Everything you need to know about Ripple and XRP – Detailed review

The XRP cryptocurrency functions as a digital asset designed specifically to streamline digital payments, aspiring to offer an alternative for processing transactions on a global scale.

The XRP cryptocurrency functions as a digital asset designed specifically to streamline digital payments, aspiring to offer an alternative for processing transactions on a global scale.

Yet, the XRP ledger represents a scalable and sustainable blockchain network that operates in a decentralized manner, guided by a global community of developers.

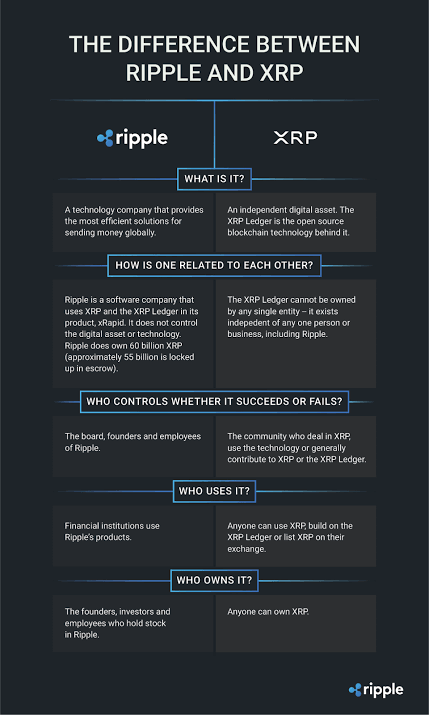

Ripple operates as a distinct entity from XRP. My goal today is to provide you with an extensive exploration of the relationship between Ripple and XRP. Main Points:

Main Points:

1. The XRP coin serves as the native cryptocurrency token within the XRP Ledger (XRPL), known for its rapid, secure, and energy-efficient decentralized blockchain network.

2. XRP’s primary aim is to facilitate global transactions at minimal costs while providing developers with a robust, open-source framework for executing complex projects.

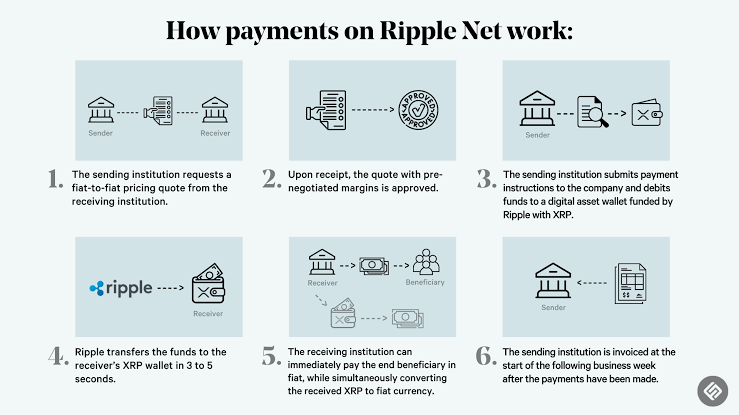

3. Introduced in 2012, RippleNet offers banks and financial institutions a real-time gross settlement system, ensuring instantaneous transactions.

4. Ripple operates as an entirely distinct entity from XRP. This San Francisco-based startup develops software utilized by banks, underscoring that XRP’s existence is independent of Ripple.

What is Ripple?

First, let’s delve into the definition of Ripple. To define Ripple, it’s crucial to note that Ripple operates as a San Francisco-based startup. Its inception aimed to develop banking software facilitating swift, worldwide financial transactions. It’s essential to emphasize that Ripple stands as an entirely distinct and independent entity from XRP. Ripple and XRP are distinct entities. Ripple operates independently from XRP, clarifying that XRP is not Ripple's token but rather a token utilized within the Ripple ecosystem.

Ripple operates independently from XRP, clarifying that XRP is not Ripple's token but rather a token utilized within the Ripple ecosystem.

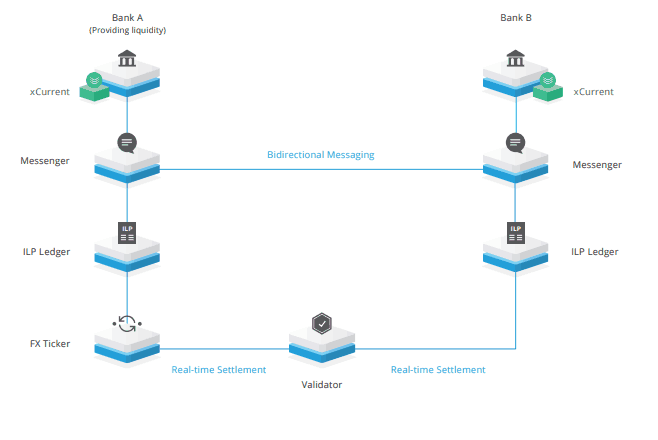

Additionally, there's RippleNet, designed to grant banks and financial institutions access to a real-time gross settlement system, ensuring secure and immediate global financial transactions.

Ripple and RippleNet allow their clientele to utilize the XRP cryptocurrency for liquidity in cross-border transactions. It's important to note that Ripple neither issued nor oversees XRP; rather, XRP constitutes a component within the broader XRP ecosystem.

However, XRP can persist even in scenarios where Ripple ceases to exist or encounters setbacks. This underscores that XRP maintains complete autonomy from Ripple, a distinction we’ll explore further.

What is XRP? XRP emerges as a cryptocurrency designed to supplant the conventional banking system. Its disruptive nature empowers global users with a cost-effective payments network, minimizing transaction charges. Moreover, it serves as the primary cryptocurrency within the XRP Ledger.

XRP emerges as a cryptocurrency designed to supplant the conventional banking system. Its disruptive nature empowers global users with a cost-effective payments network, minimizing transaction charges. Moreover, it serves as the primary cryptocurrency within the XRP Ledger.

The inception of the XRP Ledger traces back to the efforts of David Schwartz, Jed McCaleb, and Arthur Britto in 2011. This ledger serves as the cornerstone of XRP's functionality and operation. How Ripple Works

How Ripple Works

Ripple is a company specializing in developing a payment settlement system and currency exchange network capable of processing worldwide transactions.

For those interested in understanding the workings of the XRP cryptocurrency, here's a brief overview:

The XRP Ledger operates as a peer-to-peer (P2P) network, incorporating nodes, and designed to enhance the shortcomings observed in competing blockchains during its inception. The XRP Ledger employs a consensus protocol tailored to involve servers, termed validators, reaching consensus on the sequence and outcome of XRP transactions, usually concluding within 3 to 5 seconds.

The XRP Ledger employs a consensus protocol tailored to involve servers, termed validators, reaching consensus on the sequence and outcome of XRP transactions, usually concluding within 3 to 5 seconds.

How to Mine XRP?

Every server within the network can process each transaction uniformly by adhering to identical rules. Consequently, transactions following the protocol can promptly achieve confirmation. Additionally, all transactions are publicly accessible and incorporate robust cryptographic protection.

The XRP ledger operates using the XRP Ledger Consensus Protocol, designed to present a more centralized and efficient solution. This aims to minimize transaction finality and associated costs. In this particular framework, all network participants have the option to select a group of validators. These validators, operated by various entities, are servers tailored to actively engage in consensus.

In this particular framework, all network participants have the option to select a group of validators. These validators, operated by various entities, are servers tailored to actively engage in consensus.

As the network expands, each server listens to trusted validators. When a substantial majority of these validators agree upon a series of transactions and consider a specific ledger as the outcome, the server can confirm consensus.

In cases of disagreement, validators can adjust proposals to align closely with those of other trusted validators. This iterative process continues until a consensus is achieved.

XRP Pros and Cons

XRP Pros

- XRP has quick settlement speeds and low transaction fees. When compared to other crypto projects, XRP is extremely quick and affordable.

- XRP has a 3.70 seconds settlement speed and can process up to 1,500 transactions per second (TPS).

- XRP can be used by small businesses and customers for secure money transfers.

XRP Cons

- The XRP Ledger is not as decentralized when compared to other projects due to its unique consensus mechanism.

- There is a lot of confusion between Ripple and XRP.

- There is a strong rivalry with other projects.

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - The $TRUMP Dump Stinks](https://cdn.bulbapp.io/frontend/images/531eb610-e68c-4c1b-81ef-03b8b01d2d4b/1)