Bitcoin Price Plummets to $53,000, $675 Million Liquidated in Crypto Market

Bitcoin Price Plummets to $53,000, $675 Million Liquidated in Crypto Market

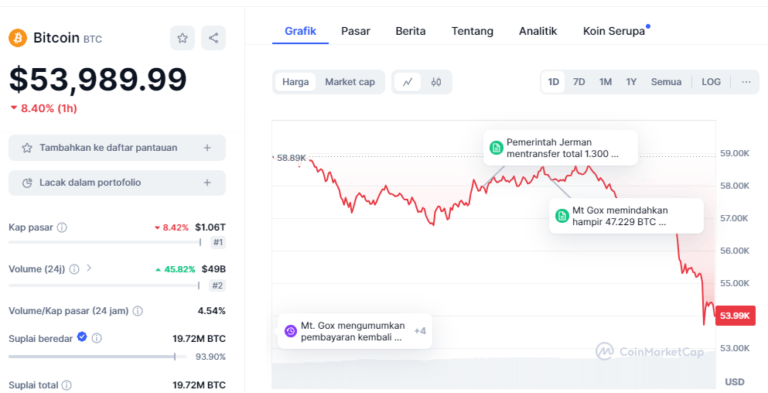

On Friday, July 5, 2024, Bitcoin's price plummeted to $53,000. As of the time of writing, BTC is trading at $53,989, marking a 12.4% decline over the past week and an 8.4% drop in the last 24 hours.

Pressures on Bitcoin’s Price

The $53,000 mark represents Bitcoin's lowest price level since February 2024. Several factors have contributed to this significant drop.

Recently, a massive transfer of Bitcoin worth $2.7 billion out of the Mt. Gox wallet has added to market jitters. This transfer is part of the compensation process for the creditors of the now-defunct crypto exchange Mt. Gox.

Adding to the downward pressure are negative sentiments surrounding the sale of Bitcoin by the German and U.S. governments. Markus Thielen, an analyst at 10x Research, discussed these issues in a report, indicating that Bitcoin could potentially fall to $50,000 after failing to hold the critical psychological level of $60,000.

eToro market analyst Josh Gilbert also expressed a bearish outlook in his interview with Cointelegraph. Gilbert anticipates further deterioration in Bitcoin’s price over the coming days, noting, "The current news flow is much more bearish than bullish, and the selling activity we’re observing clearly worries investors, often leading to more selling. I wouldn’t be surprised to see Bitcoin testing the $50,000 level next week, as it represents a key psychological threshold."

Long-Term Prospects for Bitcoin

Despite the short-term bearish outlook, Gilbert also sees reasons for optimism for long-term investors. Key factors that could potentially drive Bitcoin's price back up include potential interest rate cuts by the U.S. Federal Reserve and the approval of an Ethereum ETF. These catalysts might provide the necessary boost for Bitcoin to recover from its recent lows.

Conclusion

The recent sharp decline in Bitcoin's price to $53,000 highlights the volatile and precarious nature of the cryptocurrency market. The substantial liquidation of $675 million within 24 hours and the plunge in market sentiment to a "Fear" level underscore the significant pressures currently facing Bitcoin. Contributing factors such as the large-scale transfer of Bitcoin from Mt. Gox and negative market sentiments related to government Bitcoin sales have intensified investor anxiety, leading to a wave of sell-offs. Analysts like Markus Thielen and Josh Gilbert foresee potential further declines, with Bitcoin possibly testing the $50,000 threshold in the near future due to the prevailing bearish sentiment.

However, the long-term outlook for Bitcoin remains hopeful despite these short-term challenges. While the immediate market environment appears gloomy, there are potential catalysts on the horizon that could revive Bitcoin's fortunes. Prospects such as the anticipated reduction in U.S. interest rates and the approval of an Ethereum ETF could provide the necessary impetus for a market rebound. Investors who maintain a long-term perspective may find these developments encouraging, as they could stabilize and boost Bitcoin's value, reaffirming its resilience in the evolving financial landscape.

Read too : Analysts Predict Ethereum Will Outperform Bitcoin: Here’s Why!

*Disclaimer:

This content aims to enrich reader information. Always conduct independent research and use disposable income before investing. All buying, selling, and crypto asset investment activities are the reader's responsibility.

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)

![[LIVE] Engage2Earn: McEwen boost for Rob Mitchell](https://cdn.bulbapp.io/frontend/images/c798d46f-d3b8-4a66-bf48-7e1ef50b4338/1)