El Salvador Releases Bitcoin Ownership Monitoring Site

El Salvador Releases Bitcoin Ownership Monitoring Site

El Salvador, a country in Latin America known for being the first to adopt Bitcoin (BTC) as legal tender, is making another significant move in its cryptocurrency investment strategy.

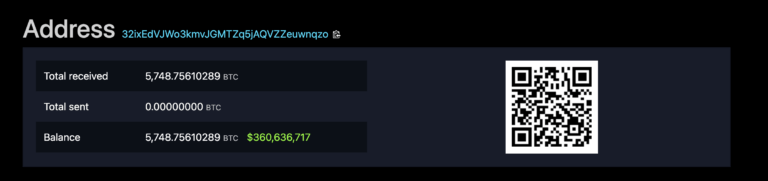

The government of El Salvador is now providing public access to Bitcoin investment data through a personalized mempool, and has launched its own proof-of-reserve site to monitor the country's BTC reserves using on-chain data.

The Salvadoran Bitcoin Treasury Office, a government-owned body responsible for managing all BTC-related projects, announced this new feature via their official Twitter account on May 12th.

According to the latest data, El Salvador currently holds a total of 5,748.76 BTC, worth over US$352.8 million. Additionally, data from El Salvador's mempool reveals that the government has made an additional purchase of 31 BTC in the last month.

This purchase is part of the Dollar Cost Averaging (DCA) strategy announced by President Nayib Bukele in November 2022. In this strategy, the government plans to buy 1 BTC every day until Bitcoin is no longer affordable with fiat currency.

Bitcoin Adoption Rate in El Salvador Still Low

Although El Salvador has committed to a strong investment strategy in BTC, the adoption rate of Bitcoin in the country is still relatively low.

According to a study from the Central American University José Simeón Cañas, only 12% of the local population in El Salvador used Bitcoin at least once to pay for goods and services in 2023. This figure represents a significant decrease from the previous year, where 24.4% of El Salvadorans were involved in Bitcoin transactions.

However, the potential of Bitcoin as a tool to promote financial inclusion, facilitate more efficient remittance payments, and attract more financial innovation remains attractive to El Salvador.

Renowned crypto analysts, such as Tim Draper, even predict that if the price of Bitcoin reaches US$100,000, El Salvador could become financially independent and repay its loans to the International Monetary Fund. However, the prospects of Bitcoin prices will heavily depend on institutional inflows from U.S. Bitcoin exchange-traded funds (ETFs) and other global market dynamics.

Conclusion

El Salvador's recent release of a Bitcoin ownership monitoring site marks a significant step in its cryptocurrency investment strategy. By providing public access to Bitcoin investment data and launching its own proof-of-reserve site, the government is enhancing transparency and accountability in its management of BTC reserves. This move aligns with President Nayib Bukele's Dollar Cost Averaging strategy, aiming to steadily accumulate BTC despite its fluctuating price against fiat currency.

However, despite El Salvador's proactive approach to BTC investment, the adoption rate of Bitcoin within the country remains relatively low. Only 12% of the local population reportedly used Bitcoin for transactions in 2023, signaling a challenge in widespread acceptance. Nonetheless, the potential of Bitcoin to promote financial inclusion, streamline remittance payments, and stimulate financial innovation continues to attract attention.

Looking ahead, renowned crypto analysts like Tim Draper speculate on the transformative potential of Bitcoin, suggesting that if its price reaches certain milestones, El Salvador could achieve financial independence. Yet, the realization of such projections hinges on various factors, including institutional investment flows and global market dynamics.

Overall, El Salvador's embrace of Bitcoin reflects a bold experiment at the intersection of finance and technology, with implications that extend beyond its borders. As the country navigates this evolving landscape, its experiences will likely offer valuable insights for other nations exploring similar paths in the realm of cryptocurrency.

Read Too : What is Zcash Halving? Here's How it Differs From Bitcoin Halving

*Disclaimer:

This content aims to enrich reader information. Always conduct independent research and use disposable income before investing. All buying, selling, and crypto asset investment activities are the reader's responsibility.

![Nekodex – Earn 20K+ NekoCoin ($20) [Highly Suggested]](https://cdn.bulbapp.io/frontend/images/b4f0a940-f27c-4168-8aaf-42f2974a82f0/1)

![[FAILED] Engage2Earn: McEwen boost for Rob Mitchell](https://cdn.bulbapp.io/frontend/images/c798d46f-d3b8-4a66-bf48-7e1ef50b4338/1)

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - OM(G) , My Biggest Bag Was A Scam????](https://cdn.bulbapp.io/frontend/images/99de9393-38a8-4e51-a7ab-a2b2c28785bd/1)