Demystifying Cryptocurrency: The Howey Test and Why it Matters

In the fast-paced world of cryptocurrency, where innovation and decentralization are the buzzwords of the day, the Howey Test emerges as a crucial player in the game of classification. While it might sound like a pop quiz from a law school textbook, the Howey Test holds immense significance in determining whether a particular cryptocurrency should be considered a security. Let's take a journey into the fascinating realm of digital currencies and explore why the Howey Test is a hot topic in this ever-evolving landscape.

William John Howey

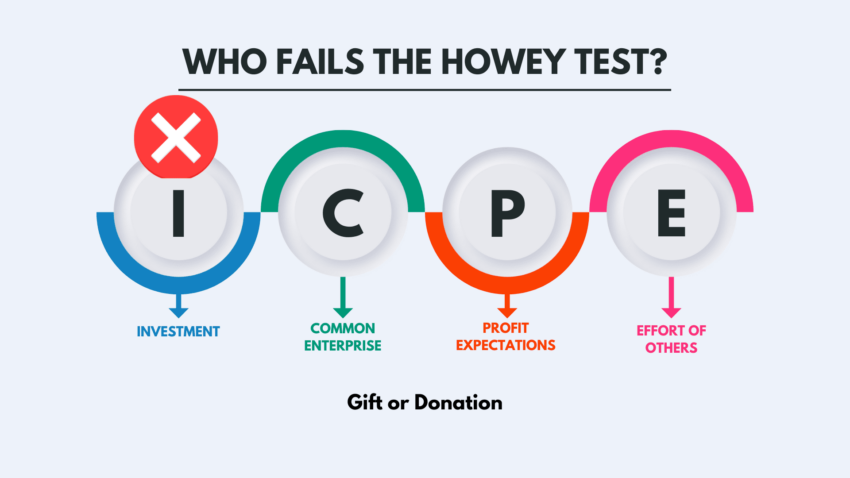

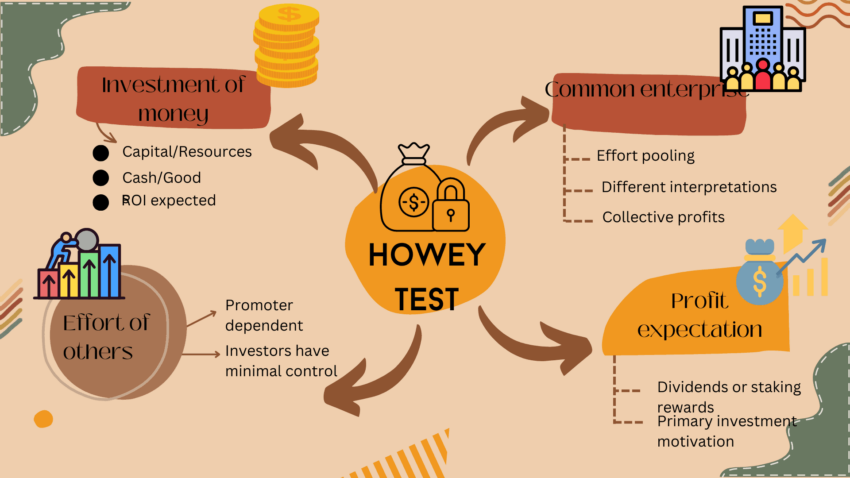

First things first, what is the Howey Test? Named after the famous Supreme Court case SEC v. W.J. Howey Co. in 1946, the test was devised to ascertain whether certain transactions qualified as investment contracts – a category that falls under the broader definition of securities. The Howey Test essentially poses four questions that help regulators and legal experts evaluate whether a particular investment arrangement should be treated as a security.

- Is there an investment of money?

- Is the investment in a common enterprise?

- Is there an expectation of profits from the investment?

- Do the profits come from the efforts of others?

Now, let's break down why these questions are crucial in the context of cryptocurrencies.

Investment of Money

In the realm of cryptocurrencies, the investment of money is a no-brainer. Whether you're buying Bitcoin, Ethereum, or any of the myriad altcoins, you're putting your hard-earned cash into a digital asset. This first prong of the Howey Test is typically satisfied by the mere act of purchasing or investing in a cryptocurrency.

Common Enterprise

The second question delves into whether the investment is in a common enterprise. In the world of decentralized cryptocurrencies, where the ethos is often rooted in breaking away from traditional financial systems, this aspect can be a bit tricky. However, the broader crypto ecosystem, with initial coin offerings (ICOs), token sales, and decentralized finance (DeFi) projects, can often be seen as shared endeavors. The commonality arises as multiple investors contribute to a project or a token, creating a collective interest in its success.:max_bytes(150000):strip_icc()/dotdash_Final_Initial_Coin_OfferingICO_2020-01-f7519afb7b28440fb0250cbbf51a74d0.jpg)

Expectation of Profits

When it comes to cryptocurrencies, the allure of profits is one of the driving forces behind investor participation. The volatility of the crypto market makes it an attractive space for those seeking substantial returns. The Howey Test recognizes this allure, and if investors are putting their money into a venture with the expectation of profits, this element of the test is satisfied.

Profits from the Efforts of Others

This is where the rubber meets the road in the cryptocurrency world. The Howey Test's fourth question examines whether the profits come substantially from the efforts of others. In traditional securities, this often relates to the managerial efforts of a company or a third party. In the crypto space, the application of this criterion has sparked debates around decentralized projects, where community-driven efforts play a pivotal role.

Consider an ICO where a development team initially launches a project but eventually steps back, allowing the community to take the reins. The Howey Test might still find the initial offering to be a security if the success of the project is deemed to be tied significantly to the developers' efforts. This criterion has spurred discussions on how to define the point at which a project becomes truly decentralized, and its success is no longer contingent on the founders' or developers' efforts.

Why Does it Matter?

The classification of a cryptocurrency as a security has far-reaching implications. Securities are subject to stringent regulations designed to protect investors and maintain market integrity. If a cryptocurrency falls under the category of a security, it must comply with securities laws, which could include registration requirements and disclosure obligations. This added layer of oversight can impact the flexibility and agility that many cryptocurrency projects strive to maintain.

Furthermore, the classification can influence investor sentiment. Securities are often associated with a higher level of scrutiny and regulation, which can either instill confidence in investors or drive them away. Clear regulatory guidance on whether a cryptocurrency is deemed a security provides a roadmap for projects to navigate the evolving legal landscape.

In recent years, regulatory bodies around the world have shown an increasing interest in bringing clarity to the classification of cryptocurrencies. The U.S. Securities and Exchange Commission (SEC) has been at the forefront, issuing guidance and enforcement actions that reflect an evolving understanding of the crypto space. The Howey Test, as a foundational tool, assists regulators in making these determinations. In conclusion, the Howey Test isn't just a legal abstraction confined to courtrooms and regulatory offices. It's a dynamic framework that shapes the landscape of the cryptocurrency market. As blockchain technology continues to revolutionize finance and decentralize power, the Howey Test will remain a critical instrument in navigating the delicate balance between innovation and investor protection. So, the next time you delve into the world of cryptocurrencies, remember that behind the complex legal jargon lies a simple set of questions that can make all the difference in how these digital assets are perceived and regulated.

In conclusion, the Howey Test isn't just a legal abstraction confined to courtrooms and regulatory offices. It's a dynamic framework that shapes the landscape of the cryptocurrency market. As blockchain technology continues to revolutionize finance and decentralize power, the Howey Test will remain a critical instrument in navigating the delicate balance between innovation and investor protection. So, the next time you delve into the world of cryptocurrencies, remember that behind the complex legal jargon lies a simple set of questions that can make all the difference in how these digital assets are perceived and regulated.

![[FAILED] Engage2Earn: McEwen boost for Rob Mitchell](https://cdn.bulbapp.io/frontend/images/c798d46f-d3b8-4a66-bf48-7e1ef50b4338/1)

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - Is Trump Dying? Or Only Killing The Market?](https://cdn.bulbapp.io/frontend/images/a129e75e-4fa1-46cc-80b6-04e638877e46/1)