Fed keeps interest rates unchanged for 6th consecutive time - Bitcoin is still "in the lead"

The Fed continues to keep interest rates unchanged and send out the message of "inaction" until the target inflation level reaches 2%.

Fed keeps interest rates unchanged for 6th consecutive time - Bitcoin is still "plugged in". Photo: Coin360

Matching predictions, the Federal Open Market Committee (FOMC) - the policy decision-making body of the US Federal Reserve (Fed) - in the early morning of May 2 (Vietnam time) decided to keep original interest rate at current level.

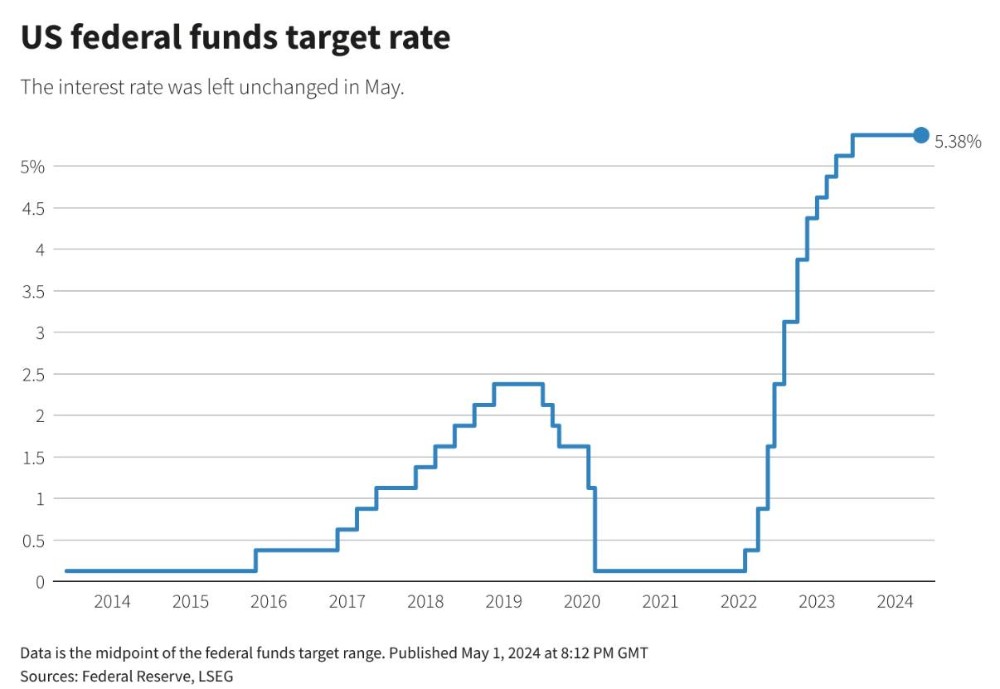

Interest rate fluctuations are regulated by the Fed since 2014. Source: Reuters

This is the 6th consecutive time the Fed has agreed not to adjust interest rates within the reference range of 5.25 - 5.5%, the highest level in the past 23 years. In the policy meetings of June 2023, September 2023, November 2023, December 2023, February 2024 and March 2024, the Fed also decided not to raise interest rates.

In an effort to control inflation, the US Federal Reserve has increased interest rates 11 times since March 2022. However, to date, the FOMC has acknowledged that the deflationary process has stalled in recent months and needs to ensure that inflation cools down in a sustainable way.

In addition to interest rate information, the Fed also announced easing restrictions on the economy, through reducing the rate of contraction of the balance sheet, another tool to help steer the economy. According to the new plan, each month the Fed will let $25 billion in government bonds mature without reinvesting. This number was previously 60 billion USD.

During the press conference, Fed Chairman Jerome Powell predicted that the economy and inflation will cool down in the second half of the year, because savings from the pandemic are shrinking.

Mr. Powell affirmed that the current economy is not in a state of "stagflation", which means high inflation with slow growth. The Fed Chairman also ruled out raising interest rates at the next policy meeting in June, emphasizing:

“We need more time to be sure that inflation is approaching the target. I just don't know exactly when that will happen. The Fed is willing to sit tight until the inflation situation changes.”

The market enters 2024 expecting a series of interest rate cuts from the US central bank. However, high anchor inflation is making the time for the Fed to reduce interest rates further and further away.

Giants JPMorgan and Goldman Sachs predict the first interest rate cut will take place in July. According to the CME FedWatch interest rate tracking tool, the market is betting that the Fed will act in November.

After hours of anxiously waiting for news, Bitcoin price finally breathed a sigh of relief and rebounded after being pressured to drop more than 4% last evening. However, the pressure from no cash flow into the ETF caused Bitcoin to plummet to the $56,552 area. Compared to the peak of 73,000 USD set in mid-March, Bitcoin has dropped more than 20%.

1h chart of the BTC/USDT pair on Binance at 08:50 AM on May 2, 2024

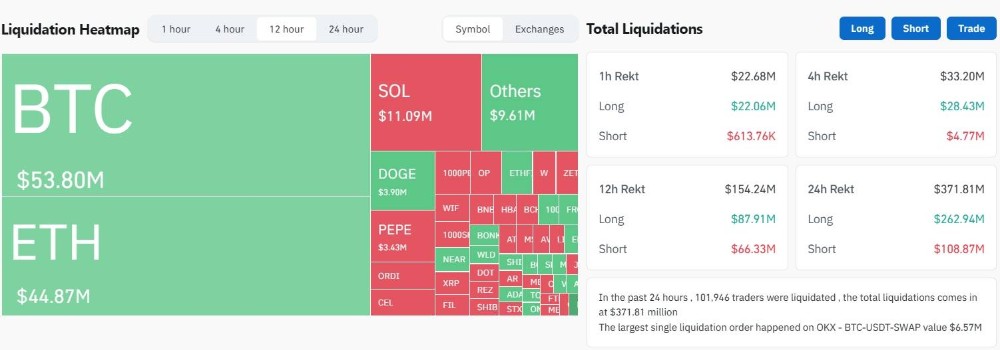

The amount of derivative orders liquidated in the last 12 hours reached about 154 million USD, with 59% being short orders.

Liquidation data in the last 12 hours, screenshot of CoinGlass at 08:50 AM on May 2, 2024

US stocks rebounded before closing the session. The Dow Jones index increased 451 points, the S&P 500 increased 52 points and the Nasdaq Composite increased 248 points. World spot gold price also increased by more than 30 USD to 2,317 USD per ounce.

![[LIVE] Engage2Earn: McEwen boost for Rob Mitchell](https://cdn.bulbapp.io/frontend/images/c798d46f-d3b8-4a66-bf48-7e1ef50b4338/1)

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)