An unlikely growth partner for Peloton: GymsHow Peloton can (finally?) return to growth

Peloton announced quarterly earnings last week and once again came up short of investor expectations. Revenue slightly beat expectations, but so did losses, with the miss blamed on a struggle to convert free-trial subscribers into paying users.

How can the company speed up its turnaround?

Step 1 — Analyzing Peloton’s business

I do like a lot of Peloton’s new marketing.

Peloton hired Twitter’s former CMO Leslie Berland last year and has since shifted their brand marketing to be more realistic. Instead of a bike in a $10M Manhattan skyline view apartment, Peloton ads show people sweating as they squeeze in an at-home workout. Bikes are placed in the garage or wherever people have space. Peloton has shifted visuals from luxe to realistic. Source: Peloton

Peloton has shifted visuals from luxe to realistic. Source: Peloton

But wait — is this not aspirational? No, it’s great. Peloton went too aspirational with their marketing. Peloton — by way of expensive content production and low marginal cost of new subscribers — will make money when they have scale. A shift to mass marketing makes sense.

Boutique fitness brands like Barry’s Bootcamp can lean into luxury marketing because their business model is designed for it. The physical nature of a Barry’s class means scarcity is part of the model — only so many people can fit in the studio. Barry’s must charge sky high prices to make ends meet — and that the experience needs to be luxe in return. And luxe it is — a single 50 minute Barry’s Bootcamp class will run you $40. $50 in the Hamptons. For that price attendees get top-tier locations, high-end facilities, Dyson hairdryers and Oribe shampoo in the shower. And, equally important for luxury, Barry’s studios are designed for attendees to announce that they are there, with mirrored walls and flattering red lighting. I am unfortunately guilty of a post-Barry’s selfie.

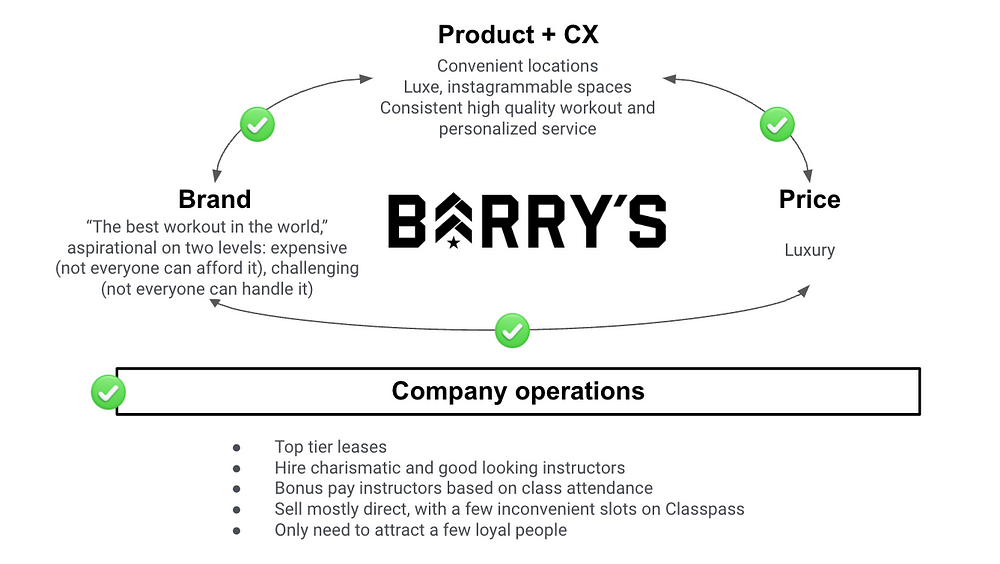

I use the Brand Flywheel model to analyze how a company’s price, product, brand, and operations link together. Barry’s luxury model self-reinforces at every link. Barry’s luxury gym model is self-reinforcing — indicative of a strong brand. Source: Author

Barry’s luxury gym model is self-reinforcing — indicative of a strong brand. Source: Author

Peloton, on the other hand, has some kinks in their model. As stated, they need scale. But there are a number of hurdles preventing that:

One, Peloton is still perceived as luxury (a likely hangover from their original marketing). But it’s pretty great value. A new Peloton bike ($1,445), plus the $44 per month all-access subscription means you can work out everyday with arguably the best instructors in your home for less than $105/month assuming you own the bike for only 2 years. Premium, certainly. But not luxury. Owning a Peloton is equal to 2.5 Barry’s classes per month. If you only have the digital subscription (me), Peloton is even cheaper at $24.99/month, plus whatever equipment you want to invest in.

Two, Peloton is still seen as the spin bike app. But Peloton offers weightlifting, barre, dance cardio, Pilates, yoga, meditation, running, walking, boxing, stretching, rowing… and I am probably forgetting others. This perception prevents many from considering Peloton in the first place.

But there is a 3rd issue: the at-home perception.

COVID19 was great for Peloton adoption as lockdowns forced everyone to work out from home. With no competition, Peloton handily won the at-home market. The issue is, the in-person gym market is bigger. But conversation around Peloton and gyms tends to be either/or.

Do I return to the gym OR do I keep working out with Peloton at home?

That dichotomy a massive problem. It cuts off Peloton from the customers most likely to pay for fitness — people who already go to the gym — leaving Peloton to offer free trials to people with the most uphill battle to a workout habit: people who did not try Peloton during COVID and who also don’t have a gym membership today.

To access the best customers, Peloton needs to target people at the gym. They need to show that Peloton is not a gym alternative. It’s a gym accompaniment.

It’s possible — consider Nike. When Nike launched Nike Training Club (Nike’s workout app) it was not seen as the end of gyms. Instead, it was an app people used at the gym to guide their training. Repositioning as a gym accompaniment would stem churn (people wouldn’t ditch the app when they go back to the gym) and increase paid subscriptions.

PS — My full content is on my brand strategy newsletter. Here’s a link if you wish to subscribe.

Back to Peloton

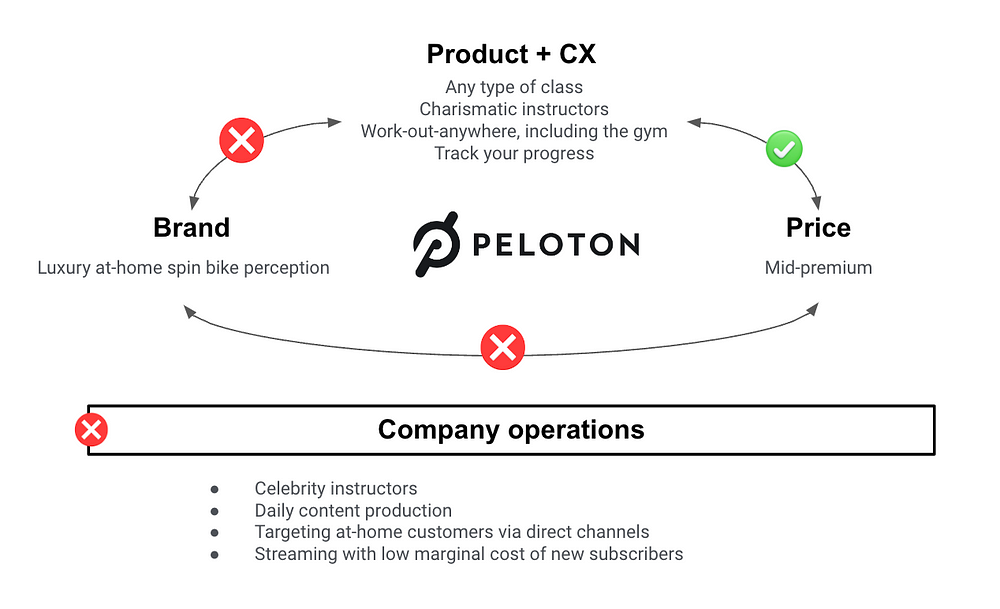

Peloton’s current Brand Flywheel model is not self-reinforcing — due to misalignment between brand perception and price, and a lack of operational scale to support the product. Peloton’s Brand Flywheel model. Source: Author

Peloton’s Brand Flywheel model. Source: Author

Step 2 — Codifying Peloton’s marketing challenges

The Brand Flywheel identifies (4) challenges for Peloton to reach its mass market potential:

1. Peloton needs to shift price perception from luxury to premium.

This shift will open up new segments of the population. To give credit, Peloton is working on this. But perception is not fully there yet.

2. Peloton needs to shift perception from at-home spinning to all-around exercising.

Peloton did release an ad this year conveying the breadth of app offerings. It’s high production, with a great soundtrack. But the video is just not compelling. There’s no point of view that builds credibility in Peloton’s non-spin offerings. There’s no ‘idea.’ It’s simply a functional montage of the app.

Peloton’s 2023 app relaunch video lacks a core creative idea. Source: Peloton on Youtube

Which brings us to the next challenge…

3. Peloton needs a story.

People know Peloton exists. Peloton needs a campaign that will catch attention and cause people to rethink the brand.

4. Peloton needs attract gym customers via distribution in gyms.

Distribution might not feel like brand marketing, but it’s one of the most important brand marketing levers there are. When Moncler rebranded from sporty to luxury, one of their first moves was to remove their coats from sporting goods stores and only stock coats in luxury boutiques.

For Peloton to shift from at-home spin app (niche market) to gym app (wide market to support their expensive business model), they need to show up where gym customers already are.

Step 3 — Answering the challenges

Peloton’s first three challenges (price perception, spin perception, and story) can be answered by a bolder creative campaign. Gym partnerships will solve the fourth challenge.

On the campaign side, I have two ideas.

Campaign idea 1: Mental health is physical health is mental health…

I did not start working out regularly until I started associating exercising with my mental rather than physical health. I am not alone — physical activity is proven to have mental health benefits. Mental health is also a growing topic. Why not create a marketing platform that connects Peloton to mental health benefits?

Peloton instructor Kendall Toole already uses her social channels as a voice for mental wellbeing. Peloton could encourage more people to talk about it — starting with their celebrity instructors. Vulnerability would capture attention, while the universal benefit of mental wellbeing would broaden their market and encourage people to give Peloton a second look.

A campaign on mental health would also anchor Peloton in a benefit (feeling great) rather than a product feature (digital workout classes). Actions like offering free classes to doctors and those in stressful situations would help them define the idea of mental wellbeing through movement. Or they could go for humor and suggest that those in a bad mood go on a 20 minute Pelorun to shake it off. As the platform for feeling good — Peloton would immediately expand its audience base from regular exercisers to anyone with a mind.

Finally, content focused on the different types of workouts to get into a good headspace — yoga to cardio to Peloton’s meditation classes — would convey the breadth of the Peloton’s offerings.

Campaign idea 2: Pelostrong

The word ‘Peloton’ is a cycling term. But Peloton is more than a cycling app — it’s an everything app. What if Peloton rebranded from Peloton to Pelostrong (just for a few days)? One, it would generate a flurry of PR around if the name change is real (just don’t do it on April Fool’s). You could even do the letters S, R, and G in a different color to show how Peloton and Pelostrong both show up in the same logo (cheesy yes — but keep reading). It would convey that the app has more than spin. Namely — killer strength classes. Weightlifting is the most popular fitness activity after running, which means the app would be significantly more applicable to large swaths of the population.

On the story front, Peloton could invest in telling stories of Pelostrong transformations. A peek into the Peloton community on Reddit reveals a trove of personal journeys — from people who went from couldn’t-finish-a-beginner-spin-class to 60-minute spinners, to first time marathoners and strength builders. These stories would convey Pelostrong and build credibility in Peloton’s non-spin offerings. A content release of new series-style classes, plus new photography in gyms would amplify the campaign.

If they want to be less cheesy, Peloton rename its everything app ‘Strong’ by Peloton in the same way Marriott created the Bonvoy name for its loyalty program (which used to be Marriott rewards) to separate the Marriott hotel brand from the loyalty program which encompasses many hotel brands and experiences. Could a new name help Peloton shift perception:?

Could a new name help Peloton shift perception:?

Expanding distribution: meet gym-goers where they already are.

Peloton will broaden their market of paying subscribers if they reposition as a gym accompaniment. They can do this by forging relationships with gyms to supply members with content or offering Peloton as a paid add-on to their membership.

Peloton might take a hit on fees by splitting revenue with gyms, but the zero marginal cost of distributing content makes it profitable. For gyms, they would lose the need to invest in their own content production and get back to what they do best: managing facilities and real estate.

Gyms may find the idea of handing their digital experience to Peloton risky. They would need to align on data sharing, and could even create a hybrid app with their own content supplemented by Peloton. But a revenue-share agreement would benefit both parties. Peloton would gain access to new, engaged audiences and a lower cost of acquisition. Gyms would get stickier revenue: customers would have a better experience in their gyms with access to Peloton content. And, if someone ditches the gym membership because they decide to do Peloton from home, that gym could still get an ongoing cut of the Peloton digital subscription fee — without having to provide any in-person services.

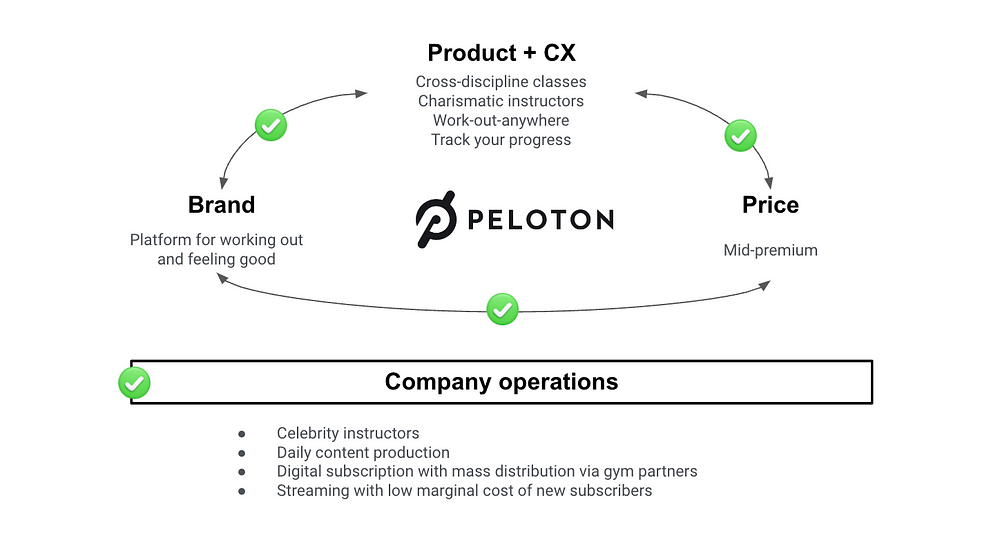

With a new story-driven campaign and distribution in every major gym chain, Peloton can shift from bougie spin app to the platform for working out and feeling good.

Peloton can shift from bougie spin app to the platform for working out and feeling good.

Peloton would also gain a reinforcing brand model — one that links its cost structure to its audience base — and finally reach its potential as the Netflix of fitness.

How would you approach turning Peloton around? Peloton still has potential to engineer a reinforcing brand flywheel. Source: Author

Peloton still has potential to engineer a reinforcing brand flywheel. Source: Author

Enjoyed the article?

It would mean a lot if you followed me on Medium. Better, sign up for my newsletter for exclusive content on marketing strategy.

Looking for help growing your brand?

I run brand consultancy Embedded — where I partner with companies to grow via strategic brand marketing.

Not sure where to start? Many clients opt for ad-hoc coaching — hourly consultations on any aspect of your marketing and brand strategy. Get in touch here.

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - Is Trump Dying? Or Only Killing The Market?](https://cdn.bulbapp.io/frontend/images/a129e75e-4fa1-46cc-80b6-04e638877e46/1)