Bitcoin ETF continues to record inflow of more than 200 million USD, BTC surpasses 59,000 USD mark

Investor sentiment has been reinforced as evidenced by inflows from spot Bitcoin ETFs in the US market.

As explained, since the green light from the SEC, inflows and outflows from Bitcoin ETFs have been the clearest representation of market sentiment. If the ETF has a positive net cash flow, it proves that investors are buying more than they are selling, indicating the expectation of price increases and vice versa.

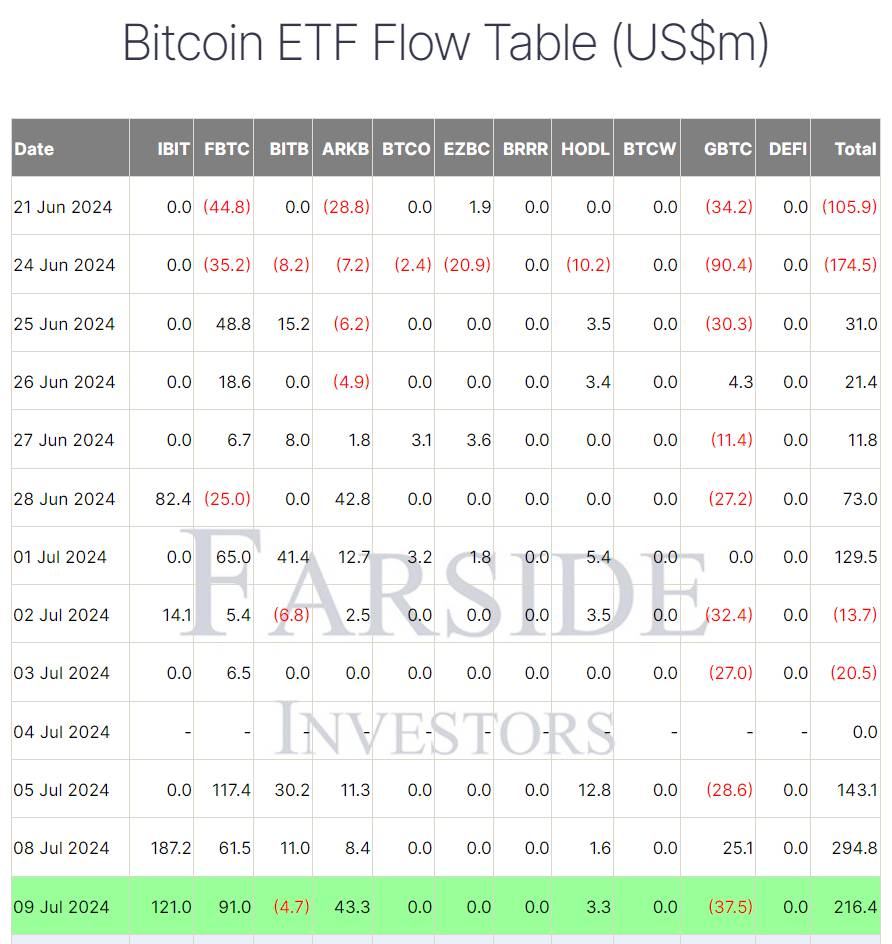

At the end of the trading day on July 9 (US time), 11 Bitcoin spot ETFs recorded an inflow of up to 216.4 million USD - following on July 8 with nearly 300 million USD, the highest level in the past month. .

In just 3 trading days after the US Independence Day (July 5, 8 and 9), ETFs recorded a total inflow of 654 million USD. Thereby, Bitcoin price has escaped the 54,260 area recorded on July 8, gradually increasing to the current milestone of 59,000 USD.

According to analysis by 68 Trading, there is a high probability that BTC will once again return to the 60,300 USD area for a back-test.

The good performance of the leading coin also helped Ethereum and other Altcoins recover strongly. ETH price is currently fluctuating around 3,110 USD.

After the Bitcoin spot ETF has been operating stably, the community is placing high expectations on the upcoming launch of the Ethereum spot ETF. As Bloomberg predicts, Ethereum ETF will soon open for trading this July.

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - Is Trump Dying? Or Only Killing The Market?](https://cdn.bulbapp.io/frontend/images/a129e75e-4fa1-46cc-80b6-04e638877e46/1)

![[LIVE] Engage2Earn: McEwen boost for Rob Mitchell](https://cdn.bulbapp.io/frontend/images/c798d46f-d3b8-4a66-bf48-7e1ef50b4338/1)