CONFIRMED AMBIT FINANCE AIRDROP

What is Ambit Finance?

Ambit is a new breed of cross-chain DeFi protocol which offers a range of functionality to users, from simple yield creation on stablecoin deposits, to sustainable money market lending and risk-defined portfolio investment strategies - all within a user friendly environment. Ambit's “North Star” is to provide a user experience that is well beyond the ambit of what exists in DeFi today.

The Ambit protocol allows users to stay on-chain with exposure to sustainable yields being produced from borrowing demand and yield creation strategies with idle capital. Ambit drives deposit and borrowing demand through the use of innovative DeFi investment strategies and vaults.

How it works

Stablecoin deposits

At the Heart of the Ambit protocol is the USDT vault. Users can deposit USDT into the Ambit vault to receive a share of the protocol yield. This vault is used by approved borrowers who will pay interest for borrowing from the vault.

When a user deposits USDT, they receive AUSD, tokenized representation of a user's share of the USDT vault. Over time, AUSD grows in value based on the yield generated from borrowing interest.

The AUSD token is a fully compliant, fungible ERC20 token that allows a depositor's liquidity to remain unlocked and usable within other DeFi protocols to further enhance yield exposure.

To learn how to deposit USDT in ambit, visit the Deposit guide.

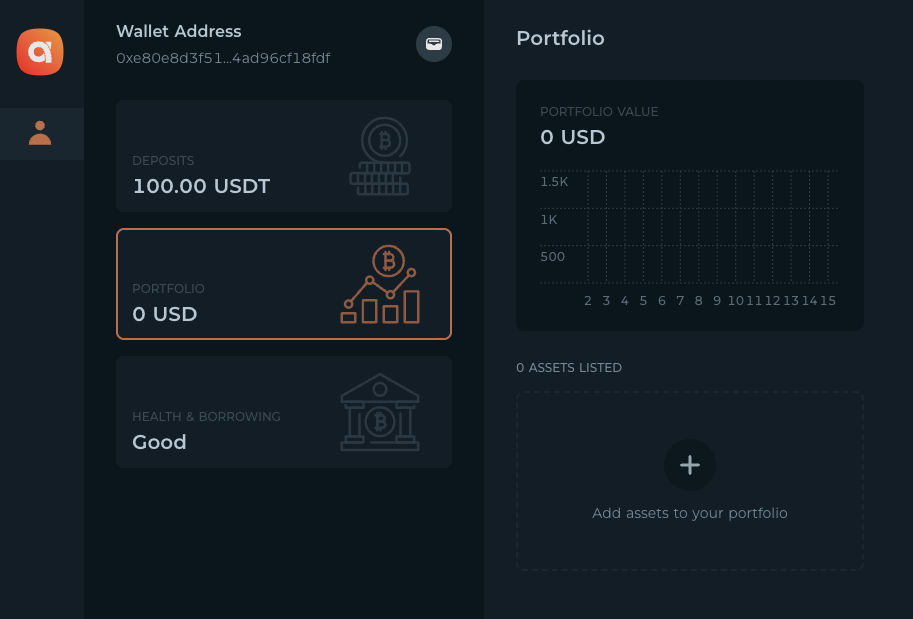

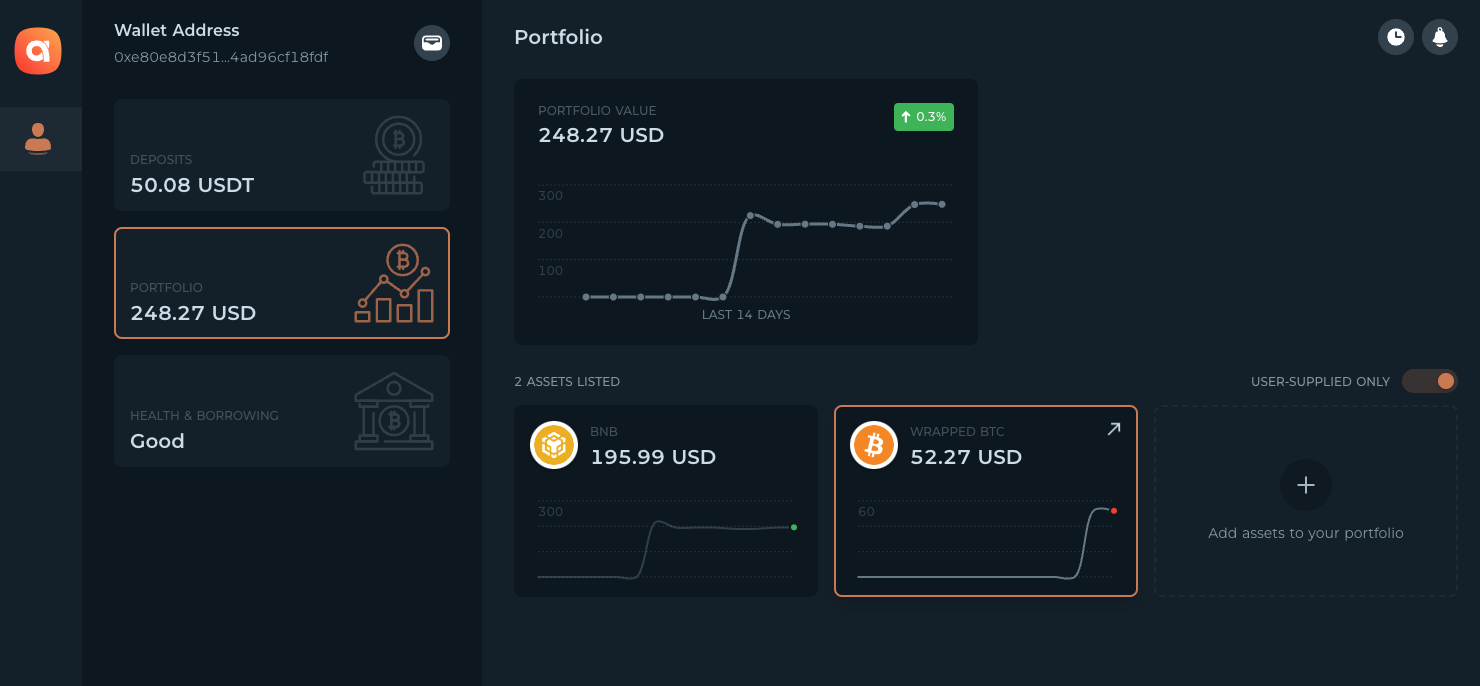

Portfolio and borrowing

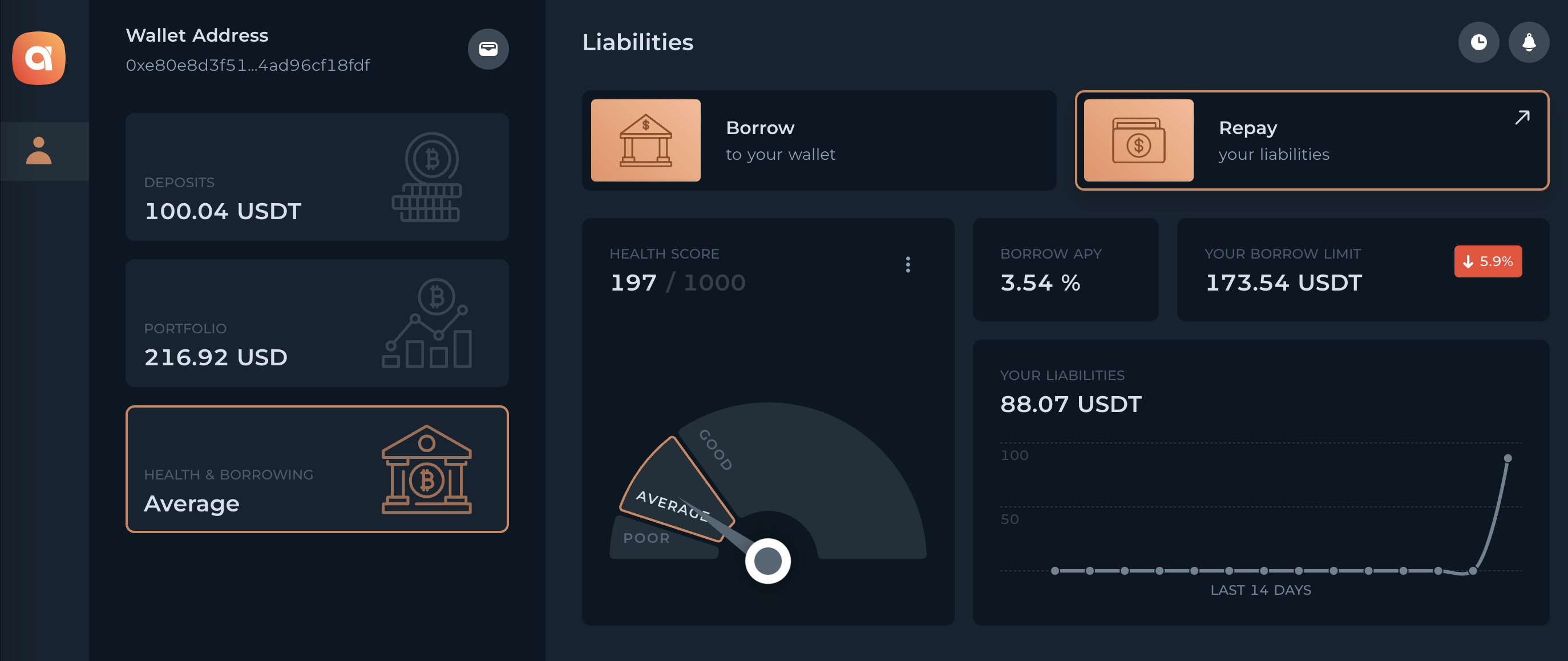

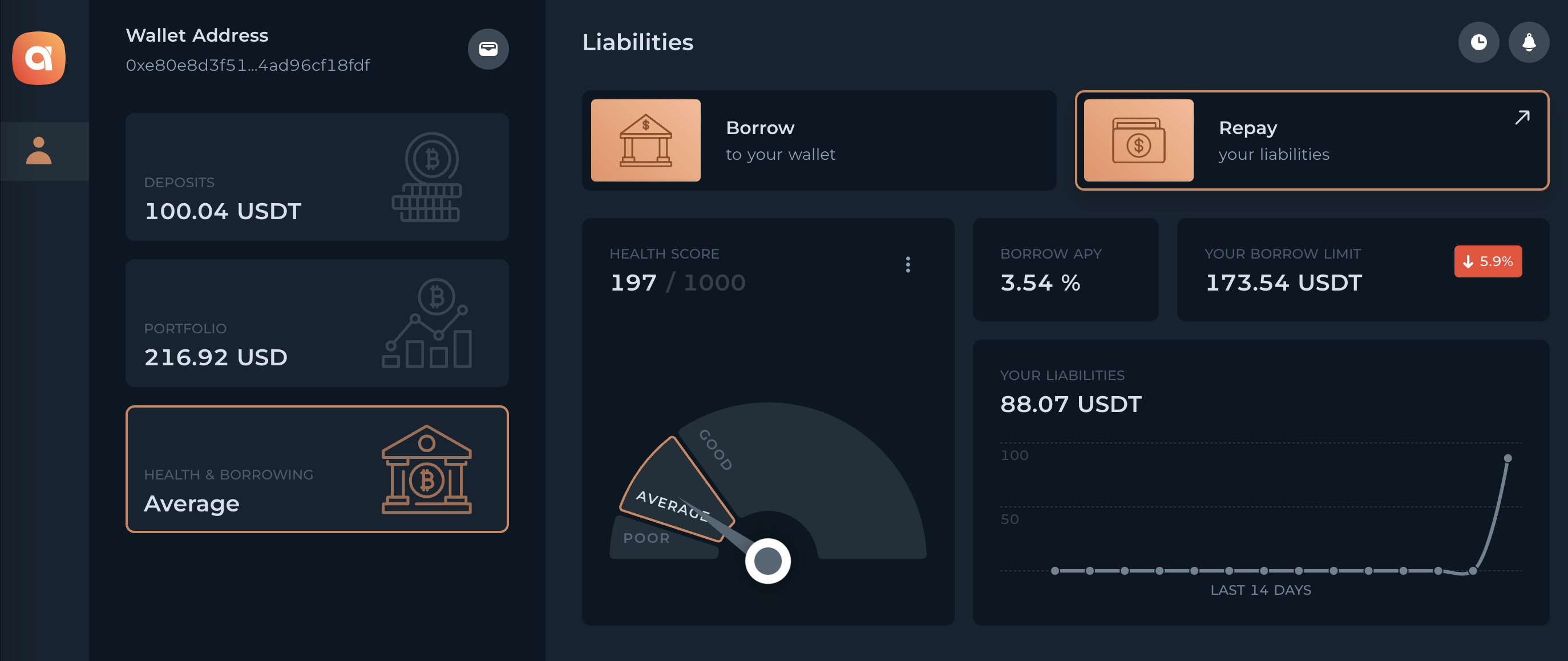

On the other side of the Ambit protocol are the borrowers. These users deposit various approved assets into their Ambit portfolio. Based on the value of their portfolios, users can borrow USDT from the Ambit vault. A dynamic interest rate is applied to the borrowed funds, and the funds are distributed to the holders of AUSD. Unlike traditional borrowing and lending protocols, Ambit does not require users to lock up their collateral or borrow against single assets. Instead, users remain fully in control of their portfolios. At any time, a user can withdraw or deposit different assets into their portfolio, provided their borrowing health is in good standing. Instead of taking each asset as individual borrowing collateral, Ambit looks at the full range of assets in a user's portfolio, and creates a health score based on the value of the assets.

Unlike traditional borrowing and lending protocols, Ambit does not require users to lock up their collateral or borrow against single assets. Instead, users remain fully in control of their portfolios. At any time, a user can withdraw or deposit different assets into their portfolio, provided their borrowing health is in good standing. Instead of taking each asset as individual borrowing collateral, Ambit looks at the full range of assets in a user's portfolio, and creates a health score based on the value of the assets.

Isolated Collateral

When a user wishes to borrow from a money market they need to provide collateral to secure their borrowing position. A traditional two-sided money market would then lend out that collateral to borrowers which presents liquidity risks to both the protocol and the depositor. With Ambit’s approach, a user's assets are only used within the confines of their own portfolio and are not available for other users to borrow. Isolated collateral allows Ambit to alleviate risk and be more secure than traditional lending systems.

Borrowing health

The amount of USDT users can borrow is based on the value of their portfolios and their borrowing health. The Borrowing Limit determines how much USDT they can borrow based on their current portfolio. A user's Health Score is a number out of 1000 that represents a user's outstanding liabilities vs their portfolio value. Higher scores indicate good borrowing health, lower scores indicate poor borrowing health. Users can repay their borrowed USDT amounts to decrease their liabilities and raise their borrowing score.

Users can freely withdraw and use assets in their portfolio, as long as their borrowing health remains in good standing. If a borrower's health score gets too low, their portfolio value can no longer be withdrawn, as their portfolio needs to have enough value to cover a portion of their outstanding liabilities. If a user does not monitor their borrowing health carefully, they risk their portfolio getting liquidated by the protocol in order to maintain collateral balances.

Interest and yield

Borrowers are charged a dynamic interest rate based on the utilization of the USDT Vault. This interest is passed back to the USDT Vault in the form of yield to the depositors.

Traditional money markets allow users to borrow assets, but that's where their interaction ends. Ambit Finance drives borrowing demand by providing users innovative DeFi investment strategies, enabling them to grow their portfolio with borrowed funds. Depending on the user risk profile, investment strategies can be geared around leveraged borrowing which comes with a premium on interest rates.

Connect your metamask wallet

Before you start, download the Google Chrome web browser

(opens in a new tab)

and the Metamask wallet extension

(opens in a new tab)

. You can create a Metamask wallet by following the Metamask guide

(opens in a new tab)

.

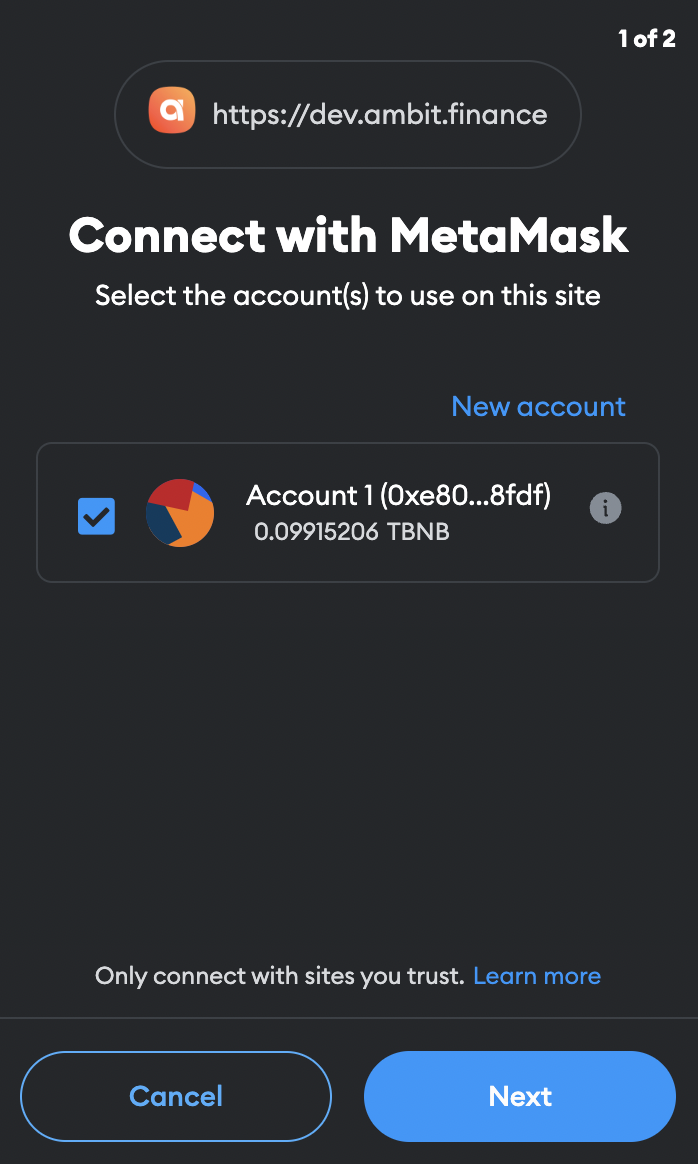

- Visit the Ambit App

- (opens in a new tab)

- in your Chrome browser. The Metamask extension should pop up. If the Metamask extension does not open, click on the Metamask icon in your extension bar.

- Click Next on the two screens asking if you want to connect to the Ambit finance app. This step lets Metamask know that this is a trusted site.

Click Confirm.

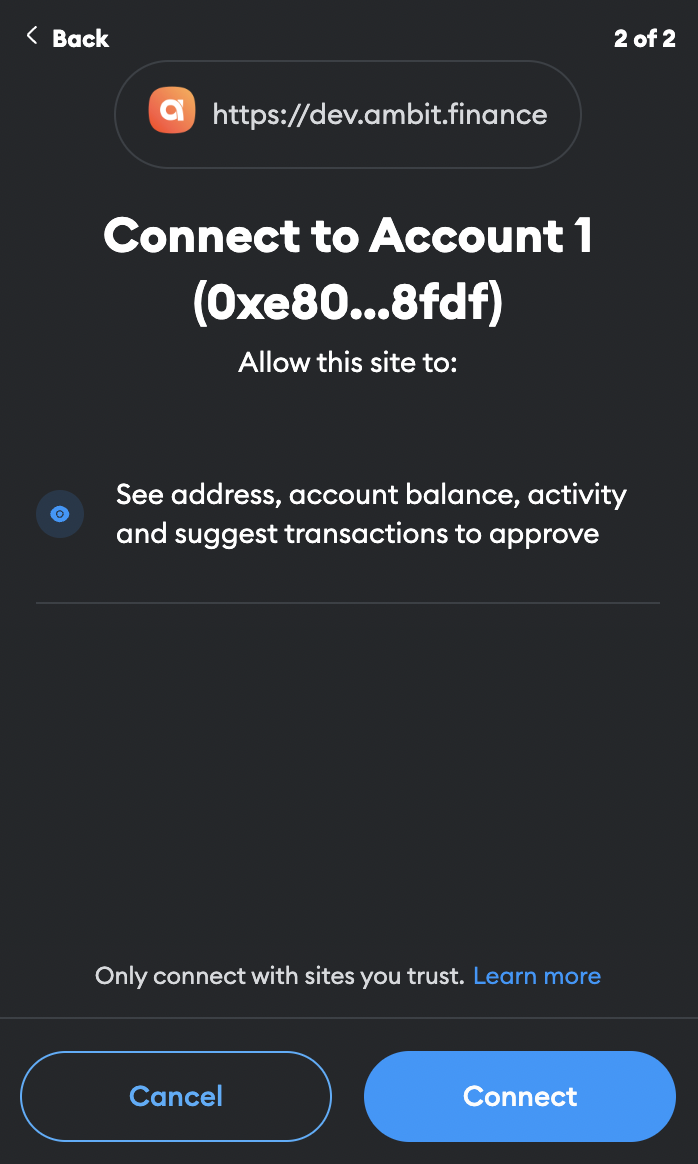

Click Confirm. Click Connect Wallet to connect your wallet.

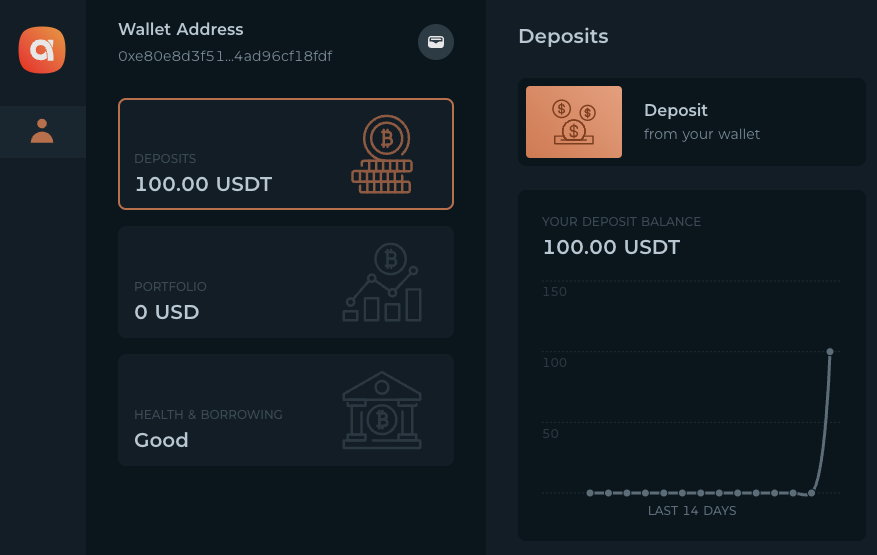

Click Connect Wallet to connect your wallet. Congratulations, you are logged in to the Ambit home screen!

Congratulations, you are logged in to the Ambit home screen!

Follow the next sections to learn how to deposit stablecoins or borrow against your portfolio.

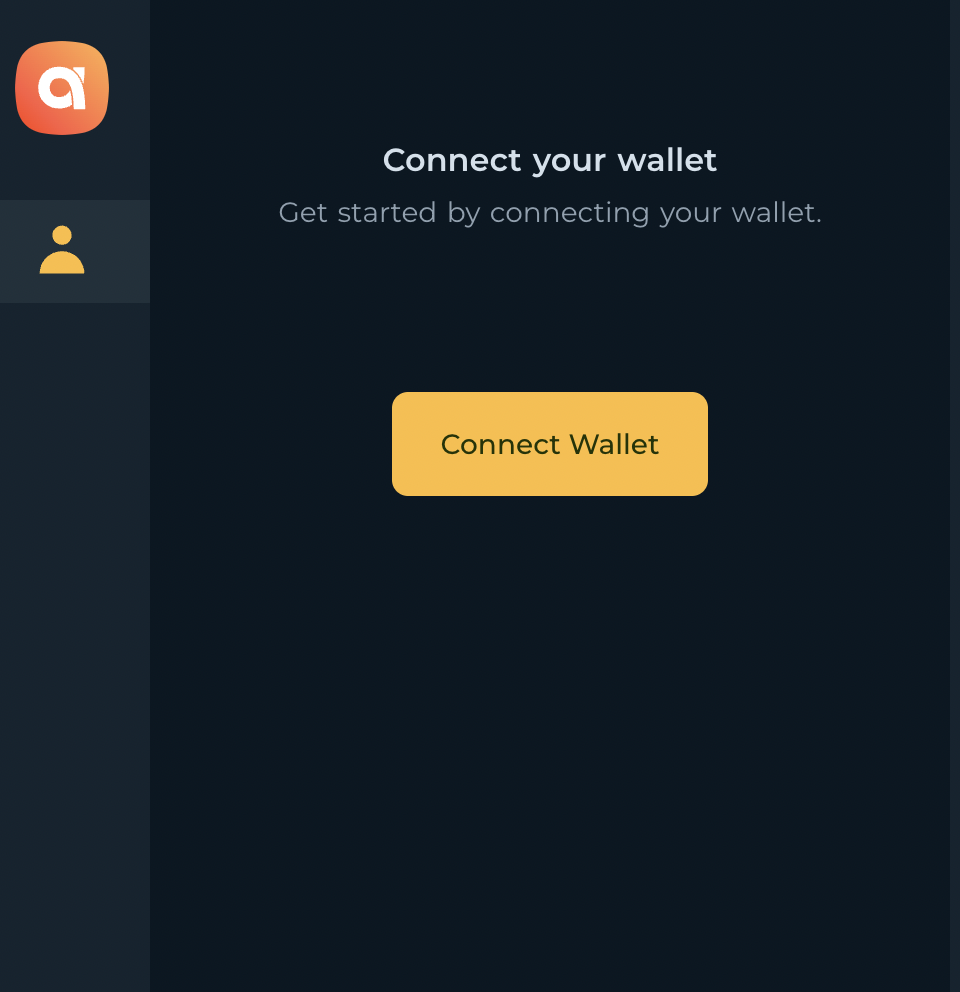

Deposit USDT

You can deposit USDT with the Ambit Web App to earn a portion of protocol yield.

- To deposit USDT, click the DEPOSITS tab in the menu bar on the left, and then click Deposit.

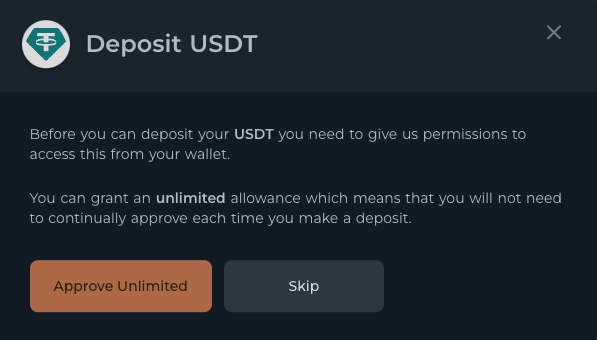

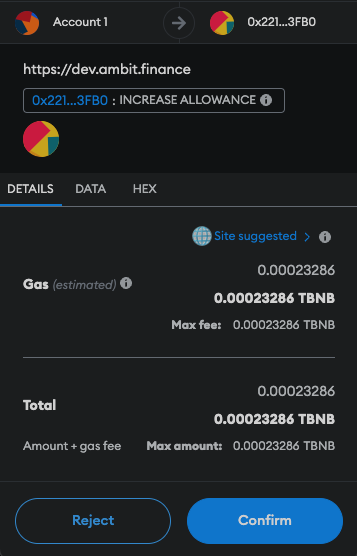

The Ambit app will ask you for permission to access your wallet. Click Approve Unlimited to approve an unlimited allowance.

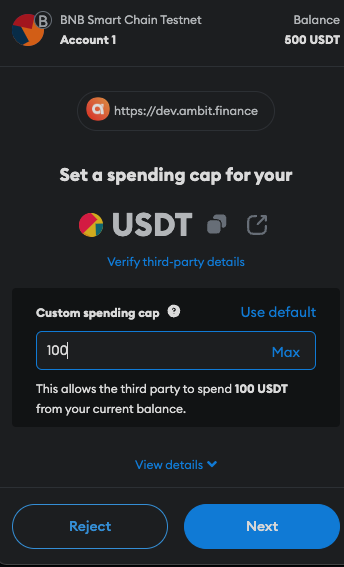

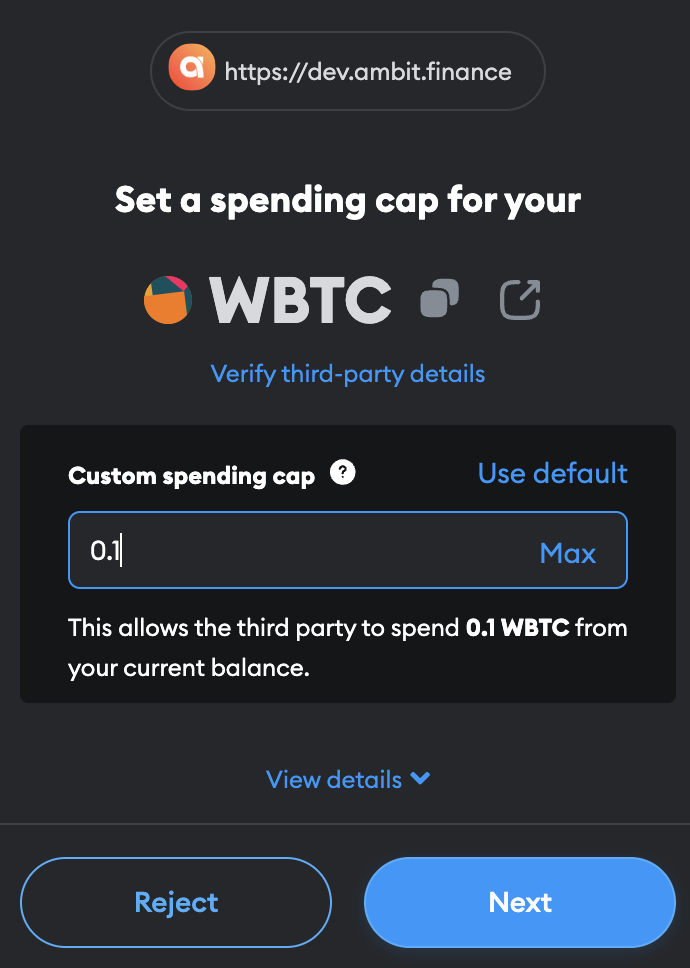

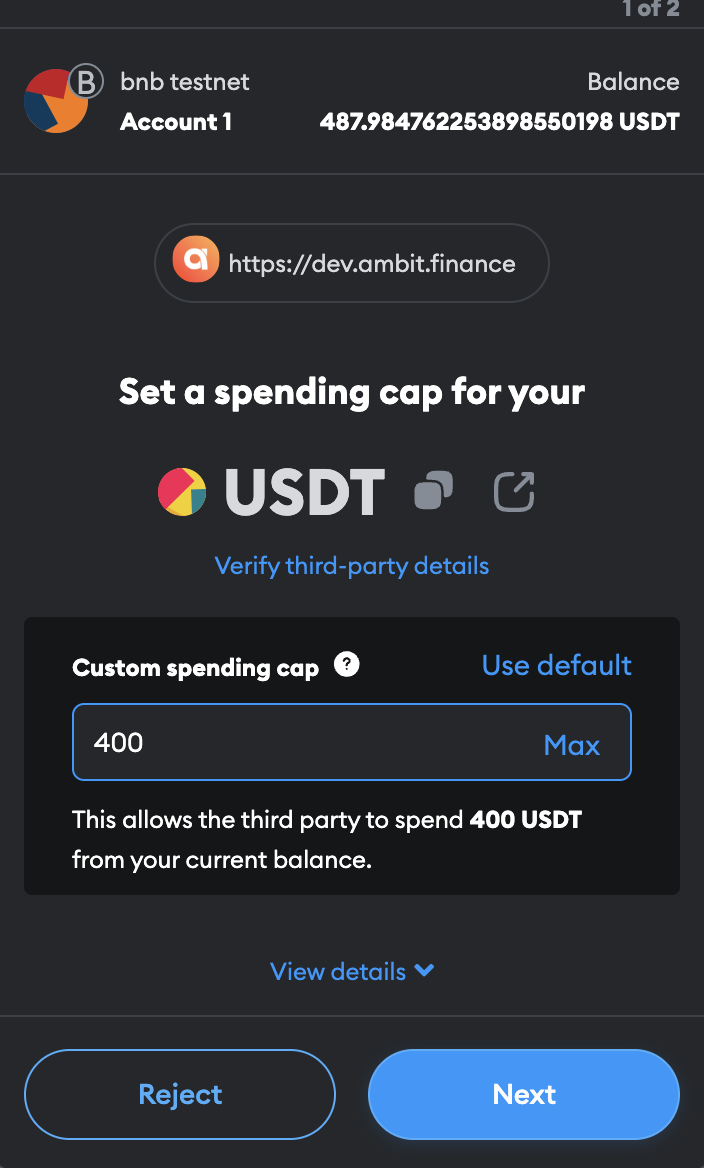

The Ambit app will ask you for permission to access your wallet. Click Approve Unlimited to approve an unlimited allowance. Your wallet may ask you to set a spending limit. Specify the amount you want to allow your Ambit account access to, and then click Next.

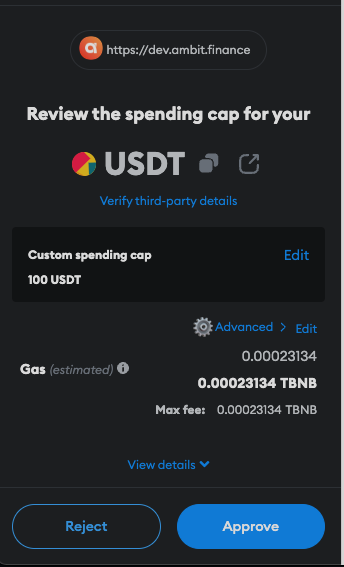

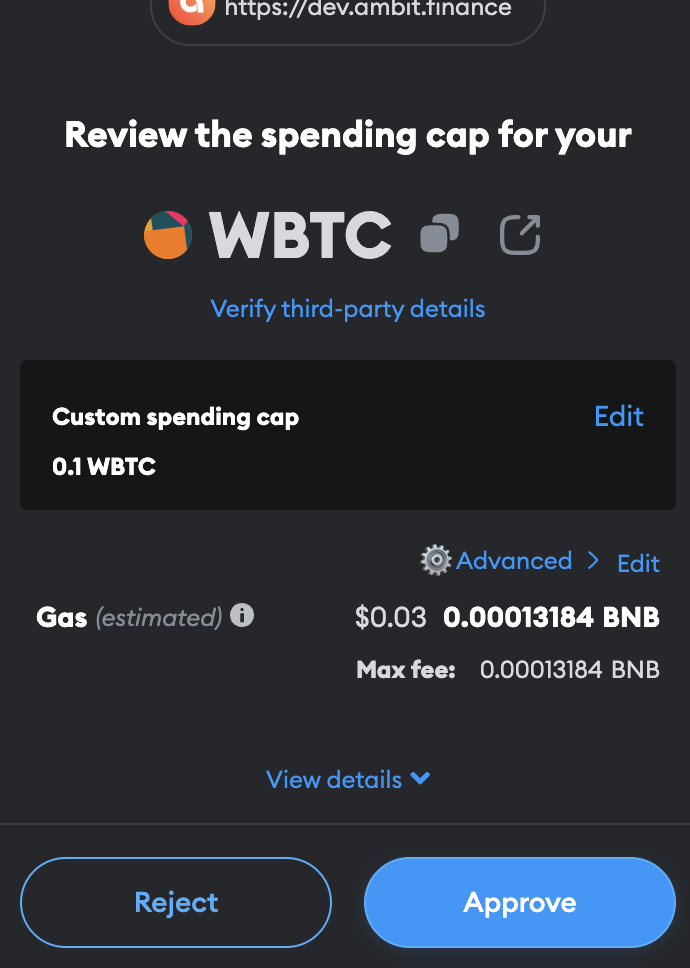

Your wallet may ask you to set a spending limit. Specify the amount you want to allow your Ambit account access to, and then click Next. Review your spending cap and click Approve.

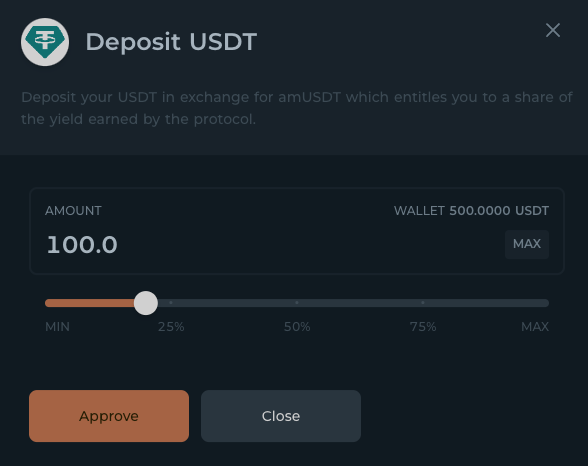

Review your spending cap and click Approve. Your wallet is all set to deposit USDT. Enter the amount of USDT you want to deposit, and click Approve.

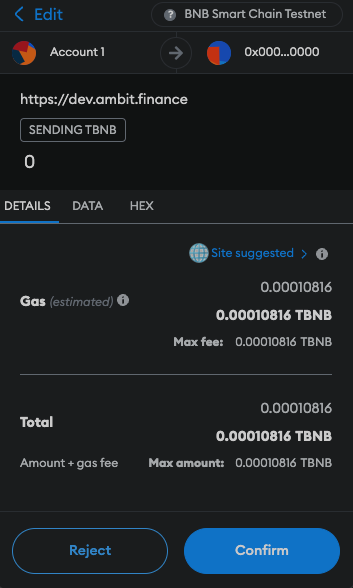

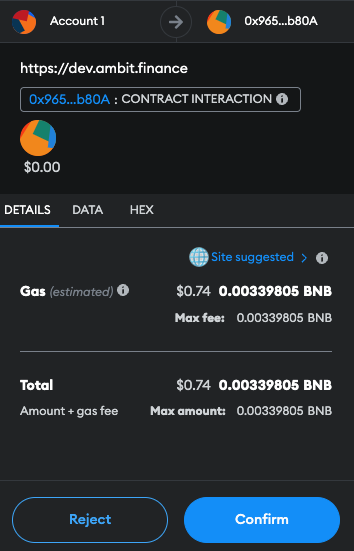

Your wallet is all set to deposit USDT. Enter the amount of USDT you want to deposit, and click Approve. Review the transaction in your wallet extension and click Confirm. Make sure the amounts are correct. Keep in mind that there will be a small computational fee to send the transaction.

Review the transaction in your wallet extension and click Confirm. Make sure the amounts are correct. Keep in mind that there will be a small computational fee to send the transaction. Congratulations! You’ve successfully deposited USDT to earn a share of the protocol’s yield. The amount you deposited will show in your dashboard.

Congratulations! You’ve successfully deposited USDT to earn a share of the protocol’s yield. The amount you deposited will show in your dashboard.

Withdraw USDT

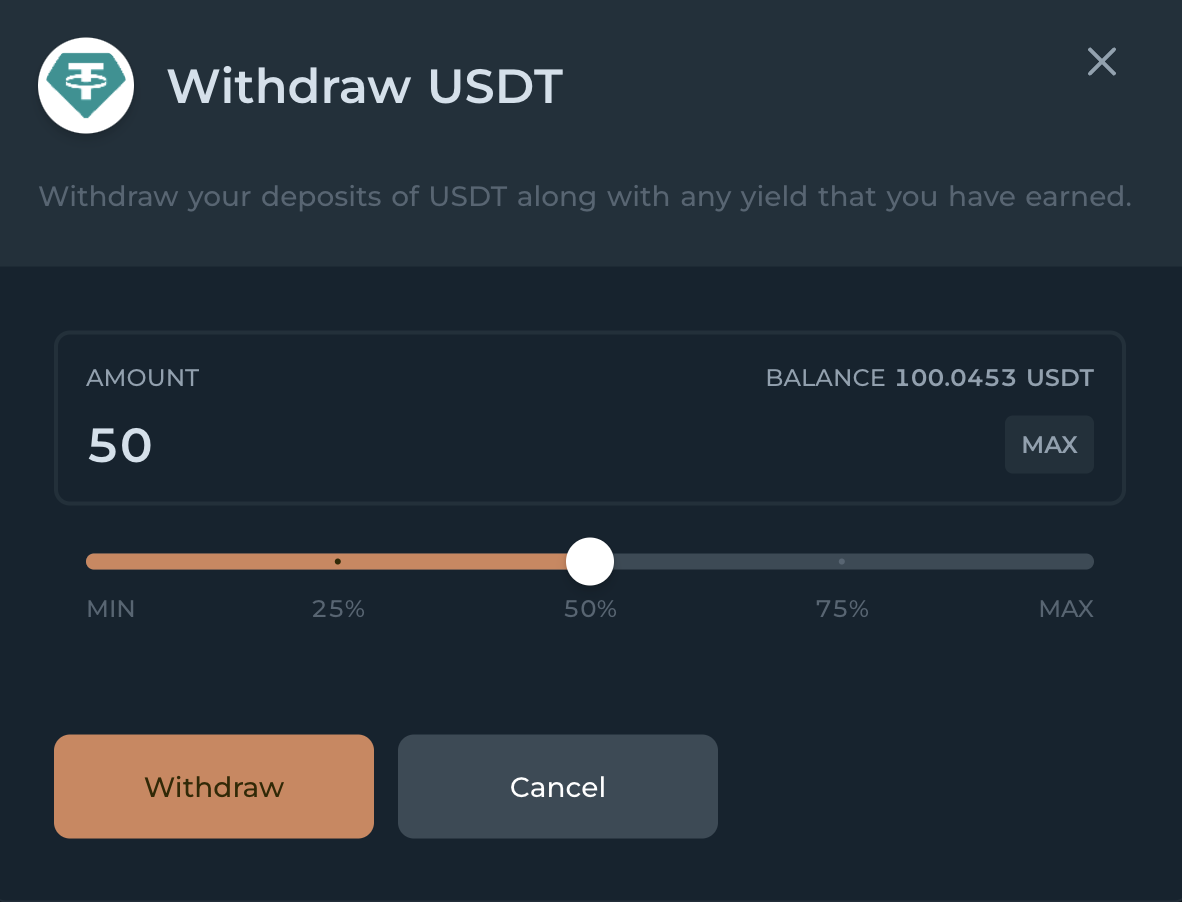

- To withdraw your deposited USDT, click the DEPOSITS tab in the menu bar on the left, and then click Withdraw.

Enter the amount you want to withdraw. You can click Max to withdraw your maximum amount.

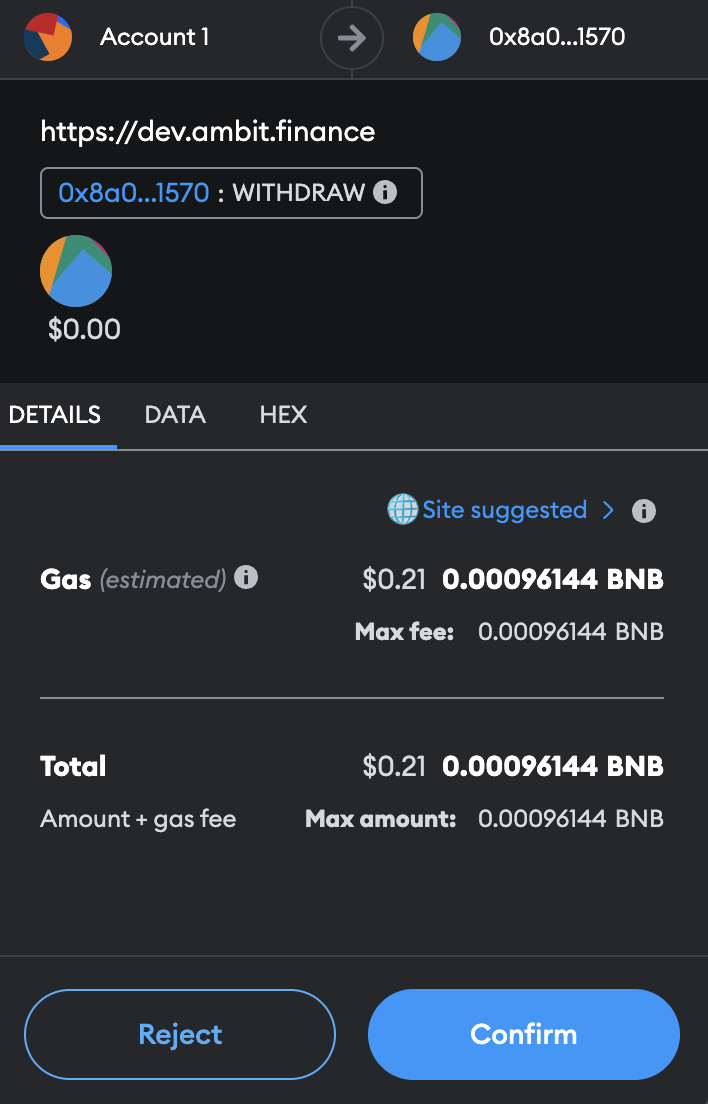

Enter the amount you want to withdraw. You can click Max to withdraw your maximum amount. Click Withdraw. 4. Review the amounts and click Confirm to approve the transaction in your wallet.

Click Withdraw. 4. Review the amounts and click Confirm to approve the transaction in your wallet. After completing the transaction, the withdrawn USDT will appear in your wallet.

After completing the transaction, the withdrawn USDT will appear in your wallet.

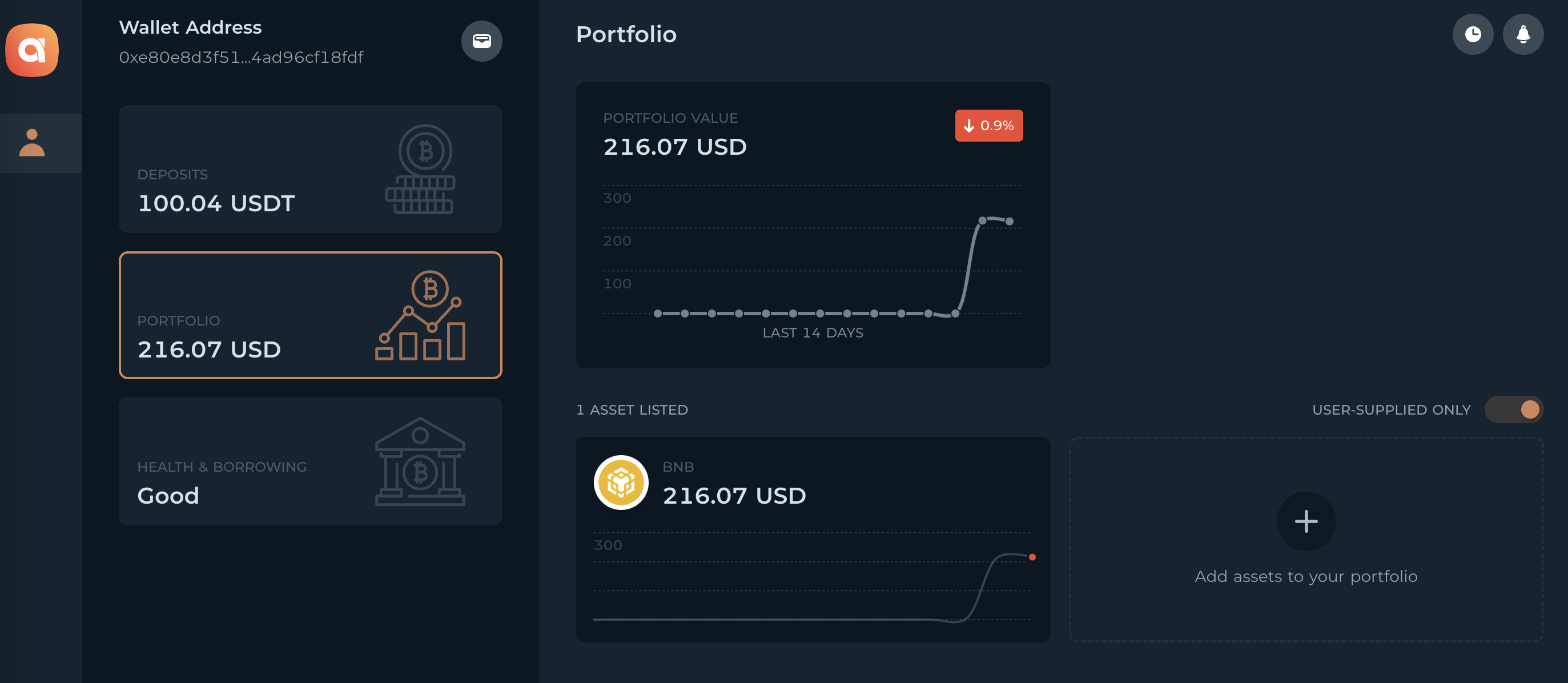

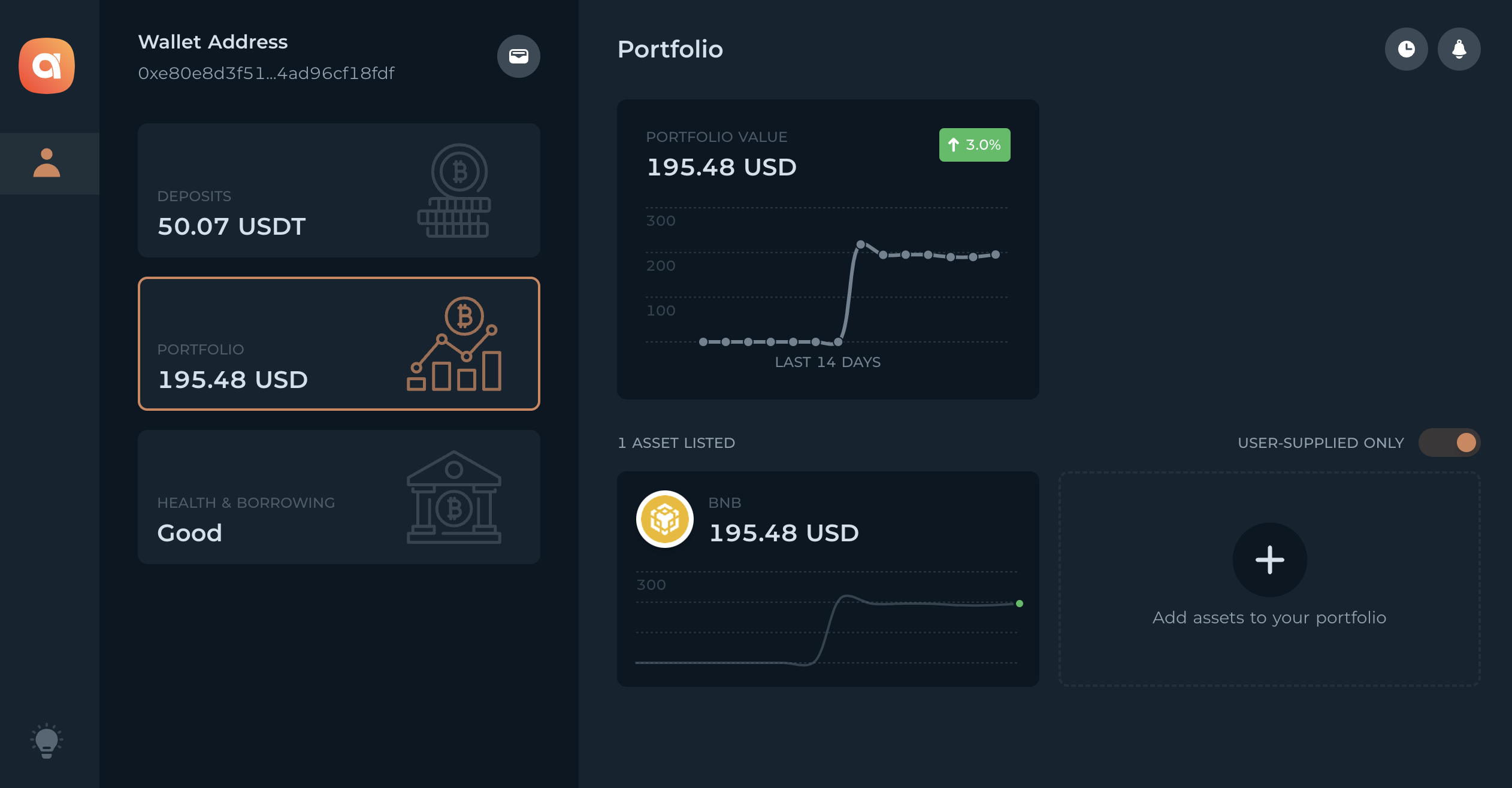

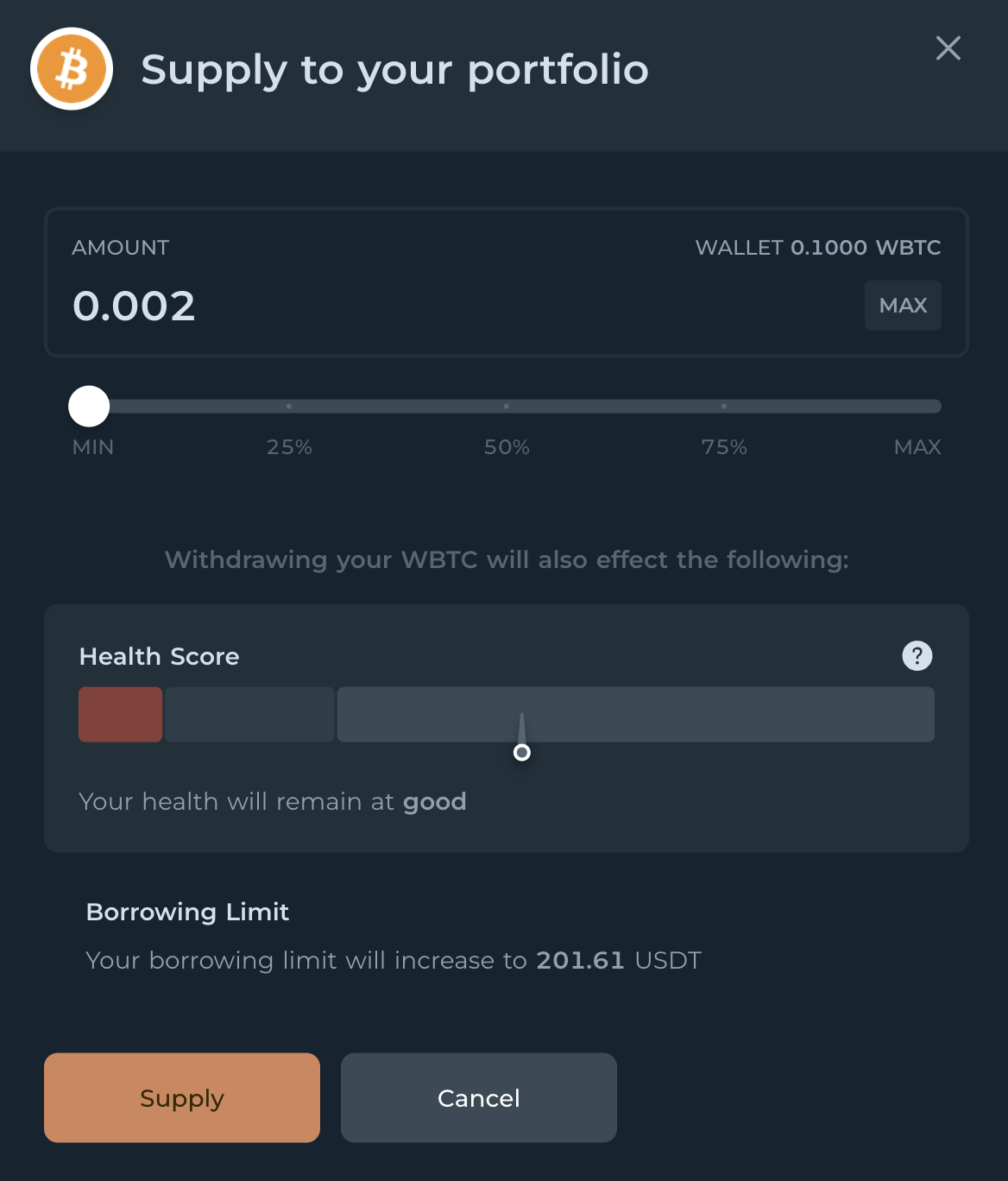

Supply your portfolio

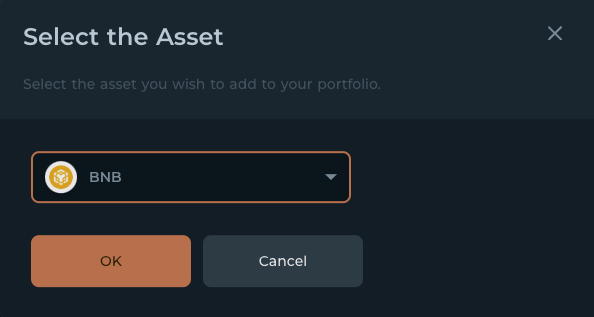

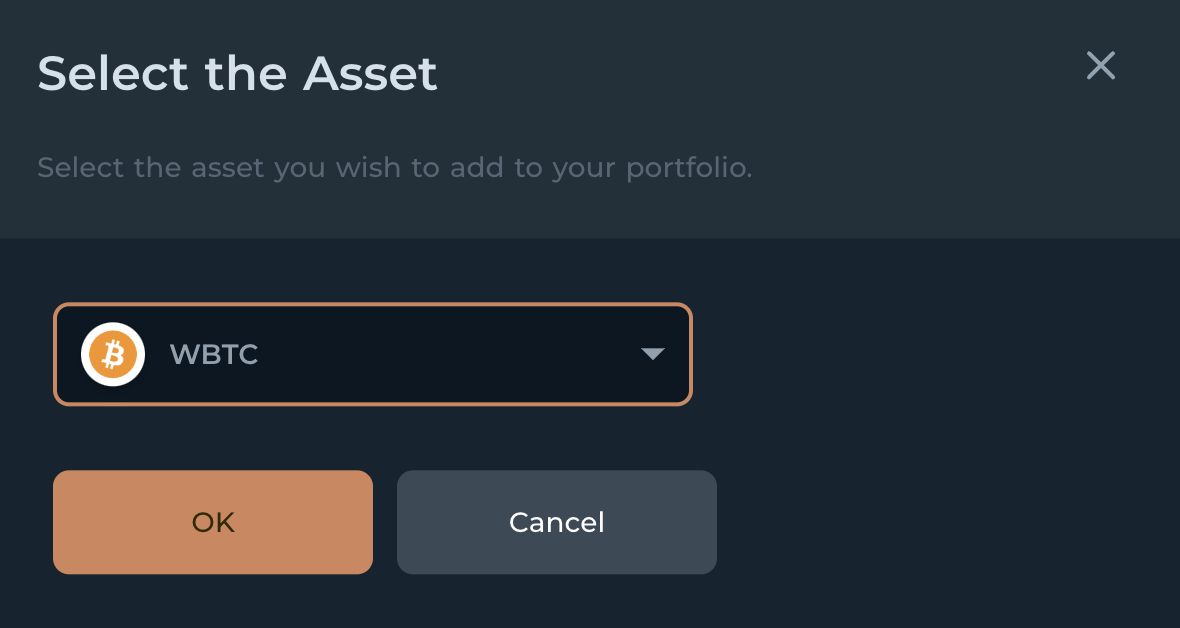

- To access your portfolio, click the Portfolio tab in the menu bar on the left. Click the plus symbol to add assets to your portfolio.

Click on the dropdown menu and select the asset you want to add to your portfolio.

Click on the dropdown menu and select the asset you want to add to your portfolio. Click OK.

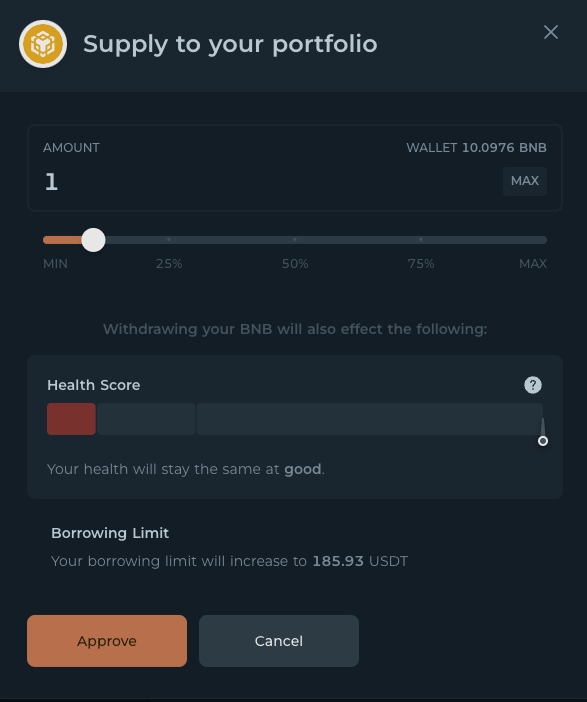

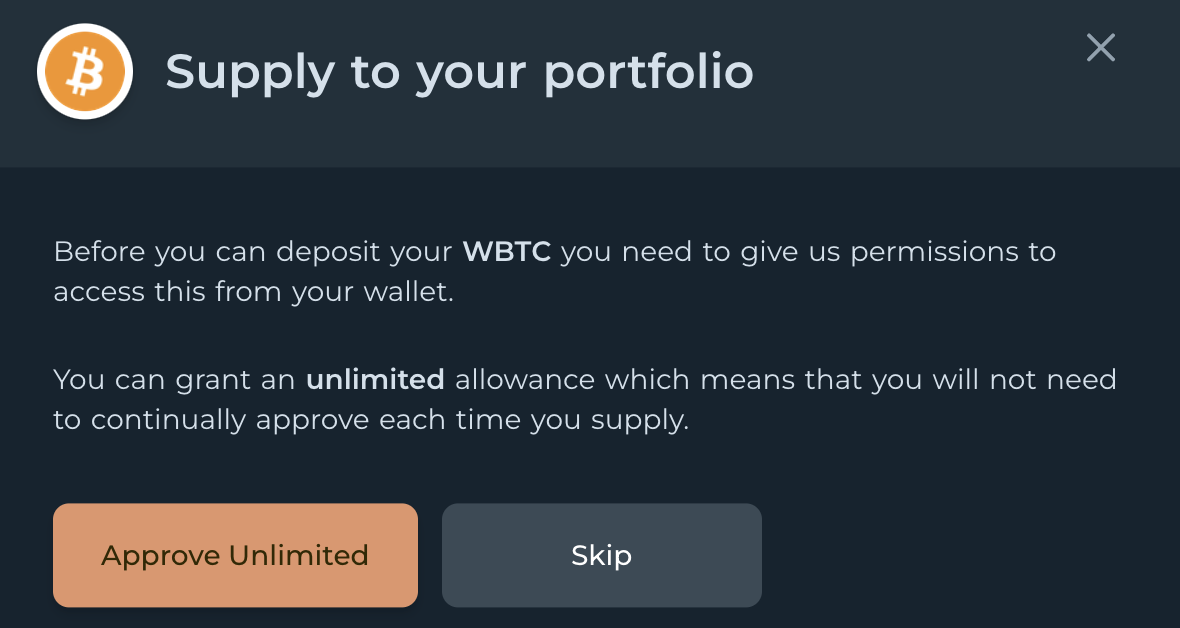

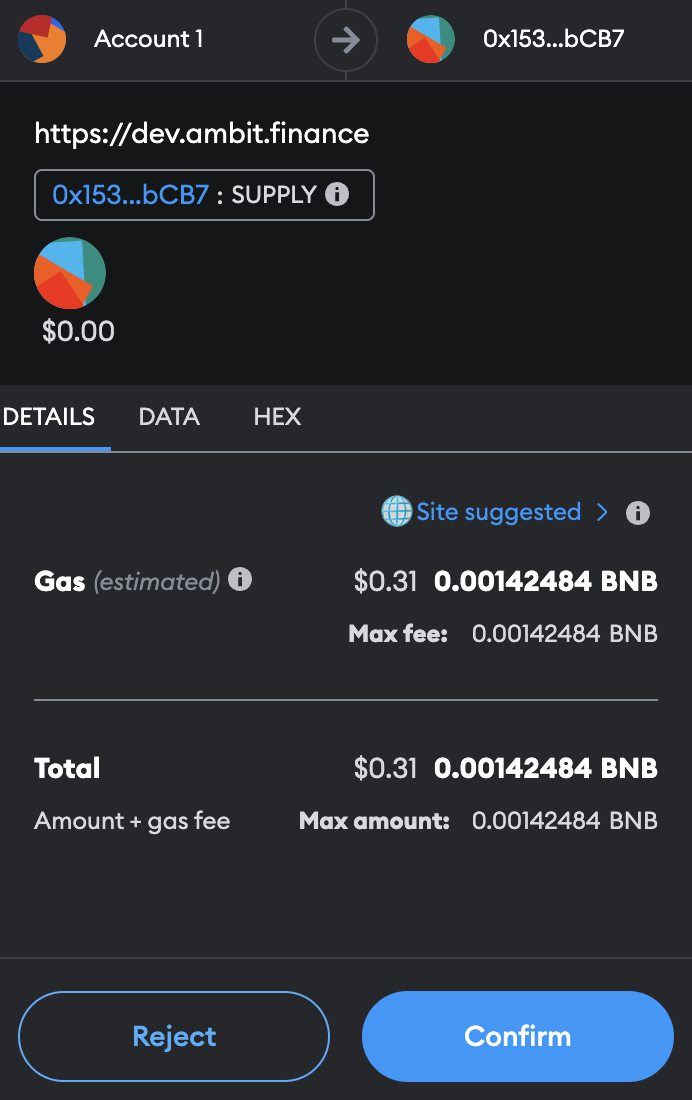

Click OK.- Enter the amount of the Asset you want to use to supply your portfolio. Your borrowing limit will appear at the bottom of the screen. Click Approve to approve the transaction.

Review the amounts and click Confirm to approve the transaction in your wallet.

Review the amounts and click Confirm to approve the transaction in your wallet. Congratulations, you’ve added an asset to your portfolio! Your portfolio value will be listed in your dashboard. To add another asset, follow these steps again. To borrow from your portfolio, follow the Borrow guide.

Congratulations, you’ve added an asset to your portfolio! Your portfolio value will be listed in your dashboard. To add another asset, follow these steps again. To borrow from your portfolio, follow the Borrow guide.

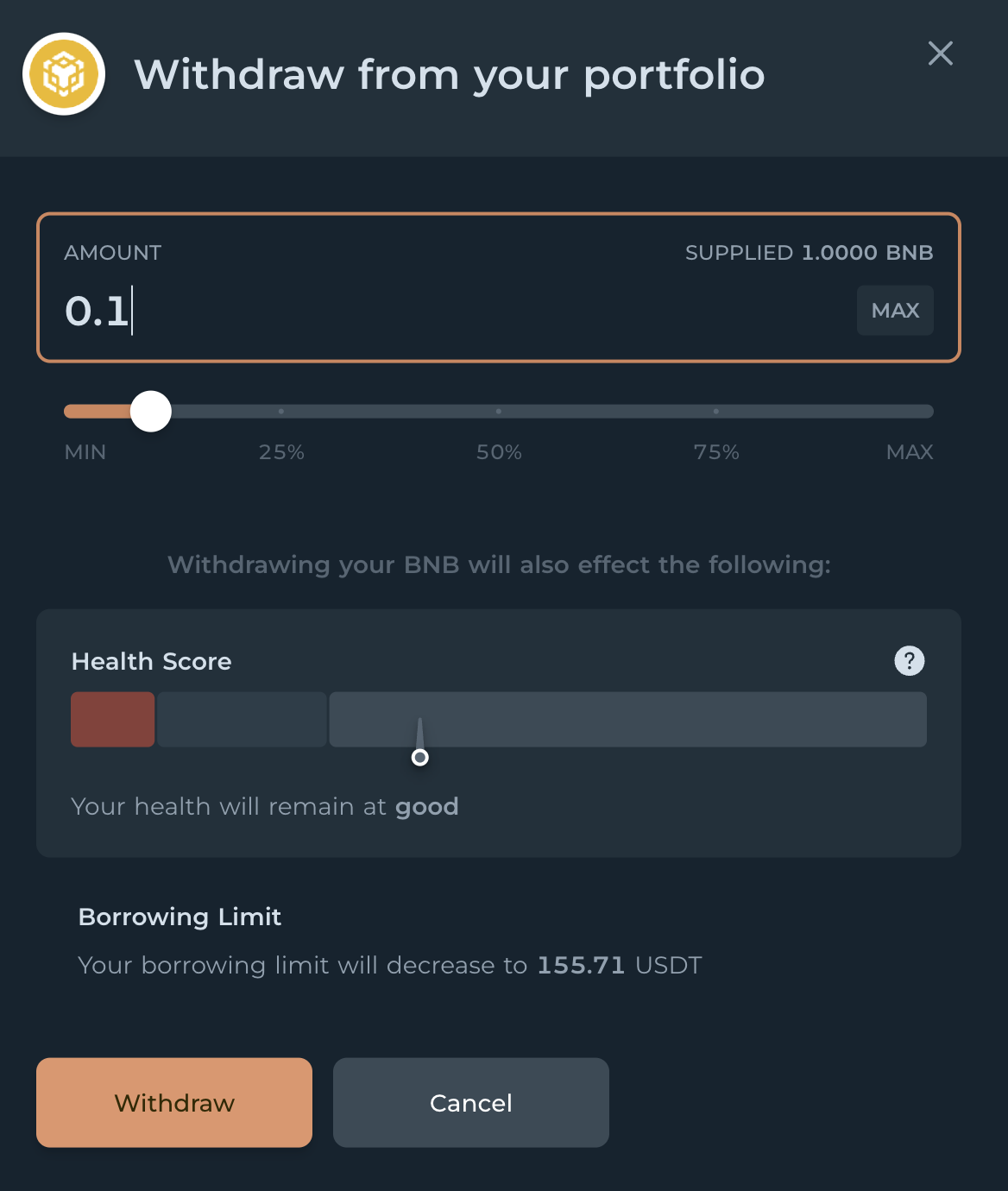

Withdraw from your portfolio

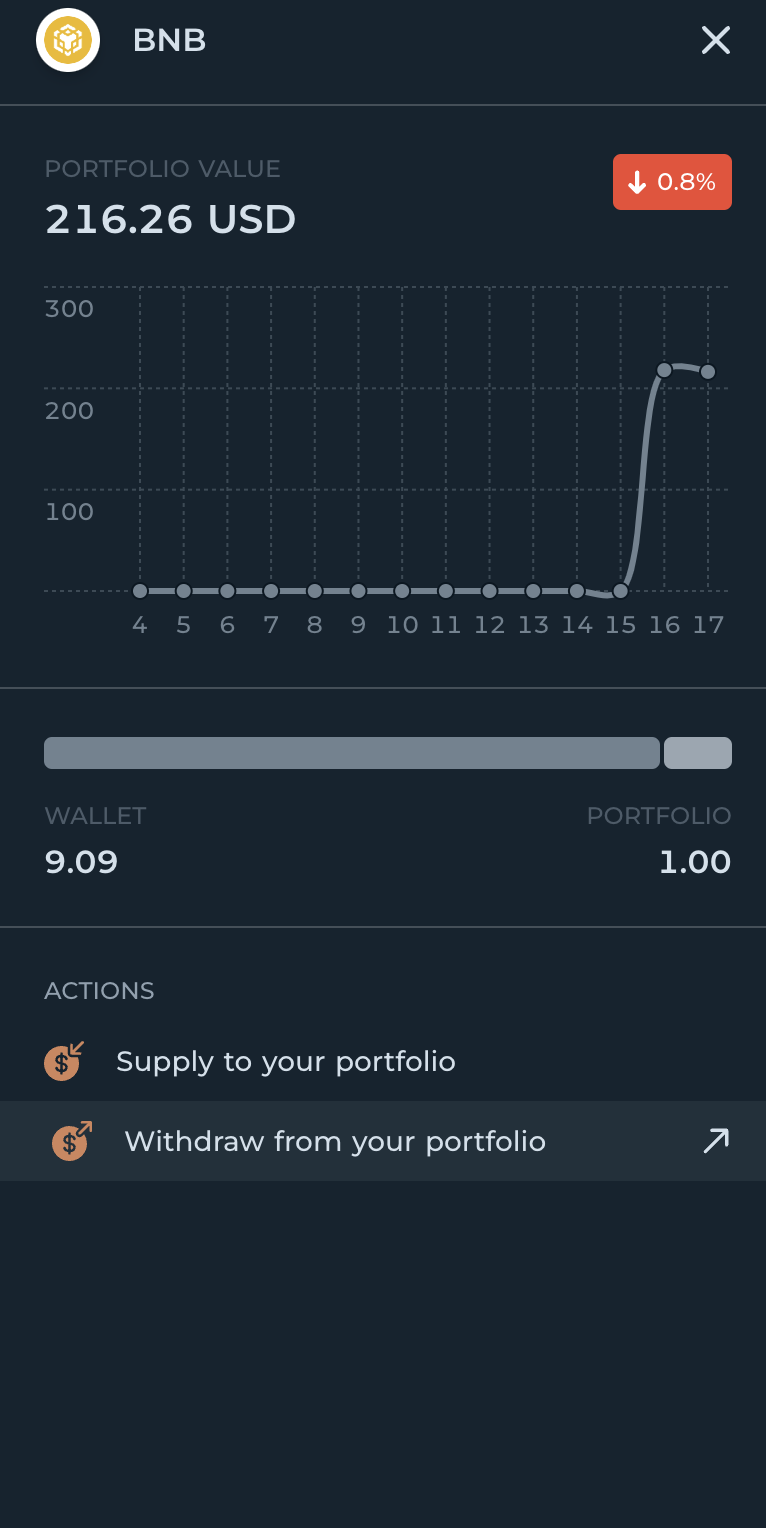

- To withdraw an asset from your portfolio, click the Portfolio tab in the menu bar on the left. Click on the asset you want to withdraw.

Click Withdraw from your portfolio in the sidebar.

Click Withdraw from your portfolio in the sidebar. Enter the amount you want to withdraw and click Withdraw.

Enter the amount you want to withdraw and click Withdraw. Review the transaction in your wallet and click Confirm. After completing the transaction, the withdrawn asset will appear in your wallet.

Review the transaction in your wallet and click Confirm. After completing the transaction, the withdrawn asset will appear in your wallet.

Buy assets with borrowed funds

- Click the Portfolio tab in the menu bar on the left. Then click Add assets to your portfolio on the bottom right of the screen.

Select the asset you want to purchase.

Select the asset you want to purchase. Before you can buy an asset, you’ll need to give Ambit permission to access your wallet. Click Approve Unlimited to approve future transactions.

Before you can buy an asset, you’ll need to give Ambit permission to access your wallet. Click Approve Unlimited to approve future transactions. Set a spending limit in your wallet for the Ambit App and click Next.

Set a spending limit in your wallet for the Ambit App and click Next. Verify the spending limit and click Approve.

Verify the spending limit and click Approve. Enter the amount you want to purchase using your borrowed funds. Make sure to check your health score. Review the amounts and click Supply.

Enter the amount you want to purchase using your borrowed funds. Make sure to check your health score. Review the amounts and click Supply. Verify the transaction in your wallet and click Confirm.

Verify the transaction in your wallet and click Confirm. Congratulations, your purchased asset will appear in your portfolio after the transaction has been executed.

Congratulations, your purchased asset will appear in your portfolio after the transaction has been executed.

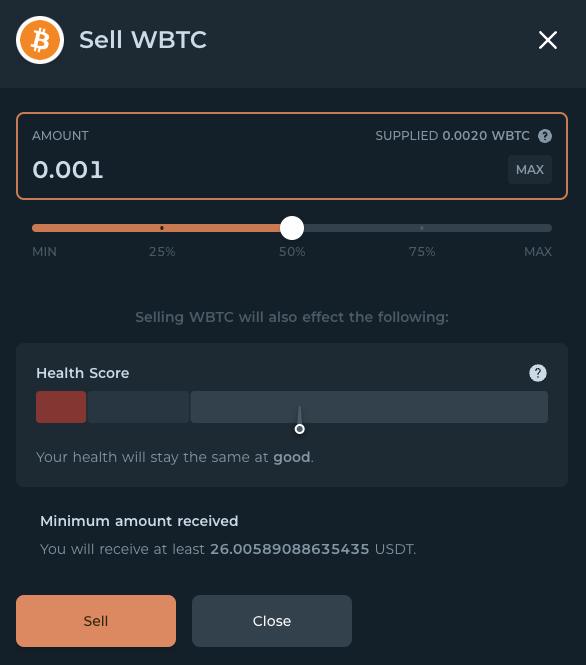

Sell assets from your portfolio

- Click the Portfolio tab in the menu bar on the left. Then, click **the asset in your portfolio that you want to sell.

In the sidebar, click Sell the asset from your portfolio.

In the sidebar, click Sell the asset from your portfolio. Enter the amount you want to sell, confirm the amounts, and click Sell.

Enter the amount you want to sell, confirm the amounts, and click Sell. Review the transaction in your wallet and click Confirm.

Review the transaction in your wallet and click Confirm. After a successful transaction, the USDT will appear in your portfolio.

After a successful transaction, the USDT will appear in your portfolio.

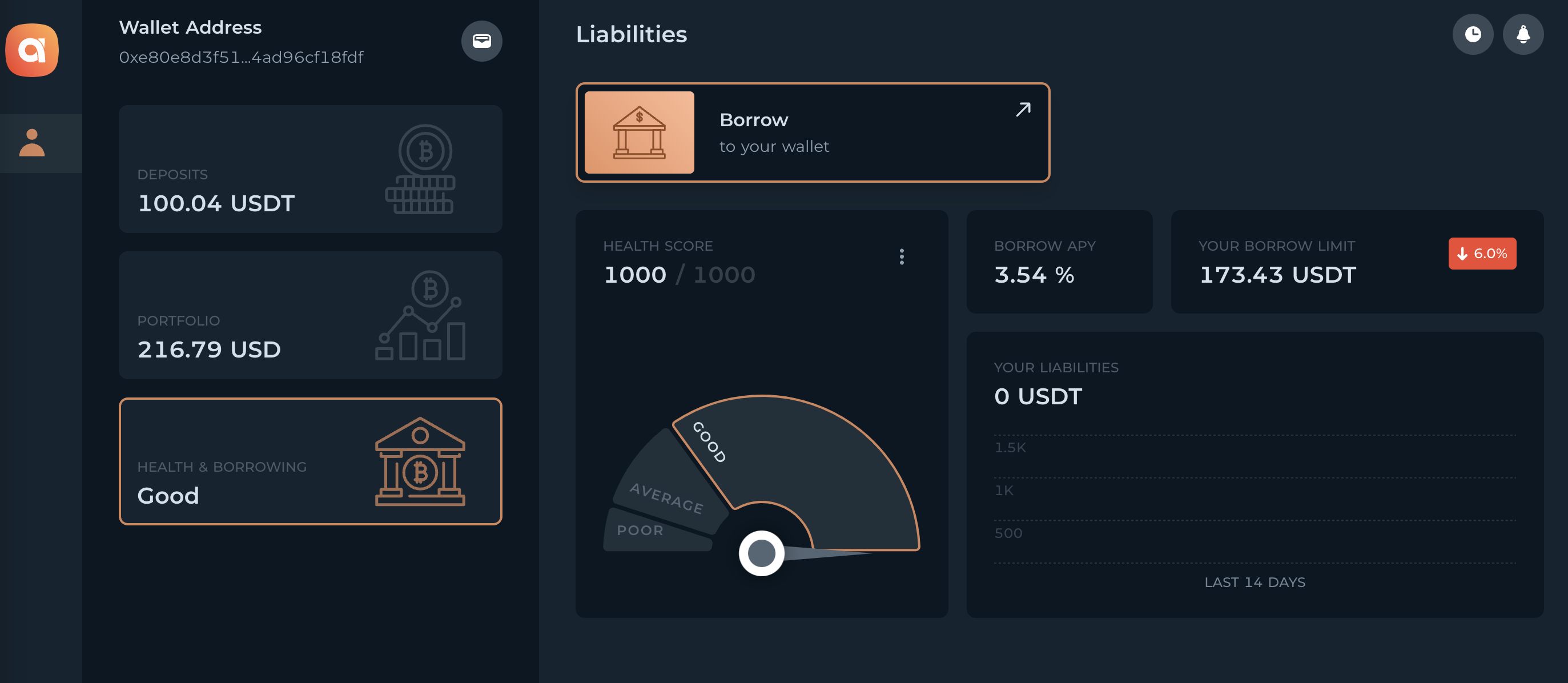

Borrow

- To borrow from your portfolio, click the Health and Borrowing tab in the menu bar on the left, and then click Borrow.

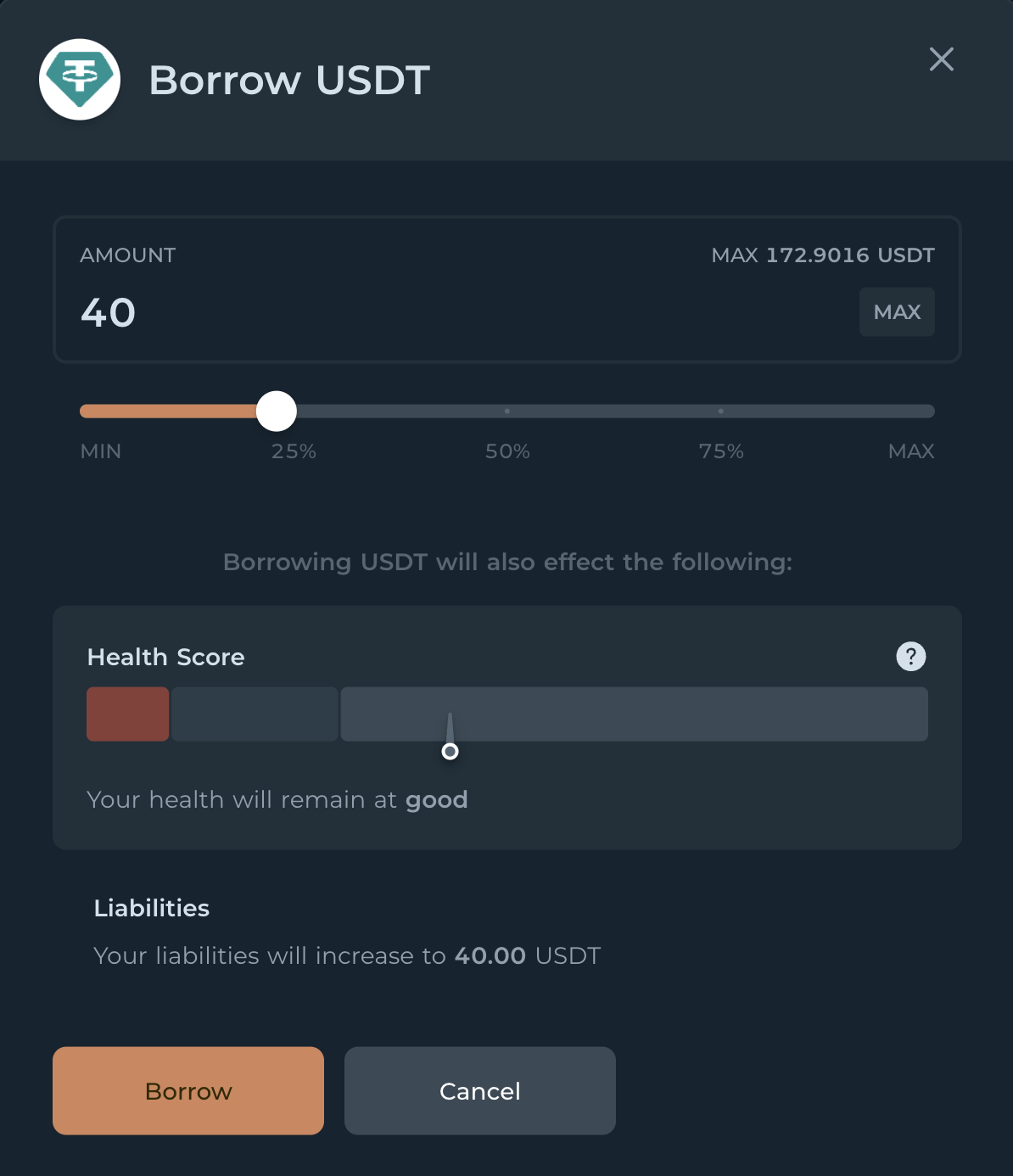

Enter the amount of USDT you want to borrow. Your borrow health will be estimated and reflected in the health bar.

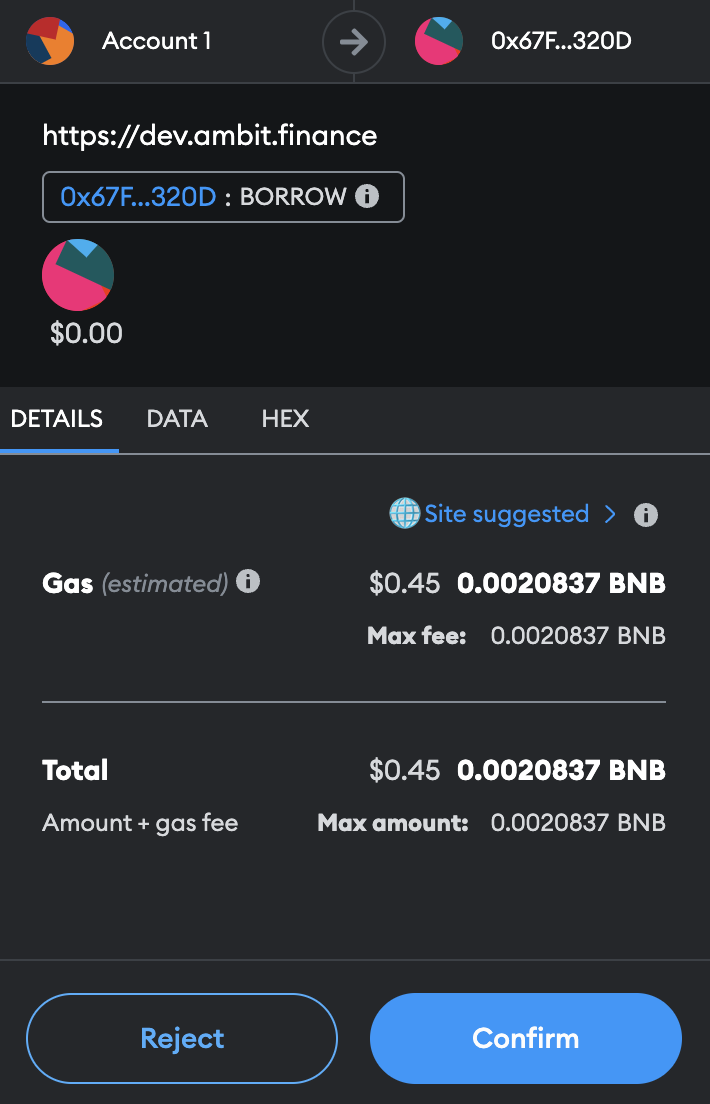

Enter the amount of USDT you want to borrow. Your borrow health will be estimated and reflected in the health bar. After confirming the amount, click Borrow 4. Review the amounts and press Confirm to approve the transaction in your wallet.

After confirming the amount, click Borrow 4. Review the amounts and press Confirm to approve the transaction in your wallet. Congratulations, you have just borrowed USDT! After completing the transaction successfully, the borrowed USDT will appear in your wallet. Follow the Repay guide to learn how to repay your borrowed amount.

Congratulations, you have just borrowed USDT! After completing the transaction successfully, the borrowed USDT will appear in your wallet. Follow the Repay guide to learn how to repay your borrowed amount.- Repay

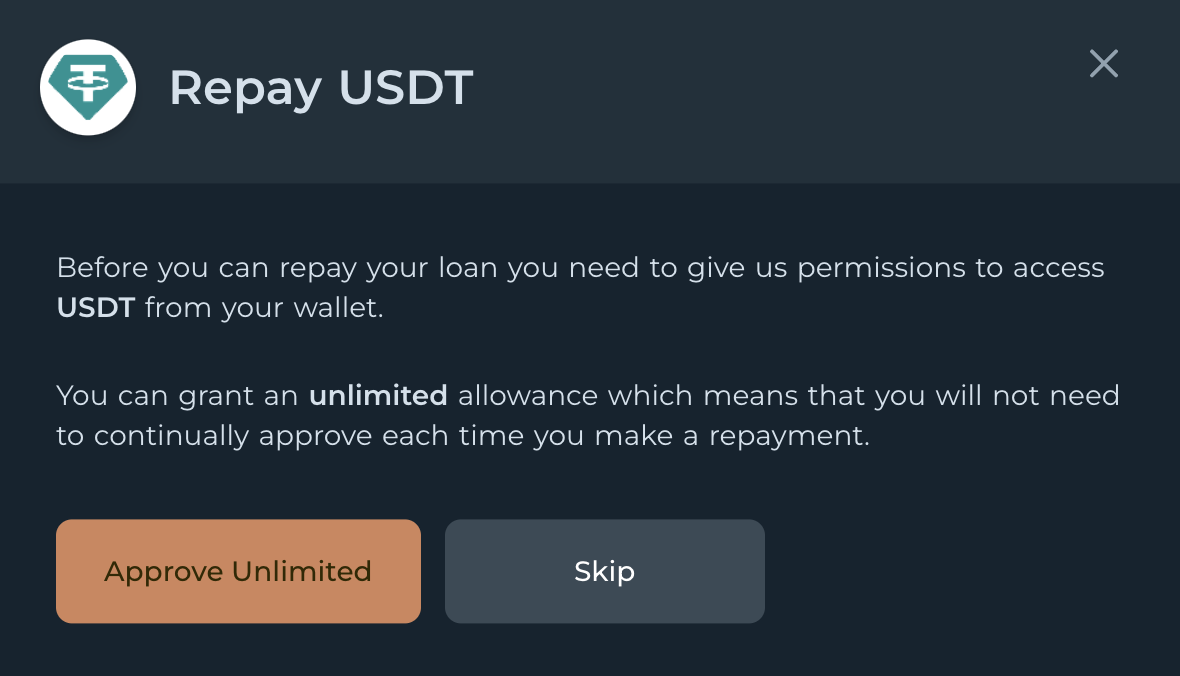

- To repay your liabilities and increase your health score, click the Health and Borrowing tab in the menu bar on the left, and then click Repay.

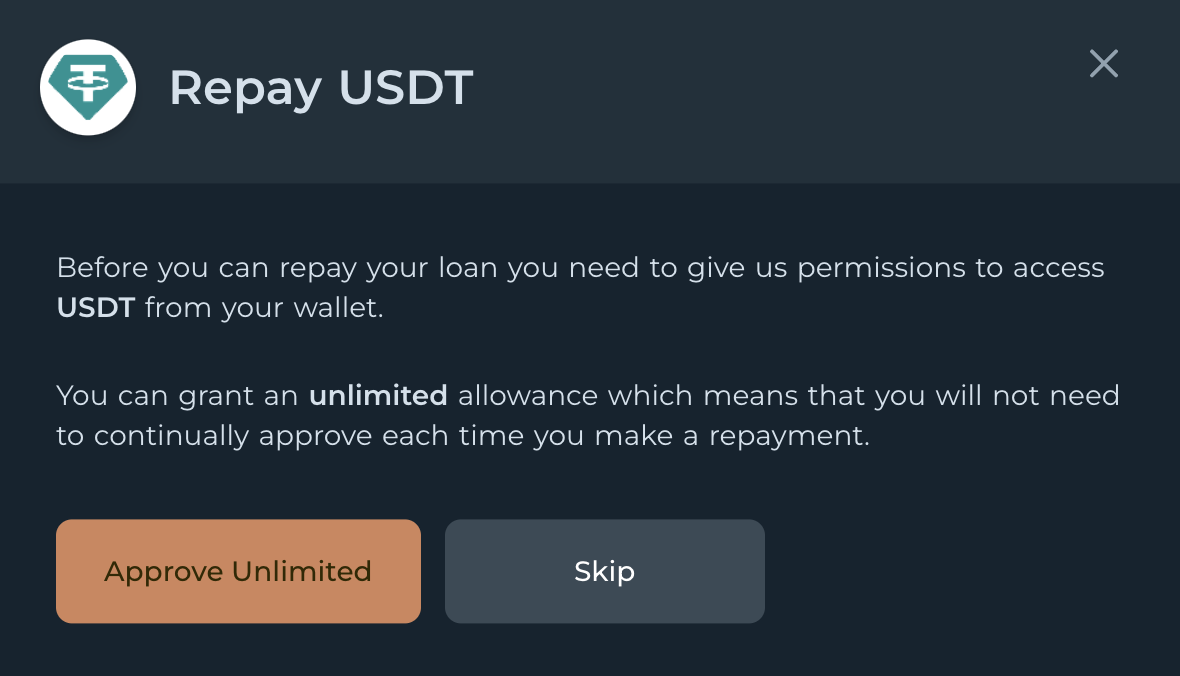

The first time you repay, you will be prompted to give the app permission to access USDT from your wallet. Click Approve Unlimited to approve any repayments. Click Skip to approve repayments each time you make them.

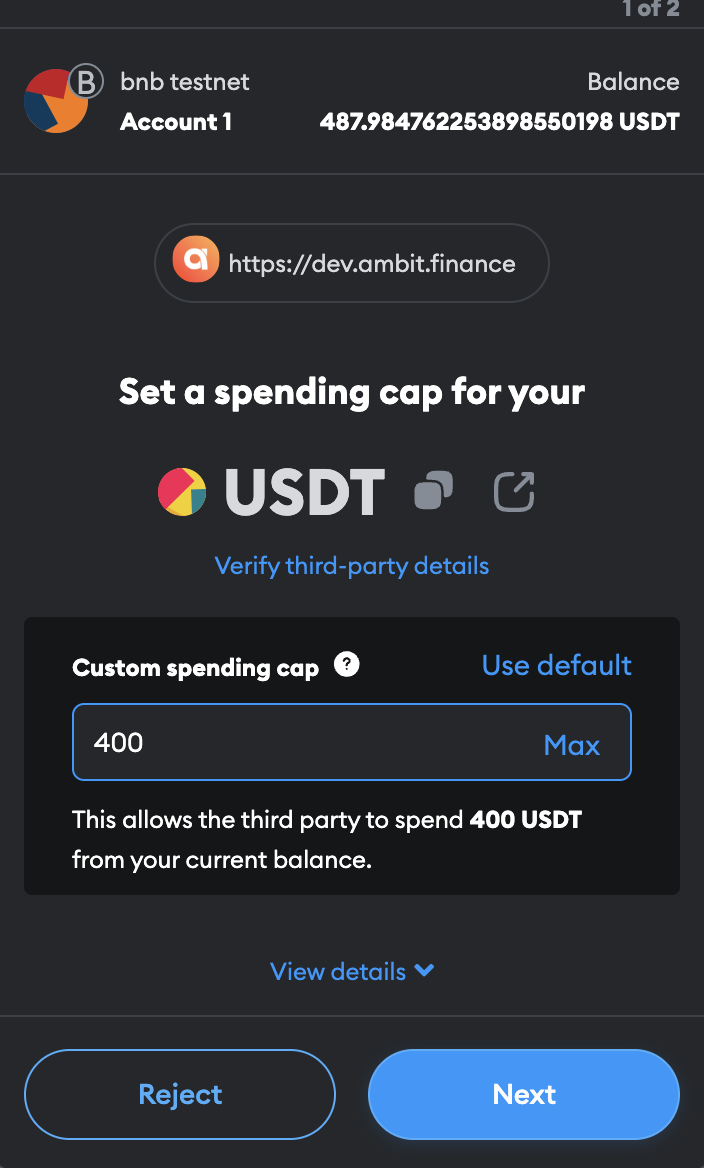

The first time you repay, you will be prompted to give the app permission to access USDT from your wallet. Click Approve Unlimited to approve any repayments. Click Skip to approve repayments each time you make them. If you clicked Approve Unlimited, you will need to enter a limit and click Next. This limit is the amount you authorize the app to have access to for repayments.

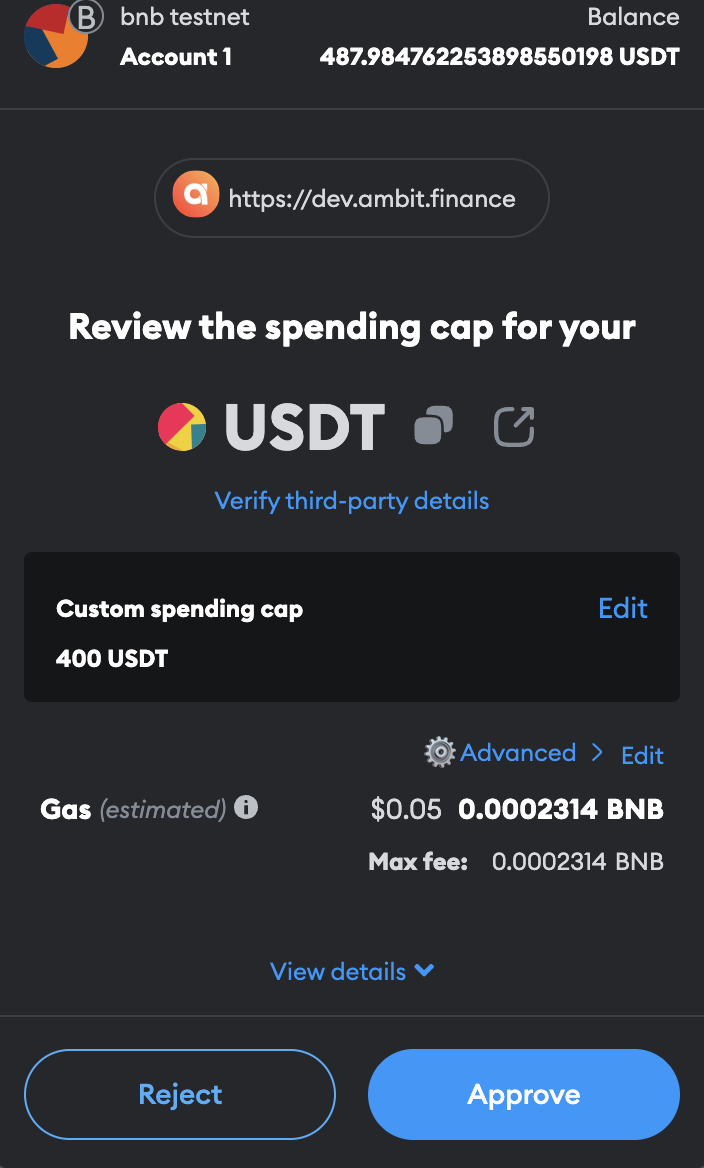

If you clicked Approve Unlimited, you will need to enter a limit and click Next. This limit is the amount you authorize the app to have access to for repayments. Click Approve to approve the transaction.

Click Approve to approve the transaction.

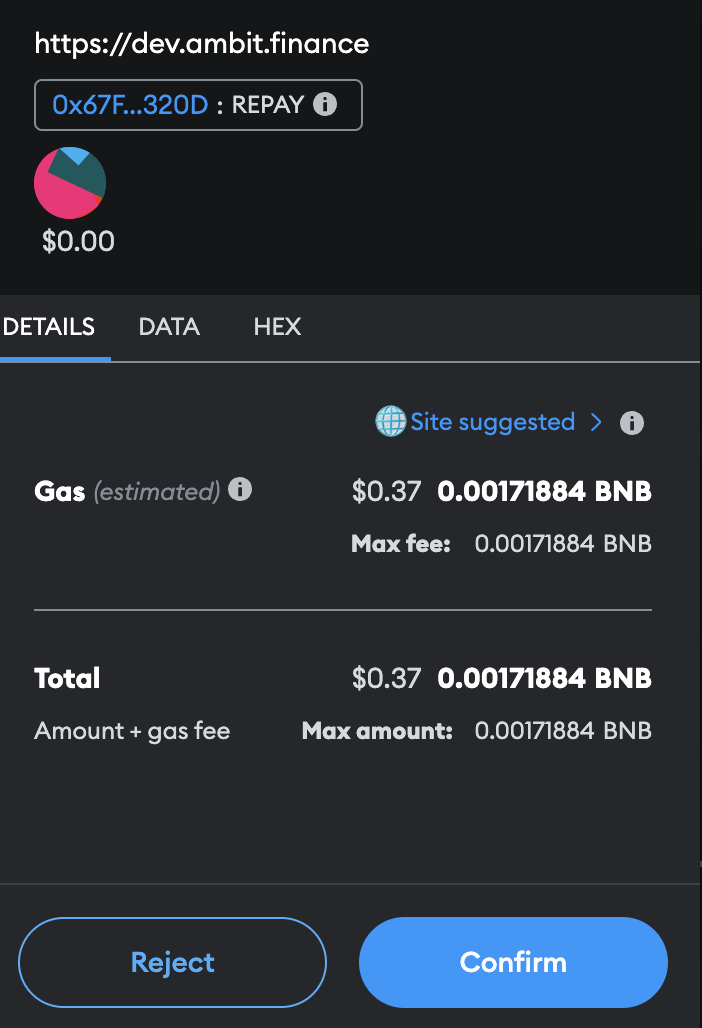

REPAY

- To repay your liabilities and increase your health score, click the Health and Borrowing tab in the menu bar on the left, and then click Repay.

The first time you repay, you will be prompted to give the app permission to access USDT from your wallet. Click Approve Unlimited to approve any repayments. Click Skip to approve repayments each time you make them.

The first time you repay, you will be prompted to give the app permission to access USDT from your wallet. Click Approve Unlimited to approve any repayments. Click Skip to approve repayments each time you make them. If you clicked Approve Unlimited, you will need to enter a limit and click Next. This limit is the amount you authorize the app to have access to for repayments.

If you clicked Approve Unlimited, you will need to enter a limit and click Next. This limit is the amount you authorize the app to have access to for repayments. Click Approve to approve the transaction.

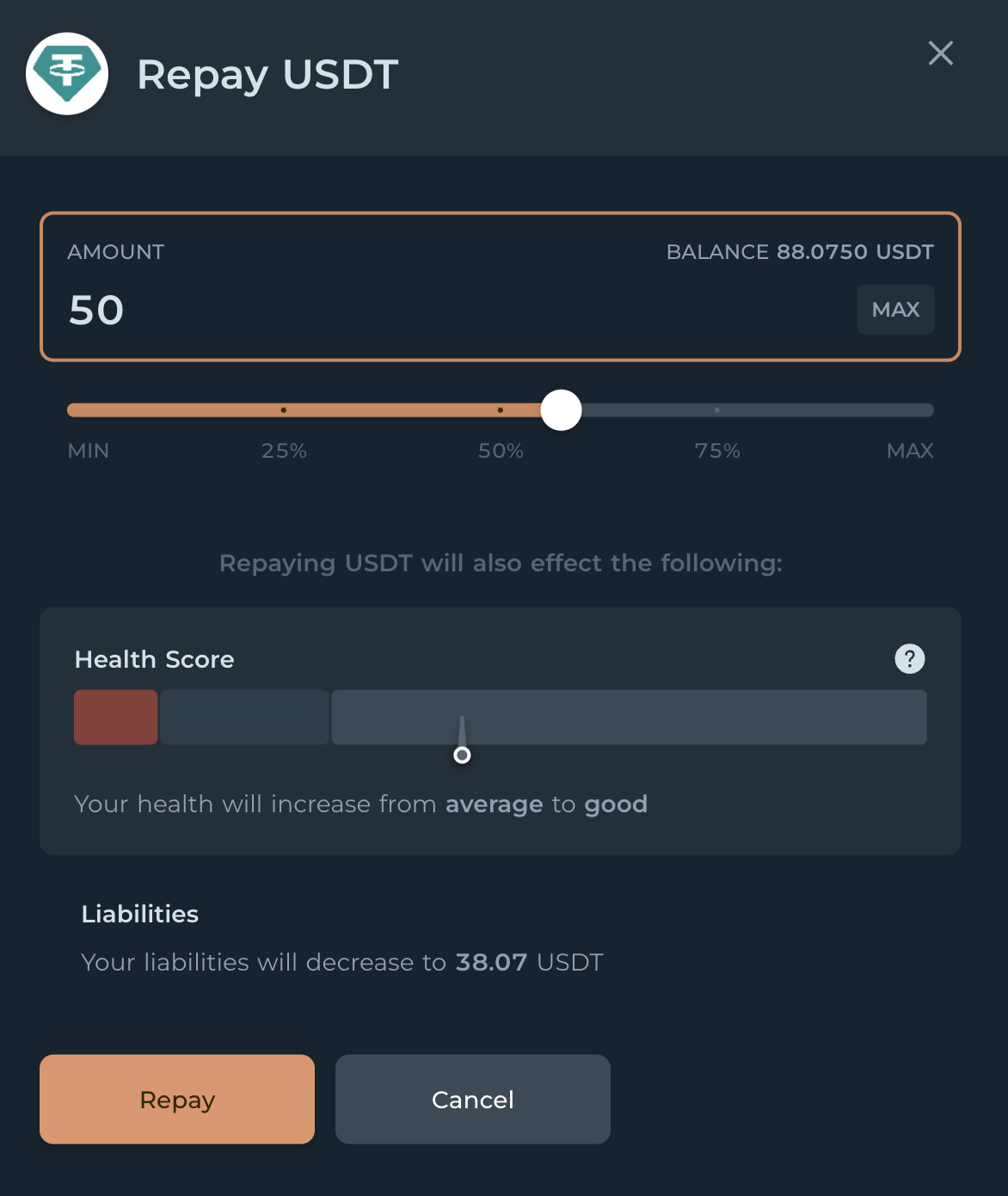

Click Approve to approve the transaction. Enter the amount you want to repay. You can click the Max button to repay the maximum amount.

Enter the amount you want to repay. You can click the Max button to repay the maximum amount. Click the Repay button. 7. Verify the amounts and click Confirm to confirm the transaction in your wallet.

Click the Repay button. 7. Verify the amounts and click Confirm to confirm the transaction in your wallet. Congratulations, you have repaid your liabilities! Check your dashboard to see your improved health score.

Congratulations, you have repaid your liabilities! Check your dashboard to see your improved health score.