What is GRT Cryptocurrency? Forecasting the Price of The Graph ($GRT) Token

The GRT crypto quadrupled its price during 2023. And even though the GRT token from The Graph managed to increase its price by more than 300%, it still sits around ten times below its all-time high (ATH). As such, now may be a good time to familiarize yourself with The Graph and analyze the $GRT cryptocurrency to see if it might be worth investing in. So, if that sounds interesting, read on as we explore this project further and analyze the GRT price! In today’s article, you’ll first have a chance to discover the gist of the project behind the GRT crypto token. We’ll start by explaining what the project known as The Graph is and what The Graph’s network is all about. We’ll also do an overview of how The Graph works. Next, we’ll focus on the GRT crypto coin. In doing so, we’ll outline the asset’s purpose and use cases. Plus, we’ll look at $GRT tokenomics.

In today’s article, you’ll first have a chance to discover the gist of the project behind the GRT crypto token. We’ll start by explaining what the project known as The Graph is and what The Graph’s network is all about. We’ll also do an overview of how The Graph works. Next, we’ll focus on the GRT crypto coin. In doing so, we’ll outline the asset’s purpose and use cases. Plus, we’ll look at $GRT tokenomics.

Then, we’ll look closer at GRT’s entire price action and outline the coin’s key support and resistance levels. We’ll also examine the asset using the best crypto indicator – Money Line. Moving forward, we’ll shift our attention to $GRT price predictions. This is where you will learn how to use the power of Moralis Money to avoid the trap of blindly falling for any GRT price prediction. After all, thanks to this platform (one of the leading cryptocurrency analysis sites), you can utilize the powerful insights of real-time, on-chain data and live prices. Moreover, by using the Moralis Money $GRT token page, you can also decide whether or not to buy this coin. Last but not least, for those of you who may decide to get a bag of the GRT crypto asset, we’ll also explain where you can do that effortlessly.

Last but not least, for those of you who may decide to get a bag of the GRT crypto asset, we’ll also explain where you can do that effortlessly.

What is GRT Crypto & The Graph?

GRT crypto typically refers to the GRT token, which is The Graph’s native cryptocurrency. However, many use “GRT crypto” as a sign to point to the project, its networks, or even the entire Graph ecosystem.  So, before we take a closer look at the $GRT coin, let’s make sure you know the gist of The Graph and its network.

So, before we take a closer look at the $GRT coin, let’s make sure you know the gist of The Graph and its network.

The Graph 101

The Graph is a revolutionary decentralized protocol designed for the indexing and querying of blockchain data. It addresses the challenges associated with obtaining information directly from complex smart contracts, such as those powering platforms like Uniswap and NFT initiatives on the Ethereum blockchain.

While basic data can be easily retrieved from the blockchain, more advanced queries involving aggregation, search, relationships, and non-trivial filtering pose significant challenges. The Graph tackles these issues with a decentralized protocol that efficiently indexes and facilitates the querying of blockchain data. This enables developers to access complex information seamlessly.

How The Graph Works

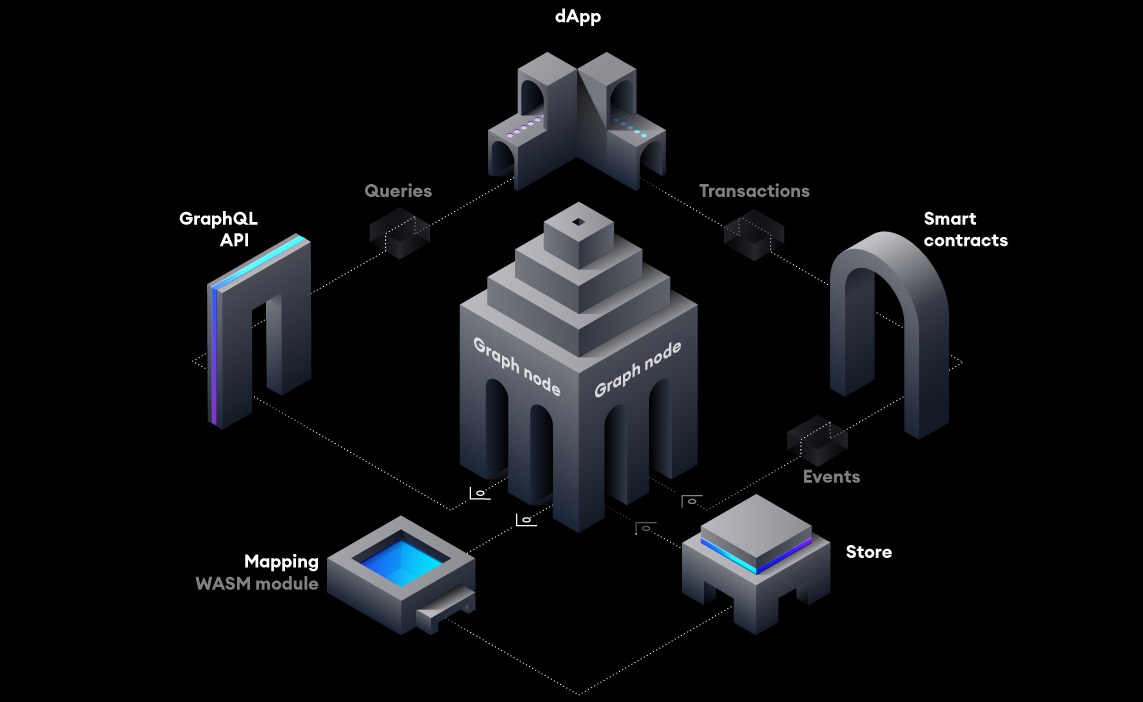

The Graph employs a sophisticated mechanism to index Ethereum data, guided by subgraph descriptions outlined in a subgraph manifest. This manifest specifies the relevant smart contracts and events and how to map event data for storage in The Graph’s database.

Once the subgraph manifest is crafted, it is stored on IPFS, and the indexing process is initiated using The Graph’s CLI. The indexing flow involves Ethereum transactions where a decentralized application (dapp) adds data through smart contract transactions. This emits events in the process.

The Graph nodes continuously scan Ethereum for new blocks, identify relevant events, and utilize mapping handlers to create or update data entities in response to these events. The dapp then queries one of The Graph’s nodes through its GraphQL endpoint, translating queries into the underlying data store queries, and displays the information in a user-friendly interface.

The Graph Network Overview

The Graph network stands as a decentralized indexing protocol designed to organize and streamline blockchain data. Through the utilization of GraphQL to query open APIs, known as subgraphs, developers gain access to efficiently indexed data on the network. This innovative approach enables the creation of serverless applications that run seamlessly on public infrastructure, offering a decentralized alternative to traditional hosting solutions.

These are some of the core benefits of using The Graph’s network as presented by the project’s documentation:

- Lower and more flexible cost structure.

- No setup costs and greater operational efficiency.

- Reliability and resiliency.

- Access to hundreds of independent indexers.

- 24/7 technical support by a global community.

Nonetheless, these are the types of network participants:

Nonetheless, these are the types of network participants:

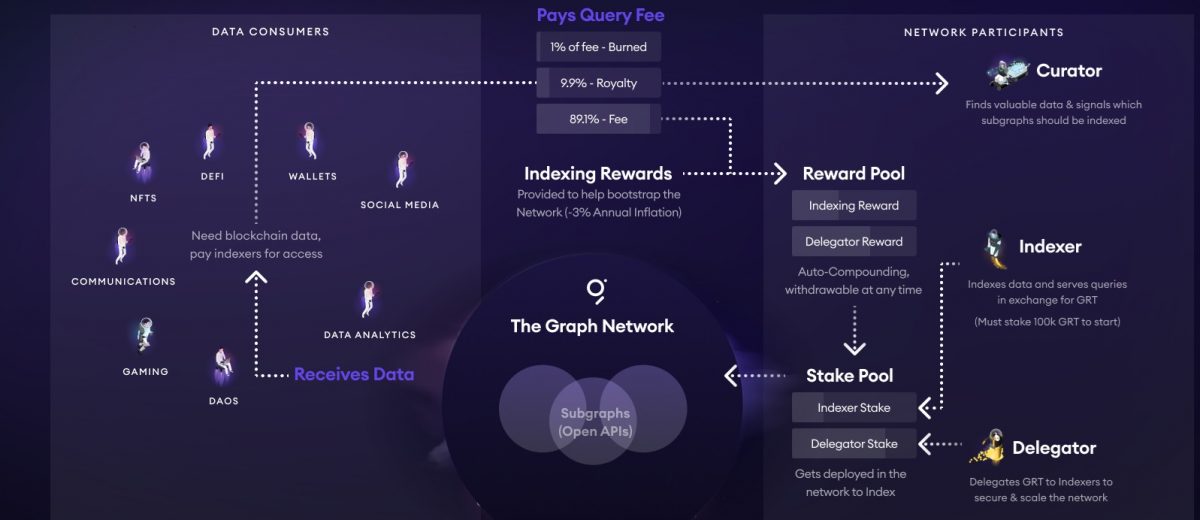

- Indexers: Node operators in The Graph’s network who stake Graph tokens (GRT) to provide indexing and query processing services, earning query fees and rewards.

- Delegators: Participants who delegate GRT to indexers contribute to the network’s security, and they do so without running Graph nodes themselves. Delegators earn a portion of query fees and rewards.

- Curators: Crucial to The Graph’s decentralized economy, curators assess and signal high-quality subgraphs, earning a share of query fees generated by those subgraphs.

- Developers: On the demand side of The Graph’s ecosystem, developers build subgraphs, publish them to the network, and query live subgraphs with GraphQL to power their applications.

Note: If you are a developer interested in building dapps, The Graph definitely deserves your attention. As such, make sure to explore the project’s documentation further. However, keep in mind that to use the best Web3 APIs, you’ll want to add Moralis to your stack.

The GRT Crypto Token

The GRT token is the integral utility token within The Graph’s ecosystem. It is in charge of orchestrating the collaboration between data providers and consumers in this decentralized protocol. So, as a utility token, GRT incentivizes participants within the network to organize and exchange data effectively.

All in all, the token’s primary purpose is to facilitate seamless coordination between the various roles in The Graph’s network. This ensures efficient data accessibility and contributes to the overall functionality of the protocol.

Use Cases of the GRT Token

GRT plays a pivotal role in The Graph’s network, serving multiple use cases:

- Coordination of Data Providers and Consumers: The GRT crypto acts as a medium of exchange, rewarding participants for their contributions to the network.

- Incentivizing Effective Data Organization: Participants earn $GRT rewards for organizing and processing data accurately, aligning their efforts with the protocol’s goals.

- Payment for Querying Blockchain Data: Developers pay for queries made to existing subgraphs using GRT, creating a direct economic exchange within the network.

- Tokenomics Mechanisms: GRT is subject to various tokenomics mechanisms, including burning, issuance, and slashing, designed to maintain the network’s economic security and stability.

$GRT Crypto Tokenomics

GRT had an initial token supply of 10 billion GRT, with a target of 3% issuance annually. The issuance serves to reward Indexers for allocating stakes on subgraphs. And, as you might have guessed, this issuance increases the total supply of GRT by 3% each year.

However, burning and slashing mechanisms slightly offset new GRT token issuance. Small percentages of various activities (delegation tax, curation tax, query fees, and slashing indexers) contribute to the annual burning of approximately 1% of the GRT supply.

Here’s an overview of GRT’s tokenomics:

- Token’s on-chain name: Graph Token

- Symbol/ticker: GRT or $GRT

- Networks:

- Ethereum (initial)

- Near

- Avalanche

- Polygon

- Harmony

- Arbitrum

- Sora

- Energi

- Smart contract address: 0xc944E90C64B2c07662A292be6244BDf05Cda44a7 (Ethereum)

- Initial supply: 10,000,000,000 $GRT

- Minting timestamp: December 13, 2020, at 20:17:13 (+UTC)

- Maximum total supply: not capped (3% yearly supply inflation and approximately 1% burned)

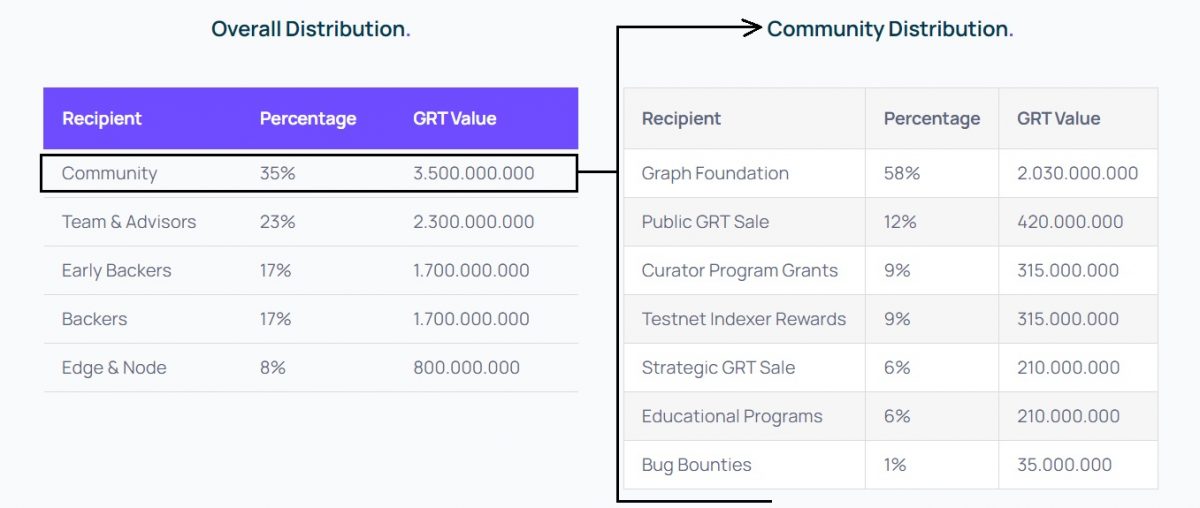

- Initial token distribution:

- 35% community

- 23% team and advisors

- 17% early backers

- 17% other backers

- 8% Edge and Node

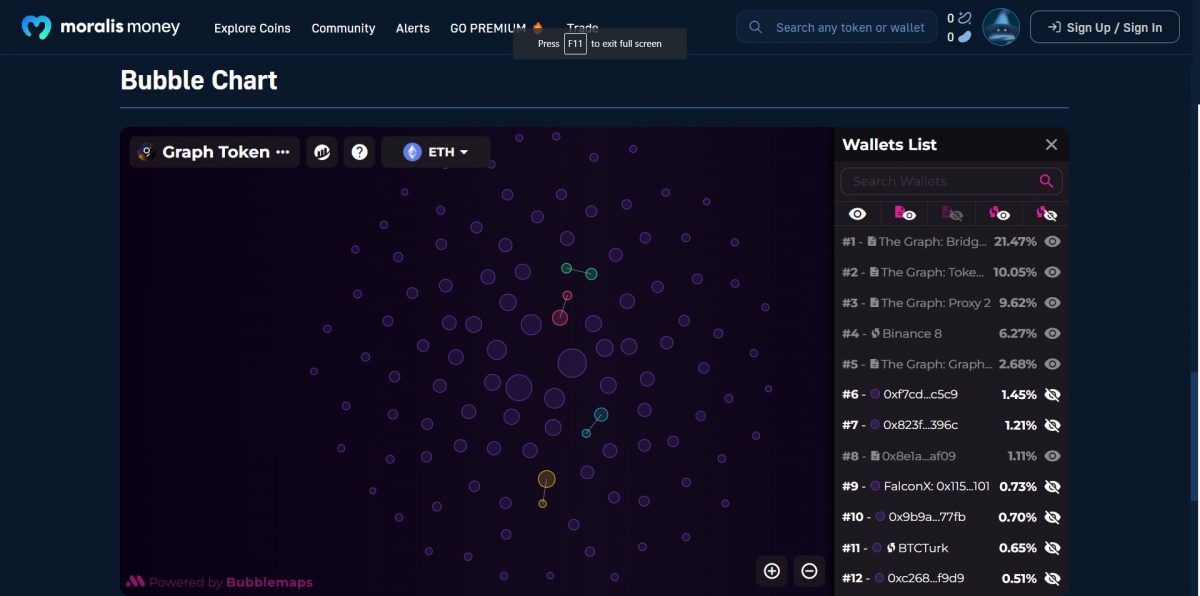

Note: You can investigate the live GRT crypto distribution using Moralis Money’s crypto bubblemaps. To access that map, use the “$GRT” link in the “Should I Buy $GRT?” section below. Once on the token’s page, focus on the “Bubble Chart” section:

Note: You can investigate the live GRT crypto distribution using Moralis Money’s crypto bubblemaps. To access that map, use the “$GRT” link in the “Should I Buy $GRT?” section below. Once on the token’s page, focus on the “Bubble Chart” section:

The Graph Token Price Action

After its birth on December 13, 2020, $GRT started trading on several major exchanges just days later. For instance, the token was listed on Binance on December 17, 2020, at $0.03. The first four days after listing, the GRT token pulled off an incredible rally, increasing by more than 2,400%. As such, the asset’s price reached as high as $0.783 on December 20, 2020.

Over the following 22 days, the price pulled back by 70%, marking a new local bottom at $0.23 on January 11, 2021. However, after that correction, $GRT pulled off another run. It went from the aforementioned bottom to the asset’s ATH, which sits at $2.88 and came in on February 12, 2021. Hence, GRT was one of the first altcoins to reach the cycle top in the 2021 bull run.

After its top, The Graph’s token started to lose its value. By June 21, 2021, the token’s price was approximately 85% below its ATH value. The price recovered a bit as Bitcoin was setting its ATH; however, it wasn’t able to break above the $1.33 level.

Then, as the entire crypto market entered a bear season, $GRT plummeted further. The token reached its bottom on November 22, 2022, at just above $0.05. After a bounce to the $0.07 region on two occasions, the price revisited the $0.05 level on the final days of 2022.

2023 Recovery

As the rest of the crypto market woke up in January 2023, $GRT was one of the first tokens to rally. By February 7, 2023, its price increased by more than 300%, reaching $0.23. However, at the time, the token didn’t have enough steam to go any higher. In fact, it ended up downtrending over the upcoming eight months and a half. $GRT reached its new local bottom on October 19, 2023, by retesting the $0.07 resistance and turning it into support.

After the aforementioned bottom, the GRT crypto rallied again, increasing by approximately 190% over 75 days. At the time of writing, $GRT is trading around $0.21.

GRT Crypto Price Prediction

In the above chart, we’ve marked all the key support and resistance levels for The Graph’s token price. These technical analysis (TA) basics can be beneficial. After all, as the price moves upwards or downwards, these levels are the most likely targets.

However, determining the most likely direction of $GRT is a lot trickier. Still, by using the right crypto analysis tools and crypto trading tools, one can predict more likely scenarios. Moreover, to determine trends, there’s no better crypto charting tool than the Money Line indicator. And for GRT, it is indicating a bullish trend on both weekly and daily timeframes: Note: If you wish to get your hands on the Money Line indicator, make sure to opt for the Moralis Money Pro or Starter plan. If you are interested in learning more about how this ultimate crypto indicator works, follow the “Money Line” link in the introduction of today’s article.

Note: If you wish to get your hands on the Money Line indicator, make sure to opt for the Moralis Money Pro or Starter plan. If you are interested in learning more about how this ultimate crypto indicator works, follow the “Money Line” link in the introduction of today’s article.

Aside from TA, which considers the token’s live price, traders should also always have a closer look at the asset’s real-time, on-chain metrics. Only by combining the power of these insights can one make short-term price predictions worth considering.

As for any $GRT long-term price prediction, please be mindful that no one can predict cryptocurrency prices with certainty. As the cryptocurrency market is dynamic and can be prone to sudden shifts, anyone promising a specific GRT crypto price prediction for 2024 or 2025 will invariably be wrong.

So, the only way for traders to make their own short-term price predictions for GRT and other cryptos is to be up-to-date with the latest on-chain and price data. And that’s exactly what Moralis Money offers. It helps traders decode on-chain data and decipher market alpha to understand how the market is moving.

Should I Buy $GRT?

By using the information obtained from the above-covered section, you should be able to decide if you find the GRT crypto at all interesting. And if yes, then you ought to research this potential opportunity further.

Fortunately, you can do so easily by using Moralis Money’s Graph Token ($GRT) page. There, you’ll find all the resources and tools you need to answer the above question with confidence. And, keeping the importance of live prices and real-time, on-chain metrics in mind, be sure to focus on the “Alpha Metrics” and “Price Chart” sections.

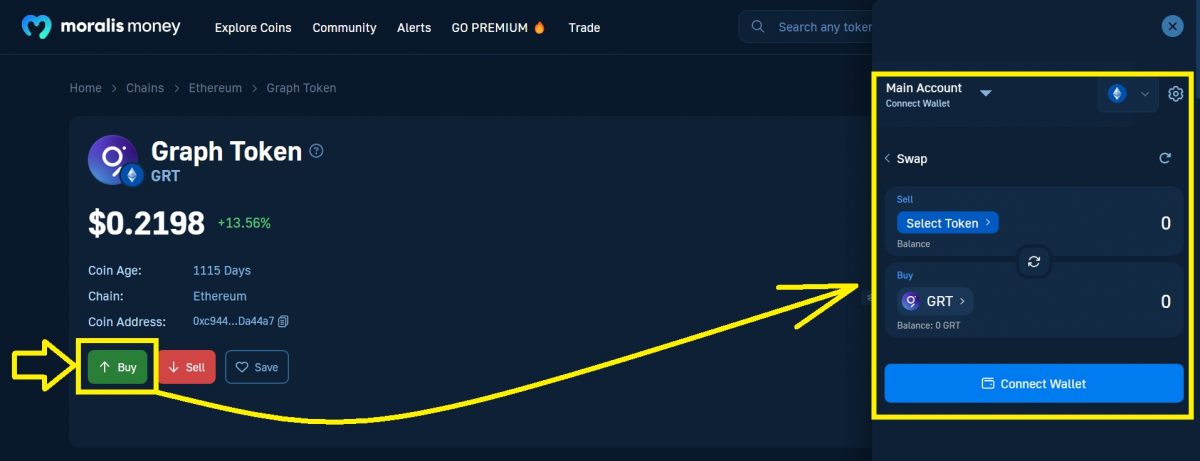

So, to decide if/when to buy the GRT crypto, simply follow the above “$GRT” link or use the interactive widget below:

Where to Buy the $GRT Crypto?

If you took a good look at the above-presented page, you probably already noticed the “Buy” button. Well, the latter is the key to buying $GRT in a frictionless, secure, and affordable manner.

So, if you wish to get a bag of GRT without breaking a sweat or the bank, just hit that button and follow the instructions that the Moralis Money instant crypto swap offers:

What is GRT Crypto? The Graph ($GRT) Price Prediction – Key Takeaways

- The Graph is all about accessing blockchain data. To achieve that, it deploys a rather unique protocol and mechanics, which allows network contributors to earn GRT.

- The GRT crypto token is the native cryptocurrency of The Graph ecosystem. Further, it servs as the medium for incentivizing network contributors and paying for data query fees.

- $GRT was born in December 2020, and it reached its current ATH in early February 2021.

- According to TA, $GRT looks bullish and could go higher in 2024 and 2025.

- To determine if/when to buy The Graph’s Graph Token, use Moralis Money’s page for that asset.

- You can also buy GRT on that page in a user-friendly and secure manner by clicking on the “Buy” button.

It’s important to keep in mind that GRT is just one of many altcoins with potential. Plus, given Graph Token’s relatively high market cap (MC) (approximately $2 billion), it would be unreasonable to expect anything more than a 10x increase for the cycle top. So, if you are interested in those 50x-plus altcoin opportunities, you ought to focus on tokens with lower MCs. However, if you prefer lower risk, then assets with higher MCs are the ones to invest in.

In either case, you need to be able to spot these altcoin opportunities. And this is where Moralis Money has no parallel. With its main feature – Token Explorer – serving as the ultimate crypto scanner, Moralis Money bests other blockchain analytics tools by miles.

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - I Think I Have Crypto PTSD](https://cdn.bulbapp.io/frontend/images/819e7cdb-b6d8-4508-8a8d-7f1106719ecd/1)