Ethereum Foundation Sells $2.27 Million ETH in the Past 20 Days

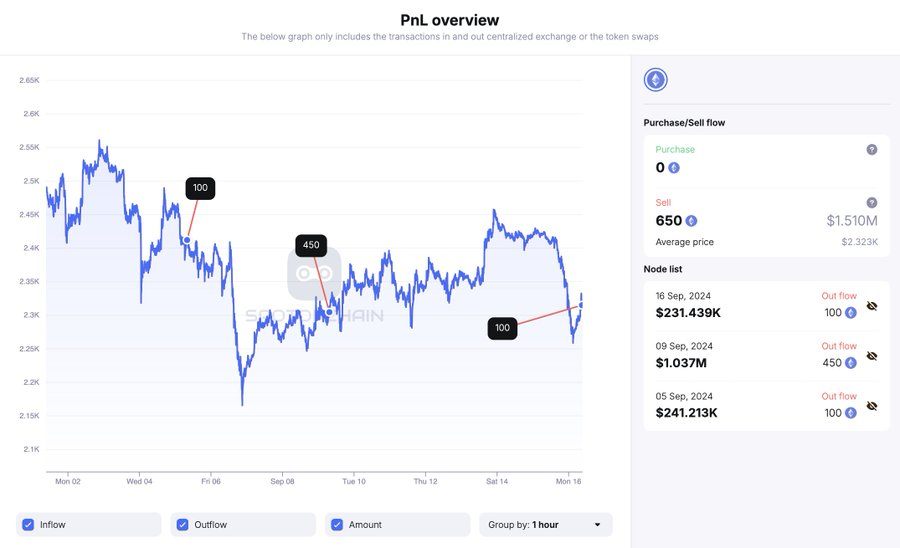

Since the beginning of September 2024, the Ethereum Foundation has closed a total of 950 ETH at an average selling price of around $2,392, earning about $2.27 million.

According to the Spot On Chain data statistics platform, the organization behind the Ethereum blockchain has recently "closed a profit" on an additional amount of ETH to receive stablecoins worth nearly $800,000.

Specifically, between 05:10 and 05:41 PM on September 20, 2024, the Ethereum Foundation made 3 transactions on the CoWSwap DEX to sell 300 ETH at an average price of $2,543, thereby earning 763,092 DAI stablecoins.

With the move to "take profit" of $763,092 worth of ETH, marking the fourth sale in just the last 20 days by the Ethereum Foundation.

The second time took place 4 days later, the Ethereum Foundation continued to sell 450 ETH to "pocket" 1.029 million DAI, marking the largest token "dumping" in September. Notably, this sale occurred on the same day as a similar action from Vitalik Buterin, with about 760 ETH being taken by the Ethereum founder to earn $1.8 million at an average price of $2,414 per coin.

From the beginning of September 2024 to the present, the organization behind the Ethereum blockchain has "taken profit" a total of 950 ETH with an average selling price of around $2,392, to earn about $2.27 million. All four sales were made by the Ethereum Foundation via the CoWSwap DEX.

The reason why Ethereum Foundation's transfers are always closely watched by crypto investors is because they often mark temporary peaks of ETH. The current situation is similar, when Bitcoin "overcame thousands of thorns" to reach 64,000 USD, the price of Ethereum also increased by nearly 14% to 2,571 USD in the last 7 days.

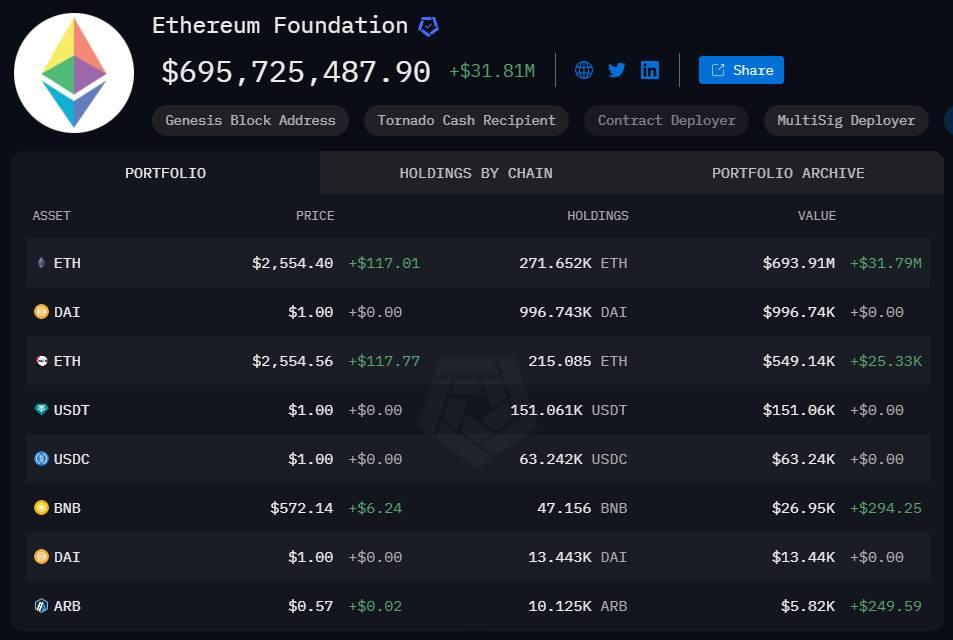

Statistics site Arkham said that the Ethereum Foundation still holds more than 695 million USD in assets, mainly in the form of ETH. This organization was also recently embroiled in a controversy over lack of transparency when it was discovered that two key members were sitting on the EigenLayer advisory group, potentially creating a conflict of interest.

![[LIVE] Engage2Earn: McEwen boost for Rob Mitchell](https://cdn.bulbapp.io/frontend/images/c798d46f-d3b8-4a66-bf48-7e1ef50b4338/1)

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)