More than 1 billion USD withdrew from KuCoin after US authorities prosecuted

After being criminally charged by the US government, the KuCoin exchange is facing a wave of withdrawals from users.

Updated on the morning of March 28:

According to the announcement in the early morning of March 28 (Vietnam time), KuCoin CEO Johnny confirmed that the exchange will airdrop 10 million USD of KCS tokens and BTC for users who have been waiting to withdraw money for the past two days. The floor will soon provide detailed information about this plan in the next 3 days.

As reported, KuCoin was suddenly called out by the Chinese government on the night of March 26. The US Department of Justice (DOJ) accused the exchange and its two Chinese founders of conspiring to operate an unlicensed money transmission business in violation of the Bank Secrecy Act (BSA), and abetting 9 billion dollars illegally since 2017.

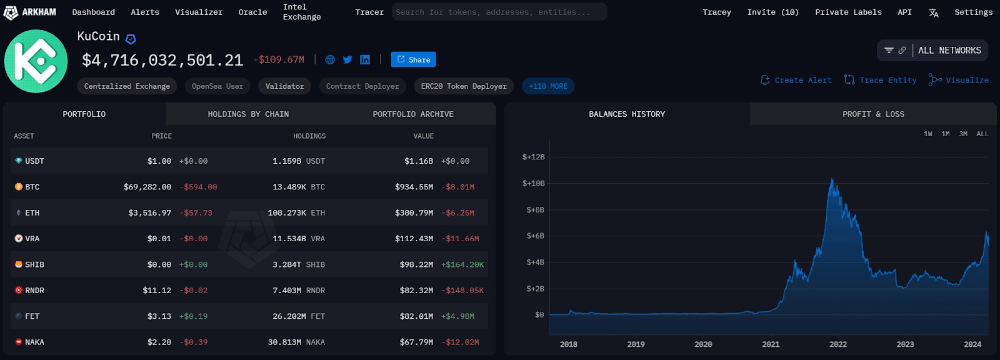

After the above news, users massively fled the exchange. In the past 24 hours, more than 1 billion USD was withdrawn from KuCoin, creating a deficit in the exchange's reserve account. Up to now, KuCoin's assets under management (AUM) have decreased by 20%, from 6 billion USD to only 4.8 billion USD. The above figures are referenced from the Nansen and Arkham Intelligence platforms.

The data recorded more than 1.083 billion USD leaving KuCoin via EVM compatible chains, while only 144 million USD was deposited into the exchange during this period. Note, Nansen's data does not take into account the amount of Bitcoin (BTC) withdrawn.

According to Scopescan's summary, KuCoin saw nearly 1.2 billion USD withdrawn from the exchange after 24 hours of "disruption". Users have begun to take action to avoid potential risks. Scopescan also pointed out the case of a certain whale withdrawing 532 billion PEPE (4.35 million USD) from KuCoin.

On However, blockchain data reflects that KuCoin still processes remittance transactions normally, it just takes more time due to the increased number of requests from users.

In a message to reassure customers last night, KuCoin affirmed that the exchange is still operating normally and is committed to ensuring the safety of user assets.

At the same time, KuCoin is also facing legal barriers with the Asset Futures Trading Commission (CFTC). The Commission accused the company of providing both spot and futures trading services, without completing required registration procedures. The complaint also accuses KuCoin of failing to comply with CFTC KYC requirements.

The Asset Futures Trading Commission (CFTC) has filed a lawsuit against the company that operates the KuCoin cryptocurrency exchange.

In a civil lawsuit against KuCoin last night, the Futures Trading Commission (CFTC) continued to recognize Bitcoin, Ethereum and Litecoin as commodities, amid the US still struggling in the battle to regulate the market. This.

The derivatives market watchdog alleged in its complaint:

"KuCoin illegally processed commodity futures, swaps and leverage trading involving commodity digital assets including Bitcoin (BTC), Ethereum (ETH) and Litecoin (LTC) without posting signed with CFTC."

CFTC Chairman Rostin Behnam once asserted that Ethereum and most stablecoins are commodities in a congressional hearing last year, shortly after his agency sued Binance.

Meanwhile, the US Securities Commission (SEC) recognizes most of the cryptocurrency market as securities, with only Bitcoin being the exception.

At the same time Behnam spoke, SEC Chairman Gary Gensler argued that tokens with a staking mechanism (like Ethereum) should be considered securities under US law.

Especially since Ethereum advanced to The Merge, Mr. Gary believes that all Ethereum transactions are under US jurisdiction, and views the staking mechanism as a stock investment model. Meanwhile, Litecoin still uses the same consensus mechanism as Bitcoin.

In recent years, the CFTC and the US Securities Commission (SEC) have clashed many times in the battle to regulate the cryptocurrency industry.

The CFTC's latest legal action takes place in parallel with the criminal charges that the Department of Justice (DOJ) placed on KuCoin last night. The US government accused the exchange and two of its founding team of violating the Bank Secrecy Act and abetting money laundering of up to 9 billion USD.

The regulator exposed that from July 2019 to June 2023, KuCoin abandoned the KYC process and still provided services to a large portion of US users.

The above is not the first government action targeting an exchange. Last December, KuCoin agreed to pay a fine of $22 million to close the lawsuit with the New York state government, under accusations of disguised securities listing and operating without a license.

The most shocking thing is that Binance, the largest crypto exchange on the planet, also received money laundering accusations from the DOJ and CFTC, and had to end it with a multi-billion dollar agreement.

![[FAILED] Engage2Earn: McEwen boost for Rob Mitchell](https://cdn.bulbapp.io/frontend/images/c798d46f-d3b8-4a66-bf48-7e1ef50b4338/1)

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - Is Trump Dying? Or Only Killing The Market?](https://cdn.bulbapp.io/frontend/images/a129e75e-4fa1-46cc-80b6-04e638877e46/1)