Underestimating Bitcoin Halving Impact: The Day Before 2024. 100 blocks remain until Bitcoin halving

Bitwise CEO Hunter Horsley said that several RIAs and multi-family offices have been exploring Bitcoin investments while staying low-key and conducting research silently.

Just a day before Bitcoin halving 2024, BTC price has come under significant selling pressure amid rising geopolitical tensions. In the last 24 hours, Bitcoin price took a dip under $60,000 and recovered quickly thereafter now trading at 5.39% up at a price of $64,510 and a market cap of $1.270 trillion. Amid a lot of FUD following this Bitcoin price volatility, Bitwise CEO Hunter Horsley showed strong confidence in BTC’s ability to surge to $100,000 pot the halving event.

Hunter’s comments came after banking giant JPMorgan stated that the halving is already priced-in and Bitcoin would continue with a downtrend trend after the event on Friday.

Commenting on this development, Hunter stated that investors are “dramatically underestimating the halving”. He added that never before the market has priced in the halving event and this time is no different. Hunter added that Bitcoin has delivered manifold returns in the 12 months following the halving event. Thus, he added that a $100K Bitcoin is just 67% from here onwards.

Horsley wrote: “The impact of the halving isn’t based on the views of fully deployed existing holders. It’s a function of if there will be meaningful consistent new demand, alongside the reduction in the daily availability of natural sellers. From my seat, I see consistent new demand ahead in 2024 and the setup for an impactful halving”.

High Bitcoin Demand among RIAs and Family Offices

The Bitwise CEO added that geopolitical tensions are no reason for selling Bitcoin, and there are hardly any redemptions from long-term investors.

The CEO of Bitwise observed that currently, numerous RIAs (Registered Investment Advisers) and multi-family offices are quietly investing in Bitcoin and conducting research on it. However, very few of them are publicly discussing their involvement with the cryptocurrency.

In recent meetings, the CEO encountered a large firm that is incorporating Bitcoin into some client accounts while contemplating its role in their investment model. Subsequently, he met with a smaller firm curious about their peers’ activities in the cryptocurrency space, wondering if it’s still primarily retail-driven.

This situation reflects a notable trend where firms are discreetly exploring Bitcoin investment opportunities, preferring to avoid attention. The CEO anticipates that eventually, firms will become more transparent about their involvement with Bitcoin, surprising many observers.

It will be interesting to see how long it takes for Bitcoin to hit a new all-time high and resume its journey towards $100,000.

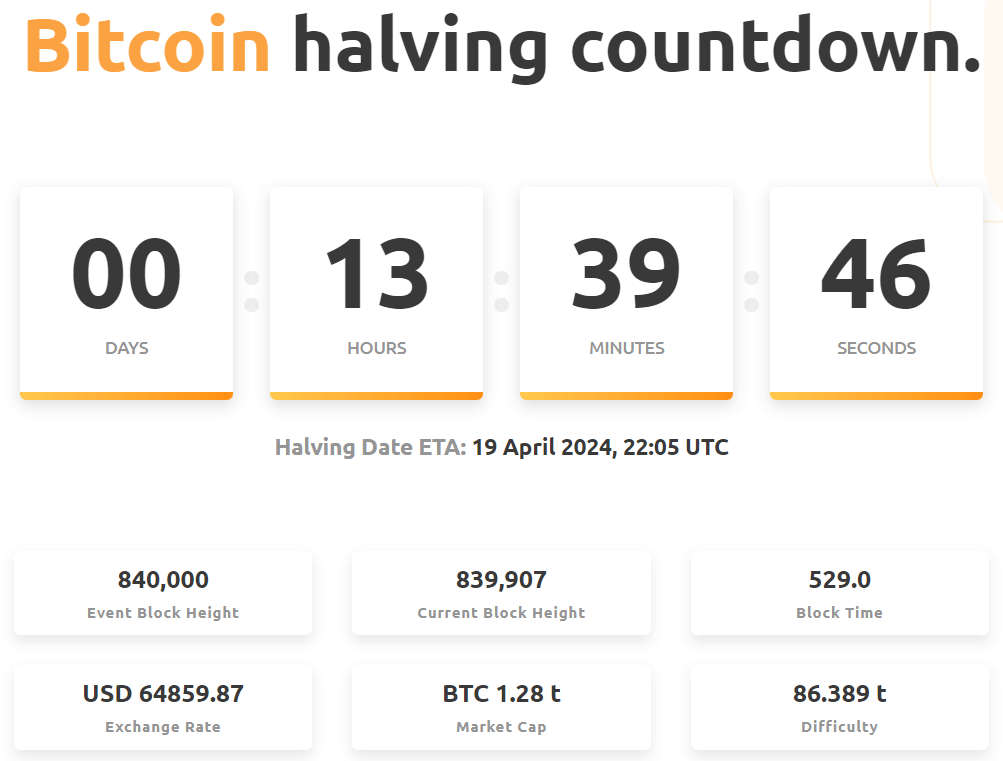

The excitement in the cryptocurrency community is mounting as one of the most important events in the crypto industry – Bitcoin (BTC) halving – is just hours away, with only 100 blocks left before the reward for mining the flagship decentralized finance (DeFi) asset cuts in half.

Indeed, although predicting the exact Bitcoin halving dates is challenging, the more accurate method of understanding when this will happen is counting down the leftover blocks to be mined, and the Bitcoin block reward halves every 210,000 blocks – coinciding with a period of roughly four years.

As a reminder, Bitcoin’s original creators have introduced this scheduled reduction mechanism to decrease the number of new Bitcoin coins going into circulation and keep the supply in check, limiting it to a finite total supply of 21 million BTC and setting it apart from conventional fiat currencies.

When is next Bitcoin halving?

Hence, after the first Bitcoin halving in November 2012, which reduced the mining reward from 50 to 25 BTC per block, the following event happened in July 2016, when it dropped from 25 to 12.5 BTC. The third halving event occurred in May 2020, reducing the block reward by another 50%.

Specifically, the next Bitcoin halving will further reduce this reward – to 3.125 BTC and will happen at exactly 840,000 blocks mined. According to data from multiple Bitcoin halving countdown platforms, there are now fewer than 100 blocks left until this comes to pass. Bitcoin halving countdown. Source: NiceHash

Bitcoin halving countdown. Source: NiceHash

BTC price prediction as halving nears

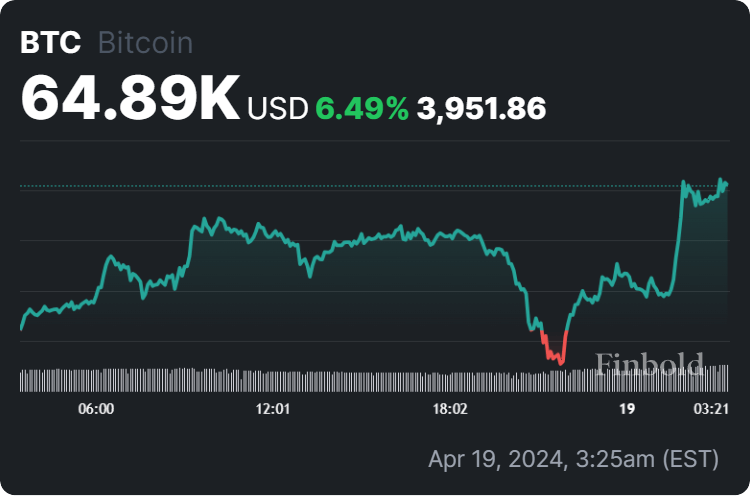

In the meantime, the price of Bitcoin, which has traditionally moved under the influence of these halving events, is starting to recover from its declines earlier this week that have seen it drop below the critical psychological price level at $65,000 and is getting stronger.

Currently, the largest asset in the crypto market is changing hands at the price of $64,890, which suggests a 6,49% gain in the last 24 hours as it moves to erase the loss of 8.42% accumulated over the previous seven days and changing its monthly chart into green by advancing 2.67%. Bitcoin price 24-hour chart. Source: Finbold

Bitcoin price 24-hour chart. Source: Finbold

All things considered, time is running out before the reward for mining Bitcoin cuts in half again, increasing scarcity for the maiden crypto asset and potentially kick-starting a massive rally that some analysts believe could imminently lead it to $80,000 shortly after and then to even more massive heights.

However, it is important to remember that trends in this sector can sometimes change suddenly, so doing one’s own detailed research and in-depth risk analysis is critical before investing a significant amount of money in any of its assets, regardless of how bullish things may seem.

In a recent interview on the future of Bitcoin, Anthony Scaramucci, the founder and managing partner of Skybridge Capital, has made a compelling prediction that the Bitcoin price could potentially reach $200,000 following its forthcoming halving event. This forecast comes at a time of considerable volatility within the crypto markets, exacerbated by recent geopolitical tensions and broader economic uncertainty.

Bitcoin Poised To Hit $200,000

During the interview, Scaramucci provided insights into the forces he believes will drive Bitcoin’s price in the coming months. “Well, I mean, look, you could get shocks like wars and you could get, you know, God forbid a terrorist calamity or something like that that could take Bitcoin down 10 or 15%,” he explained. Despite potential short-term setbacks, Scaramucci emphasized the underlying demand dynamics bolstering Bitcoin’s price, particularly highlighting the influence of new financial products like ETFs and the growing interest from institutional investors.

He elaborated on his bullish outlook, linking it to the anticipated Bitcoin halving, an event that historically impacts the supply side of Bitcoin economics by reducing the reward for mining new blocks, thereby constraining supply. “But long term with the halving coming this week, I think this thing trades to $170,000, possibly to $200,000,” Scaramucci asserted.

The discussion also veered into the broader implications of Bitcoin’s integration into traditional financial products, such as ETFs. Scaramucci argued that these instruments play a critical role in broadening Bitcoin’s investor base.

He dismissed concerns over the potential for ETFs to lead to centralization of Bitcoin ownership. “In terms of adoption vis-a-vis the ETF, you look out your four-year time horizon. […] It will still be less than 10 % of the overall ownership of Bitcoin. So this whole notion that the ETFs are gonna overly centralize Bitcoin, I don’t buy it. I think what the ETFs are, though, is they’re a great conduit for people that are used to buying them.”

BTC Is Still In The Web 1.0 Era

Scaramucci compared Bitcoin’s trajectory to the early internet era, particularly drawing parallels with significant tech stocks like Amazon during the dot-com bubble. “In 1999, Amazon was an emerging stock on an emerging technology, and it was quite volatile. And you lost 20 to 50 % eight times on Amazon. You lost 80%. Yeah, that one time in March of 2020, it went down 80%. But if you held Amazon over that period of time, $10,000 is worth a little over $14 million today.”

He also addressed concerns about Bitcoin’s practical uses, contrasting its current utility with more traditional assets like gold, which also do not offer direct cash flow. Scaramucci highlighted innovative financial practices within the crypto ecosystem that provide returns similar to traditional cash flow, such as yield-generating accounts and borrowing agreements available through platforms like Galaxy Digital.

Regarding potential market downturns akin to the dot-com bust, Scaramucci acknowledged the risks but remained optimistic about Bitcoin’s resilience and long-term value proposition. “I think if we go through a dot-com bust in the broader market in the next year or two, I think you’ll have a price shock in Bitcoin consistent with a dot-com bust. However, if you’re willing to hold that asset, which we are over a rolling four-year period of time, no one has ever lost money in Bitcoin,” he noted, underscoring the importance of a long-term investment horizon.

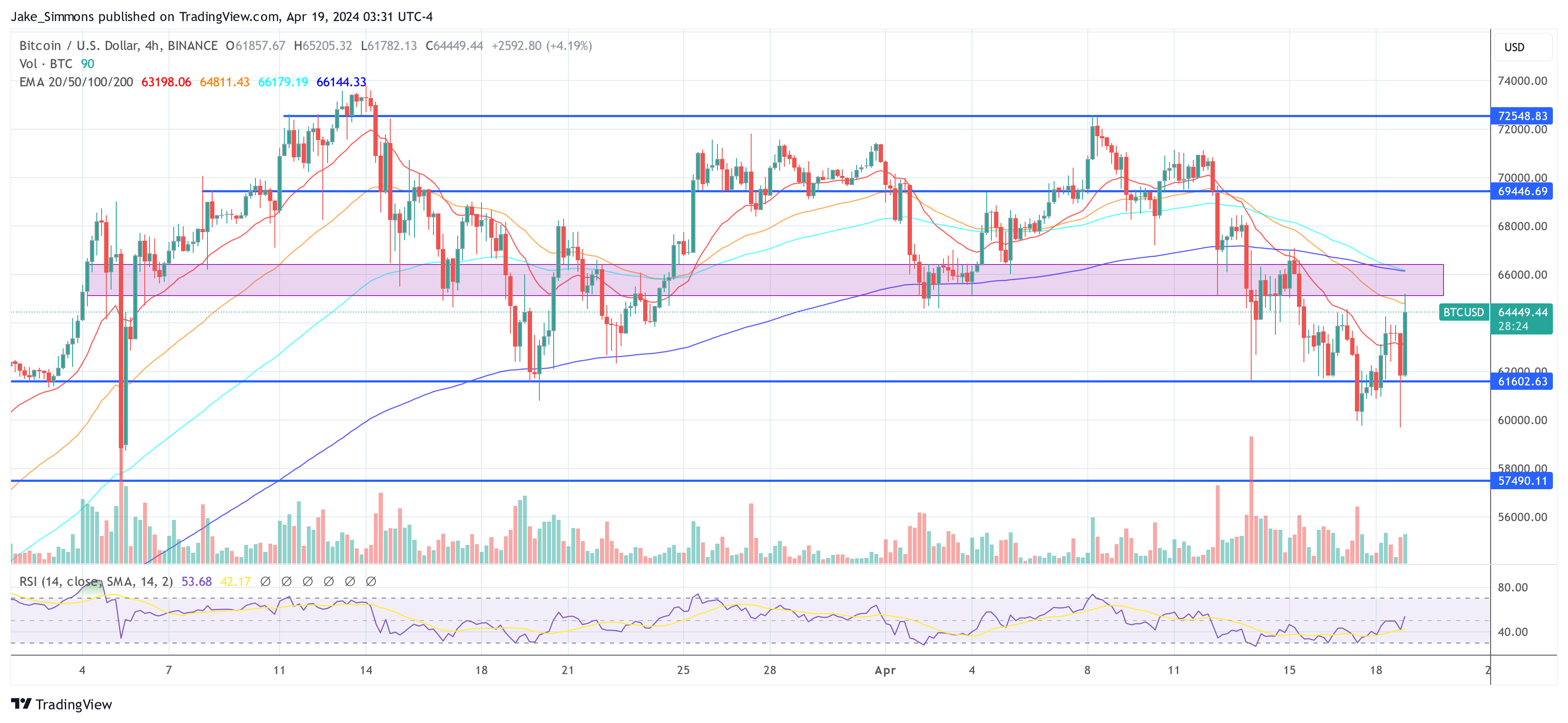

At press time, the BTC price rallied back above $64,000. BTC price, 4-hour chart | Source: BTCUSD on TradingView.com

BTC price, 4-hour chart | Source: BTCUSD on TradingView.com