly for a while. When the market comes, it will not be so short-lived. Don’t cut the flesh casually, because it may just be harvested by emotions.

As for the value of Bitcoin spot ETF, the market will give a clear answer in the future. Now that we are in a bear market, it is better to manage your positions first, avoid being washed away, and then look for future opportunities.

The above is just my personal opinion, no investment advice. I am Chuxiaolian, and I am paying attention to the encryption market and web3.

3

Bitcoin Etf

Btc

SEC

3

Follow

Follow

Written by CryptoLola

1K Followers

·

Writer for

Coinmonks

I am a content creator, a self-media. I mainly focus on NFTs, Metaverse, Blockchain, etc.

More from CryptoLola and Coinmonks

CryptoLola

CryptoLola

in

Coinmonks

How to optimize the Gitcoin passport score to above 17?

I did a thrivecoin task some time ago, completed 4 tasks in the first phase, and received 10 OPs, about $15;

5 min read

·

Jul 20, 2023

21

2

Shantanu Gupta

Shantanu Gupta

in

Coinmonks

Which Crypto Will Explode in 2024? Here Are Some Of MyTop Picks.

As we approach the end of the year, investors worldwide are gearing up for the anticipated bull run in the crypto market, eyeing the next…

4 min read

·

Dec 19, 2023

726

4

Velvet.Capital

Velvet.Capital

in

Coinmonks

🚨Velvet.Capital Token Distribution (Airdrop)🚨

🚨 Airdrop Alert🚨: DeFi Asset Management Done right! Everything you need to know for Velvet.Capital’s Token Distribution & Airdrop!

4 min read

·

Dec 30, 2022

40K

1063

CryptoLola

CryptoLola

in

Coinmonks

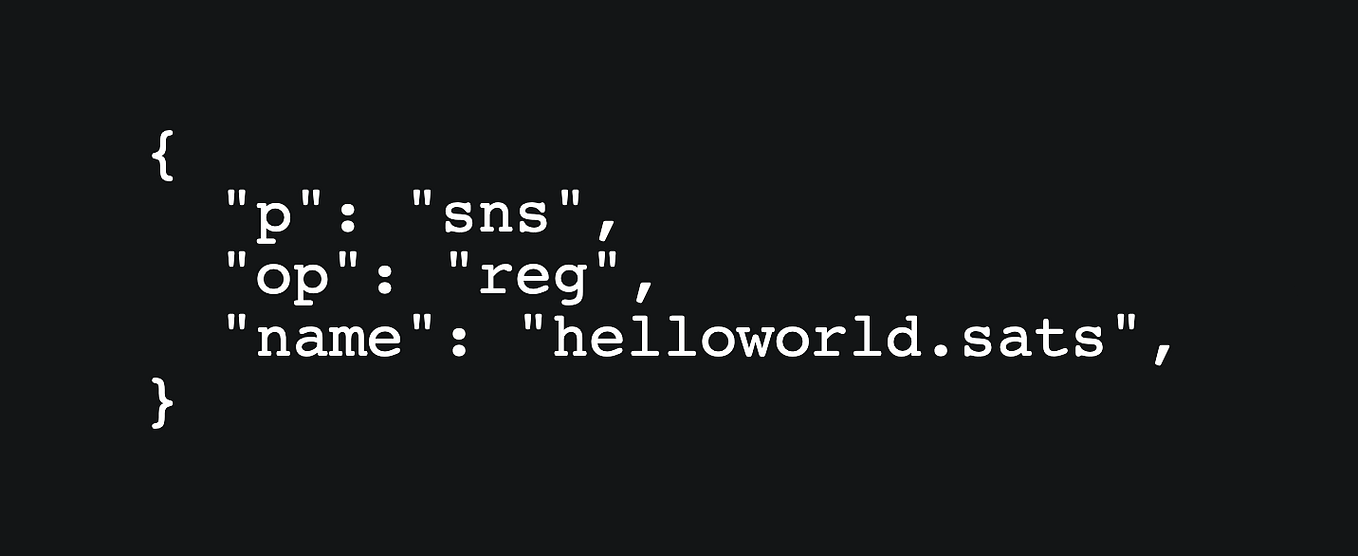

How to register the .sats on the BTC chain?

As the original blockchain work, the BTC domain name was also fired.

5 min read

·

Mar 30, 2023

51

Recommended from Medium

Pantera

Pantera

in

The Crypto Kiosk

Unbank Yourself With Bitcoin Cash

Be Your Own Bank With a $50 Smart Phone and Bitcoin Cash

·

5 min read

·

5 days ago

117

Johnwege

Johnwege

in

Coinmonks

The Greatest Crypto Bull Market You’ve Ever Seen

Throughout your life there will be a handful of decisions that you make that will change your life financially forever. For the better, or…

·

5 min read

·

6 days ago

305

3

Lists

Staff Picks558 stories

Staff Picks558 stories

·

644

saves

Stories to Help You Level-Up at Work19 stories

Stories to Help You Level-Up at Work19 stories

·

420

saves

Self-Improvement 10120 stories

Self-Improvement 10120 stories

·

1221

saves

Productivity 10120 stories

Productivity 10120 stories

·

1118

saves

0xAnn

0xAnn

in

Crypto 24/7

What we know about Bitcoin ETFs so far

It’s finally here, so how is the first impression?

·

5 min read

·

5 days ago

96

3

CryptoHunters100X.com

CryptoHunters100X.com

Crypto Hunters 100x Q4 Review

10 min read

·

Jan 3

103

Brandon Duff, The Boring Passive Income Dad

Brandon Duff, The Boring Passive Income Dad

Crypto Challenge: $10 Into $100 In 24 Hours — Step by Step Guide

Brandon The Boring Passive Income Dad

·

4 min read

·

6 days ago

240 The Pareto Investor

The Pareto Investor

The Beautiful Mathematics Behind Bitcoin

The One and Only Formula You Need to Know to Understand the Genius Behind Satoshi’s Masterpiece.

·

3 min read

·

5 days ago

286

3

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - WEN ALT Season?](https://cdn.bulbapp.io/frontend/images/5e881bda-7f7a-42c8-9a03-01263004c332/1)