Why Bitcoin Matters

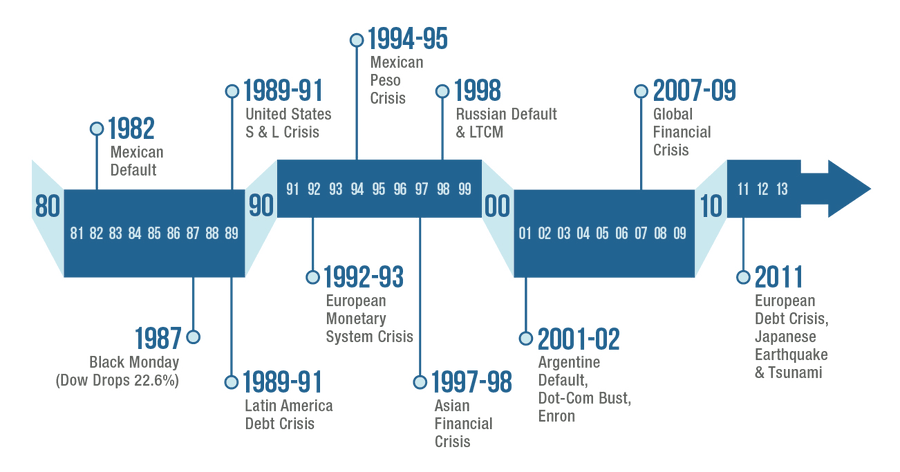

Our financial world has been showing us that Fiat can not last forever. Money has evolved fast over the years and we are closing in fast on the next evolutionary cycle.

Governments worldwide are looking at something new called Central Bank Digital Currencies (CBDCs) as a solution. On the surface, CBDCs seem like they could help fix our finances and economies. But there’s a big debate happening — it’s about the balance between making our finances stable and keeping our personal freedom.

In this article, we’ll explore CBDCs, Bitcoin, and what they might mean for us. It’s clear that while CBDCs could help with our financial problems, they also come with the risk of giving a small amount of people a lot of control. I'll make the case that, especially now, Bitcoin is an important alternative. It doesn’t just offer financial stability but also protects our freedom. So, let’s explore why Bitcoin is so important in these times.

The Need for Financial Stability

Image by 3D Animation Production Company from Pixabay

Image by 3D Animation Production Company from Pixabay

In recent years, our global financial system has faced problems due to economic crises, mounting debts, and rising costs of living. The traditional centralized financial system struggles to maintain stability.

The world economy is forecast to slow from 6.0 percent in 2021 to 3.2 percent in 2022 and 2.7 percent in 2023. — Source

One major concern is inflation (at the moment), which destroys the value of our money and impacts household budgets. Additionally, past financial crises have shown the fragility of our centralized financial infrastructure, destroying public trust. Source

Source

Some of the top risks for 2023 with the greatest potential impact on a global scale include:

Energy supply crisis

Cost-of-living crisis

Rising inflation

Food supply crisis

Cyber-attacks on critical infrastructure

Source

Central Bank Digital Currencies (CBDCs) have gained traction as a solution (Democrats are about twice as inclined (22%) to support adopting a CBDC than Republicans (11%). Interestingly, a majority (53%) of Republicans oppose a CBDC, while most Democrats (56%) don’t have an opinion and 22% are opposed — Source), offering an updated financial system. The Feds have created something this year called FedNow. This is the first step to the release of a CBDC. There are debates happening about using CBDCs but we all know that no matter how hard we fight it will happen. There is no way around this and this is one of the many reasons Bitcoin shines in the financial darkness.

The FedNow Service is a new service for instant payments built by the Federal Reserve to help make everyday payments fast and convenient for American households and businesses. Banks and credit unions of all sizes can sign up for the FedNow Service and offer new instant payment services to their customers. — Source

However, we need to consider whether centralization can provide the security we seek without compromising personal privacy and freedom. When big companies and governments have too much control they tend to misuse their power.

Facebook — Privacy and Data

TikTok — Privacy Violations

Google — Data Sales

Governments — The NSA was paying U.S. private tech companies for clandestine access to their communications networks.

I could go on forever with these but If you want to search for a company for yourself then check out the Good Jobs First Violation Tracker. There are multiple other ways to find this information. You just have to start digging. When you use Bitcoin it uses blockchain technology. This allows every computer that runs a node to be part of the validation process and allows every user to see Bitcoin in its entirety. It is a transparent ledger that allows anyone to look at transactions. This is a trustless system that allows anyone to be their own bank.

In the next section, we’ll explore CBDCs and introduce Bitcoin as a decentralized alternative that financial stability and individual freedom. Our choices will significantly shape the future of our financial system and personal liberties.

The Promise of CBDCs

Image by Gerd Altmann from Pixabay

Image by Gerd Altmann from Pixabay

Central Bank Digital Currencies (CBDCs) have captured the interest of governments and financial institutions as they seek to modernize financial systems. CBDCs offer the potential to address long-standing financial challenges through digitization. These digital currencies promise increased efficiency in financial transactions, streamlining payments, reducing processing times, and lowering costs. They could particularly benefit cross-border transactions, with the possibility of making financial services more accessible.

Pros of CBDCs

- Improved Payment Efficiency and Accessibility

- Enhanced Financial Inclusion and Access to Banking Services

- Increased Security and Transparency

- Reduced Costs and Risks of Physical Cash Handling

- Potential for Monetary Policy Implementation

Source

CBDCs also aim to promote financial inclusion by offering digital currency accessible to anyone with a smartphone or internet connection (which Bitcoin already does). This could bring previously unbanked individuals into the formal financial system, reducing disparities in financial access and fostering economic development in underserved regions. CBDCs, being digital and traceable, may also reduce counterfeiting and slow illicit financial activities. The Obama phone and CBDCs would be the most efficient to start allowing everyone, no matter what class you are in a way to be connected. This could also be a great way for the government to spy on the lower class. Who would say no to free money and a free phone? I think it is amazing that the government gives out phones but I am always skeptical when it comes to getting something free. What do you think?

Central banks view CBDCs as a way to apply financial policy more effectively. With real-time transaction data, they can make informed decisions on interest rates and money supply, helping economic balance during crises. Enhanced security measures in CBDCs, including advanced encryption and authentication, could also bolster the integrity of digital transactions.

However, the release of CBDCs raises deep questions about privacy, control, and the balance between state authority and individual autonomy. While we explore the potential benefits of CBDCs, it’s crucial to consider potential trade-offs, especially in terms of personal freedom and privacy.

Cons of CBDCs

- Cybersecurity and Privacy Risks

- Disintermediation and Potential for Bank Runs

- Technological and Infrastructural Challenges

- Inherent Complexity and Regulatory Issues

- Potential Disruption of the Existing Financial System

Source

Next, we will explore the concerns and criticisms surrounding CBDCs, including the risk of centralized control and implications for individual privacy. We will also introduce Bitcoin as an alternative, highlighting its vision for the future of finance, decentralization, and individual sovereignty.

The Trade-Off - Total Control

Image by Gerd Altmann from Pixabay

Image by Gerd Altmann from Pixabay

Central Bank Digital Currencies (CBDCs) offer the promise of rebuilding and stabilizing financial systems, but they come with a critical trade-off. The potential for significant government and central authority control.

The primary concern with CBDCs is their centralization. These digital currencies are typically issued and managed by central banks or government bodies, granting them the power to monitor and influence every financial transaction within their jurisdiction. While this control can be used to implement monetary policies and combat illegal activities, it also raises alarms about personal financial privacy disappearing and the risk of power abuse.

CBDCs involve extensive data collection on individuals’ financial activities, creating a detailed digital record of every purchase, transfer, and transaction. While this transparency can help combat fraud, it also creates a surveillance state where individuals may feel their financial actions are constantly inspected, creating concerns for personal privacy and civil liberties. One might say we already deal with these problems when using debit and credit cards but the big difference is these are not owned by the federal government and still have to follow privacy guidelines. If a government owns the money that is used then you have no freedoms or privacy.

CBDCs make individuals increasingly dependent on government policies and decisions. Governments could implement measures like negative interest rates or restrict access to funds during crises, potentially limiting individuals’ financial autonomy in the name of economic stability. The monitoring and control capabilities of CBDCs could also lead to discrimination and exclusion, as governments might deny funds or financial services to individuals or groups they consider undesirable or politically inconvenient, particularly endangering marginalized communities.

The digital nature of CBDCs exposes them to cybersecurity vulnerabilities, making them susceptible to hacking attempts or system breaches that could lead to financial chaos and a loss of trust in the system. This would be a lot more difficult if you owned your own keys, which Bitcoin allows you to do.

As we explore these concerns, it becomes clear that CBDCs present a delicate balance between the advantages of modernization and the risks of centralized control. While they have the potential to address some deficiencies in the existing financial system, they also introduce new challenges and vulnerabilities.

Next, we will introduce Bitcoin as an alternative to CBDCs, highlighting its decentralization, transparency, and protection of individual freedom. Bitcoin’s decentralized nature stands out from the centralized control associated with CBDCs, offering a vision of a financial system that allows personal power and security.

Bitcoin as a Solution

Image by Annette from Pixabay

Image by Annette from Pixabay

In the middle of ongoing discussions about Central Bank Digital Currencies (CBDCs) and their potential pros and cons, another financial system has gained popularity, Bitcoin. This decentralized digital currency has attracted widespread interest from individuals and institutions around the world, offering a sharp contrast to the centralized control envisioned by CBDCs.

Bitcoin’s appeal comes from its core features. Unlike CBDCs, which central authorities control, Bitcoin operates on a decentralized ledger called the blockchain. This means that no single entity, whether a government or corporation, holds authority over the Bitcoin network. Transactions are verified by a distributed network of participants, making it resistant to censorship and manipulation. Anyone willing to download Bitcoin Core can download the Bitcoin ledger in its entirety. Which at the moment is almost 400 GB. Now I am not 100% sure how to actually look at the info stored but you can also see all Bitcoin transactions by going to blockchain.info and pasting the address you want to check out.

A blockchain is a decentralized, distributed and public digital ledger that is used to record transactions across many computers so that the record cannot be altered retroactively without the alteration of all subsequent blocks and the consensus of the network. — Source

Transparency is an important characteristic of Bitcoin. All Bitcoin transactions are recorded on a publicly accessible ledger, allowing anyone to verify and scrutinize them. This transparency builds trust in the system and reduces the risk of fraud and corruption often associated with centralized financial systems. This means anyone can see each Bitcoin transaction without giving away the whos and the whys.

Bitcoin’s monetary policy stands out from traditional fiat currencies. It is based on a fixed supply schedule, ensuring that there will only ever be 21 million Bitcoins in existence. This scarcity is designed to counter inflationary pressures and safeguard the currency’s value over time. Unlike the dollar which can be printed whenever and for whatever the government deems necessary. Smaller forms of Bitcoin are called Sats or Satoshis.

The dollar is a promise of payment, Bitcoin is a payment without promise.

Bitcoin also gives individuals financial power. Users become their own banks, with full control over their funds and no reliance on intermediaries (as long as you own your keys (passphrase) of course. Always remember the phrase “not your keys, not your Crypto”). This autonomy is particularly valuable in regions with unstable financial systems or governments that impose restrictions on capital movement.

Operating globally, Bitcoin allows for seamless cross-border transactions without intermediaries or excessive fees. This accessibility opens up new possibilities for financial inclusion and economic empowerment, especially in areas with limited access to traditional banking services.

Security is a big concern when it comes to digital money, and Bitcoin addresses it by using blockchain technology, which uses advanced cryptographic techniques to secure transactions and wallets. While no system is entirely immune to threats, Bitcoin’s strong security measures have proven its strength over its decade-long existence.

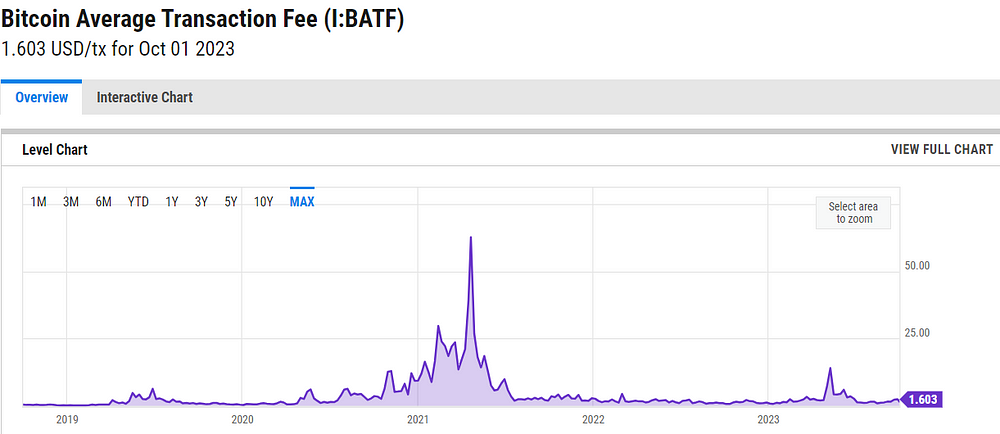

Bitcoin’s emergence has sparked innovation within the financial industry, giving rise to new products and services such as decentralized finance (DeFi) and non-fungible tokens (NFTs), all built on blockchain technology, with the potential to reshape our interaction with money and assets. This has allowed the creation of a whole new economy. Bitcoins Layer 2 solution (The Bitcoin Lightning Network) has made the use of Bitcoin easier than ever. Practically no transaction fees, lightning fast, and easy to use. If you would like to learn a little more about the Bitcoin Lightning Network then Check out my article “What is Nostr?”. I will also be doing a better article in the future so people can understand how easy it is to get started with Bitcoin.

However, it is important to acknowledge that Bitcoin is not without its challenges and uncertainties, including price volatility, regulatory concerns, and the need for widespread adoption. Nonetheless, Bitcoin represents an alternative vision for the future of finance, one that emphasizes decentralization, individual freedom, and transparency.

Next, we will look deeper into Bitcoin’s advantages and explore its potential role in addressing the challenges in the current unpredictable financial world. As we do so, it becomes increasingly evident that Bitcoin’s significance extends beyond being a digital currency, it signifies a paradigm shift in our understanding of money, power, and personal autonomy.

The Advantages of Bitcoin

Image by Petre Barlea from Pixabay

Image by Petre Barlea from Pixabay

Bitcoin’s adoption in the financial world is driven not by mere curiosity but by its unique advantages and potential to reshape our financial landscape. As we explore these advantages, it becomes clear why Bitcoin has created significant attention and enthusiasm.

Bitcoin transactions are censorship-resistant, immune to freezing of funds or transaction blocking, particularly vital in regions with oppressive governments or political instability. Once a transaction is recorded on the Bitcoin blockchain, it becomes immutable (unchangeable), offering a transparent ledger that deters fraud and safeguards the financial system’s integrity.

Also, Bitcoin empowers individuals with actual ownership and control over their funds through private keys aka passphrases, aligning with principles of financial sovereignty. Its fixed supply of 21 million coins sets it apart from inflation-prone fiat currencies, making it an appealing store of value and hedge against inflation.

A passphrase is a sentence like string of words used for authentication that is longer than a traditional password, easy to remember and difficult to crack. — Source

Bitcoin’s global accessibility makes it accessible to anyone with an internet connection, and eliminates borders and intermediaries in cross-border transactions, promoting financial inclusion and empowerment. Its cost-effective transactions, often with lower fees than traditional financial services, make it ideal for payments and international commerce. Source

Source

Security is paramount in Bitcoin, based on cryptographic principles and decentralized consensus, with a decade-long track record of resilience against attacks. It has also driven financial innovation, fostering decentralized finance (DeFi) platforms, peer-to-peer lending, and novel financial instruments.

While Bitcoin transactions are private when it comes to who is sending, its public and transparent blockchain allows anyone to verify supply and audit transactions, reducing the risk of corruption or hidden financial activities. Bitcoin’s endurance since its 2009 inception, gaining acceptance from mainstream financial institutions and corporations, underscores its longevity and potential as a global reserve asset.

These advantages collectively position Bitcoin as an appealing and important alternative in the evolving financial world, empowering users, individual freedom, and an escape from traditional financial systems. In the next section, we will explore Bitcoin’s role in preserving individual freedom and financial control, addressing concerns related to potential centralized control of Central Bank Digital Currencies (CBDCs), and why Bitcoin holds profound significance at this crucial juncture.

Bitcoin’s Role in Preserving Individual Freedom

Bitcoin is a symbol of individual freedom and financial self-determination. It represents a decentralized cryptocurrency that has the potential to reshape the way we approach personal autonomy in the realm of finance.

Bitcoin is a symbol of individual freedom and financial self-determination. It represents a decentralized cryptocurrency that has the potential to reshape the way we approach personal autonomy in the realm of finance.

Bitcoin offers a unique form of financial control, empowering individuals to act as their own banks. With Bitcoin, users can seamlessly send, receive, and store value without the reliance on traditional financial intermediaries. This self-custody aspect ensures that no one can seize or freeze your assets without your explicit consent, providing you with unparalleled control over your financial destiny. This can also not work in your favor if you tend to lose things a lot or forget things a lot. Imagine losing the keys to a wallet that holds 8,000 Bitcoins like James Howell. I would be devastated.

Bitcoin provides a vital safeguard against wealth confiscation and capital controls, particularly in regions plagued by political instability or oppressive governments. Citizens in such areas can securely store their wealth in Bitcoin, keeping it beyond the reach of authorities seeking to seize assets or impose restrictive measures.

In terms of privacy, Bitcoin transactions are recorded on a public ledger, but they remain pseudonymous (know the transaction but not the sender), not directly tied to individual identities. This unique feature affords a level of privacy often absent in traditional banking systems, allowing users to engage in financial activities discreetly.

Bitcoin’s global accessibility is a significant aspect of its appeal. It is open to anyone with an internet connection, irrespective of their geographical location or socioeconomic status. This inclusivity breaks down longstanding barriers to financial participation, granting access to economic opportunities to those historically excluded from the traditional financial system.

As central banks continue to print fiat currencies, leading to value erosion through inflation, Bitcoin offers a robust hedge. Its fixed supply ensures the preservation of purchasing power over time, a critical consideration in a world marked by fluctuating inflation rates.

Bitcoin’s decentralized nature makes it resistant to government interference, setting it apart from traditional financial systems vulnerable to regulatory changes or capital controls. It remains accessible even amid regulatory uncertainty, providing users with a reliable financial alternative. Bitcoin holds huge potential. It can provide essential financial services to unbanked and underbanked populations worldwide, enabling individuals without access to traditional banking to participate in the global economy, receive remittances, and securely store their wealth.

Bitcoin shifts the balance of power away from centralized authorities and empowers individuals to take control of their financial futures. This philosophy of self-responsibility aligns with the principles of personal freedom and independence.

Bitcoin has become a big name in the financial world. We could go on forever about why I think Bitcoin will play a huge role in our financial world for decades to come but time is running thin and I am sure you if you have made it this far you are tired of reading. If you want to learn more about Bitcoin then check out its official website.

Please remember that this is not financial advice. I am not telling you to invest your hard-earned money into Bitcoin. I am just showing you why I think it is important, and why I think all of us should start learning about this amazing technology.

Final Thoughts

Image by Piyapong Saydaung from Pixabay

Image by Piyapong Saydaung from Pixabay

As the world becomes more aware of the vulnerabilities in our financial systems and governments deal with the ongoing challenge of maintaining economic stability, we find ourselves at an important moment in the ongoing debate about the future of money.

The question of why Bitcoin matters goes beyond the world of finance. It’s a question that touches on our identity, our values, and our vision for the future. As we think about the significance of Bitcoin, we find ourselves at the crossroads of technology, philosophy, and personal liberty, with the power to change the very essence of money and freedom in the 21st century.

Stay tuned because my next article is going to be about a fairly new play-to-earn opportunity that pretty much anyone can enjoy. If you have a browser you can enjoy one of the first browser-based FPS. Remember to sign up for email alerts so you know when I post!

Earn With Hatty — Earn With Hatty is a website I created that connects you to some of the best Cryptocurrency opportunities I have come across.

Learn With Hatty — This website is a work in progress. I will be adding more information as time goes on. This website will be available to help people understand Cryptocurrency and Blockchain technology.

These websites do not have ads and strictly run on my earnings from articles such as this one and the apps and websites I use to earn. Donations are accepted and will help me keep growing!

If you would like to start earning Bitcoin and getting involved then I suggest checking out ZEBEDEE. Remember to use the code: 7IHY2E

I have 3 invites left so sign up while you can.

Check out the list below for all of my favorite ways to earn online.

Blogging, gaming, writing, reading, listening, the sky is the limit when earning Crypto. Find the full list on my website!

Faucets and PTC (Point to Click) Website/Apps

FaucetPay — FaucetPay is a microwallet that connects you to multiple earning websites and allows you to deal in microtransactions without having to pay high gas fees. Click here to learn more about this earning opportunity.

Cointiply — Earn BTC, DOGE, ETH, and LTC

GlobalHive — Earn ZEC

CoinPayz — Earn multiple different types of Crypto

FaucetCrypto — Earn over 21 different types of Crypto. Sometimes you have to wait for the withdraw wallets to get filled but it is a

Social Blockchain

Tangled — XLM

Torum — XTM

Uhive — (Code:VD4R7R)HVE2

Desofy — (Code: Fynxik) — DeSo

MAIN — MAIN token on BNB blockchain

Real-Estate

LoftyAI — Real Estate that runs on the Algorand Blockchain. Buy fractions of Real Estate and earn Daily from your investment.

Atlas Earth — or use 0GNQNB

Blogging for Crypto!

Medium — You do not earn Crypto from Medium but you can use this amazing blogging platform to get your content out there. After 100 followers you can start earning money. It takes a little time but it is worth the effort.

read. Cash — Earn BCH

PublishOX — Earn AMPL, ETH, and SPT

G’day Fam — Earn XRP

BULB — Earn BULB blogging and interacting

Watch videos and earn

Slice — Earn Crypto or PayPal by watching YouTube or browsing!

Crypto Sense — Watch ads and play games. Withdraw from over 20 different types of Crypto!

Play to Earn

Womplay — Earn EOS, MATIC, pBTC

ZEBEDEE — Earn Bitcoin LN

Listen to Podcasts and earn Bitcoin

Fountain — Earn Bitcoin by listening to podcasts.

Thank you for reading my article about “Why Bitcoin Matters”!

Please like, follow, and comment to help my page grow.

Follow me on Twitch and zap.stream to watch me play games. Since Mojang took down earning with Satlantis I am on the hunt for a new game to stream.

Check out my YouTube channel for all of my videos.

Check out my website for all my content and learn more about Crypto!

Earn With Hatty

Original article on Medium