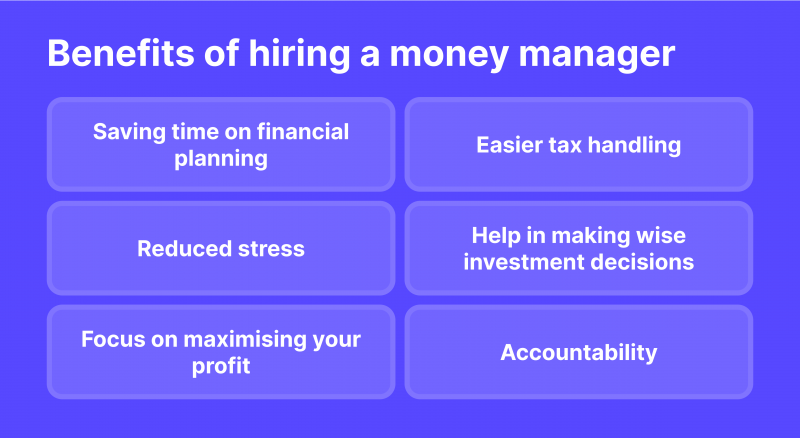

BENEFITS OF HIRING A MONEY MANAGER

Hiring a personal money manager can be favourable for several reasons, such as the following:

Hiring a personal money manager can be favourable for several reasons, such as the following:

1. Save Time on Planning

Clients can save time and effort by communicating personal goals to their corporate money manager, allowing them to plan their future finances without relying on income-based expenses.

2. Easier Tax Handling

Money managers assist individuals in filing taxes, which is crucial for companies as they pay significant taxes.

3. Advantages Over Brokers

Investment brokers charge commissions based on returns, making decisions in their best interest. Investment managers, on the other hand, charge fees independent of returns to maximise customer gains and provide other services.

4. Help in Investment Decisions

Through market-driven research, investment managers offer customers the best investment options like government securities, stocks, and cryptocurrencies, avoiding speculative activities.

How to Choose a Reliable Money Manager

To select the best daily money manager, conduct thorough research consisting of figuring out manager type, studying suggested options and an interview involving a thorough understanding of each step and your financial needs.

1. Decide on The Manager Type

To choose the right money manager, assess your financial plan and investment portfolio. A certified daily money manager can assist with basic budgeting, estate planning, and investing for more robust planning.

2. Study The Suggested Options

To evaluate money managers, first determine your needs and preferences. After a background check, review their regulatory qualifications, experience, and previous client complaints.

Analyse their portfolio performance in recent years and whether they typically manage clients with similar financial backgrounds. It’s crucial to understand how they make their money, as not all money managers receive a percentage of their clients’ portfolios.

3. Interview

To choose a money manager, it’s essential to speak with a few potential options to understand their communication style, investment philosophy, risk tolerance, and demeanour.

It’s crucial to gauge their level of personalisation and service, as they may have different client-manager relationships. Money managers have different levels of autonomy over portfolios, so it’s essential to ensure they prioritise your needs and preferences.

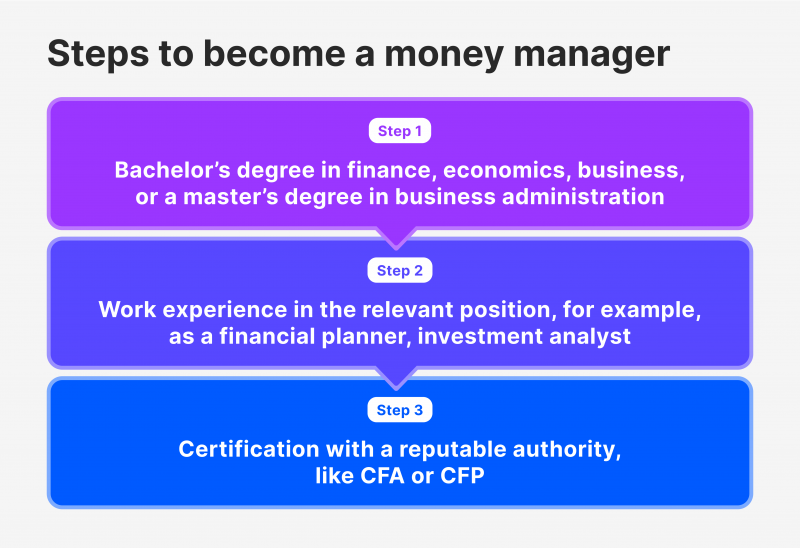

How to Become a Money Manager

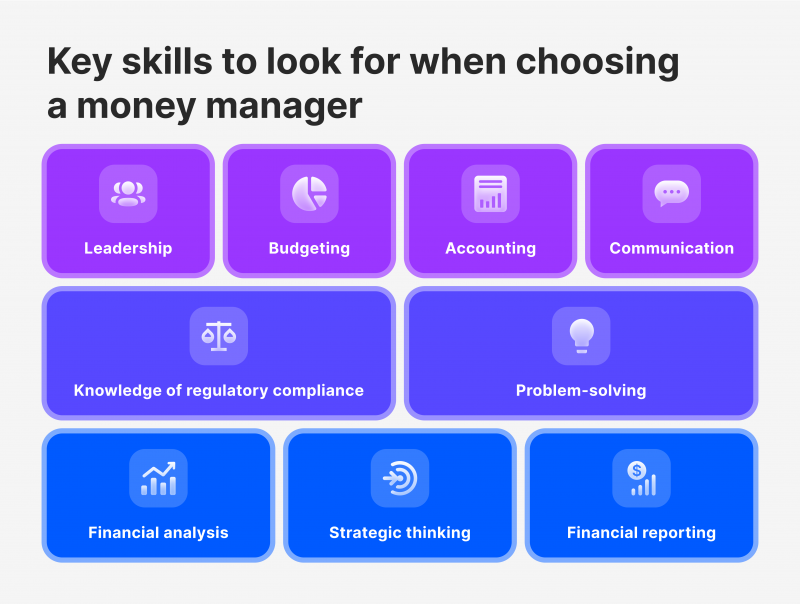

To become an investment adviser, you must meet multiple criteria, including education, training, and work experience.

Portfolio managers require accounting skills to analyse and discuss financial reports with accountants and executives. They also need technical skills in data and financial technologies like QuickBooks, SAP, or Hyperion.

Quantitative skills enable them to review company and market financial data to identify risks and opportunities. Financial reporting ensures compliance with tax regulations and laws, and they create, review, and present financial reports to executives.

The abovementioned requirements and responsibilities require a profound knowledge and corresponding education in the field. Money managers typically hold a Bachelor’s Degree in Finance, Economics, Business, or a related field, with some employers preferring candidates with a Master’s Degree in Business Administration.

Good financial managers typically have years of experience in finance roles like investment analyst, financial planner, or portfolio manager and may also have related experience in accounting or risk management.

Certification is another crucial aspect of becoming a trustworthy money manager. Certified daily money managers often hold professional certifications like CFA or CFP, demonstrating expertise in financial analysis, investment management, and financial planning. Besides professional knowledge and vast experience, investment managers must have good soft skills. They are responsible for clear communication, organisation, leadership, and attention to detail in their roles. They must present financial data clearly, analyse large amounts of information, lead consulting teams, and ensure legal compliance by correcting reporting, budgeting, and forecasting errors. They may also advance to executive leadership roles.

Besides professional knowledge and vast experience, investment managers must have good soft skills. They are responsible for clear communication, organisation, leadership, and attention to detail in their roles. They must present financial data clearly, analyse large amounts of information, lead consulting teams, and ensure legal compliance by correcting reporting, budgeting, and forecasting errors. They may also advance to executive leadership roles.

Money managers should stay informed about market trends, economic conditions, and industry regulations through continuing education and professional development opportunities like conferences and courses.

Final Takeaways

Choosing a money manager can be challenging due to the numerous titles and options available. A money manager specialises in managing investment portfolios and has a fiduciary duty to clients.

Understanding what is a money manager is crucial, especially for beginners, since picking a dependable manager can be tricky.

To become a portfolio manager, one should meet many criteria in terms of education and certification, develop good soft skills, and always stay updated on market conditions and trends.

FAQ

Should everyone have a money manager?

It depends. Money managers can manage independently if someone has a financial background, like a finance teacher or student, but it can be beneficial for those with limited time or seeking professional advice.

What obligations do I have as an investment manager?

As a financial manager, you’ll analyse financial data, tabulate data, report findings, evaluate market trends, oversee staff, and develop organisational budgets.

Why should I hire a money manager?

An asset manager can help manage your portfolio effectively, maximising its value without the stress or emotional rollercoaster that comes with it.

What are the average earnings of money managers?

Money managers offer professional services in accounting, financial management, taxation, and investment, earning an average of $95,445, with some experienced managers earning nearly $200,000.

![[FAILED] Engage2Earn: McEwen boost for Rob Mitchell](https://cdn.bulbapp.io/frontend/images/c798d46f-d3b8-4a66-bf48-7e1ef50b4338/1)

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - Is Trump Dying? Or Only Killing The Market?](https://cdn.bulbapp.io/frontend/images/a129e75e-4fa1-46cc-80b6-04e638877e46/1)