Bitcoin: four reasons why the price should surge in 2024

The year 2023 will be remembered as turbulent for cryptocurrencies, with numerous important developments that ultimately helped to “clean up” the space to potentially make it more attractive to mainstream investors. Notably there was the conviction of FTX CEO Sam Bankman-Fried for fraud.

Top exchange Binance also reached a US$4 billion settlement (£3.1 billion) with the US treasury department over money-laundering charges, which saw CEO Changpeng “CZ” Zhao agreeing to step down and pay a US$50 million fine.

Meanwhile, regulators continued cracking down on other operators, but potentially lost one of their key cases against the industry after a US court ruled that the XRP token, one of the top ten cryptocurrencies, was not a security (meaning a tradeable financial asset like shares or bonds).

This means its creator, Ripple, did not break the law by selling it on exchanges. Viewed as a test case for the majority of cryptocurrencies, the US Securities Exchange Commission (SEC) is currently appealing.

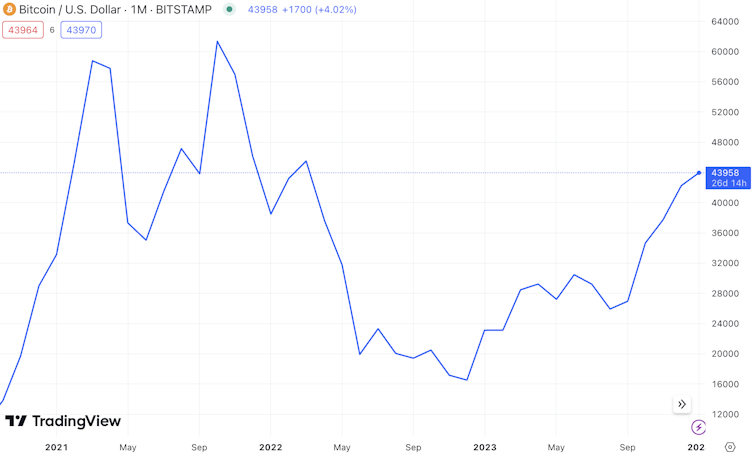

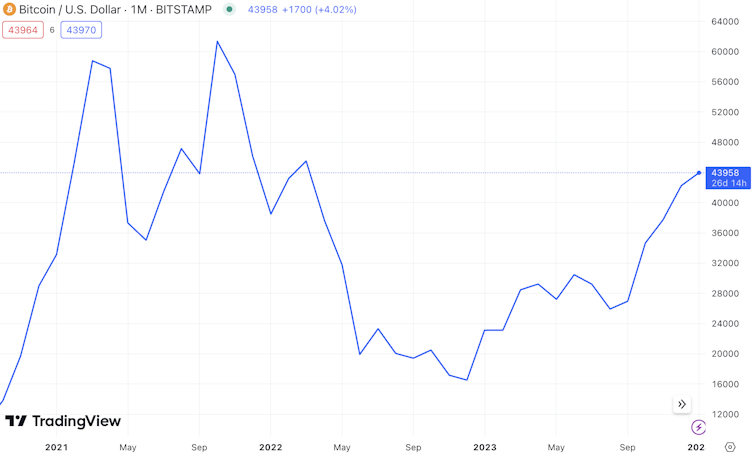

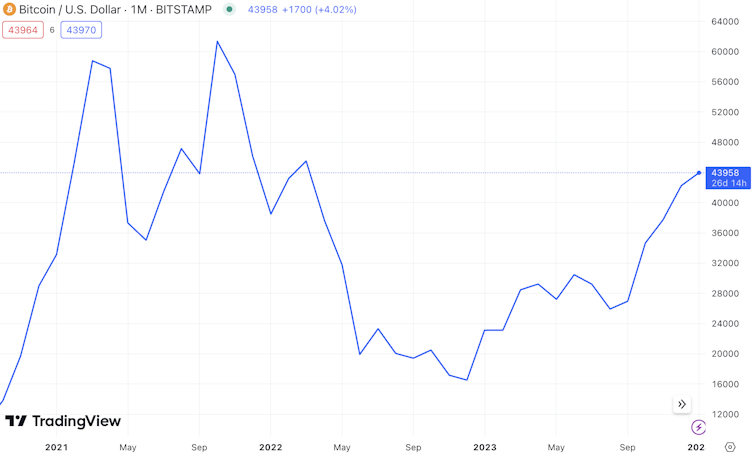

While all this was happening, the bitcoin price rose away from the lows of late 2022. It started the year at US$16,000 and ended comfortably above the US$40,000 threshold.

So what does 2024 look like for this sector and what key events are on the horizon?

1. ETFs

The SEC may finally be about to greenlight a type of investment vehicle known as an exchange traded fund (ETF) for the general or “spot” bitcoin market. ETFs already exist for everything from oil to the FTSE 100 to even regions and countries. They track the underlying asset, creating an easy way for people to invest without having to buy the asset directly.

Until now, the only ETFs permitted for crypto in the US have been for the futures markets. These niche markets are concerned with where investors think crypto prices are heading in future.

Bitcoin price 2021-24 Trading View

Trading View

A spot bitcoin ETF would likely encourage mainstream investors to buy exposure to this market, while potentially attracting banks to actively participate too. Bitcoin could be offered by financial advisors and there would no longer be a need for investors to hold the assetThe year 2023 will be remembered as turbulent for cryptocurrencies, with numerous important developments that ultimately helped to “clean up” the space to potentially make it more attractive to mainstream investors. Notably there was the conviction of FTX CEO Sam Bankman-Fried for fraud.

Top exchange Binance also reached a US$4 billion settlement (£3.1 billion) with the US treasury department over money-laundering charges, which saw CEO Changpeng “CZ” Zhao agreeing to step down and pay a US$50 million fine.

Meanwhile, regulators continued cracking down on other operators, but potentially lost one of their key cases against the industry after a US court ruled that the XRP token, one of the top ten cryptocurrencies, was not a security (meaning a tradeable financial asset like shares or bonds).

This means its creator, Ripple, did not break the law by selling it on exchanges. Viewed as a test case for the majority of cryptocurrencies, the US Securities Exchange Commission (SEC) is currently appealing.

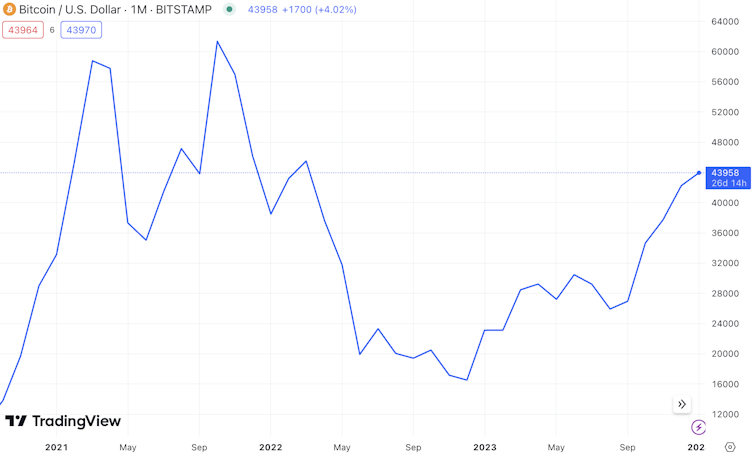

While all this was happening, the bitcoin price rose away from the lows of late 2022. It started the year at US$16,000 and ended comfortably above the US$40,000 threshold.

So what does 2024 look like for this sector and what key events are on the horizon?

1. ETFs

The SEC may finally be about to greenlight a type of investment vehicle known as an exchange traded fund (ETF) for the general or “spot” bitcoin market. ETFs already exist for everything from oil to the FTSE 100 to even regions and countries. They track the underlying asset, creating an easy way for people to invest without having to buy the asset directly.

Until now, the only ETFs permitted for crypto in the US have been for the futures markets. These niche markets are concerned with where investors think crypto prices are heading in future.

Bitcoin price 2021-24 Trading View

Trading View

A spot bitcoin ETF would likely encourage mainstream investors to buy exposure to this market, while potentially attracting banks to actively participate too. Bitcoin could be offered by financial advisors and there would no longer be a need for investors to hold the assetThe year 2023 will be remembered as turbulent for cryptocurrencies, with numerous important developments that ultimately helped to “clean up” the space to potentially make it more attractive to mainstream investors. Notably there was the conviction of FTX CEO Sam Bankman-Fried for fraud.

Top exchange Binance also reached a US$4 billion settlement (£3.1 billion) with the US treasury department over money-laundering charges, which saw CEO Changpeng “CZ” Zhao agreeing to step down and pay a US$50 million fine.

Meanwhile, regulators continued cracking down on other operators, but potentially lost one of their key cases against the industry after a US court ruled that the XRP token, one of the top ten cryptocurrencies, was not a security (meaning a tradeable financial asset like shares or bonds).

This means its creator, Ripple, did not break the law by selling it on exchanges. Viewed as a test case for the majority of cryptocurrencies, the US Securities Exchange Commission (SEC) is currently appealing.

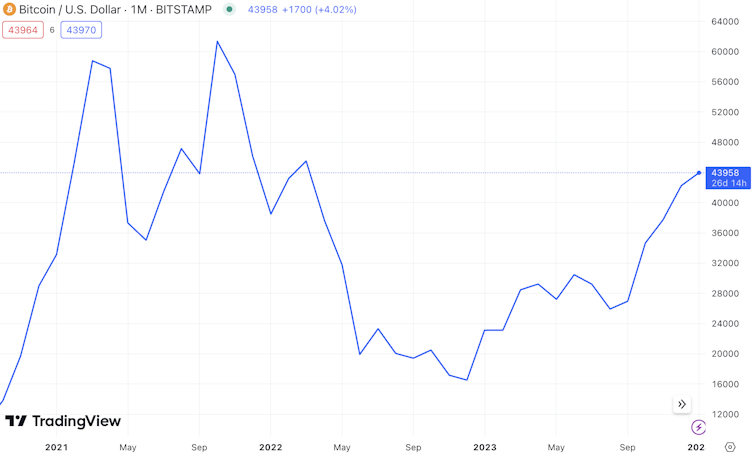

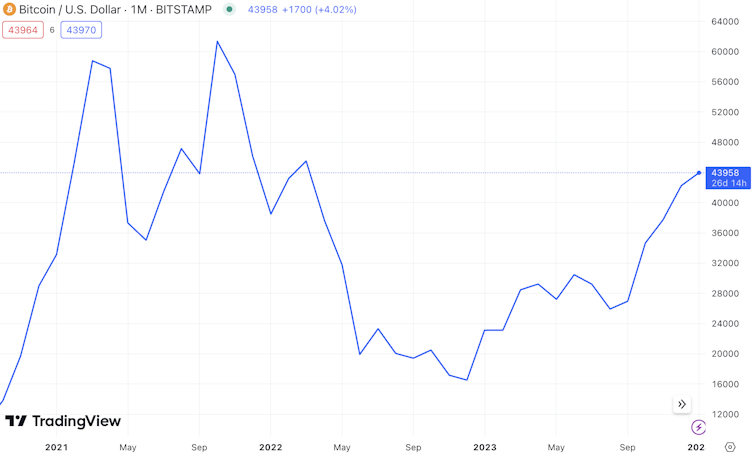

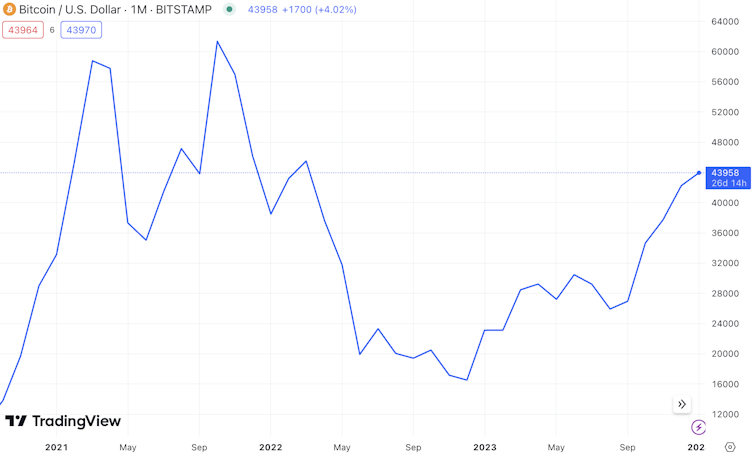

While all this was happening, the bitcoin price rose away from the lows of late 2022. It started the year at US$16,000 and ended comfortably above the US$40,000 threshold.

So what does 2024 look like for this sector and what key events are on the horizon?

1. ETFs

The SEC may finally be about to greenlight a type of investment vehicle known as an exchange traded fund (ETF) for the general or “spot” bitcoin market. ETFs already exist for everything from oil to the FTSE 100 to even regions and countries. They track the underlying asset, creating an easy way for people to invest without having to buy the asset directly.

Until now, the only ETFs permitted for crypto in the US have been for the futures markets. These niche markets are concerned with where investors think crypto prices are heading in future.

Bitcoin price 2021-24 Trading View

Trading View

A spot bitcoin ETF would likely encourage mainstream investors to buy exposure to this market, while potentially attracting banks to actively participate too. Bitcoin could be offered by financial advisors and there would no longer be a need for investors to hold the asassetThe year 2023 will be remembered as turbulent for cryptocurrencies, with numerous important developments that ultimately helped to “clean up” the space to potentially make it more attractive to mainstream investors. Notably there was the conviction of FTX CEO Sam Bankman-Fried for fraud.

Top exchange Binance also reached a US$4 billion settlement (£3.1 billion) with the US treasury department over money-laundering charges, which saw CEO Changpeng “CZ” Zhao agreeing to step down and pay a US$50 million fine.

Meanwhile, regulators continued cracking down on other operators, but potentially lost one of their key cases against the industry after a US court ruled that the XRP token, one of the top ten cryptocurrencies, was not a security (meaning a tradeable financial asset like shares or bonds).

This means its creator, Ripple, did not break the law by selling it on exchanges. Viewed as a test case for the majority of cryptocurrencies, the US Securities Exchange Commission (SEC) is currently appealing.

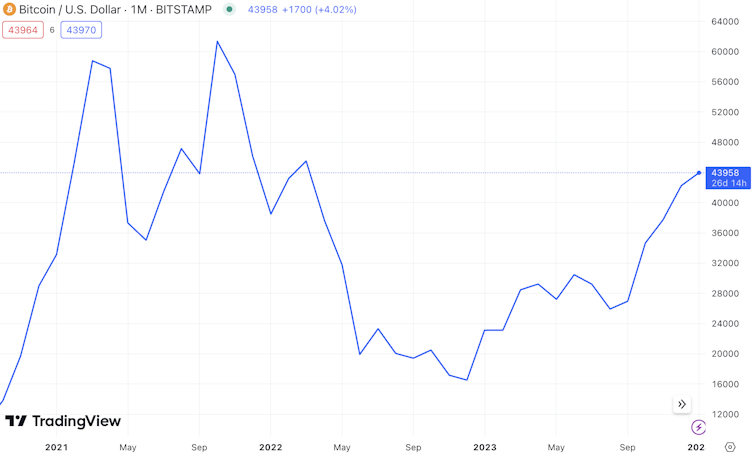

While all this was happening, the bitcoin price rose away from the lows of late 2022. It started the year at US$16,000 and ended comfortably above the US$40,000 threshold.

So what does 2024 look like for this sector and what key events are on the horizon?

1. ETFs

The SEC may finally be about to greenlight a type of investment vehicle known as an exchange traded fund (ETF) for the general or “spot” bitcoin market. ETFs already exist for everything from oil to the FTSE 100 to even regions and countries. They track the underlying asset, creating an easy way for people to invest without having to buy the asset directly.

Until now, the only ETFs permitted for crypto in the US have been for the futures markets. These niche markets are concerned with where investors think crypto prices are heading in future.

Bitcoin price 2021-24 Trading View

Trading View

A spot bitcoin ETF would likely encourage mainstream investors to buy exposure to this market, while potentially attracting banks to actively participate too. Bitcoin could be offered by financial advisors and there would no longer be a need for investors to hold the assetThe year 2023 will be remembered as turbulent for cryptocurrencies, with numerous important developments that ultimately helped to “clean up” the space to potentially make it more attractive to mainstream investors. Notably there was the conviction of FTX CEO Sam Bankman-Fried for fraud.

Top exchange Binance also reached a US$4 billion settlement (£3.1 billion) with the US treasury department over money-laundering charges, which saw CEO Changpeng “CZ” Zhao agreeing to step down and pay a US$50 million fine.

Meanwhile, regulators continued cracking down on other operators, but potentially lost one of their key cases against the industry after a US court ruled that the XRP token, one of the top ten cryptocurrencies, was not a security (meaning a tradeable financial asset like shares or bonds).

This means its creator, Ripple, did not break the law by selling it on exchanges. Viewed as a test case for the majority of cryptocurrencies, the US Securities Exchange Commission (SEC) is currently appealing.

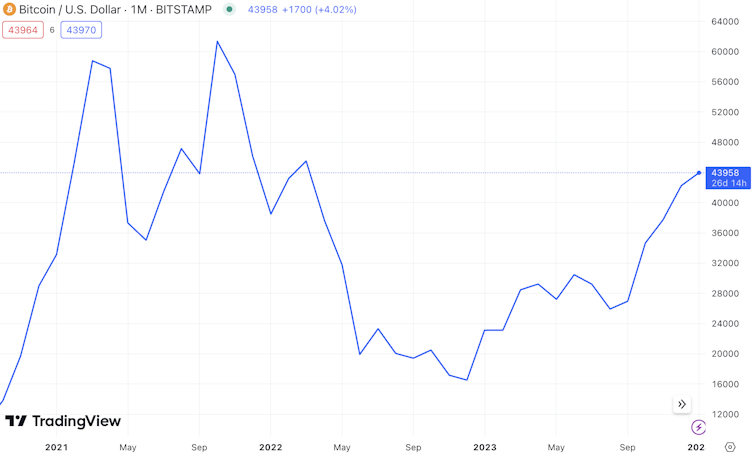

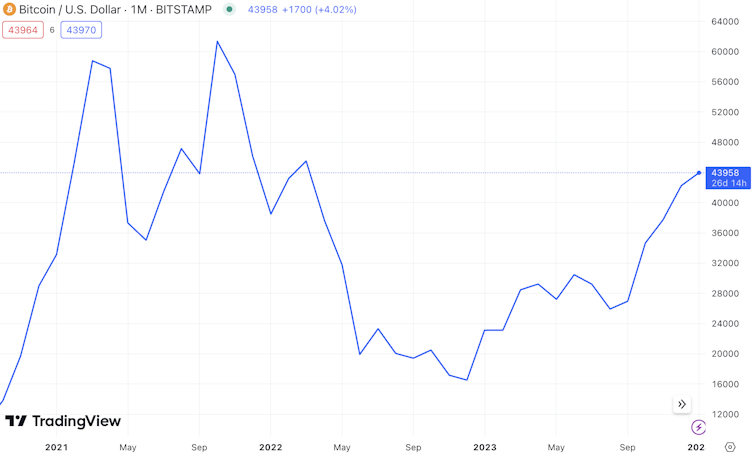

While all this was happening, the bitcoin price rose away from the lows of late 2022. It started the year at US$16,000 and ended comfortably above the US$40,000 threshold.

So what does 2024 look like for this sector and what key events are on the horizon?

1. ETFs

The SEC may finally be about to greenlight a type of investment vehicle known as an exchange traded fund (ETF) for the general or “spot” bitcoin market. ETFs already exist for everything from oil to the FTSE 100 to even regions and countries. They track the underlying asset, creating an easy way for people to invest without having to buy the asset directly.

Until now, the only ETFs permitted for crypto in the US have been for the futures markets. These niche markets are concerned with where investors think crypto prices are heading in future.

Bitcoin price 2021-24 Trading View

Trading View

A spot bitcoin ETF would likely encourage mainstream investors to buy exposure to this market, while potentially attracting banks to actively participate too. Bitcoin could be offered by financial advisors and there would no longer be a need for investors to hold the assetThe year 2023 will be remembered as turbulent for cryptocurrencies, with numerous important developments that ultimately helped to “clean up” the space to potentially make it more attractive to mainstream investors. Notably there was the conviction of FTX CEO Sam Bankman-Fried for fraud.

Top exchange Binance also reached a US$4 billion settlement (£3.1 billion) with the US treasury department over money-laundering charges, which saw CEO Changpeng “CZ” Zhao agreeing to step down and pay a US$50 million fine.

Meanwhile, regulators continued cracking down on other operators, but potentially lost one of their key cases against the industry after a US court ruled that the XRP token, one of the top ten cryptocurrencies, was not a security (meaning a tradeable financial asset like shares or bonds).

This means its creator, Ripple, did not break the law by selling it on exchanges. Viewed as a test case for the majority of cryptocurrencies, the US Securities Exchange Commission (SEC) is currently appealing.

While all this was happening, the bitcoin price rose away from the lows of late 2022. It started the year at US$16,000 and ended comfortably above the US$40,000 threshold.

So what does 2024 look like for this sector and what key events are on the horizon?

1. ETFs

The SEC may finally be about to greenlight a type of investment vehicle known as an exchange traded fund (ETF) for the general or “spot” bitcoin market. ETFs already exist for everything from oil to the FTSE 100 to even regions and countries. They track the underlying asset, creating an easy way for people to invest without having to buy the asset directly.

Until now, the only ETFs permitted for crypto in the US have been for the futures markets. These niche markets are concerned with where investors think crypto prices are heading in future.

Bitcoin price 2021-24 Trading View

Trading View

A spot bitcoin ETF would likely encourage mainstream investors to buy exposure to this market, while potentially attracting banks to actively participate too. Bitcoin could be offered by financial advisors and there would no longer be a need for investors to hold the assetThe year 2023 will be remembered as turbulent for cryptocurrencies, with numerous important developments that ultimately helped to “clean up” the space to potentially make it more attractive to mainstream investors. Notably there was the conviction of FTX CEO Sam Bankman-Fried for fraud.

Top exchange Binance also reached a US$4 billion settlement (£3.1 billion) with the US treasury department over money-laundering charges, which saw CEO Changpeng “CZ” Zhao agreeing to step down and pay a US$50 million fine.

Meanwhile, regulators continued cracking down on other operators, but potentially lost one of their key cases against the industry after a US court ruled that the XRP token, one of the top ten cryptocurrencies, was not a security (meaning a tradeable financial asset like shares or bonds).

This means its creator, Ripple, did not break the law by selling it on exchanges. Viewed as a test case for the majority of cryptocurrencies, the US Securities Exchange Commission (SEC) is currently appealing.

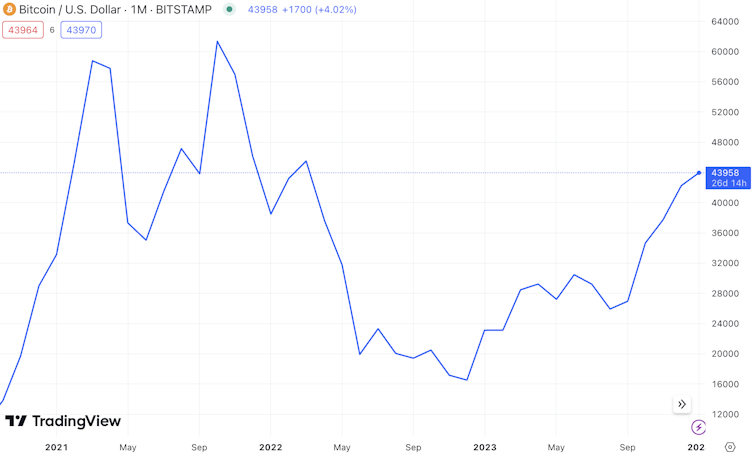

While all this was happening, the bitcoin price rose away from the lows of late 2022. It started the year at US$16,000 and ended comfortably above the US$40,000 threshold.

So what does 2024 look like for this sector and what key events are on the horizon?

1. ETFs

The SEC may finally be about to greenlight a type of investment vehicle known as an exchange traded fund (ETF) for the general or “spot” bitcoin market. ETFs already exist for everything from oil to the FTSE 100 to even regions and countries. They track the underlying asset, creating an easy way for people to invest without having to buy the asset directly.

Until now, the only ETFs permitted for crypto in the US have been for the futures markets. These niche markets are concerned with where investors think crypto prices are heading in future.

Bitcoin price 2021-24 Trading View

Trading View

A spot bitcoin ETF would likely encourage mainstream investors to buy exposure to this market, while potentially attracting banks to actively participate too. Bitcoin could be offered by financial advisors and there would no longer be a need for investors to hold the assetThe year 2023 will be remembered as turbulent for cryptocurrencies, with numerous important developments that ultimately helped to “clean up” the space to potentially make it more attractive to mainstream investors. Notably there was the conviction of FTX CEO Sam Bankman-Fried for fraud.

Top exchange Binance also reached a US$4 billion settlement (£3.1 billion) with the US treasury department over money-laundering charges, which saw CEO Changpeng “CZ” Zhao agreeing to step down and pay a US$50 million fine.

Meanwhile, regulators continued cracking down on other operators, but potentially lost one of their key cases against the industry after a US court ruled that the XRP token, one of the top ten cryptocurrencies, was not a security (meaning a tradeable financial asset like shares or bonds).

This means its creator, Ripple, did not break the law by selling it on exchanges. Viewed as a test case for the majority of cryptocurrencies, the US Securities Exchange Commission (SEC) is currently appealing.

While all this was happening, the bitcoin price rose away from the lows of late 2022. It started the year at US$16,000 and ended comfortably above the US$40,000 threshold.

So what does 2024 look like for this sector and what key events are on the horizon?

1. ETFs

The SEC may finally be about to greenlight a type of investment vehicle known as an exchange traded fund (ETF) for the general or “spot” bitcoin market. ETFs already exist for everything from oil to the FTSE 100 to even regions and countries. They track the underlying asset, creating an easy way for people to invest without having to buy the asset directly.

Until now, the only ETFs permitted for crypto in the US have been for the futures markets. These niche markets are concerned with where investors think crypto prices are heading in future.

Bitcoin price 2021-24 Trading View

Trading View

A spot bitcoin ETF would likely encourage mainstream investors to buy exposure to this market, while potentially attracting banks to actively participate too. Bitcoin could be offered by financial advisors and there would no longer be a need for investors to hold the asset

The year 2023 will be remembered as turbulent for cryptocurrencies, with numerous important developments that ultimately helped to “clean up” the space to potentially make it more attractive to mainstream investors. Notably there was the conviction of FTX CEO Sam Bankman-Fried for fraud.

Top exchange Binance also reached a US$4 billion settlement (£3.1 billion) with the US treasury department over money-laundering charges, which saw CEO Changpeng “CZ” Zhao agreeing to step down and pay a US$50 million fine.

Meanwhile, regulators continued cracking down on other operators, but potentially lost one of their key cases against the industry after a US court ruled that the XRP token, one of the top ten cryptocurrencies, was not a security (meaning a tradeable financial asset like shares or bonds).

This means its creator, Ripple, did not break the law by selling it on exchanges. Viewed as a test case for the majority of cryptocurrencies, the US Securities Exchange Commission (SEC) is currently appealing.

While all this was happening, the bitcoin price rose away from the lows of late 2022. It started the year at US$16,000 and ended comfortably above the US$40,000 threshold.

So what does 2024 look like for this sector and what key events are on the horizon?

1. ETFs

The SEC may finally be about to greenlight a type of investment vehicle known as an exchange traded fund (ETF) for the general or “spot” bitcoin market. ETFs already exist for everything from oil to the FTSE 100 to even regions and countries. They track the underlying asset, creating an easy way for people to invest without having to buy the asset directly.

Until now, the only ETFs permitted for crypto in the US have been for the futures markets. These niche markets are concerned with where investors think crypto prices are heading in future.

Bitcoin price 2021-24 Trading View

Trading View

A spot bitcoin ETF would likely encourage mainstream investors to buy exposure to this market, while potentially attracting banks to actively participate too. Bitcoin could be offered by financial advisors and there would no longer be a need for investors to hold the asset

The year 2023 will be remembered as turbulent for cryptocurrencies, with numerous important developments that ultimately helped to “clean up” the space to potentially make it more attractive to mainstream investors. Notably there was the conviction of FTX CEO Sam Bankman-Fried for fraud.

Top exchange Binance also reached a US$4 billion settlement (£3.1 billion) with the US treasury department over money-laundering charges, which saw CEO Changpeng “CZ” Zhao agreeing to step down and pay a US$50 million fine.

Meanwhile, regulators continued cracking down on other operators, but potentially lost one of their key cases against the industry after a US court ruled that the XRP token, one of the top ten cryptocurrencies, was not a security (meaning a tradeable financial asset like shares or bonds).

This means its creator, Ripple, did not break the law by selling it on exchanges. Viewed as a test case for the majority of cryptocurrencies, the US Securities Exchange Commission (SEC) is currently appealing.

While all this was happening, the bitcoin price rose away from the lows of late 2022. It started the year at US$16,000 and ended comfortably above the US$40,000 threshold.

So what does 2024 look like for this sector and what key events are on the horizon?

1. ETFs

The SEC may finally be about to greenlight a type of investment vehicle known as an exchange traded fund (ETF) for the general or “spot” bitcoin market. ETFs already exist for everything from oil to the FTSE 100 to even regions and countries. They track the underlying asset, creating an easy way for people to invest without having to buy the asset directly.

Until now, the only ETFs permitted for crypto in the US have been for the futures markets. These niche markets are concerned with where investors think crypto prices are heading in future.

Bitcoin price 2021-24 Trading View

Trading View

A spot bitcoin ETF would likely encourage mainstream investors to buy exposure to this market, while potentially attracting banks to actively participate too. Bitcoin could be offered by financial advisors and there would no longer be a need for investors to hold the asset

The year 2023 will be remembered as turbulent for cryptocurrencies, with numerous important developments that ultimately helped to “clean up” the space to potentially make it more attractive to mainstream investors. Notably there was the conviction of FTX CEO Sam Bankman-Fried for fraud.

Top exchange Binance also reached a US$4 billion settlement (£3.1 billion) with the US treasury department over money-laundering charges, which saw CEO Changpeng “CZ” Zhao agreeing to step down and pay a US$50 million fine.

Meanwhile, regulators continued cracking down on other operators, but potentially lost one of their key cases against the industry after a US court ruled that the XRP token, one of the top ten cryptocurrencies, was not a security (meaning a tradeable financial asset like shares or bonds).

This means its creator, Ripple, did not break the law by selling it on exchanges. Viewed as a test case for the majority of cryptocurrencies, the US Securities Exchange Commission (SEC) is currently appealing.

While all this was happening, the bitcoin price rose away from the lows of late 2022. It started the year at US$16,000 and ended comfortably above the US$40,000 threshold.

So what does 2024 look like for this sector and what key events are on the horizon?

1. ETFs

The SEC may finally be about to greenlight a type of investment vehicle known as an exchange traded fund (ETF) for the general or “spot” bitcoin market. ETFs already exist for everything from oil to the FTSE 100 to even regions and countries. They track the underlying asset, creating an easy way for people to invest without having to buy the asset directly.

Until now, the only ETFs permitted for crypto in the US have been for the futures markets. These niche markets are concerned with where investors think crypto prices are heading in future.

Bitcoin price 2021-24 Trading View

Trading View

A spot bitcoin ETF would likely encourage mainstream investors to buy exposure to this market, while potentially attracting banks to actively participate too. Bitcoin could be offered by financial advisors and there would no longer be a need for investors to hold the asset

![[FAILED] Engage2Earn: McEwen boost for Rob Mitchell](https://cdn.bulbapp.io/frontend/images/c798d46f-d3b8-4a66-bf48-7e1ef50b4338/1)

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - OM(G) , My Biggest Bag Was A Scam????](https://cdn.bulbapp.io/frontend/images/99de9393-38a8-4e51-a7ab-a2b2c28785bd/1)

![Nekodex – Earn 20K+ NekoCoin ($20) [Highly Suggested]](https://cdn.bulbapp.io/frontend/images/b4f0a940-f27c-4168-8aaf-42f2974a82f0/1)