Tether to Stop Issuing USDT on EOS and Algorand

USDT redemptions on EOS and Algorand will continue for the next 12 months. After that, Tether will evaluate and announce further changes.

Starting on June 24, 2024, Tether - the world's largest stablecoin issuer - will stop supporting the EOS and Algorand (ALGO) platforms by ceasing USDT issuance on both blockchains.

“We are committed to our community that this transition will be done carefully and with minimal disruption…Our top priority remains providing a seamless user experience and we are committed to facilitating a smooth transition.”

While not sharing a clear reason for ceasing USDT issuance on EOS and Algorand, Tether “tactfully” explained that the decision was made after an evaluation process “aimed at achieving a balance between maintainability, usage, and community interest.”

“Our goal is to allocate resources where we can best improve security and efficiency, while continuing to support innovation across the entire crypto space,” Tether said in the announcement.

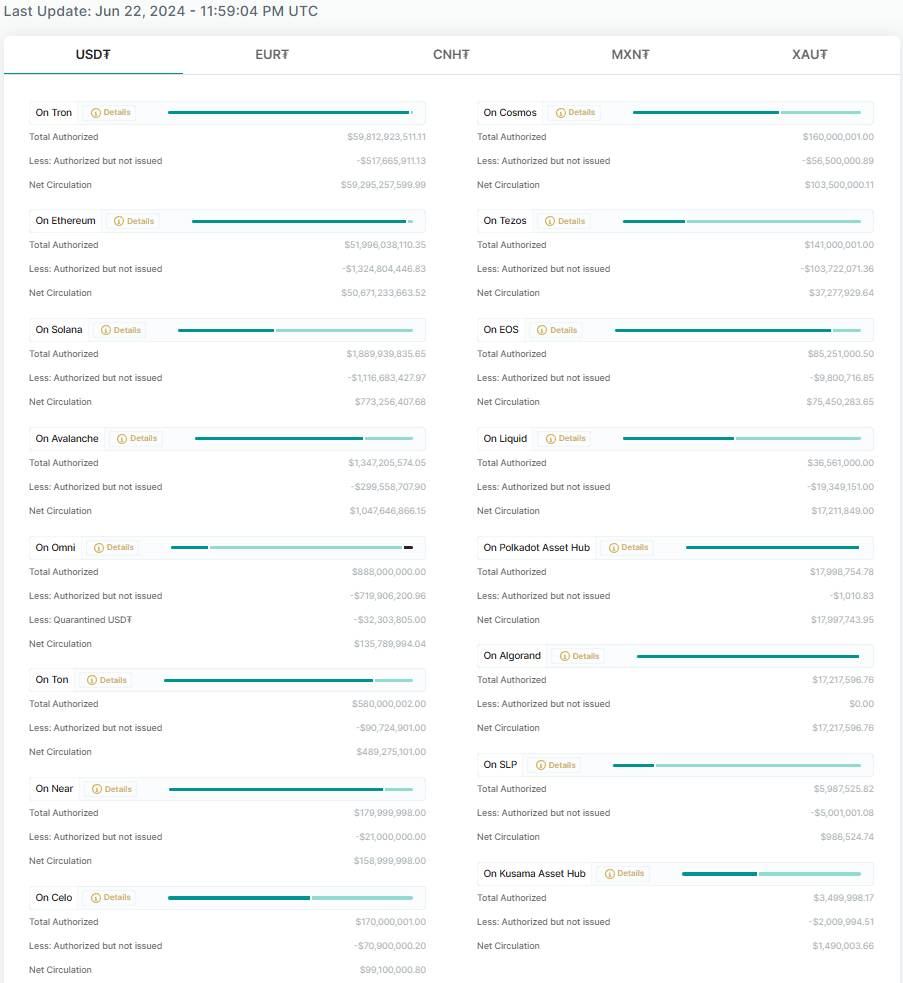

According to Tether’s website, there are currently around 113 billion USDT in circulation, distributed across 16 different blockchains, including Avalanche, Celo, Kava (Cosmos), Ethereum, Liquid Network, NEAR, Polkadot, Solana, Tezos, TON, and Tron.

However, on EOS there are only 85 million USDT, equivalent to 0.08% of the total supply. Meanwhile, on Algorand there are only 17 million USDT, equivalent to 0.015% of the total supply. The majority of USDT is on just two chains – around $59 billion on Tron and $52 billion on Ethereum.

Previously in August 2023, Tether stopped issuing USDT on three blockchains: Omni, Bitcoin Cash, and Kusama. Notably, Omni is a protocol built on Bitcoin, the first blockchain supported by Tether when it launched USDT in 2014.

This announcement comes after Tether announced the launch of a new product in the cryptocurrency category called "tethered assets", with the first token launched being "Alloy by Tether" - abbreviated as aUSDT, a token backed by physical gold stored in Switzerland.

Tether, the dominant stablecoin issuer in the crypto market, plans to double its workforce to 200 by mid-2025.

Accordingly, Tether will focus on adding staff to its finance department, which currently manages $118 billion in assets backed by USDT. Adroino said:

"We pride ourselves on keeping our team lean and want to continue to do so to stay agile. We are particularly careful in hiring, only selecting candidates with extensive experience.”

Despite its small staff, Tether has become a financial powerhouse in the crypto industry, posting $5.2 billion in revenue in the first half of 2024, largely thanks to USDT. Meanwhile, major crypto exchanges like Binance and Coinbase have a workforce of thousands.

The hiring plan is aimed at increasing surveillance of illicit activity in the secondary market involving USDT. This includes trading USDT on exchanges and over-the-counter markets, which require much more specialized and automated tools. Meanwhile, the main market is where investors directly trade USDT for Tether.

Tether has been caught up in legal USDT transactions on several occasions. A Wall Street Journal report in April found that Russian arms smugglers were using USDT to circumvent US sanctions. Tether said it was cooperating with global authorities to address the issue. 05/2024, Tether has established a partnership with Chainalysis to monitor the transaction system and ensure that they do not violate sanctions.

In addition, Tether has used the accumulated yield from its huge treasury to invest $2 billion in startups over the past two years, such as Northern Data Group and Bitdeer Technologies Group. Notably, the current investments are managed by a team of just 15 people.

The company has recently expanded into Bitcoin mining, payment processing, and artificial intelligence (AI) through cloud computing. Tether plans to invest more than $1 billion in various deals in the coming year, amid the US government's clampdown.

In conclusion, Ardoino still says no to expanding his staff too quickly:

“There’s nothing I hate more than companies, especially Silicon Valley companies, hiring hundreds of people during a growth spurt, then laying them off as soon as the market goes down. I think that’s one of the most unfair things you can do to your employees.”

![[LIVE] Engage2Earn: Julian Hill Bruce boost](https://cdn.bulbapp.io/frontend/images/dbf23bb3-aba5-43ea-9678-e8c2dbad951c/1)

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)