Bitcoin's Meteoric Rise to $35,000 Erases $232M in Short Positions in Just 24 Hours

24-Hour Rally: Crypto Economy’s Ascent Liquidates $427M in Short and Long Stakes

Currently, the cryptocurrency market’s value hovers around a whopping $1.3 trillion, marking a 10% increase. Within the past day, BTC’s value ascended by 13%. Other major players also saw notable gains: ETH leaped by 9%, BNB ascended by 5%, and XRP and Solana both notched a 7% hike.

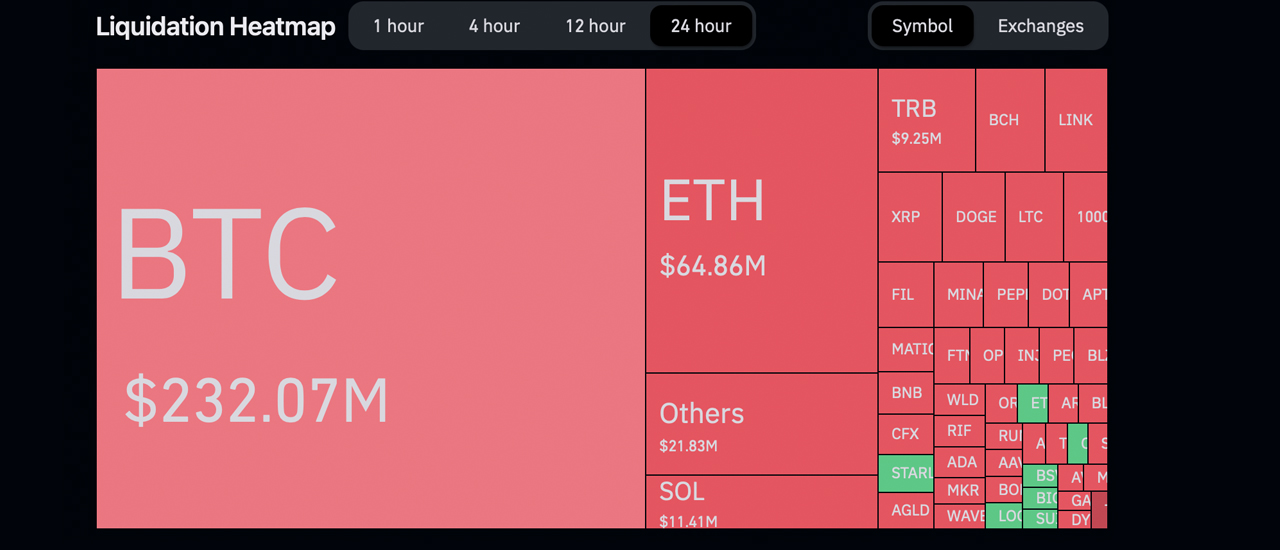

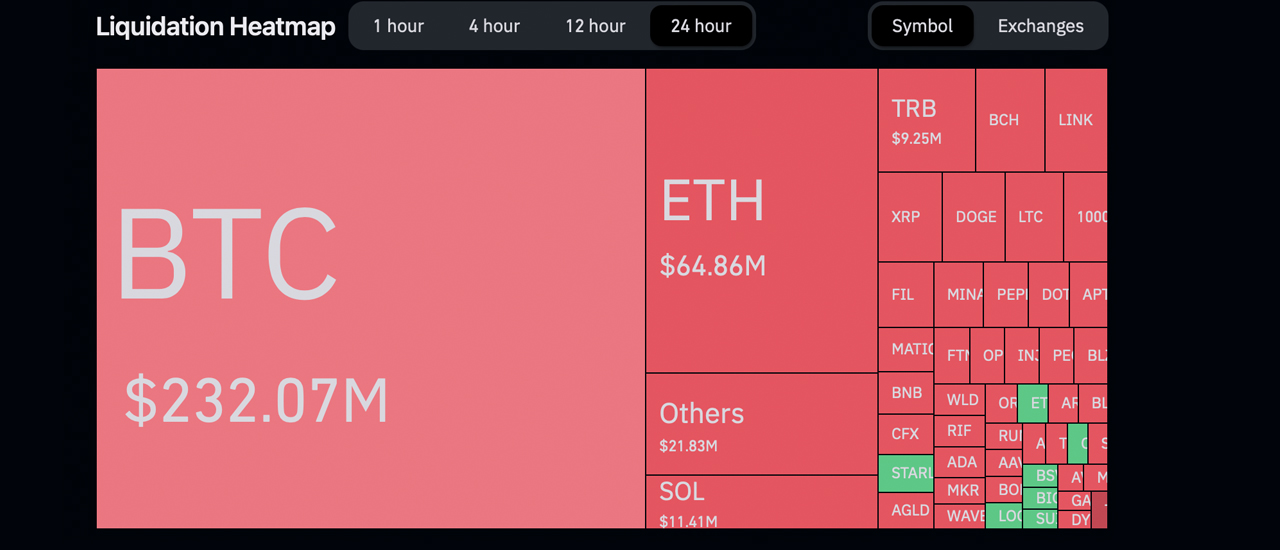

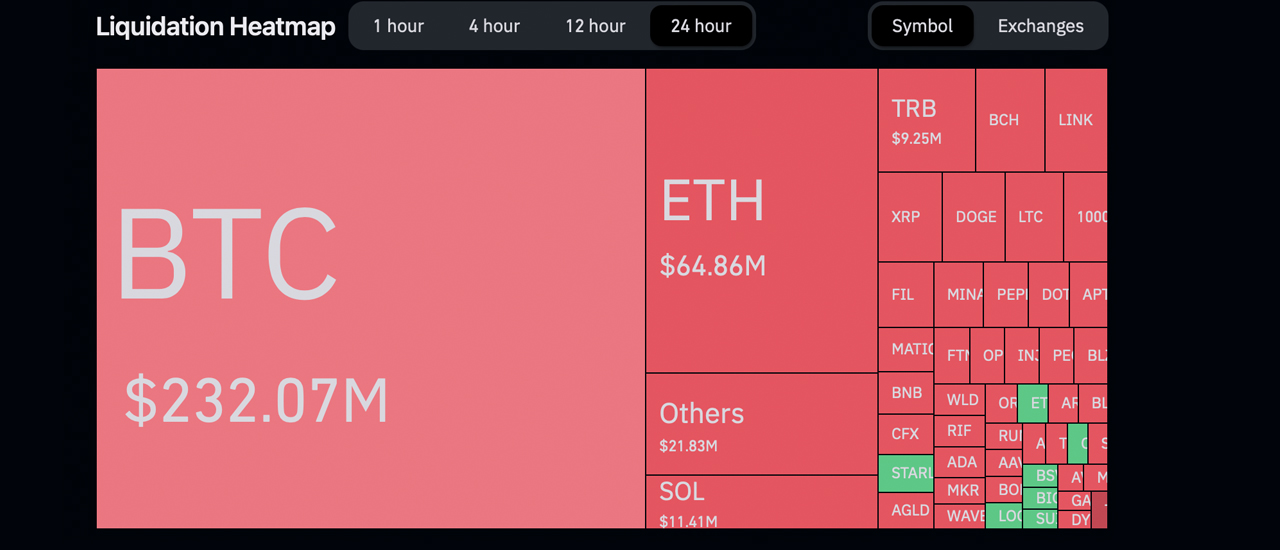

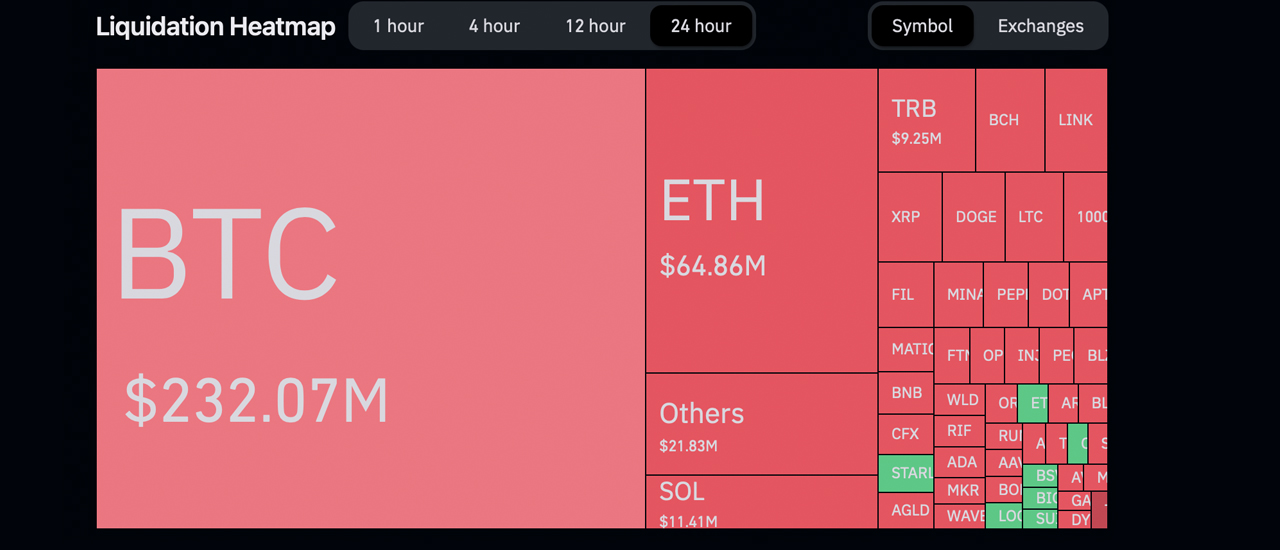

These rapid price escalations have left those who shorted top cryptocurrencies scrambling, as their positions vanished in the wake of these impressive and quick rallies. Recent data from Coinglass reveals that in the last 12 hours, the market witnessed the liquidation of $51.91 million in long positions and a hefty $103 million in short positions. Source: Coinglass.com

Source: Coinglass.com

Breaking down the 24-hour stats, short positions worth $323 million were obliterated, and another $104 million in longs faced a similar fate. Notably, of the total shorts liquidated, bitcoin contracts made up a significant chunk, accounting for $232 million out of the $323 million total.

Meanwhile, ethereum (ETH) saw more than $64 million in shorts liquidated. Solana (SOL) shorts tallied up to about $11.4 million. Additionally, shorts from a myriad of other alternative crypto tokens totaled approximately $21.83 million.

Coinglass data also highlighted a surge in trading volume, reaching $203 billion in the past 24 hours, a 143% increase from the previous day. Open interest now stands at nearly $29.73 billion, up 4.55%. In total, the last day saw crypto liquidations amounting to an eye-popping $429.46 million across both long and short positions.

What do you think about all the speculative bets being wiped out over the past 24 hours? Share your thoughts and opinions about this subject in the comments section below.On October 24, 2023, bitcoin (BTC) experienced a robust 13% surge during the early morning trading hours, Eastern Time (ET). This rise catapulted bitcoin’s value to $35,108 per unit, propelling the entire cryptocurrency market upwards by over 10%. As the market soared, traders who had placed their bets against crypto assets like bitcoin and ethereum found themselves in a tight spot. In a mere 24 hours, a staggering $323 million in crypto short positions evaporated.

24-Hour Rally: Crypto Economy’s Ascent Liquidates $427M in Short and Long Stakes

Currently, the cryptocurrency market’s value hovers around a whopping $1.3 trillion, marking a 10% increase. Within the past day, BTC’s value ascended by 13%. Other major players also saw notable gains: ETH leaped by 9%, BNB ascended by 5%, and XRP and Solana both notched a 7% hike.

These rapid price escalations have left those who shorted top cryptocurrencies scrambling, as their positions vanished in the wake of these impressive and quick rallies. Recent data from Coinglass reveals that in the last 12 hours, the market witnessed the liquidation of $51.91 million in long positions and a hefty $103 million in short positions. Source: Coinglass.com

Source: Coinglass.com

Breaking down the 24-hour stats, short positions worth $323 million were obliterated, and another $104 million in longs faced a similar fate. Notably, of the total shorts liquidated, bitcoin contracts made up a significant chunk, accounting for $232 million out of the $323 million total.

Meanwhile, ethereum (ETH) saw more than $64 million in shorts liquidated. Solana (SOL) shorts tallied up to about $11.4 million. Additionally, shorts from a myriad of other alternative crypto tokens totaled approximately $21.83 million.

Coinglass data also highlighted a surge in trading volume, reaching $203 billion in the past 24 hours, a 143% increase from the previous day. Open interest now stands at nearly $29.73 billion, up 4.55%. In total, the last day saw crypto liquidations amounting to an eye-popping $429.46 million across both long and short positions.

What do you think about all the speculative bets being wiped out over the past 24 hours? Share your thoughts and opinions about this subject in the comments section below.On October 24, 2023, bitcoin (BTC) experienced a robust 13% surge during the early morning trading hours, Eastern Time (ET). This rise catapulted bitcoin’s value to $35,108 per unit, propelling the entire cryptocurrency market upwards by over 10%. As the market soared, traders who had placed their bets against crypto assets like bitcoin and ethereum found themselves in a tight spot. In a mere 24 hours, a staggering $323 million in crypto short positions evaporated.

24-Hour Rally: Crypto Economy’s Ascent Liquidates $427M in Short and Long Stakes

Currently, the cryptocurrency market’s value hovers around a whopping $1.3 trillion, marking a 10% increase. Within the past day, BTC’s value ascended by 13%. Other major players also saw notable gains: ETH leaped by 9%, BNB ascended by 5%, and XRP and Solana both notched a 7% hike.

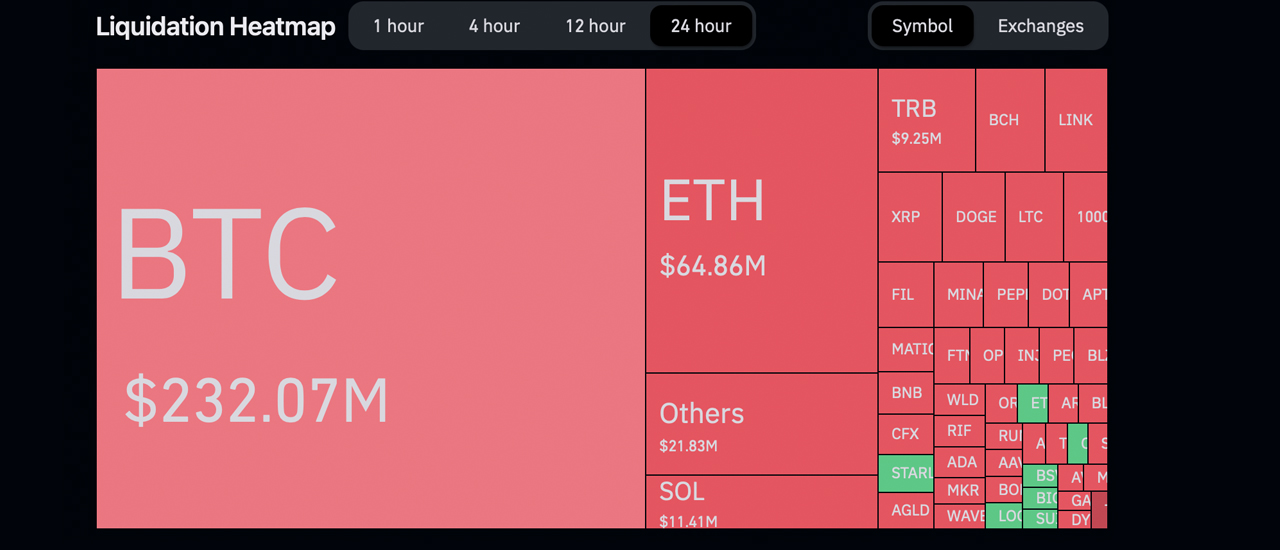

These rapid price escalations have left those who shorted top cryptocurrencies scrambling, as their positions vanished in the wake of these impressive and quick rallies. Recent data from Coinglass reveals that in the last 12 hours, the market witnessed the liquidation of $51.91 million in long positions and a hefty $103 million in short positions. Source: Coinglass.com

Source: Coinglass.com

Breaking down the 24-hour stats, short positions worth $323 million were obliterated, and another $104 million in longs faced a similar fate. Notably, of the total shorts liquidated, bitcoin contracts made up a significant chunk, accounting for $232 million out of the $323 million total.

Meanwhile, ethereum (ETH) saw more than $64 million in shorts liquidated. Solana (SOL) shorts tallied up to about $11.4 million. Additionally, shorts from a myriad of other alternative crypto tokens totaled approximately $21.83 million.

Coinglass data also highlighted a surge in trading volume, reaching $203 billion in the past 24 hours, a 143% increase from the previous day. Open interest now stands at nearly $29.73 billion, up 4.55%. In total, the last day saw crypto liquidations amounting to an eye-popping $429.46 million across both long and short positions.

What do you think about all the speculative bets being wiped out over the past 24 hours? Share your thoughts and opinions about this subject in the comments section below.On October 24, 2023, bitcoin (BTC) experienced a robust 13% surge during the early morning trading hours, Eastern Time (ET). This rise catapulted bitcoin’s value to $35,108 per unit, propelling the entire cryptocurrency market upwards by over 10%. As the market soared, traders who had placed their bets against crypto assets like bitcoin and ethereum found themselves in a tight spot. In a mere 24 hours, a staggering $323 million in crypto short positions evaporated.

24-Hour Rally: Crypto Economy’s Ascent Liquidates $427M in Short and Long Stakes

Currently, the cryptocurrency market’s value hovers around a whopping $1.3 trillion, marking a 10% increase. Within the past day, BTC’s value ascended by 13%. Other major players also saw notable gains: ETH leaped by 9%, BNB ascended by 5%, and XRP and Solana both notched a 7% hike.

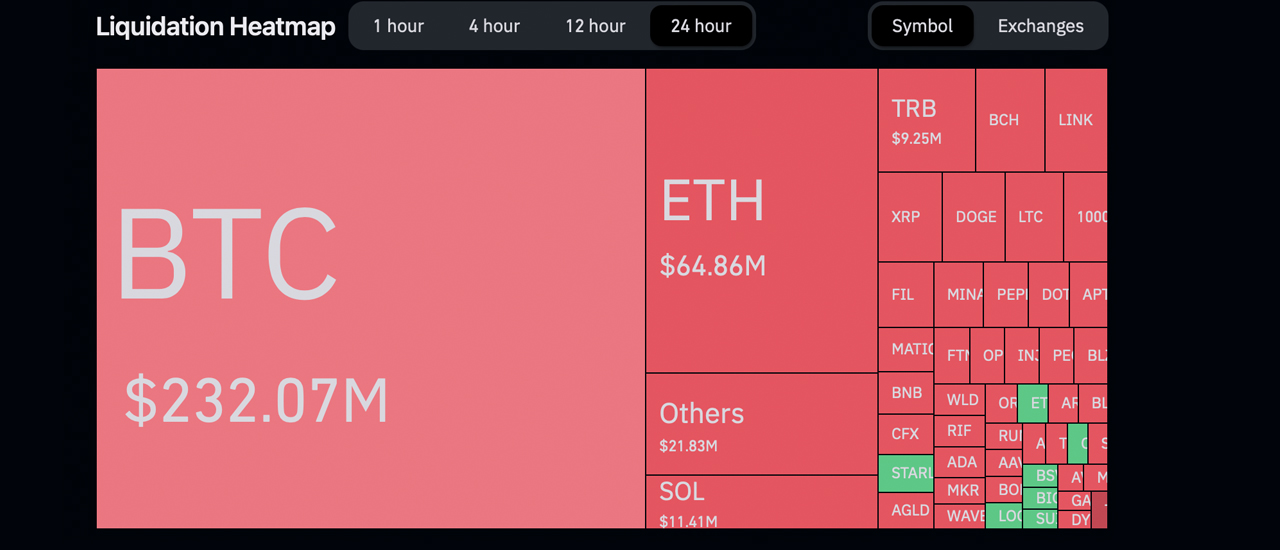

These rapid price escalations have left those who shorted top cryptocurrencies scrambling, as their positions vanished in the wake of these impressive and quick rallies. Recent data from Coinglass reveals that in the last 12 hours, the market witnessed the liquidation of $51.91 million in long positions and a hefty $103 million in short positions. Source: Coinglass.com

Source: Coinglass.com

Breaking down the 24-hour stats, short positions worth $323 million were obliterated, and another $104 million in longs faced a similar fate. Notably, of the total shorts liquidated, bitcoin contracts made up a significant chunk, accounting for $232 million out of the $323 million total.

Meanwhile, ethereum (ETH) saw more than $64 million in shorts liquidated. Solana (SOL) shorts tallied up to about $11.4 million. Additionally, shorts from a myriad of other alternative crypto tokens totaled approximately $21.83 million.

Coinglass data also highlighted a surge in trading volume, reaching $203 billion in the past 24 hours, a 143% increase from the previous day. Open interest now stands at nearly $29.73 billion, up 4.55%. In total, the last day saw crypto liquidations amounting to an eye-popping $429.46 million across both long and short positions.

What do you think about all the speculative bets being wiped out over the past 24 hours? Share your thoughts and opinions about this subject in the comments section below.On October 24, 2023, bitcoin (BTC) experienced a robust 13% surge during the early morning trading hours, Eastern Time (ET). This rise catapulted bitcoin’s value to $35,108 per unit, propelling the entire cryptocurrency market upwards by over 10%. As the market soared, traders who had placed their bets against crypto assets like bitcoin and ethereum found themselves in a tight spot. In a mere 24 hours, a staggering $323 million in crypto short positions evaporated.

24-Hour Rally: Crypto Economy’s Ascent Liquidates $427M in Short and Long Stakes

Currently, the cryptocurrency market’s value hovers around a whopping $1.3 trillion, marking a 10% increase. Within the past day, BTC’s value ascended by 13%. Other major players also saw notable gains: ETH leaped by 9%, BNB ascended by 5%, and XRP and Solana both notched a 7% hike.

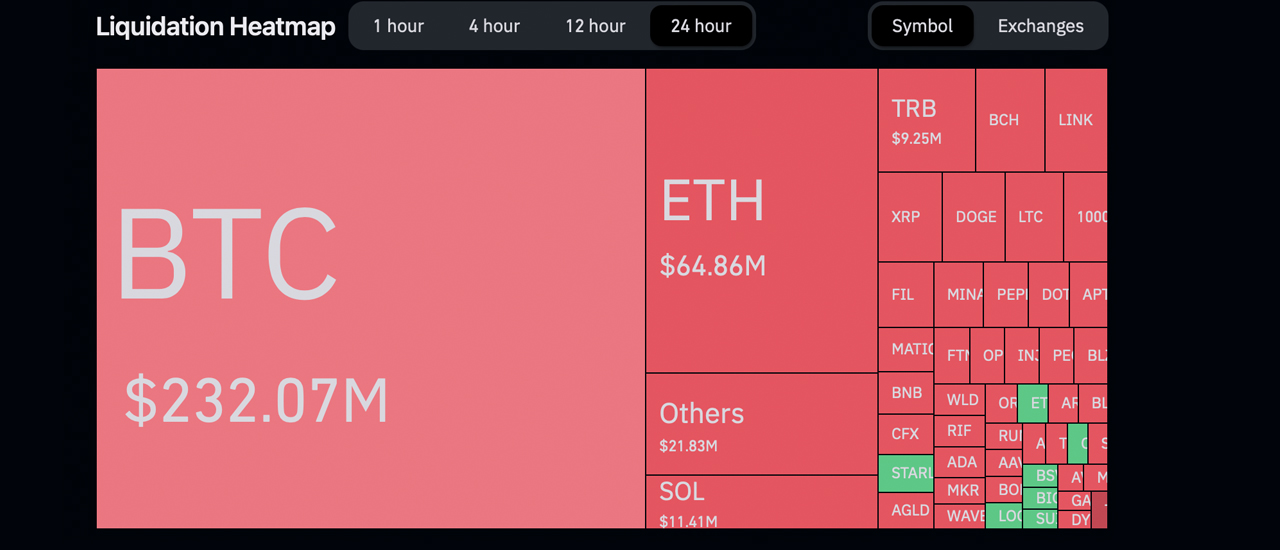

These rapid price escalations have left those who shorted top cryptocurrencies scrambling, as their positions vanished in the wake of these impressive and quick rallies. Recent data from Coinglass reveals that in the last 12 hours, the market witnessed the liquidation of $51.91 million in long positions and a hefty $103 million in short positions. Source: Coinglass.com

Source: Coinglass.com

Breaking down the 24-hour stats, short positions worth $323 million were obliterated, and another $104 million in longs faced a similar fate. Notably, of the total shorts liquidated, bitcoin contracts made up a significant chunk, accounting for $232 million out of the $323 million total.

Meanwhile, ethereum (ETH) saw more than $64 million in shorts liquidated. Solana (SOL) shorts tallied up to about $11.4 million. Additionally, shorts from a myriad of other alternative crypto tokens totaled approximately $21.83 million.

Coinglass data also highlighted a surge in trading volume, reaching $203 billion in the past 24 hours, a 143% increase from the previous day. Open interest now stands at nearly $29.73 billion, up 4.55%. In total, the last day saw crypto liquidations amounting to an eye-popping $429.46 million across both long and short positions.

What do you think about all the speculative bets being wiped out over the past 24 hours? Share your thoughts and opinions about this subject in the comments section below.On October 24, 2023, bitcoin (BTC) experienced a robust 13% surge during the early morning trading hours, Eastern Time (ET). This rise catapulted bitcoin’s value to $35,108 per unit, propelling the entire cryptocurrency market upwards by over 10%. As the market soared, traders who had placed their bets against crypto assets like bitcoin and ethereum found themselves in a tight spot. In a mere 24 hours, a staggering $323 million in crypto short positions evaporated.

24-Hour Rally: Crypto Economy’s Ascent Liquidates $427M in Short and Long Stakes

Currently, the cryptocurrency market’s value hovers around a whopping $1.3 trillion, marking a 10% increase. Within the past day, BTC’s value ascended by 13%. Other major players also saw notable gains: ETH leaped by 9%, BNB ascended by 5%, and XRP and Solana both notched a 7% hike.

These rapid price escalations have left those who shorted top cryptocurrencies scrambling, as their positions vanished in the wake of these impressive and quick rallies. Recent data from Coinglass reveals that in the last 12 hours, the market witnessed the liquidation of $51.91 million in long positions and a hefty $103 million in short positions. Source: Coinglass.com

Source: Coinglass.com

Breaking down the 24-hour stats, short positions worth $323 million were obliterated, and another $104 million in longs faced a similar fate. Notably, of the total shorts liquidated, bitcoin contracts made up a significant chunk, accounting for $232 million out of the $323 million total.

Meanwhile, ethereum (ETH) saw more than $64 million in shorts liquidated. Solana (SOL) shorts tallied up to about $11.4 million. Additionally, shorts from a myriad of other alternative crypto tokens totaled approximately $21.83 million.

Coinglass data also highlighted a surge in trading volume, reaching $203 billion in the past 24 hours, a 143% increase from the previous day. Open interest now stands at nearly $29.73 billion, up 4.55%. In total, the last day saw crypto liquidations amounting to an eye-popping $429.46 million across both long and short positions.

What do you think about all the speculative bets being wiped out over the past 24 hours? Share your thoughts and opinions about this subject in the comments section below.On October 24, 2023, bitcoin (BTC) experienced a robust 13% surge during the early morning trading hours, Eastern Time (ET). This rise catapulted bitcoin’s value to $35,108 per unit, propelling the entire cryptocurrency market upwards by over 10%. As the market soared, traders who had placed their bets against crypto assets like bitcoin and ethereum found themselves in a tight spot. In a mere 24 hours, a staggering $323 million in crypto short positions evaporated.

24-Hour Rally: Crypto Economy’s Ascent Liquidates $427M in Short and Long Stakes

Currently, the cryptocurrency market’s value hovers around a whopping $1.3 trillion, marking a 10% increase. Within the past day, BTC’s value ascended by 13%. Other major players also saw notable gains: ETH leaped by 9%, BNB ascended by 5%, and XRP and Solana both notched a 7% hike.

These rapid price escalations have left those who shorted top cryptocurrencies scrambling, as their positions vanished in the wake of these impressive and quick rallies. Recent data from Coinglass reveals that in the last 12 hours, the market witnessed the liquidation of $51.91 million in long positions and a hefty $103 million in short positions. Source: Coinglass.com

Source: Coinglass.com

Breaking down the 24-hour stats, short positions worth $323 million were obliterated, and another $104 million in longs faced a similar fate. Notably, of the total shorts liquidated, bitcoin contracts made up a significant chunk, accounting for $232 million out of the $323 million total.

Meanwhile, ethereum (ETH) saw more than $64 million in shorts liquidated. Solana (SOL) shorts tallied up to about $11.4 million. Additionally, shorts from a myriad of other alternative crypto tokens totaled approximately $21.83 million.

Coinglass data also highlighted a surge in trading volume, reaching $203 billion in the past 24 hours, a 143% increase from the previous day. Open interest now stands at nearly $29.73 billion, up 4.55%. In total, the last day saw crypto liquidations amounting to an eye-popping $429.46 million across both long and short positions.

What do you think about all the speculative bets being wiped out over the past 24 hours? Share your thoughts and opinions about this subject in the comments section below.

![[FAILED] Engage2Earn: McEwen boost for Rob Mitchell](https://cdn.bulbapp.io/frontend/images/c798d46f-d3b8-4a66-bf48-7e1ef50b4338/1)

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - Is Trump Dying? Or Only Killing The Market?](https://cdn.bulbapp.io/frontend/images/a129e75e-4fa1-46cc-80b6-04e638877e46/1)