The Evolution of Cryptocurrency: Exploring Bitcoin Halving, Bitcoin ETF, and Ethereum ETF

Introduction

Cryptocurrencies have rapidly evolved since the introduction of Bitcoin in 2009. Over the years, various developments have shaped the crypto landscape, including the Bitcoin halving and the emergence of exchange-traded funds (ETFs) for Bitcoin and Ethereum. This article explores these key aspects, highlighting their impact on the cryptocurrency market and the broader financial landscape.

Bitcoin Halving: A Deflationary Mechanism

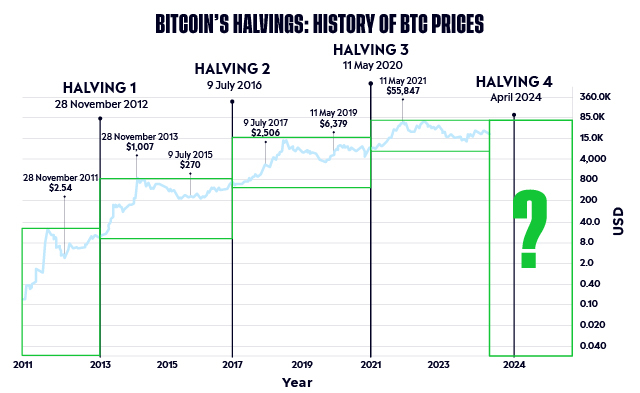

The Bitcoin halving, occurring approximately every four years, is a crucial event that influences the supply and inflation rate of Bitcoin. The process involves reducing the block reward for miners by half, thereby limiting the rate at which new bitcoins are created. With each halving, the supply of new bitcoins decreases, leading to a deflationary effect on the cryptocurrency.

The first Bitcoin halving took place in 2012, reducing the block reward from 50 to 25 bitcoins. The second halving occurred in 2016, reducing the reward to 12.5 bitcoins. The most recent halving took place in May 2020, further reducing the reward to 6.25 bitcoins. This process is programmed to continue until the maximum supply of 21 million bitcoins is reached, making Bitcoin a scarce asset similar to gold.

Bitcoin ETF: A Gateway to Mainstream Adoption

A Bitcoin exchange-traded fund (ETF) is a financial product that tracks the price of Bitcoin and allows investors to gain exposure to the cryptocurrency without needing to buy or store it directly. ETFs are traded on traditional stock exchanges, making them accessible to a wide range of investors, including institutional players. The introduction of a Bitcoin ETF has been viewed as a significant milestone in the mainstream adoption of cryptocurrencies.

Despite several attempts, a Bitcoin ETF was not approved by the U.S. Securities and Exchange Commission (SEC) until recently. In October 2021, the SEC approved the first Bitcoin futures ETF, paving the way for more widespread adoption of Bitcoin in traditional financial markets. The approval of a Bitcoin ETF has been seen as a positive development for the cryptocurrency market, as it provides a regulated investment vehicle for institutional and retail investors alike.

The approval of a Bitcoin ETF has several potential benefits. Firstly, it provides a more accessible and familiar way for investors to gain exposure to Bitcoin, potentially increasing demand and liquidity in the cryptocurrency market. Additionally, the approval of a Bitcoin ETF could lead to greater regulatory clarity for cryptocurrencies, as regulators gain a better understanding of how to regulate these assets within the traditional financial system.

Ethereum ETF: Expanding the Cryptocurrency Universe

In addition to Bitcoin, Ethereum has emerged as one of the most popular and widely used cryptocurrencies. Ethereum is not just a digital currency but also a platform for decentralized applications (dApps) and smart contracts. The introduction of an Ethereum ETF further expands the cryptocurrency universe, providing investors with more options to gain exposure to different digital assets.

An Ethereum ETF would function similarly to a Bitcoin ETF, tracking the price of Ethereum and allowing investors to trade the ETF on traditional stock exchanges. While no Ethereum ETF has been approved yet, there is growing interest and speculation about the possibility of one being approved in the future. An Ethereum ETF could potentially open up new opportunities for investors looking to diversify their cryptocurrency holdings beyond Bitcoin.

Conclusion

The evolution of cryptocurrencies, including Bitcoin halving and the introduction of ETFs for Bitcoin and potentially Ethereum, reflects the growing acceptance and integration of digital assets into the traditional financial system. These developments have significant implications for investors, regulators, and the broader economy, highlighting the need for continued research and innovation in the cryptocurrency space. As cryptocurrencies continue to evolve, it will be fascinating to see how they shape the future of finance and investment.