Markets Update: Cryptocurrency Valuations Gain Billions in One Day

Two days ago, cryptocurrency bulls were attempting to break strong resistance and managed to push digital asset values to much higher price regions. The price of bitcoin core (BTC) was averaging $6,740 per BTC during the early morning trading sessions on July 17, then the digital currency spiked to $7,300 a few hours later. Then again, BTC touched a high of $7,546 gaining over $800 over the course of the day. Digital currency prices, in general, followed BTC’s path as most of the top cryptocurrencies gained 10-20 percent in 24-hours.

Crypto-Bulls Return But Will They Run Out of Steam?

The crypto-bulls are back, at least for time being, bringing most of the top digital assets back into the green after months of bearish sentiment. Most of the digital currencies are seeing gains between 10-20 percent but some coins like Stellar are up well over 30 percent today. The overall market capitalization of all 1600+ assets on July 18, is hovering around $296Bn with 24-hour trade volume around $20Bn. Cryptocurrency trade volumes across the boards have spiked considerably since our last markets update two days ago.

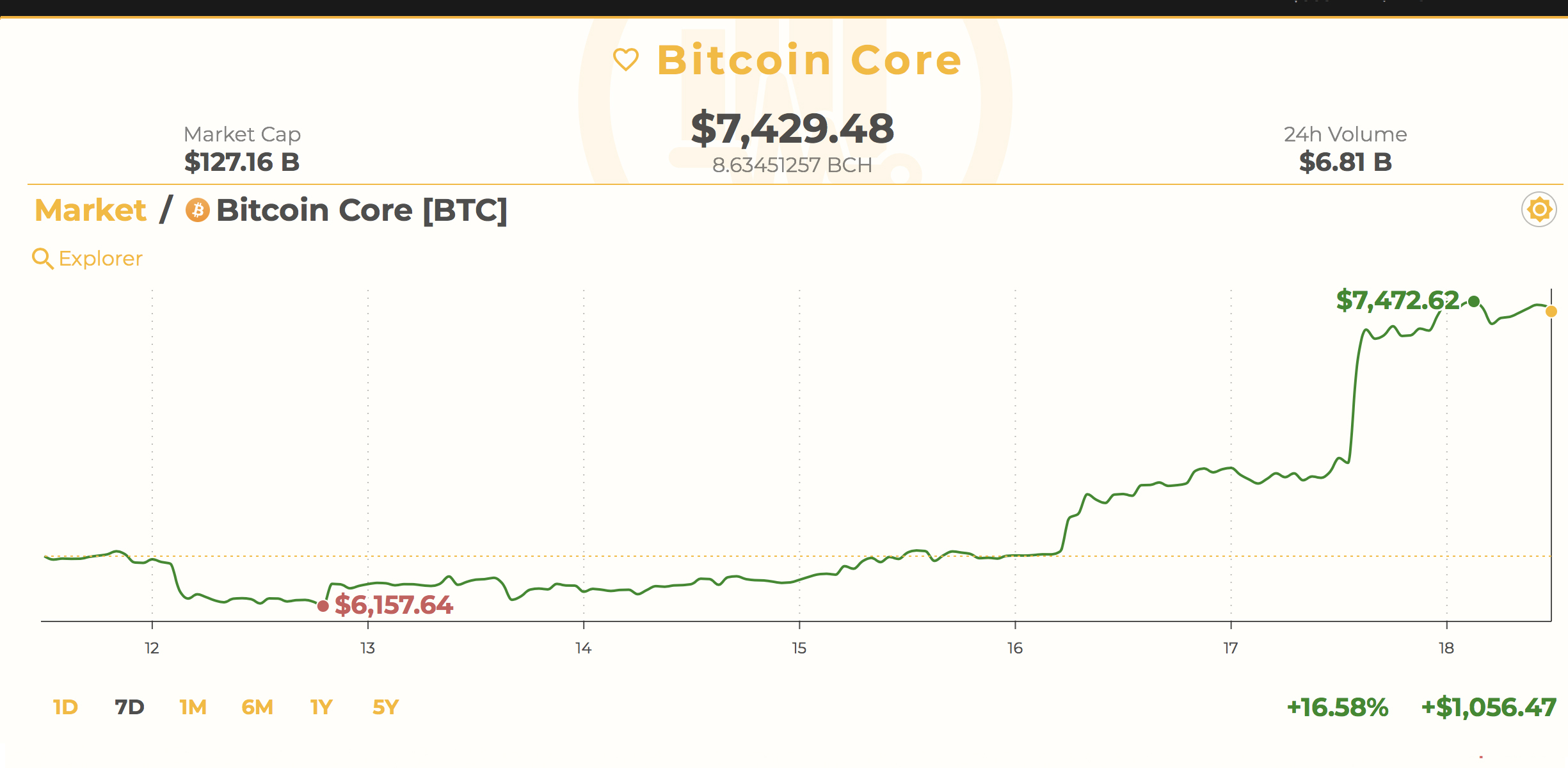

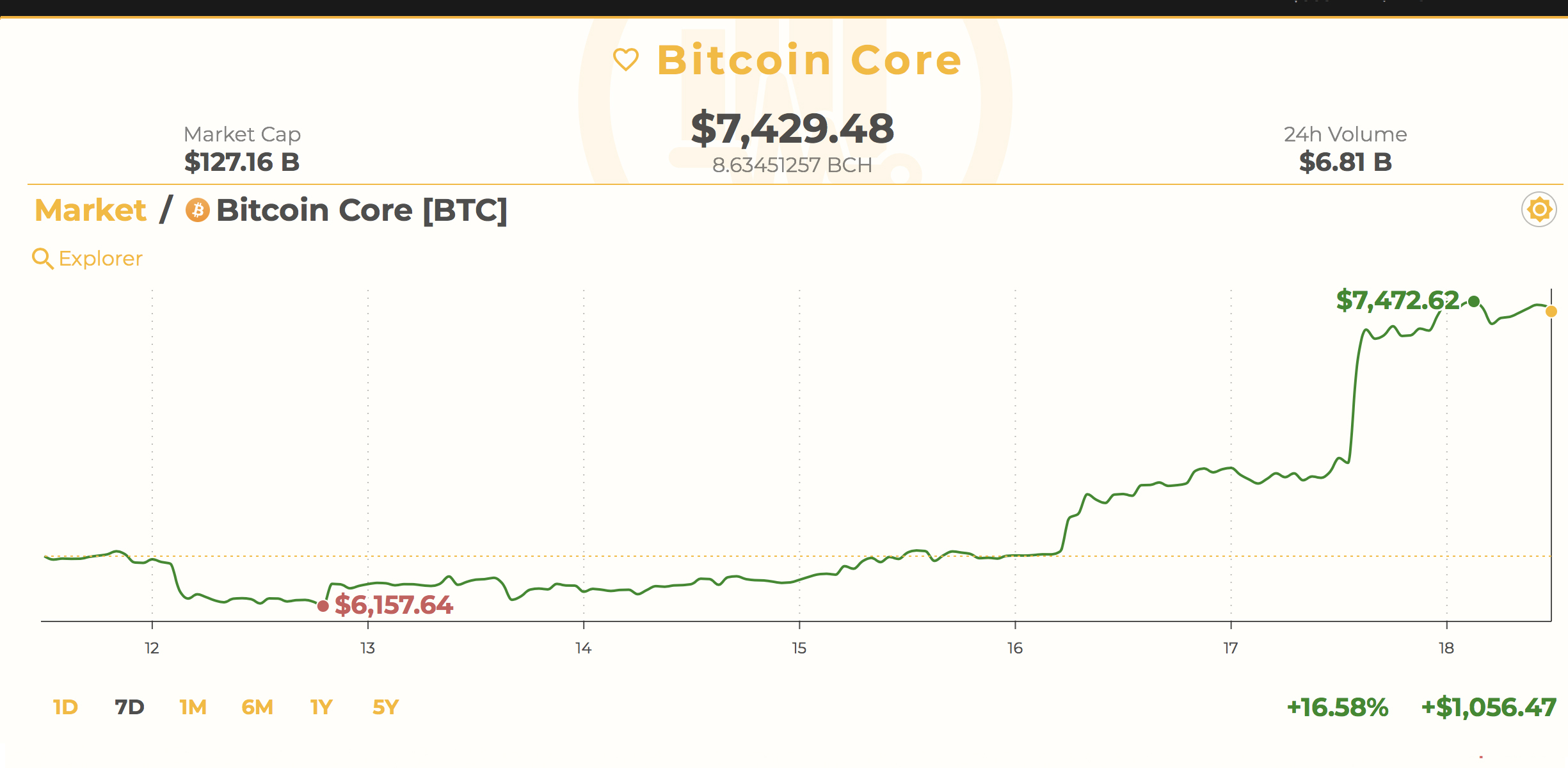

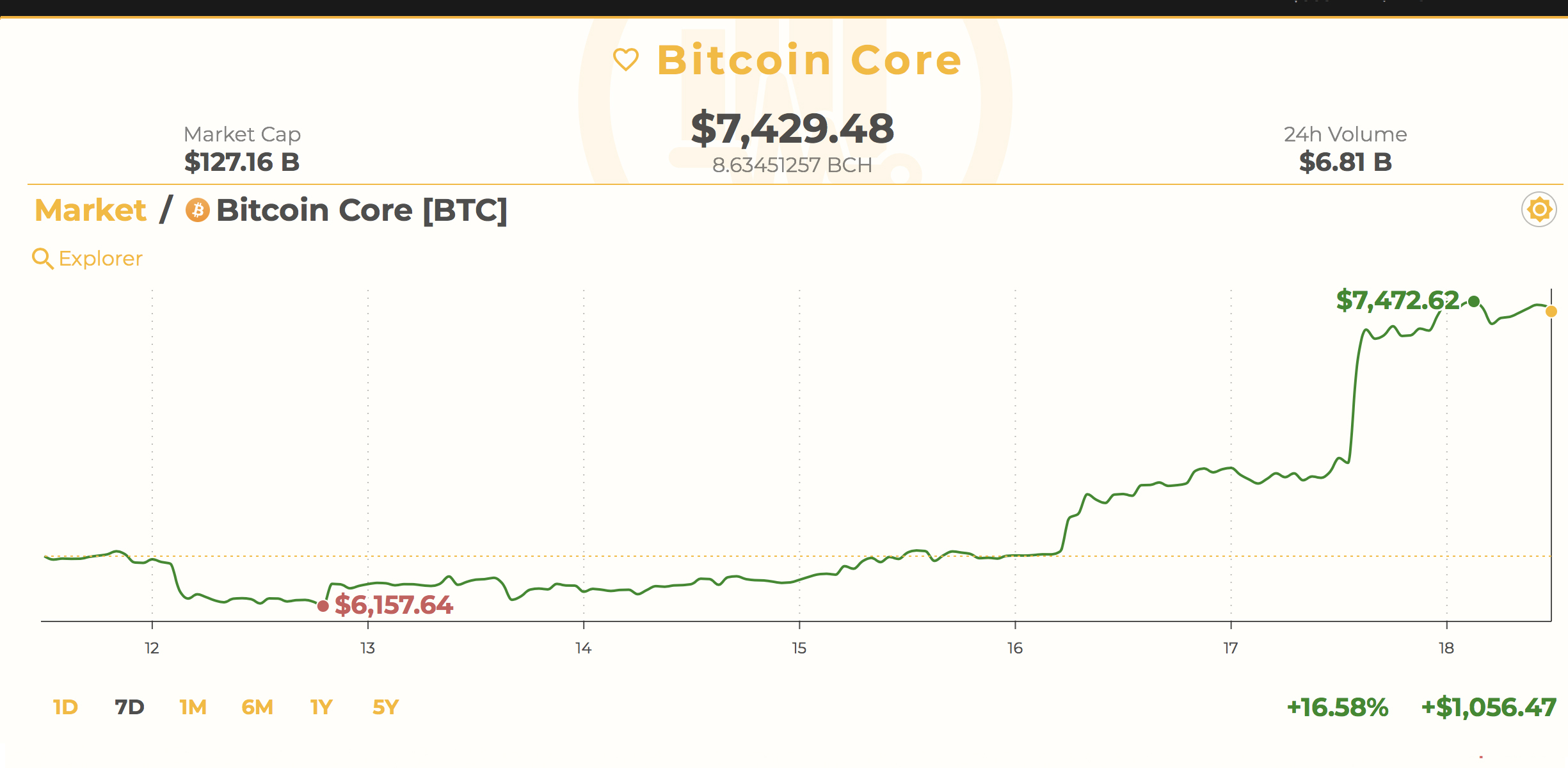

Bitcoin Core (BTC) Markets

Bitcoin core (BTC) market action has seen 24-hour trade volume jump from $4.4Bn on Monday to $6.6Bn today. Currently, BTC/USD is valued at approximately $7,435 per BTC. At the time of publication, the entire BTC market valuation is roughly $127Bn and BTC commands the top trade volume out of all the top markets. The top exchanges swapping the most bitcoin core today include Bitflyer, Coinbene, Bitfinex, Binance, and Fcoin. The Japanese yen is the most traded pair today with BTC capturing 54 percent of global trades. This is followed by tether (USDT 26.5%), USD (13.6%), EUR (2%), and the KRW (1.4%). Bitcoin dominance among the entire list of market capitalizations is approximately 43 percent at the time of publication.

BTC/USD Technical Indicators

Looking at the daily, 30-minute, and 4-hour BTC/USD charts on Bitstamp and Coinbase shows BTC reversed trends after completing an inverse head & shoulders pattern. Right now, looking at the two Simple Moving Averages (SMA), the short term 100 SMA is now well above the 200 SMA trendline. This gap indicates the path of least resistance is toward the upside for the time being. The MACd looks maxed out and may head southbound while the Relative Strength Index (RSI) is hovering above 86 showing overbought conditions. With this being said, a jump to the $8K region may not be in the cards, at least for today. Order books show resistance is strong between $7600 to $8K so BTC bulls will have to overtake this area. On the backside, if bears took control, which seems unlikely, there is strong foundational support all the way back to $6,400.

Two days ago, cryptocurrency bulls were attempting to break strong resistance and managed to push digital asset values to much higher price regions. The price of bitcoin core (BTC) was averaging $6,740 per BTC during the early morning trading sessions on July 17, then the digital currency spiked to $7,300 a few hours later. Then again, BTC touched a high of $7,546 gaining over $800 over the course of the day. Digital currency prices, in general, followed BTC’s path as most of the top cryptocurrencies gained 10-20 percent in 24-hours.

Crypto-Bulls Return But Will They Run Out of Steam?

The crypto-bulls are back, at least for time being, bringing most of the top digital assets back into the green after months of bearish sentiment. Most of the digital currencies are seeing gains between 10-20 percent but some coins like Stellar are up well over 30 percent today. The overall market capitalization of all 1600+ assets on July 18, is hovering around $296Bn with 24-hour trade volume around $20Bn. Cryptocurrency trade volumes across the boards have spiked considerably since our last markets update two days ago.

Bitcoin Core (BTC) Markets

Bitcoin core (BTC) market action has seen 24-hour trade volume jump from $4.4Bn on Monday to $6.6Bn today. Currently, BTC/USD is valued at approximately $7,435 per BTC. At the time of publication, the entire BTC market valuation is roughly $127Bn and BTC commands the top trade volume out of all the top markets. The top exchanges swapping the most bitcoin core today include Bitflyer, Coinbene, Bitfinex, Binance, and Fcoin. The Japanese yen is the most traded pair today with BTC capturing 54 percent of global trades. This is followed by tether (USDT 26.5%), USD (13.6%), EUR (2%), and the KRW (1.4%). Bitcoin dominance among the entire list of market capitalizations is approximately 43 percent at the time of publication.

BTC/USD Technical Indicators

Looking at the daily, 30-minute, and 4-hour BTC/USD charts on Bitstamp and Coinbase shows BTC reversed trends after completing an inverse head & shoulders pattern. Right now, looking at the two Simple Moving Averages (SMA), the short term 100 SMA is now well above the 200 SMA trendline. This gap indicates the path of least resistance is toward the upside for the time being. The MACd looks maxed out and may head southbound while the Relative Strength Index (RSI) is hovering above 86 showing overbought conditions. With this being said, a jump to the $8K region may not be in the cards, at least for today. Order books show resistance is strong between $7600 to $8K so BTC bulls will have to overtake this area. On the backside, if bears took control, which seems unlikely, there is strong foundational support all the way back to $6,400.

Two days ago, cryptocurrency bulls were attempting to break strong resistance and managed to push digital asset values to much higher price regions. The price of bitcoin core (BTC) was averaging $6,740 per BTC during the early morning trading sessions on July 17, then the digital currency spiked to $7,300 a few hours later. Then again, BTC touched a high of $7,546 gaining over $800 over the course of the day. Digital currency prices, in general, followed BTC’s path as most of the top cryptocurrencies gained 10-20 percent in 24-hours.

Crypto-Bulls Return But Will They Run Out of Steam?

The crypto-bulls are back, at least for time being, bringing most of the top digital assets back into the green after months of bearish sentiment. Most of the digital currencies are seeing gains between 10-20 percent but some coins like Stellar are up well over 30 percent today. The overall market capitalization of all 1600+ assets on July 18, is hovering around $296Bn with 24-hour trade volume around $20Bn. Cryptocurrency trade volumes across the boards have spiked considerably since our last markets update two days ago.

Bitcoin Core (BTC) Markets

Bitcoin core (BTC) market action has seen 24-hour trade volume jump from $4.4Bn on Monday to $6.6Bn today. Currently, BTC/USD is valued at approximately $7,435 per BTC. At the time of publication, the entire BTC market valuation is roughly $127Bn and BTC commands the top trade volume out of all the top markets. The top exchanges swapping the most bitcoin core today include Bitflyer, Coinbene, Bitfinex, Binance, and Fcoin. The Japanese yen is the most traded pair today with BTC capturing 54 percent of global trades. This is followed by tether (USDT 26.5%), USD (13.6%), EUR (2%), and the KRW (1.4%). Bitcoin dominance among the entire list of market capitalizations is approximately 43 percent at the time of publication.

BTC/USD Technical Indicators

Looking at the daily, 30-minute, and 4-hour BTC/USD charts on Bitstamp and Coinbase shows BTC reversed trends after completing an inverse head & shoulders pattern. Right now, looking at the two Simple Moving Averages (SMA), the short term 100 SMA is now well above the 200 SMA trendline. This gap indicates the path of least resistance is toward the upside for the time being. The MACd looks maxed out and may head southbound while the Relative Strength Index (RSI) is hovering above 86 showing overbought conditions. With this being said, a jump to the $8K region may not be in the cards, at least for today. Order books show resistance is strong between $7600 to $8K so BTC bulls will have to overtake this area. On the backside, if bears took control, which seems unlikely, there is strong foundational support all the way back to $6,400.

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - Is Trump Dying? Or Only Killing The Market?](https://cdn.bulbapp.io/frontend/images/a129e75e-4fa1-46cc-80b6-04e638877e46/1)

![[LIVE] Engage2Earn: McEwen boost for Rob Mitchell](https://cdn.bulbapp.io/frontend/images/c798d46f-d3b8-4a66-bf48-7e1ef50b4338/1)