Bitcoin’s Early Halving Year Pattern

Renowned YouTuber Benjamin Cowen examines a recurring pattern in Bitcoin’s behaviour in the first part of its halving year in a new video titled “Bitcoin: Early Halving Year Pattern.” An important event in the Bitcoin ecosystem is the halving event, which happens about every four years and reduces the reward for mining new blocks by half, slowing down the rate at which new bitcoins are created.

For more insights and updates, consider joining our Telegram Channel for reliable crypto signals. Btc halving

Btc halving

How Does Halving Occur? What Is It?

A maximum of 21 million coins were intended to be in circulation when Bitcoin was first established. The goal of this design was to maintain the coin’s long-term worth and create scarcity. A calculated decision to limit the amount of new currencies that can enter circulation and stop mining from driving up inflationary pressures is to halve the block rewards.

The goal of the halving process is to progressively introduce additional Bitcoin coins over a period of years in order to control supply inflation, promote market stability, and guarantee a fair distribution of the cryptocurrency.

The Pre-Halving Years’ Pattern

Cowen recalls a forecast from the third quarter of the year prior to the halving as he opens the video. Based on past trends, it was predicted that at this time, Bitcoin will drop below its bull market support band. As Bitcoin fell below the support band in line with historical patterns, this pattern — seen in years before the halving — did in fact recur.

For more insights and updates, consider joining our Telegram Channel for reliable crypto signals.

February in the Halving Year: An Important Month

The behaviour of Bitcoin in February of the year of the halving is a major topic of discussion in the video. The author observes a recurring pattern in which this month has seen Bitcoin consistently hover around its bull market support band. This pattern refers to the specific location of Bitcoin at the support band in February of each halving year, rather than whether it is above or below it.

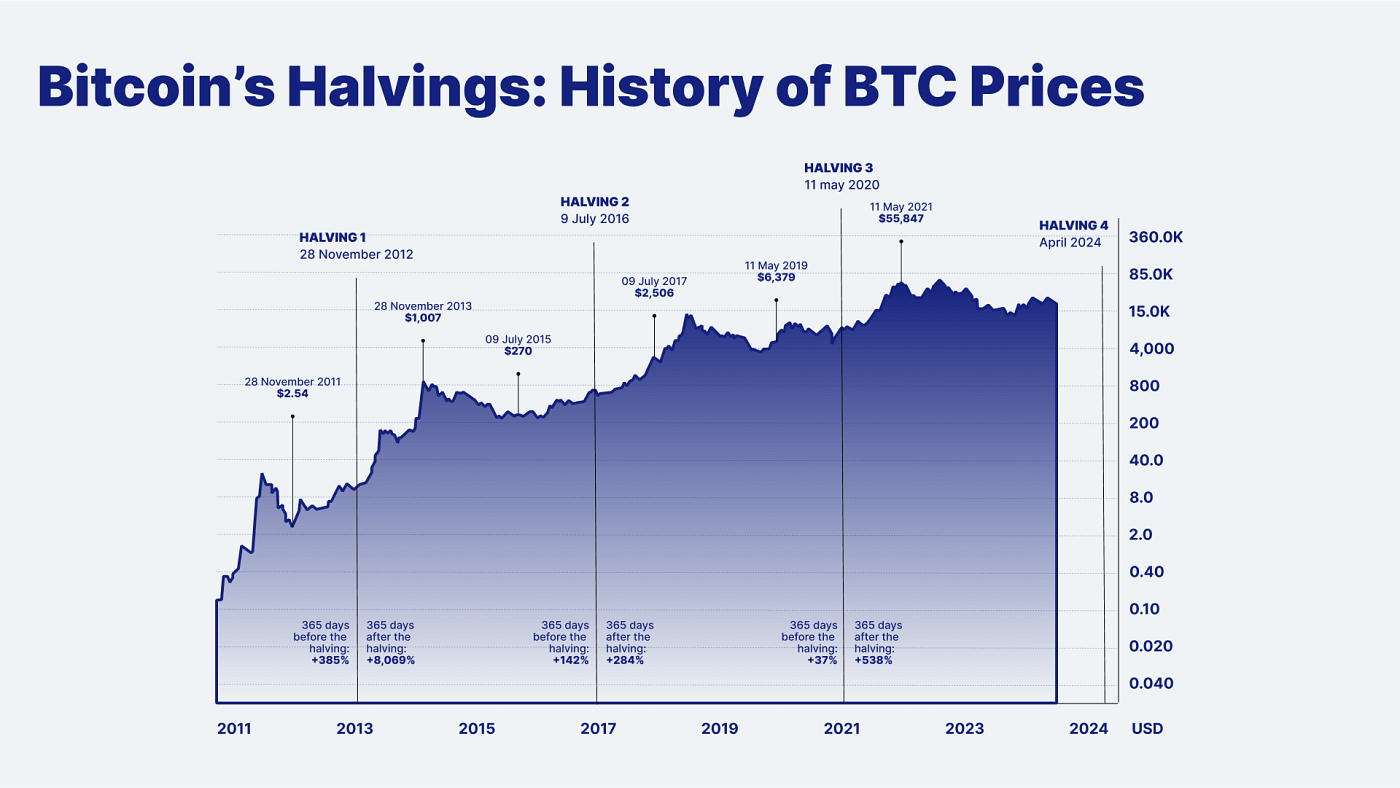

Past Data and Forecasts for the Future

The presenter backs up this remark with historical data. They provide examples from February of 2012, 2016 and 2020, demonstrating that during this month in each of these years, Bitcoin reached the bull market support zone. Reaching the support band at the current levels would indicate a sizable 15% decline in the price of Bitcoin. However, the movement of the support band itself, which may get stronger with time, may have an impact on the pace of descent. bitc halving

bitc halving

Changes in the Market and Outside Influences

The video also discusses how Bitcoin has behaved after reaching the band of support. Bitcoin was able to hold the support band level in 2012 and 2016, but the pandemic and ensuing recession prevented it from doing so in 2020. These findings imply that external economic variables, such as the status of the economy and Federal Reserve policies, can have a big impact on Bitcoin’s capacity to maintain the support band level.

Ramifications for the price of bitcoin

Cowen emphasises the significance of this pattern and its possible ramifications for future price changes of Bitcoin in his conclusion. It is expected that, as February draws near, Bitcoin will decline to the bull market support band; however, the precise path may differ depending on a number of variables.

For more insights and updates, consider joining our Telegram Channel for reliable crypto signals.

2

Next Bull

Crypto

Cryptocurrency

Cryptocurrency Investment

Bitcoin

2Follow

Written by Shogun Saski

More from Shogun Saski

Shogun Saski

This cryptocurrency will turn your $200 to $20k in the next 91 days.

The original goal of first-generation cryptocurrencies like Bitcoin and Ether was to act as all-purpose substitutes for currencies like…

8 min read

·

4 days ago

105

5

Shogun Saski

Here is how I turned $517 to $21k trading crypto tokens during Christmas.

And no, this ain’t click bait. It’s a true story

4 min read

·

Dec 30, 2023

125

Shogun Saski

The Top 5 Cryptocurrencies to Invest in Right Now for the Next Bull Run

A range of tokens with varied chances for growth and innovation are going to significantly increase your rewards as 2024 approaches.

5 min read

·

Jan 4

72

1

Shogun Saski

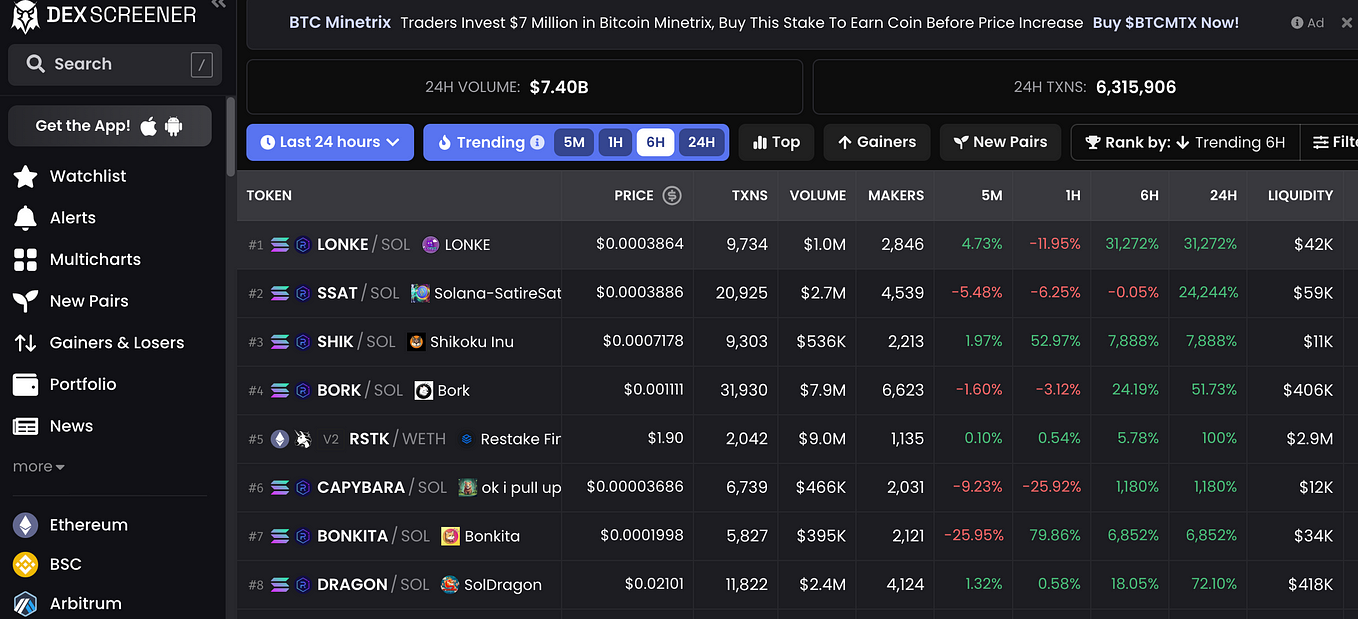

Discover 3 FREE tools you can use to find and buy new gems before they moon.

Forget Coinbase and Binance — real gains happen before listing. By the time you are buying on CEXs, you’re someone’s exit strategy. This…

4 min read

·

Jan 4

71

1

Recommended from Medium

Smid

Smid

Discover Crypto Altcoins with 100x Potential Now

Discover Crypto Altcoins with 100x Potential Now

10 min read

·

Jan 12

58

Aurora Grace

Aurora Grace

in

GamingArena

What are the 4 Cryptocurrency Predictions for 2024?

In the landscape of cryptocurrency, 2023 unfolded as a year of unprecedented growth and innovation. Bitcoin and Ethereum maintained their…

9 min read

·

Jan 4

82

1

Lists

Modern Marketing54 stories

·

376

saves

Generative AI Recommended Reading52 stories

Generative AI Recommended Reading52 stories

·

633

saves

Shogun Saski

This cryptocurrency will turn your $200 to $20k in the next 91 days.

The original goal of first-generation cryptocurrencies like Bitcoin and Ether was to act as all-purpose substitutes for currencies like…

8 min read

·

4 days ago

105

5

Mike Coldman

Mike Coldman

Top 4 Crypto Gems Set to Explode in 2024 !

Unlock the Secret Strategies of Elite Investors and Transform Your Portfolio Overnight !

·

5 min read

·

Jan 8

264

6

Crypto Insider Talks

Crypto Insider Talks

Shiba Inu Price Predictions 2024: The Million Dollar Question

4 min read

·

4 days ago

61

1

Michel Marchand

Michel Marchand

in

Coinmonks

The Bull Is Back? Top 10 Cryptos to Buy on Coinbase in 2024

well . . . I’M back, shouldn’t that be enough?

21 min read

·

Dec 31, 2023

502

8