Bitcoin Fear & Greed Index: Neutral After Recent Plunge

Data shows that Bitcoin sentiment has cooled off to neutral from greed following the asset’s latest plunge to the $57,000 level.

Bitcoin Fear & Greed Index Has Returned To Neutral Levels

The “Fear & Greed Index” is an indicator created by Alternative that shows the average sentiment among investors in the Bitcoin and wider cryptocurrency market.

This index estimates sentiment by considering five factors: volatility, trading volume, social media data, market cap dominance, and Google Trends.

The metric uses a scale that runs from zero to 100 to represent this average sentiment. All values under 46 suggest that investors are fearful, while those above 54 imply a greedy market. The zone between these two cutoffs naturally corresponds to the territory of neutral mentality.

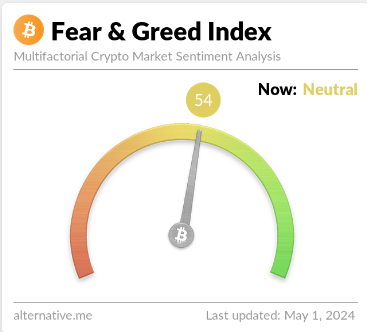

Now, here is what the Bitcoin sentiment looks like right now, according to the Fear & Greed Index:

The value of the metric appears to be 54 at the moment | Source: Alternative

As displayed above, the Bitcoin Fear & Greed Index is at a value of 54, implying that investors share a neutral sentiment currently. However, the neutrality is only just, as the metric is right at the boundary of the greed region.

This is a significant departure from yesterday’s sentiment: 67. The chart below shows how the indicator’s value has changed recently.

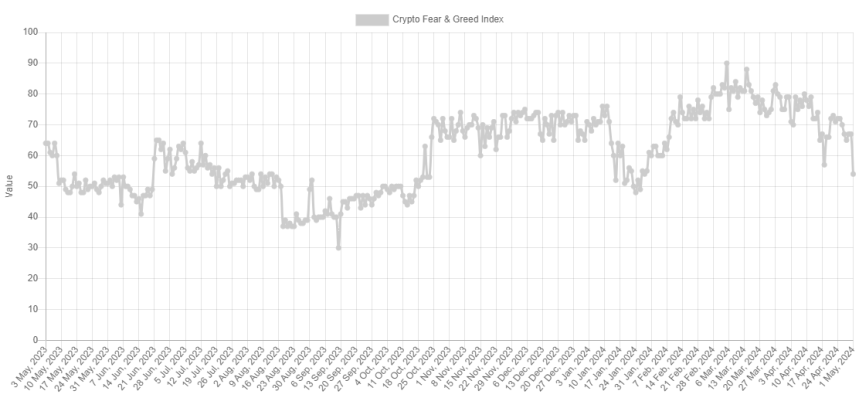

The trend in the Fear & Greed Index over the past year | Source: Alternative

As the graph shows, the Bitcoin Fear & Greed Index has been declining recently. For most of February and March, as well as the first half of April, the indicator was in or near a special zone called extreme greed.

The market assumes this sentiment at values above 75. As the asset price struggled recently, the mentality cooled off from this extreme zone and entered the normal greed region. With the latest crash in BTC, the index has seen a sharp plunge, now exiting out of greed altogether.

Historically, cryptocurrency has tended to move against the majority’s expectations. The stronger this expectation, the higher the probability of such a contrary move.

This expectation is considered the strongest in extreme sentiment zones, as well as extreme fear and greed. As such, major bottoms and tops have often occurred in these territories.

The all-time high (ATH) price last month, which continues to be the top of the rally so far, also occurred alongside extreme values of the Bitcoin Fear & Greed Index.

With the sentiment now cooled to neutral, some investors may be watching for a fall into fear. This is natural because a rebound would become more probable the worse the sentiment gets now.

BTC Price

During Bitcoin’s latest plunge, its price briefly slipped below $57,000 before surging back to $57,300.

Looks like the price of the asset has registered a sharp drop over the past two days | Source: BTCUSD on TradingView

Bitcoin still astounds the financial area with its thrilling price alterations. From its early ages of few cents even per coin to today’s highs reaching more than $74,000, Bitcoin’s journey has been nothing short of remarkable.

However, this journey has been marked by extreme volatility, with fluctuations of over 80% in value at times. Uncovering the origin of Bitcoin’s volatile nature is crucial for the success of investors and analysts as well, because that can give an indication of the future of cryptocurrencies.

The Bitcoin volatility is rooted in a diverse range of factors which take beginnings in the characteristic of the digital currency that is very young. Unlike the aged traditional assets that have a centuries-long historical data, Bitcoin and the broader cryptocurrency market are unable to maintain stability that comes from decades of influence of established market dynamics.

This first stage of the cryptocurrency development model leads to the permanent process of price discovery, when the value of Bitcoin is regularly reassessed by the market, which results in great price fluctuations in reaction on new information and happenings.

One of the fundamental contributors to Bitcoin’s volatility is its fixed supply cap of 21 million coins. This inherent scarcity factor can magnify price fluctuations as demand fluctuates against the unyielding supply limit. Additionally, the influence of large-scale investors, commonly referred to as “whales,” further exacerbates price volatility. Their substantial holdings allow them to sway market dynamics with significant buy or sell orders, leading to abrupt price changes.

Furthermore, the immaturity of the cryptocurrency market infrastructure introduces liquidity issues, wherein the capacity to execute large trades without impacting market prices is limited compared to more established markets. This lack of liquidity can intensify price swings as investors maneuver in and out of positions.

With the development of the cryptocurrency environment and regulatory frameworks taking shape, things might be changing for Bitcoin, which may moderate its volatility overtime. The emergence of Bitcoin-related derivatives shown in spot ETFs and the evolution of market infrastructure could make the trading process more stable.

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)

![[LIVE] Engage2Earn: McEwen boost for Rob Mitchell](https://cdn.bulbapp.io/frontend/images/c798d46f-d3b8-4a66-bf48-7e1ef50b4338/1)