Dogecoin: Betting on a 30% hike? DOGE’s price prediction says…

Victor Olanrewaju

Victor Olanrewaju

Journalist

Edited By: Ann Maria Shibu

Posted: March 28, 2024

Share this article

- The velocity and MVRV ratio spiked, hinting at a price decrease.

- Money flowing into Dogecoin stalled as indicators favored a fall to $0.16.

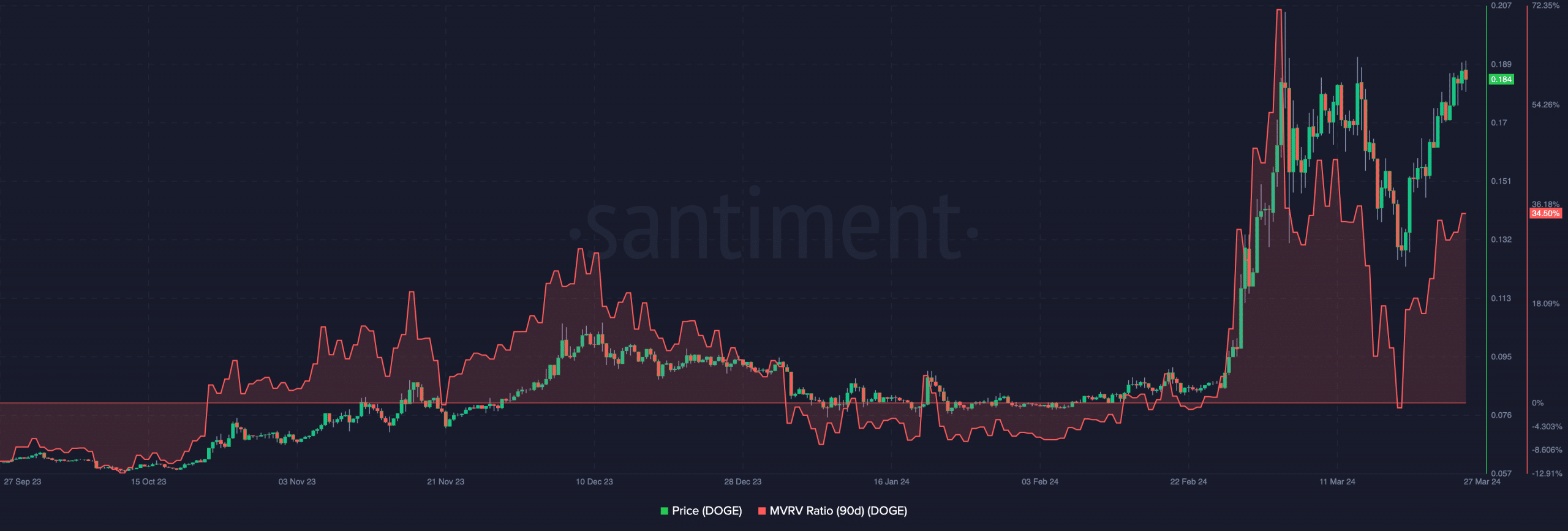

After a 34.76% seven-day increase, Dogecoin [DOGE] could pause the week-long surge. This prediction was because of the Market Value to Realized Value (MVRV) ratio.

According to AMBCrypto’s analysis, Dogecoin’s 90-day MVRV ratio was 34.50%. This indicates that unrealized profits within the last three months have been relatively impressive.

Historically, a negative MVRV ratio is a bullish sign, and market participants use that opportunity to stack more coins. However, a double-digit positive value is not typically great for the price action.

For Dogecoin, this might not be the time to accumulate as holders might begin booking profits. If profit-taking increases, a correction could be next.

Some weeks back, AMBCrypto reported how holders in profit might continue to grow. During that time, 85% of total DOGE holders had unrealized gains. Source: Santiment

Source: Santiment

As it stands, that percentile might decrease as the coin might soon face selling pressure. DOGE’s price was $0.18. But in the first week of March, the value was higher.

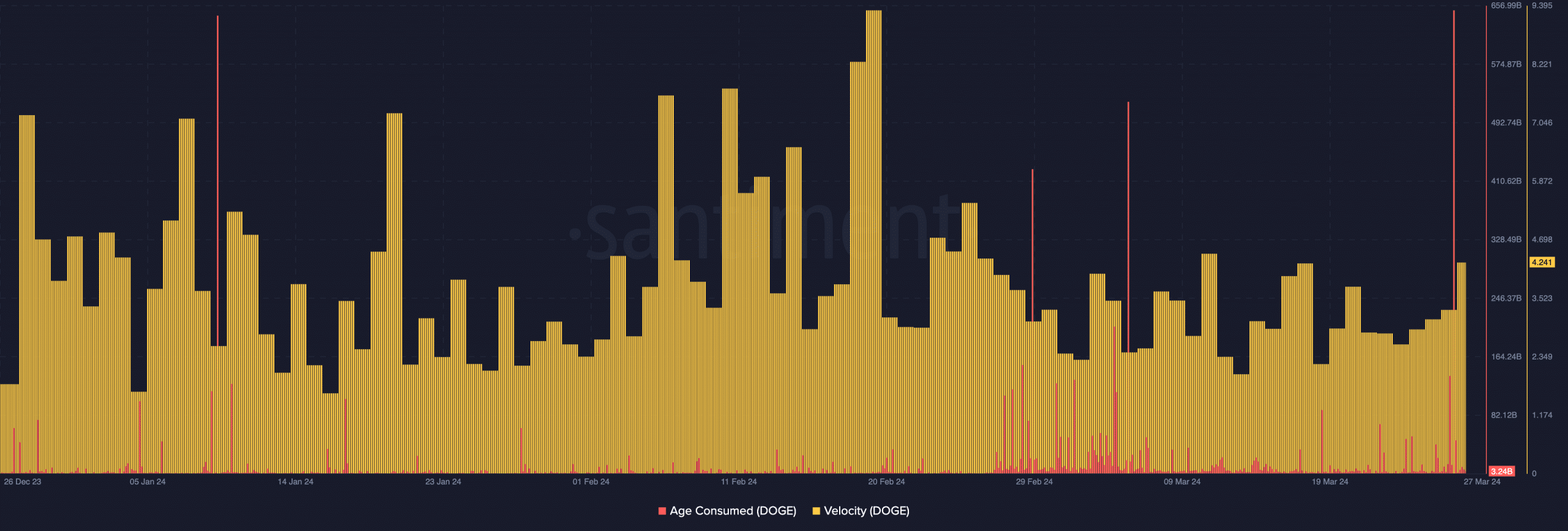

While there was a decline afterward, we found another metric indicating that a move toward $0.20 might be postponed. Based on our assessment using Santiment, the Age Consumed metric agreed with the MVRV ratio indications.

On the 27th of March, Dogecoin’s Age Consumed spiked. A hoisted reading of the coin’s age means that dormant addresses were transferring the coins somewhere else.

In most cases, some of these transfers go into exchanges. If the exchange inflow climbs, the price of the cryptocurrency risks a decline, and that was the case with DOGE.

Likewise, the velocity painted a bearish picture. At press time, the velocity increased, suggesting that a lot of Dogecoin was circulating.

In recent times, whenever the velocity decreases, the price of DOGE falls days after. Therefore, there is a high chance that history might repeat itself. Source: Sentiment

Source: Sentiment

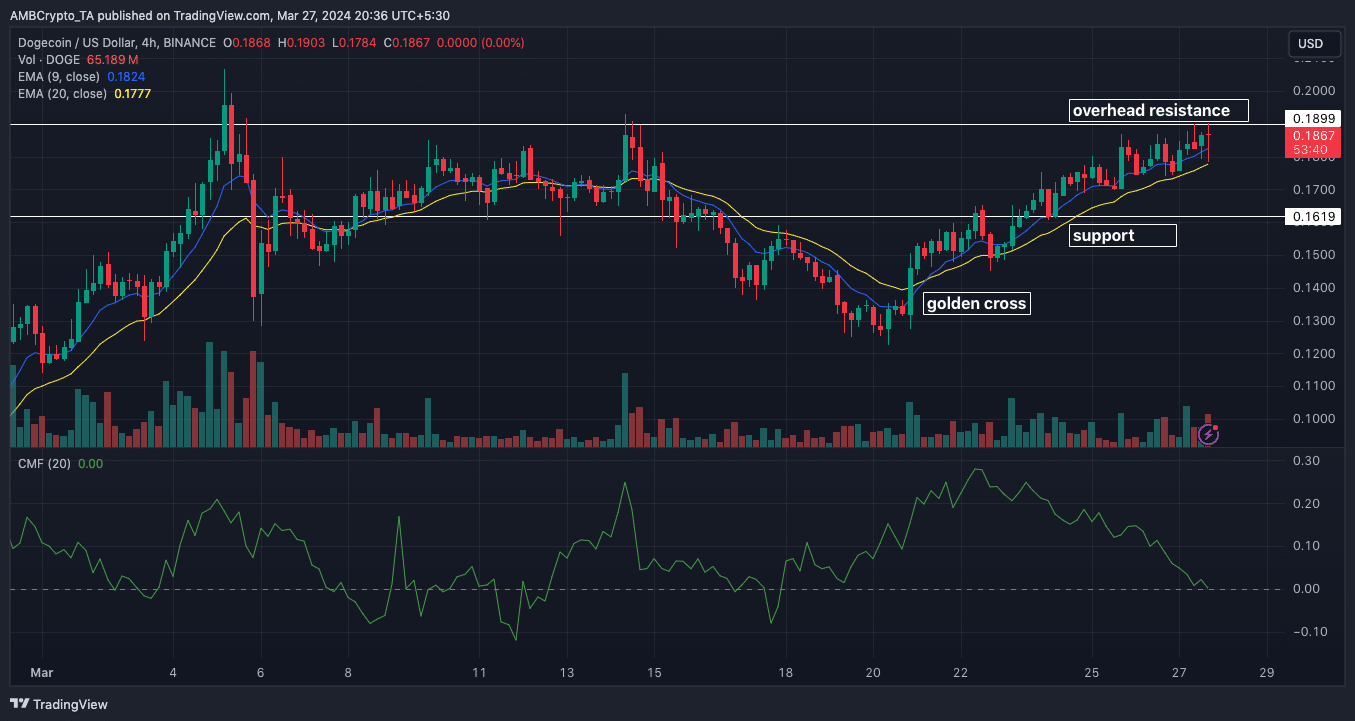

Beyond the on-chain signals, AMBCrypto also looked at DOGE’s technical outlook. At press time, the Exponential Moving Average (EMA) formed a golden cross on the 21st of March as the 9 EMA (blue) crossed over the 20 EMA (yellow).

This crossover was one of the reasons the price rallied. However, the DOGE was on the brink of falling below the EMAs. If this happens, the price of the coin might retrace to the $0.16 underlying support.

However, bulls might attempt to key into the overhead resistance at $0.18. But in the meantime, a rejection might follow. Source: TradingView

Source: TradingView

Read Dogecoin’s [DOGE] Price Prediction 2024-2025

Additionally, the 4-hour chart revealed that the Chaikin Money Flow (CMF) had fallen to the neutral region.

If the CMF continues to oscillate around the same region, previously sustained buying pressure might fizzle out. Hence, Dogecoin’s price might not hit $0.20 before this week ends.

Follow AMBCrypto on Google News

Next: 1.1 Million daily users on Polygon: MATIC’s next move?

Read the Next Article

1.1 Million daily users on Polygon: MATIC's next move?

2min Read

A higher stablecoin market cap meant higher liquidity and efficiency.

Aniket Verma

Aniket Verma

Journalist

Edited By: Ann Maria Shibu

Posted: March 28, 2024

Share this article

- Polygon was the sixth-largest chain in terms of total stablecoin supply.

- Whales have shown lukewarm interest towards MATIC.

The Polygon [MATIC] chain has been experiencing higher user participation and liquidity infusion in 2024, causing the broader market to sit up and take notice.

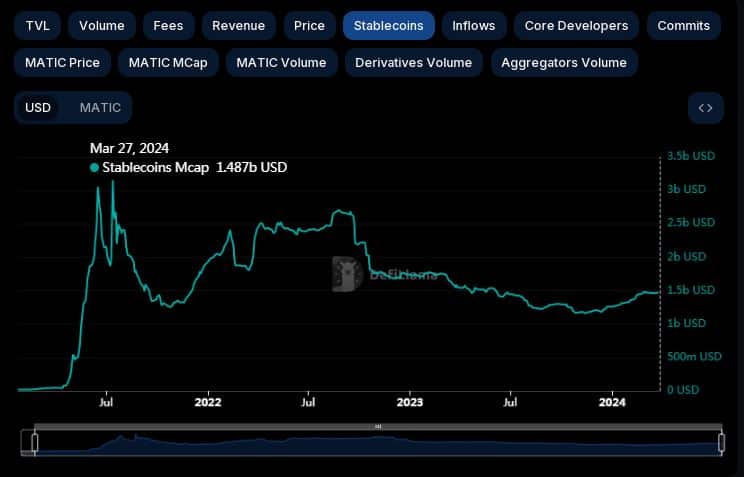

Polygon sees rise in stablecoin supply

According to AMBCrypto’s analysis of DeFiLlama’s data, Polygon’s stablecoin market cap hit nearly $1.5 billion as of this writing, marking an impressive 18% growth year-to-date (YTD). As of this writing, it was the sixth-largest chain in terms of total stablecoin supply. Source: DeFiLlama

Source: DeFiLlama

Stablecoins can be construed as the on-chain equivalent of cash in traditional financial markets. A higher stablecoin marketcap indicates a larger pool of liquidity, making trading on the chain easier, and thereby leading to a more efficient market.

That being said, the current levels still remained a far way off from the peak registered in July 2021. In reality, Polygon’s next aim should be the pre-bear market level of $2.6 billion achieved in September 2022.

The best-performing ETH scaling solution

The rise in stablecoin market cap comes alongside an impressive surge in user engagement on the network.

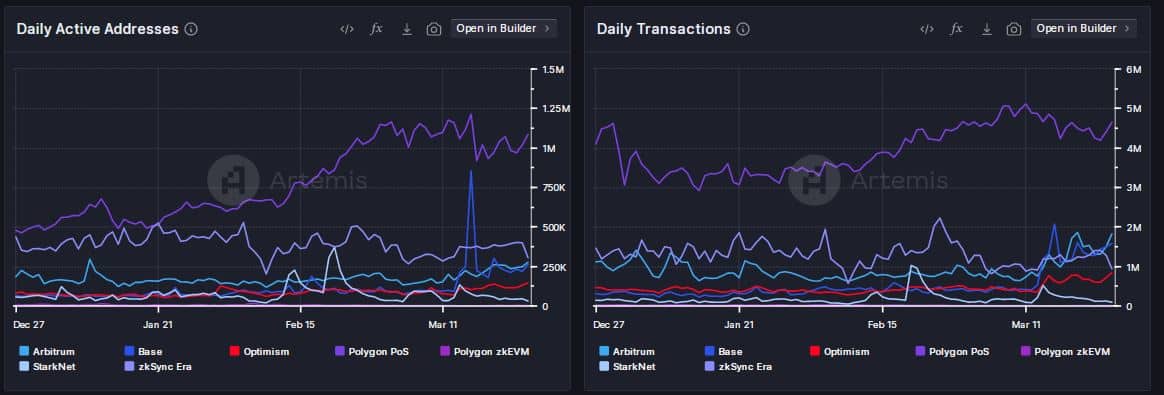

According to AMBCrypto’s examination of Artemis’ data, the Polygon proof-of-stake (PoS) chain massively outperformed other scaling networks in daily active addresses and transactions in 2024. Source: Artemis

Source: Artemis

Take for instance, the daily active addresses count on Polygon PoS on the 26th of March was 1.1 million, more than triple the count of the second-best ranked chain on the list. A similar trend came to light when it came to transaction count.

Will whales show interest?

The chain’s native token MATIC rose 1.73% in the last 24 hours, taking its last seven-day gains to over 11%, as per CoinMarketCap. MATIC’s performance was in line with the broader altcoin market report card. On a YTD basis, the crypto was up 12%

Is your portfolio green? Check out the MATIC Profit Calculator

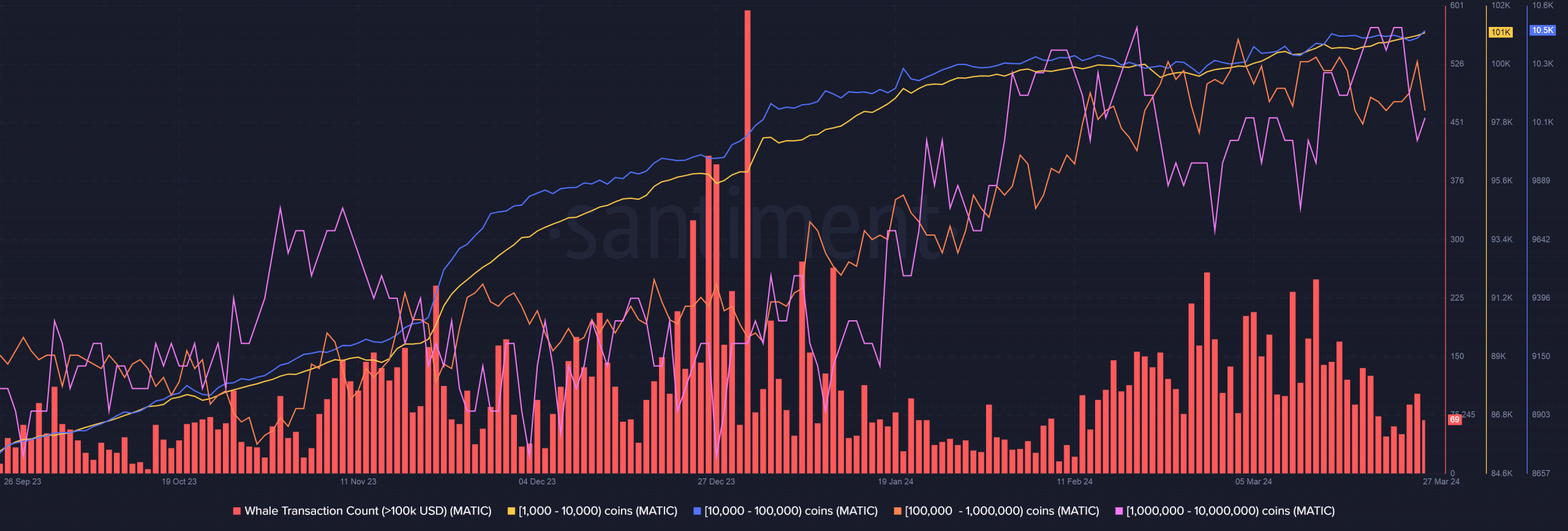

Interestingly, the rise was not built on whales’ accumulation. Using Santiment, AMBCrypto noted a sharp drop in whale transactions in 2o24.

Moreover, the holdings of these influential investors remained flat during this time, implying lower engagement from whales. Source: Santiment

Source: Santiment

Previous: Dogecoin: Betting on a 30% hike? DOGE’s price prediction says…

Next: BlockDAG Surpasses HNT’s Growth and BlackRock’s Innovations

Read the Next Article

- Home > Press Release > BlockDAG Surpasses HNT’s Growth and BlackRock’s Innovations

BlockDAG Surpasses HNT's Growth and BlackRock's Innovations

2min Read

AMBCrypto Team

AMBCrypto Team

contributor

Posted: March 28, 2024

Share this article

In the swiftly evolving landscape of digital finance, the recent advancements by Helium in decentralized networking and BlackRock’s foray into asset tokenization are redefining investment paradigms. Amidst these notable trends, BlockDAG (BDAG) carves out a premier spot among 2024’s leading altcoins with its community-centric blockchain innovation, steering the sector towards a new horizon of growth and inclusivity.

Helium’s Network Expansion Signals Price Surge

Helium’s unique decentralized wireless network, designed to connect IoT devices through blockchain technology, sets a precedent for community-driven rewards in cryptocurrency. The Helium network rewards participants with HNT tokens for hosting hotspots, facilitating wireless connections, and participating in blockchain mining. This model enhances network coverage and utility and propels the Helium coin price upward, reflecting the network’s expanding footprint and potential for widespread adoption. Predictions by industry analysts highlight a bullish outlook for Helium’s coin price, forecasting significant growth from 2024 through 2030. Such projections underscore Helium’s enduring value proposition and its role in shaping the future of decentralized networking and blockchain rewards.

Predictions by industry analysts highlight a bullish outlook for Helium’s coin price, forecasting significant growth from 2024 through 2030. Such projections underscore Helium’s enduring value proposition and its role in shaping the future of decentralized networking and blockchain rewards.

BlackRock Pioneers with Groundbreaking Tokenization Strategy

At the helm of financial transformation, BlackRock’s venture into tokenizing $10 trillion of assets heralds a new era of efficiency and accessibility in traditional finance. This strategic initiative, highlighted by Forbes, leverages blockchain technology to enhance the liquidity and management of Real World Assets (RWA), notably through the launch of the BlackRock USD Institutional Digital Liquidity Fund on the Ethereum blockchain. BlackRock’s tokenization project, especially in real estate, aims to democratize investment opportunities and streamline asset management, showcasing the firm’s dedication to leveraging digital innovations to address client challenges and unlock new value in asset markets.

BlackRock’s tokenization project, especially in real estate, aims to democratize investment opportunities and streamline asset management, showcasing the firm’s dedication to leveraging digital innovations to address client challenges and unlock new value in asset markets.

BlockDAG Stands Tall Among 2024’s Crypto Innovators

Amidst the dynamic shifts in cryptocurrency, BlockDAG distinguishes itself as a leader with a significant $9.8 million milestone in its presale, emphasizing its robust model for enhancing investor value. BlockDAG’s approach, centered around community engagement and blockchain education, positions it as a forerunner in fostering a collaborative and thriving digital ecosystem.

BlockDAG’s unique blend of technology and community focus and its ambitious vision for a $600 million valuation showcase its potential to match and surpass the growth trajectories of Helium and BlackRock’s innovative endeavors. With its presale drawing investors with the promise of up to 5000x returns, BlockDAG sets the stage for unprecedented growth and participation in the crypto market.

In Summary

As we delve into the future of cryptocurrency in 2024, BlockDAG, Helium, and BlackRock represent pivotal forces driving innovation, community engagement, and the integration of traditional finance with blockchain technology. With BlockDAG leading the charge with its impressive presale success and vision for community-driven growth, the cryptocurrency sector is poised for a transformative journey, offering a glimpse into a future where digital finance is more accessible, efficient, and inclusive.

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - Is Trump Dying? Or Only Killing The Market?](https://cdn.bulbapp.io/frontend/images/a129e75e-4fa1-46cc-80b6-04e638877e46/1)

![[FAILED] Engage2Earn: McEwen boost for Rob Mitchell](https://cdn.bulbapp.io/frontend/images/c798d46f-d3b8-4a66-bf48-7e1ef50b4338/1)