Riding the Wave: Tokens Surge Double Digits as Bitcoin Shrugs GBTC Stream

Introduction:

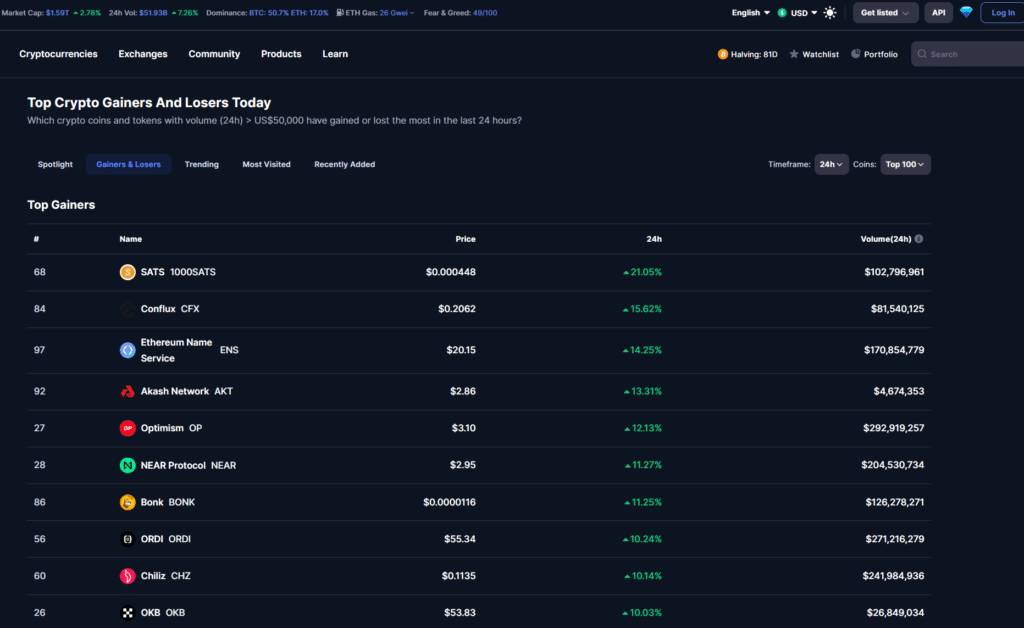

In the dynamic landscape of cryptocurrency, market movements often send ripples across various assets. Recently, while Bitcoin, the pioneer cryptocurrency, maintained relative stability, several tokens experienced a surge in value, with double-digit gains capturing the attention of investors and enthusiasts alike. This article explores the underlying factors driving this surge in tokens, even as Bitcoin appears to shrug off fluctuations in Grayscale Bitcoin Trust (GBTC) streaming.

Understanding Tokens Surge Amid Bitcoin's Stability

Diversification of Investment Strategies:

Amidst Bitcoin's stability, investors have diversified their portfolios by exploring alternative assets such as tokens. Unlike Bitcoin, which operates as a digital store of value, tokens represent a broader range of use cases, including utility within decentralized applications (dApps), governance in decentralized autonomous organizations (DAOs), and even as collateral in decentralized finance (DeFi) protocols. The diverse utility and potential for high returns have attracted investors seeking to capitalize on emerging trends in the cryptocurrency market.

https://crypto.news/tokens-surge-double-digits-as-bitcoin-shrugs-gbtc-stream/

Expansion of Decentralized Finance (DeFi):

The surge in tokens can be attributed in part to the rapid expansion of decentralized finance (DeFi) protocols. DeFi platforms offer a wide array of financial services, including lending, borrowing, staking, and yield farming, all facilitated by smart contracts on blockchain networks. As DeFi continues to gain traction, tokens associated with these platforms experience increased demand, driven by users seeking to participate in various DeFi activities and earn attractive yields on their investments.

https://www.finextra.com/blogposting/21818/decentralized-finance-defi-trends-for-creating-futuristic-crypto-businesses

Rise of Non-Fungible Tokens (NFTs)

Another factor contributing to the surge in tokens is the growing popularity of non-fungible tokens (NFTs). NFTs represent unique digital assets that are indivisible and non-interchangeable, often used to tokenize digital art, collectibles, virtual real estate, and more. As interest in NFTs continues to soar, tokens associated with NFT platforms and marketplaces have witnessed significant appreciation, fueled by demand from collectors, artists, and speculators participating in the burgeoning NFT ecosystem.

https://blockchain.news/analysis/Understanding-the-Rise-of-NonFungible-Tokens-0d510d18-5b1c-4489-9f98-b14232816930![]()

Innovation and Adoption in Layer 2 Solutions

Layer 2 scaling solutions, designed to improve the scalability and efficiency of blockchain networks, have also played a role in the surge of tokens. Projects implementing Layer 2 solutions aim to address the scalability challenges faced by blockchain networks such as Ethereum, enabling faster and cheaper transactions without compromising security. Tokens associated with Layer 2 protocols and solutions have experienced increased attention from investors seeking to capitalize on innovations aimed at improving blockchain scalability and usability.

https://pixelplex.io/blog/what-is-layer-2/

Evolution of Governance and DAOs

Additionally, the evolution of governance mechanisms and decentralized autonomous organizations (DAOs) has contributed to the surge in tokens. DAOs enable decentralized decision-making and governance processes, allowing token holders to participate in protocol governance, proposal voting, and fund management. As the importance of community governance grows within blockchain ecosystems, tokens associated with DAOs have gained value, driven by increased participation and engagement from community members.

Conclusion

In conclusion, while Bitcoin maintains its position as the flagship cryptocurrency, the recent surge in tokens highlights the diverse opportunities and innovations within the broader cryptocurrency ecosystem. Factors such as diversification of investment strategies, expansion of decentralized finance (DeFi), rise of non-fungible tokens (NFTs), innovation in Layer 2 solutions, and evolution of governance and DAOs have contributed to the appreciation of tokens even as Bitcoin remains relatively stable. As the cryptocurrency market continues to evolve, investors and enthusiasts should remain vigilant and informed, exploring opportunities beyond Bitcoin and embracing the diversity and dynamism of the digital asset space.

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - I Think I Have Crypto PTSD](https://cdn.bulbapp.io/frontend/images/819e7cdb-b6d8-4508-8a8d-7f1106719ecd/1)