Cryptocurrency has emerged as a transformative force, reshaping traditional financial landscapes and empowering individuals with unprecedented control over their assets. As we delve into the intricate world of digital currencies, let’s explore the key facets that make cryptocurrencies a fascinating and dynamic realm.

The Rise of Decentralization

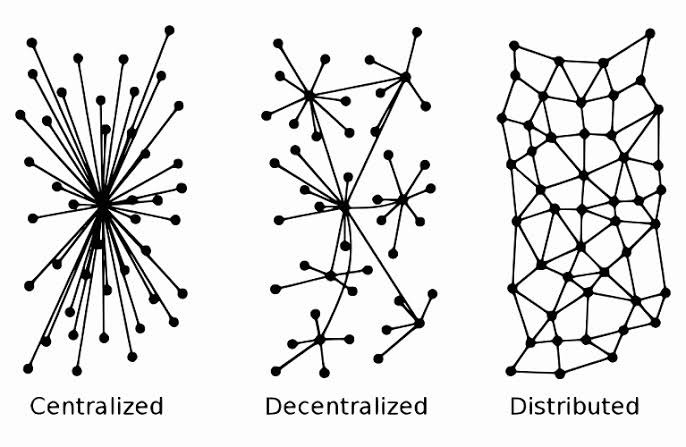

One of the defining features of cryptocurrencies is decentralization. Unlike traditional banking systems, which rely on centralized authorities, cryptocurrencies operate on blockchain technology. This decentralized ledger ensures transparency, security, and immutability, eliminating the need for intermediaries and placing the power back into the hands of users.

One of the defining features of cryptocurrencies is decentralization. Unlike traditional banking systems, which rely on centralized authorities, cryptocurrencies operate on blockchain technology. This decentralized ledger ensures transparency, security, and immutability, eliminating the need for intermediaries and placing the power back into the hands of users.

Bitcoin: Pioneering the Path

Bitcoin, the pioneer of cryptocurrencies, has transcended its role as a digital currency to become a symbol of financial sovereignty. With a capped supply of 21 million coins, Bitcoin has sparked discussions about scarcity, store of value, and its potential to serve as “digital gold.” Its decentralized nature and global accessibility have captured the imagination of both investors and enthusiasts alike.

Bitcoin, the pioneer of cryptocurrencies, has transcended its role as a digital currency to become a symbol of financial sovereignty. With a capped supply of 21 million coins, Bitcoin has sparked discussions about scarcity, store of value, and its potential to serve as “digital gold.” Its decentralized nature and global accessibility have captured the imagination of both investors and enthusiasts alike.

Ethereum: Smart Contracts and Beyond

While Bitcoin laid the foundation, Ethereum introduced the concept of smart contracts, allowing for programmable, self-executing agreements. This innovation opened the floodgates to decentralized applications (DApps), enabling a wide range of possibilities from decentralized finance (DeFi) to non-fungible tokens (NFTs). Ethereum’s vibrant ecosystem has demonstrated the potential of blockchain technology beyond mere transactions.

While Bitcoin laid the foundation, Ethereum introduced the concept of smart contracts, allowing for programmable, self-executing agreements. This innovation opened the floodgates to decentralized applications (DApps), enabling a wide range of possibilities from decentralized finance (DeFi) to non-fungible tokens (NFTs). Ethereum’s vibrant ecosystem has demonstrated the potential of blockchain technology beyond mere transactions.

DeFi: Revolutionizing Finance

Decentralized Finance, or DeFi, represents a paradigm shift in the financial sector. By leveraging smart contracts on blockchain platforms, DeFi protocols offer a borderless and permissionless alternative to traditional banking services. Users can lend, borrow, trade, and earn interest without relying on intermediaries, providing financial inclusion to a global audience.

Decentralized Finance, or DeFi, represents a paradigm shift in the financial sector. By leveraging smart contracts on blockchain platforms, DeFi protocols offer a borderless and permissionless alternative to traditional banking services. Users can lend, borrow, trade, and earn interest without relying on intermediaries, providing financial inclusion to a global audience.

NFTs: Digital Ownership and Creativity

Non-fungible tokens (NFTs) have taken the art and entertainment world by storm, offering a new paradigm for ownership and monetization of digital assets. From digital art to virtual real estate, NFTs have created a platform for artists and creators to directly connect with their audience, while collectors can own a unique piece of the digital landscape.

Non-fungible tokens (NFTs) have taken the art and entertainment world by storm, offering a new paradigm for ownership and monetization of digital assets. From digital art to virtual real estate, NFTs have created a platform for artists and creators to directly connect with their audience, while collectors can own a unique piece of the digital landscape.

Regulatory Challenges and Opportunities

As the crypto space matures, it encounters regulatory scrutiny and discussions around its role in the broader financial ecosystem. Striking a balance between innovation and consumer protection remains a challenge, but it also presents opportunities for the industry to evolve responsibly and integrate with existing frameworks.

As the crypto space matures, it encounters regulatory scrutiny and discussions around its role in the broader financial ecosystem. Striking a balance between innovation and consumer protection remains a challenge, but it also presents opportunities for the industry to evolve responsibly and integrate with existing frameworks.

The Road Ahead

The crypto landscape is constantly evolving, with new projects and technologies emerging regularly. From layer-2 solutions addressing scalability issues to the exploration of sustainable consensus mechanisms, the journey ahead promises continued innovation and growth.

The crypto landscape is constantly evolving, with new projects and technologies emerging regularly. From layer-2 solutions addressing scalability issues to the exploration of sustainable consensus mechanisms, the journey ahead promises continued innovation and growth.

The Nuances of Decentralization

Within the overarching theme of decentralization lies a myriad of nuances that shape the very fabric of cryptocurrencies. At its core, decentralization isn't just a buzzword; it's a fundamental shift in how we conceptualize trust and authority. The blockchain, as the backbone of this revolution, is a distributed ledger that records transactions across a network of computers. This not only ensures transparency but also guards against single points of failure, making it resistant to censorship and manipulation.

Within the overarching theme of decentralization lies a myriad of nuances that shape the very fabric of cryptocurrencies. At its core, decentralization isn't just a buzzword; it's a fundamental shift in how we conceptualize trust and authority. The blockchain, as the backbone of this revolution, is a distributed ledger that records transactions across a network of computers. This not only ensures transparency but also guards against single points of failure, making it resistant to censorship and manipulation.

Delving deeper, the concept of consensus mechanisms becomes crucial. Proof-of-Work (PoW), the mechanism powering Bitcoin, relies on miners solving complex mathematical puzzles to validate transactions. Ethereum, on the other hand, is transitioning to Proof-of-Stake (PoS), a more energy-efficient alternative where validators are chosen to create new blocks based on the amount of cryptocurrency they "stake." Understanding these mechanisms unveils the intricate design choices that underpin the decentralized nature of cryptocurrencies.

Bitcoin's Resilience and Limitations

While Bitcoin's prominence is undisputed, it's essential to delve into both its resilience and limitations. Its decentralized nature and finite supply contribute to its resilience against inflation and centralized control. However, the energy-intensive PoW consensus mechanism has sparked debates about its environmental impact. Exploring potential solutions, such as layer-2 scaling solutions or transitioning to alternative consensus models, reveals ongoing efforts to address these concerns while preserving Bitcoin's core principles.

While Bitcoin's prominence is undisputed, it's essential to delve into both its resilience and limitations. Its decentralized nature and finite supply contribute to its resilience against inflation and centralized control. However, the energy-intensive PoW consensus mechanism has sparked debates about its environmental impact. Exploring potential solutions, such as layer-2 scaling solutions or transitioning to alternative consensus models, reveals ongoing efforts to address these concerns while preserving Bitcoin's core principles.

Ethereum's Evolution and Challenges

Ethereum's journey is equally fascinating as it evolves from a mere cryptocurrency to a robust smart contract platform. Delving into Ethereum 2.0, the ambitious upgrade aiming to enhance scalability and sustainability, provides insights into the challenges of maintaining decentralization while improving efficiency. Navigating issues like gas fees and network congestion reveals the delicate balance between innovation and practical implementation within the Ethereum ecosystem.

Ethereum's journey is equally fascinating as it evolves from a mere cryptocurrency to a robust smart contract platform. Delving into Ethereum 2.0, the ambitious upgrade aiming to enhance scalability and sustainability, provides insights into the challenges of maintaining decentralization while improving efficiency. Navigating issues like gas fees and network congestion reveals the delicate balance between innovation and practical implementation within the Ethereum ecosystem.

DeFi's Intricate Ecosystem

The decentralized finance (DeFi) landscape is a labyrinth of protocols, tokens, and liquidity pools. Understanding the mechanics of lending, borrowing, and yield farming requires a deep dive into smart contract interactions. The interplay between different decentralized applications and the risks associated with them sheds light on the challenges of building a financial ecosystem outside traditional structures. DeFi's potential is immense, but it necessitates a nuanced understanding to navigate its complexities successfully.

The decentralized finance (DeFi) landscape is a labyrinth of protocols, tokens, and liquidity pools. Understanding the mechanics of lending, borrowing, and yield farming requires a deep dive into smart contract interactions. The interplay between different decentralized applications and the risks associated with them sheds light on the challenges of building a financial ecosystem outside traditional structures. DeFi's potential is immense, but it necessitates a nuanced understanding to navigate its complexities successfully.

NFTs: Beyond Digital Collectibles

Non-fungible tokens (NFTs) have transcended their initial perception as digital collectibles. Delving deeper reveals their potential applications in industries like gaming, real estate, and intellectual property. Exploring the underlying standards, such as ERC-721 and ERC-1155, showcases the technical intricacies that enable the unique representation and ownership of digital assets. NFTs' intersection with decentralized identity and the broader implications for the digital economy further underline their transformative potential.

Non-fungible tokens (NFTs) have transcended their initial perception as digital collectibles. Delving deeper reveals their potential applications in industries like gaming, real estate, and intellectual property. Exploring the underlying standards, such as ERC-721 and ERC-1155, showcases the technical intricacies that enable the unique representation and ownership of digital assets. NFTs' intersection with decentralized identity and the broader implications for the digital economy further underline their transformative potential.

Regulatory Dynamics: Striking a Delicate Balance

As cryptocurrencies attract increased attention from regulators, the nuanced dynamics of finding a regulatory balance become evident. Delving into discussions around consumer protection, anti-money laundering (AML), and investor rights reveals the industry's maturation process. Striking the delicate balance between fostering innovation and safeguarding against illicit activities becomes a complex dance, requiring collaboration between the crypto community and regulatory bodies.

As cryptocurrencies attract increased attention from regulators, the nuanced dynamics of finding a regulatory balance become evident. Delving into discussions around consumer protection, anti-money laundering (AML), and investor rights reveals the industry's maturation process. Striking the delicate balance between fostering innovation and safeguarding against illicit activities becomes a complex dance, requiring collaboration between the crypto community and regulatory bodies.

The Uncharted Future

Cryptocurrencies, with their ever-evolving landscape, beckon us towards an uncharted future. Delving into emerging technologies like zero-knowledge proofs, sharding, and inter-chain interoperability hints at the potential solutions to current challenges. The ongoing dialogue around governance models and community-driven decision-making emphasizes the participatory nature of this evolving ecosystem. Navigating this uncharted territory requires continuous exploration, adaptation, and a collective commitment to shaping the future of finance and technology.

Cryptocurrencies, with their ever-evolving landscape, beckon us towards an uncharted future. Delving into emerging technologies like zero-knowledge proofs, sharding, and inter-chain interoperability hints at the potential solutions to current challenges. The ongoing dialogue around governance models and community-driven decision-making emphasizes the participatory nature of this evolving ecosystem. Navigating this uncharted territory requires continuous exploration, adaptation, and a collective commitment to shaping the future of finance and technology.

In conclusion, the world of cryptocurrencies is a captivating tapestry of technology, finance, and decentralization. As we navigate this evolving landscape, it’s crucial to approach it with a curious mindset, acknowledging both its potential and the challenges it poses. Whether you’re an investor, developer, or enthusiast, the future of crypto invites us to be part of a transformative journey that could redefine the way we interact with money and digital assets.

![[LIVE] Engage2Earn: McEwen boost for Rob Mitchell](https://cdn.bulbapp.io/frontend/images/c798d46f-d3b8-4a66-bf48-7e1ef50b4338/1)

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - Is Trump Dying? Or Only Killing The Market?](https://cdn.bulbapp.io/frontend/images/a129e75e-4fa1-46cc-80b6-04e638877e46/1)