How Solana Fees Hit Record High Amid AI Memecoin Frenzy

Solana, one of the leading blockchain networks, recently witnessed an unprecedented peak in transaction-related fees, hitting over $11 million on Oct. 24, 2023. The rise, primarily driven by an AI-driven memecoin trading craze, has placed Solana at the top of daily trading volume rankings in the decentralized finance (DeFi) sector for an impressive 13 consecutive days, according to DefiLlama data.

This surge underscores Solana’s capacity to handle high-throughput applications and its ongoing appeal within DeFi, where the intersection of artificial intelligence and speculative assets creates a unique, high-demand market.

AI Memecoins Fuel Fee Surge on Solana Network

With the blockchain landscape experiencing continual evolution, the combination of artificial intelligence with memecoins has created a frenzy, particularly on the Solana network. This recent surge, marked by record-breaking transaction-related fees, has drawn significant attention to Solana as a network capable of accommodating high volumes of transactions while providing a viable ecosystem for trading experimental assets.

The $11 million in transaction-related fees, a measure known as “real economic value” (REV), encompasses validator fees and Miner Extractable Value (MEV) tips, which reward validators for confirming transactions and managing network traffic.

Amid this surge, the trading volume on Solana’s decentralized exchanges reached over $2.6 billion on Oct. 24 alone, highlighting the platform’s efficiency in processing vast amounts of trades.

The sustained high trading volumes seen on Solana align with the recent rise in popularity of AI-influenced tokens, notably Goatseus Maximus (GOAT), a memecoin inspired by the AI entity Truth Terminal. Truth Terminal’s release of a fictional “Goatse Gospel” storyline inspired the inception of GOAT, a memecoin that has amassed a market cap of $650 million.

Within a day, GOAT generated an impressive $450 million in on-chain transactions, demonstrating the remarkable effect that artificial intelligence and digital narratives can have on speculative trading.

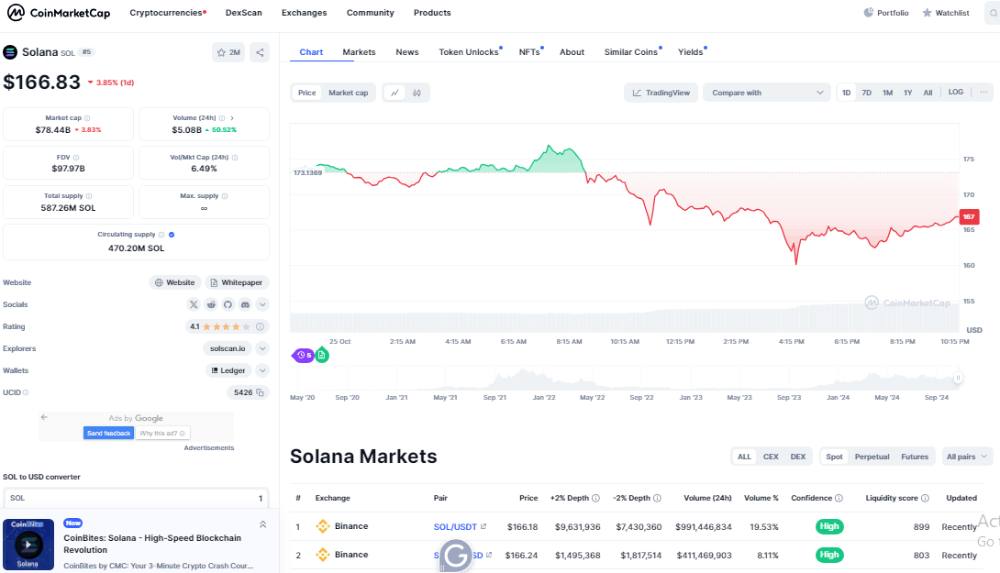

Solana Recent Price

The Role of Pump.fun in Solana’s Memecoin Boom

Adding to the intensity of Solana’s transaction volume and fee records is the activity of the memecoin-focused launchpad, Pump.fun. According to data provided by Hashed’s Dune Analytics dashboard, Pump.fun saw an all-time high of 36,339 tokens deployed on Oct. 24, a count that comprised over 84% of the 43,166 total tokens issued on Solana in a single day. The surge in token deployments on Pump.fun is indicative of the escalating interest in memecoins and signals Solana’s readiness to support large-scale token generation, often required by projects aiming to capture short-lived but high-volume interest from traders.

With Pump.fun tokens taking the lead in weekly trading volumes, the launchpad managed to generate roughly $8.7 billion in trading volumes last week. This high turnover in trading volumes reinforces the emerging popularity of decentralized finance as a space that can quickly adapt to and capitalize on trends, such as the combination of AI with memecoins, to generate high activity and engagement from both novice and experienced traders. The launchpad also crossed a significant threshold on Oct. 24, as Pump.fun surpassed 1 million SOL in revenue within just nine months of launching.

This rapid accumulation of revenue speaks to the platform’s ability to drive large-scale engagement and highlights how Solana is effectively monetizing DeFi projects with substantial appeal.

Solana’s Fee Spike and the Evolving Role of DeFi Networks

Solana’s capacity to handle an influx of trading activity with relative efficiency has made it an attractive choice for DeFi projects and traders alike, particularly as the network sustains high levels of fee generation from transactional activity. The $11 million in fees reflects Solana’s commitment to maintaining infrastructure that can manage both high volume and high value of trades—a critical feature as decentralized finance continues to grow. As a platform that accommodates diverse projects, from AI-driven tokens to DeFi lending platforms, Solana stands out for its capability to rapidly adapt to and benefit from spikes in demand, especially within the dynamic ecosystem of blockchain assets.

This surge in transaction-related fees also highlights a shift within the DeFi landscape. As more projects integrate AI elements, speculative trading around AI-associated assets could become a defining trend. Solana’s ability to manage this demand efficiently provides a competitive advantage, especially as blockchains continue to compete for market share in the DeFi space. The success of Goatseus Maximus (GOAT) and the unprecedented engagement on Pump.fun emphasize how blockchain platforms are becoming incubators for digital economies influenced by artificial intelligence, with Solana positioned at the forefront of this trend.

The Influence of AI Memecoins on Blockchain Activity

As the digital economy increasingly intertwines with artificial intelligence, AI-integrated assets are creating a distinct form of speculative trading. Goatseus Maximus, for example, became a cultural phenomenon that quickly amassed a substantial following, fueled by a fictional narrative and the enthusiasm of a speculative trading community. This trend indicates that AI-driven assets are likely to become more prevalent within DeFi, where rapid adoption of new concepts and assets is the norm. Solana, in its role as a high-throughput blockchain, stands as a critical player capable of capturing this evolving trend.

The potential for increased engagement from AI-associated assets represents a shift in the broader DeFi and blockchain ecosystems, where digital assets, artificial intelligence, and blockchain technology intersect. With Solana’s recent performance, it is clear that blockchain networks capable of supporting diverse projects with substantial scalability can seize market opportunities that blend technology with digital culture. This trend could result in an influx of both retail and institutional traders to platforms capable of handling unique digital assets that foster speculation, digital storytelling, and high trading activity.

Future Implications for Solana and Decentralized Finance

Solana’s ability to register such a high volume of transaction-related fees speaks to its positioning within the blockchain sector, where demand for scalable and adaptable platforms is rapidly growing. This milestone of $11 million in daily fees not only underscores Solana’s role as a leader in DeFi but also points to a future where blockchain networks must evolve to keep pace with emerging trends like AI-driven asset trading.

The success of Goatseus Maximus and the record-setting deployments on Pump.fun indicate that blockchain projects integrating elements of artificial intelligence are likely to continue shaping DeFi in the months to come. As Solana demonstrates its capability to support such projects, other blockchain networks may follow suit by expanding infrastructure that accommodates the demands of token trading volumes and high-value, transaction-heavy activities. This could lead to a reshaped DeFi landscape where platforms that best capture high-value, trending assets gain the most market share.

With AI memecoins capturing market attention, Solana’s recent performance could signal a broader trend toward speculative assets designed to engage users through narrative and technology. The implications for decentralized finance are far-reaching, as AI-influenced assets present an avenue for user engagement that goes beyond typical blockchain projects, creating spaces for entertainment, speculation, and rapid engagement.

Reference Link To Original Source Article

https://cryptoslate.com/solana-registers-new-all-time-high-in-daily-transaction-related-fees/

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - WEN ALT Season?](https://cdn.bulbapp.io/frontend/images/5e881bda-7f7a-42c8-9a03-01263004c332/1)