Blockstream Raises $210 Million to Fuel Layer-2 Growth, Buy More Bitcoin

Blockstream’s $210 million in convertible bonds will be used to fuel layer-2 Bitcoin growth, expand its mining operations, and buy more Bitcoin.

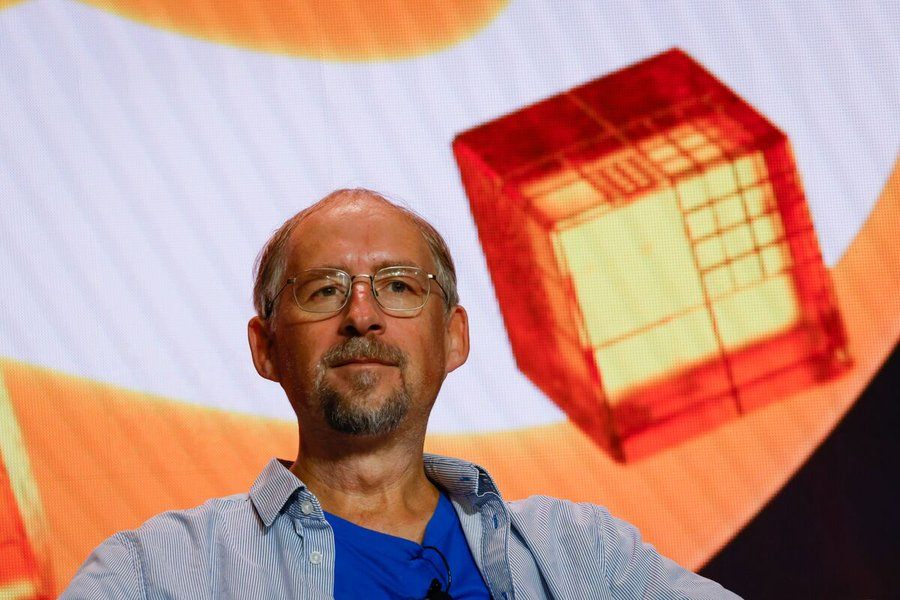

After Blockstream CEO and co-founder Adam Back appeared in HBO’s “Bitcoin Unmasking” documentary last week, the crypto mining and crypto infrastructure company announced today that it has raised $210 million in a convertible bond round led by Fulgur Ventures.

Blockstream will use the new capital to fuel adoption and development of layer-2 Bitcoin technologies, increase its BTC reserves, and expand its mining operations to “prepare for the next Bitcoin market cycle.” Adam Back said the round of funding is a significant milestone for the company as it enters a new phase of growth aimed at bridging the gap between Bitcoin and the broader financial world.

The new $210 million raised brings Blockstream’s total funding since 2014 to $621 million, with its most recent funding coming in January 2023 ($125 million).

Also in the announcement, the company announced the addition of Michael Minkevich to its leadership team, who previously served as product engineering lead at global IT services provider Luxoft, to the role of Blockstream’s Chief Operating Officer (COO).

Blockstream’s Layer-2 Bitcoin solutions include the Liquid Network — a Bitcoin-based sidechain that can deploy a variety of cryptoassets — and Core Lightning — an implementation of the Lightning Network designed to make Bitcoin transactions faster and cheaper, and is typically focused on serving enterprise users and developers looking to build applications on top of the long-standing Bitcoin layer-2 solution.

Blockstream is leveraging the growing interest in Bitcoin as an asset class and its broader tokenization potential to position the Liquid Network as the “default infrastructure” for tokenizing Real World Assets (RWA) in the Bitcoin ecosystem.

The company says it has had over $1.8 billion in assets, including stablecoins, cryptobonds, and securities, issued on the Liquid Network to date, with over 3,844 BTC (about $250 million) locked on-chain. Bitfinex’s L-BTC tokenized securities product is an example of one that uses the platform.

Last month, Blockstream also launched Series 3 of its BMN2 security token, which provides direct exposure to the company’s Bitcoin hashrate.

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - Did This Poor Baby Make A Profit On The BTC He Sold?](https://cdn.bulbapp.io/frontend/images/255151e6-9e83-4151-9644-80af06e53b74/1)