Crypto Wallets Overview.

Crypto Wallets Explained

Now that we’ve identified the best crypto wallets for beginners, let’s take a closer look at what these wallets are. In simple terms, cryptocurrency wallets are software programs or hardware devices that allow users to store, manage, and transfer popular cryptocurrencies like BTC and ETH.

These wallets act as the holder’s “portal” to the crypto market, making it easy to hold crypto assets safely over the long term. Various types of wallets are on offer, such as “hot” and “cold” wallets, which offer varying degrees of safety and functionality.

We’ll explore these wallet types in more detail later, but it’s important to note that all wallets have a “public” and “private” key. These keys are essential since they prove asset ownership and enable wallet holders to send/receive funds. According to a report by TripleA, it’s estimated that over 420 million people worldwide own crypto. Most of these people are based in Asia and North America, although this figure is growing every month. Due to this vast customer base, the importance of using crypto wallets is more significant than ever – especially since the market is still relatively unregulated compared to “traditional” asset classes and hackers and scammers are extremely active.

According to a report by TripleA, it’s estimated that over 420 million people worldwide own crypto. Most of these people are based in Asia and North America, although this figure is growing every month. Due to this vast customer base, the importance of using crypto wallets is more significant than ever – especially since the market is still relatively unregulated compared to “traditional” asset classes and hackers and scammers are extremely active.

Ultimately, crypto wallets act as a way to store crypto safely without keeping it on an exchange or brokerage account, giving an individual more power over their holdings. Although there are various types of crypto wallets with specific features and security measures, all of them are designed to serve this purpose.

How Do Bitcoin Wallets Work?

Whether someone’s looking to invest in the cryptos with the most potential or is more interested in well-established coins, it’s vital to understand how wallet storage works. Regardless of where the Bitcoin account is held, using a crypto wallet is critical for protecting crypto asset holdings from cyber attackers and other bad actors.

The simplest way of viewing crypto wallets is as a method for protecting an investor’s holdings via access to their public and private keys. As noted above, these keys have essential use cases – but what do they do? Here’s a quick overview:

- Public Key: The public key can be considered the wallet’s “account number” and is used to receive funds from other individuals/businesses.

- Private Key: The private key is an alphanumeric code unique to each wallet and used to prove ownership of the crypto assets inside. In this sense, the private key is like a password – meaning it should never be shared with anyone else.

Crypto wallets store and manage the private key – not the actual crypto assets. This is because the crypto assets are still held on the blockchain, meaning the private key simply provides access to them.

Crypto wallets are so important because they use advanced cryptographic techniques to protect the user’s private key, essentially a password. Different wallets have different approaches, but they can range from DDoS protection to biometric verification – and even 3D face scans. The best crypto wallets usually offer backup and recovery options that ensure users can’t lose access to their crypto. In the past, if a user lost their private key, their crypto assets could never be re-accessed. Nowadays, many wallet providers have recovery seed phrases and other features that can restore access, although it is important individuals also take great care not to share or lose those.

The best crypto wallets usually offer backup and recovery options that ensure users can’t lose access to their crypto. In the past, if a user lost their private key, their crypto assets could never be re-accessed. Nowadays, many wallet providers have recovery seed phrases and other features that can restore access, although it is important individuals also take great care not to share or lose those.

Whether a user opts for a crypto hardware wallet or a software wallet, partnering with a well-respected provider is essential. Moreover, it’s also vital that users follow security practices, like ensuring their private keys remain confidential and implementing a backup procedure.

Why Do You Need a Cryptocurrency Wallet?

Finding and using the best crypto wallet available is an integral part of the crypto-trading journey for beginners, especially if they plan to hold, trade or manage large sums of crypto. These wallets are essentially for safely storing, sending, and receiving digital currencies, making them like a ‘crypto bank account’.

As we’ve touched on earlier, traders need these crypto wallets since they keep the private key safe. The private key is the only way for someone to gain unauthorized access to the user’s funds – if this key is kept safe, the funds are inaccessible. Moreover, many of the best things to buy with Bitcoin can only be purchased by sending payment from a reputable wallet provider. Since crypto wallets make it easy to send crypto payments, they’re vital for buying goods/services online that are denominated in digital currencies.

Moreover, many of the best things to buy with Bitcoin can only be purchased by sending payment from a reputable wallet provider. Since crypto wallets make it easy to send crypto payments, they’re vital for buying goods/services online that are denominated in digital currencies.

Another critical feature of crypto wallets is that they allow users to have complete control over their crypto assets. Since cryptocurrencies are decentralized, they aren’t held by intermediaries like banks. Even holding on a centralized exchange comes with its own risk, as FTX customers previously found when the exchange collapsed, leading to billions of dollars in investor losses, or if the exchange is hacked – like has been recently seen with Huobi Global, when $8 million was stolen in September 2023. Thus, having a self-custody crypto wallet will ensure that only the user “owns” the associated crypto assets.

Finally, crypto wallets are also important because they make it easy to access the crypto market. Most wallets allow users to instantly buy/sell crypto from within the wallet’s interface, and many providers offer support for NFTs and DeFi protocols, significantly broadening the investment possibilities.

Types of Crypto Wallets – Hardware and Software, Hot and Cold, Paper

Deciding to buy altcoins or crypto tokens is a huge decision – yet choosing where to store them post-purchase is just as important.

We’ve already discussed what crypto wallets are, but there various types of wallets on offer with a litany of language that can leave beginners confused.

Software Wallets (Hot Wallet)

Software wallets are the most popular type of storage solution for crypto assets, especially for beginners. These digital platforms allow users to store and manage cryptos in a user-friendly manner. The most important thing to note about these wallets is that they’re connected to the internet – which is in stark contrast to hardware wallets.

There are two main types of software wallets:

- Mobile wallets: These are smartphone apps designed to provide on-the-go access to the user’s cryptos. Mobile wallets are often offered for free by many top exchanges, like Best Wallet.

- Desktop wallets: These are applications that can be downloaded and installed on the user’s computer. Desktop wallets are slightly safer than mobile wallets since they store the user’s private key locally on the computer – MetaMask is one such example.

Either way, these wallet types are considered “hot” since they’re connected to the internet. This makes them more susceptible to cyberattacks than “cold” wallets, which have no connection to the internet.

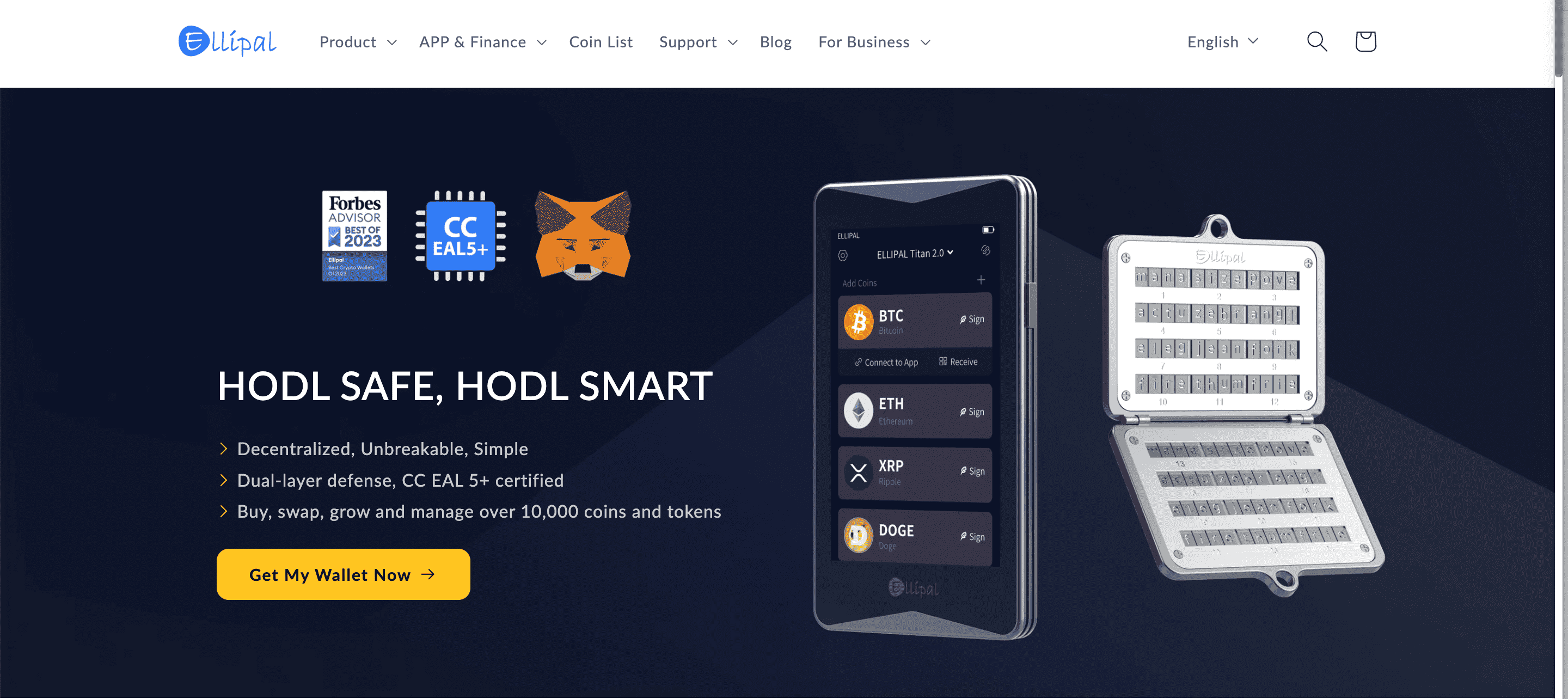

Hardware Wallets (Cold Wallet)

Alternatively, crypto holders can store their assets in hardware wallets, which are also often referred to as cold wallets – think cold storage – as they are not connected to the internet until a user connects a physical device.

A Bitcoin hardware wallet is a physical device used to store the user’s private keys. These devices usually look like USB sticks and hold the private key offline – meaning hackers can’t access it. As noted by Kraken, hardware wallets are one of the most effective ways for a user to protect their private key and are a must for investors or traders who are managing extremely large sums of crypto.

As noted by Kraken, hardware wallets are one of the most effective ways for a user to protect their private key and are a must for investors or traders who are managing extremely large sums of crypto.

It is simply not safe to have huge holdings linked to the internet at all times.

However, these wallets must be connected to another device, such as a laptop or smartphone, to initiate transactions. So, although they have a much higher security level, hardware wallets aren’t as user-friendly as software wallets.

Another downside is that as they are physical devices they come with additional cost to purchase – Trezor’s latest Model T, for example, costs in excess of $200.

Paper Wallets

The third wallet type is paper wallets. Unlike an online Bitcoin wallet, paper wallets are a type of “cold” storage that involves a user writing their public and private keys on a piece of paper.

The user would then store this piece of paper somewhere safe where nobody else could access it – for example, in a safe, safety deposit box or locker.

The downside to this approach is that those with paper wallets still eventually need to use a crypto wallet app to spend or transfer digital assets.

Thus, paper wallets are relatively impractical and considered less safe than the alternatives – hence why they aren’t widely used.