The Crypto Exchange Rollercoaster: Binance Leads as Top 10 Exchanges Hit $34.26 Trillion Trading Vol

2023, a year that sent shockwaves through the cryptocurrency realm — a thrilling rollercoaster ride for enthusiasts and investors alike. The crypto exchange market witnessed unprecedented growth, with a jaw-dropping $34.26 trillion in trading volume across the top 10 exchanges. Buckle up as we delve into the highs, lows, and unexpected turns that defined this crypto saga.

2023, a year that sent shockwaves through the cryptocurrency realm — a thrilling rollercoaster ride for enthusiasts and investors alike. The crypto exchange market witnessed unprecedented growth, with a jaw-dropping $34.26 trillion in trading volume across the top 10 exchanges. Buckle up as we delve into the highs, lows, and unexpected turns that defined this crypto saga.

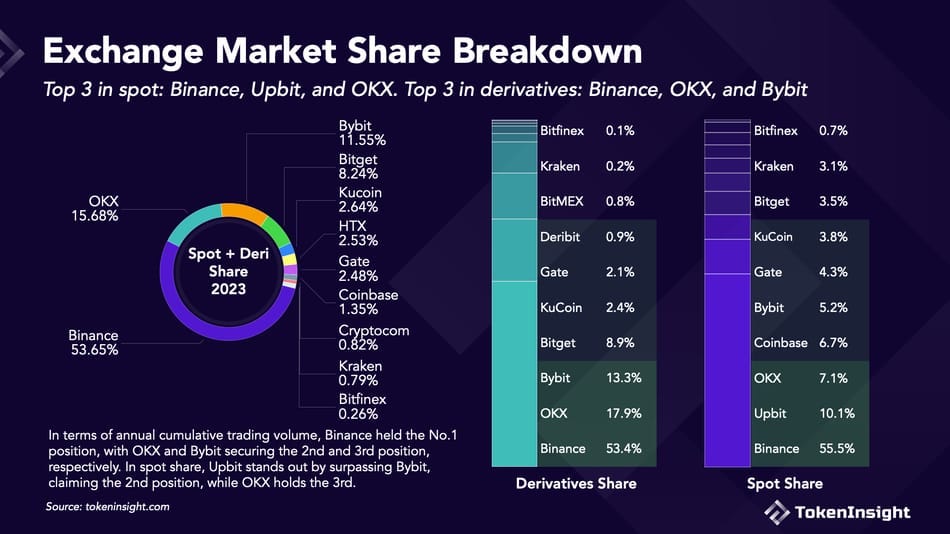

The Stage is Set: Overview of Top 10 Exchanges Picture this: a dynamic landscape where crypto giants battled for supremacy. The top 10 exchanges, the power players in this digital arena, collectively orchestrated a trading volume that could make heads spin. Now, let’s shine the spotlight on the undisputed leader of this grand spectacle — Binance.

Picture this: a dynamic landscape where crypto giants battled for supremacy. The top 10 exchanges, the power players in this digital arena, collectively orchestrated a trading volume that could make heads spin. Now, let’s shine the spotlight on the undisputed leader of this grand spectacle — Binance.

Binance’s Dominance

In the heart of the crypto maelstrom, Binance stood tall, defying the odds and holding the coveted crown. Despite legal storms and regulatory hurdles attempting to rain on its parade, Binance showcased resilience that left many in awe.

Legal Storms and Regulatory Hurdles

Now, let’s peel back the layers of Binance’s dominance. It wasn’t all smooth sailing. Legal battles and regulatory challenges became a part of Binance’s narrative, yet it weathered the storms with a tenacity that mirrored the resilience of a seasoned surfer riding the turbulent waves.

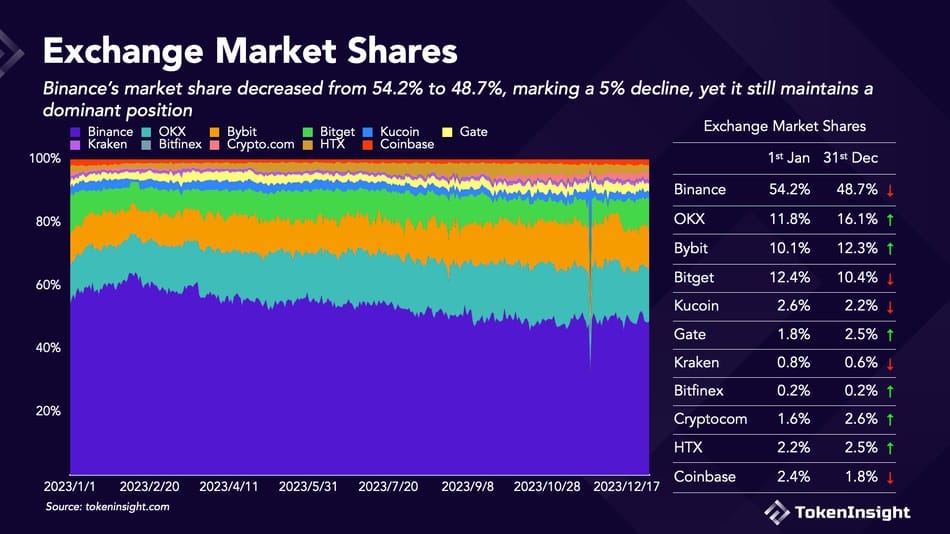

Market Share Shake-Up: From 54.2% to 48.7% The plot thickens as we dissect the market share dynamics. Binance, with a once-imposing 54.2% share, experienced a slight dip to 48.7%. What triggered this change? Regulatory incidents and the cessation of Binance’s zero-fee Bitcoin event in March played pivotal roles.

The plot thickens as we dissect the market share dynamics. Binance, with a once-imposing 54.2% share, experienced a slight dip to 48.7%. What triggered this change? Regulatory incidents and the cessation of Binance’s zero-fee Bitcoin event in March played pivotal roles.

Rising Stars: OKX and Bybit

In the ever-evolving landscape of cryptocurrency exchanges, two names emerged as beacons of progress amidst the tumultuous market currents. OKX, with a remarkable ascension, witnessed a staggering 4.3% jump in market share. Picture this: a cryptocurrency platform gaining ground, carving its niche in the competitive arena.

OKX’s journey mirrors the resilience and strategic moves akin to a chess grandmaster plotting each move with precision. The 4.3% surge wasn’t a stroke of luck but a calculated series of steps, reflecting the platform’s adaptability and response to market demands. Now, let’s turn our attention to Bybit, a platform that adeptly navigated the unpredictable crypto currents, experiencing a 2.2% surge in market share. It’s akin to sailing through uncharted waters — Bybit found its course, leveraging the waves of market trends to propel its growth.

Now, let’s turn our attention to Bybit, a platform that adeptly navigated the unpredictable crypto currents, experiencing a 2.2% surge in market share. It’s akin to sailing through uncharted waters — Bybit found its course, leveraging the waves of market trends to propel its growth.

Shifting dynamics in the crypto realm are often akin to witnessing the emergence of new players on a global stage. OKX and Bybit, once underdogs, have etched their names alongside the giants, reshaping the narrative of the top 10 exchanges.

Crypto Market Chronicles

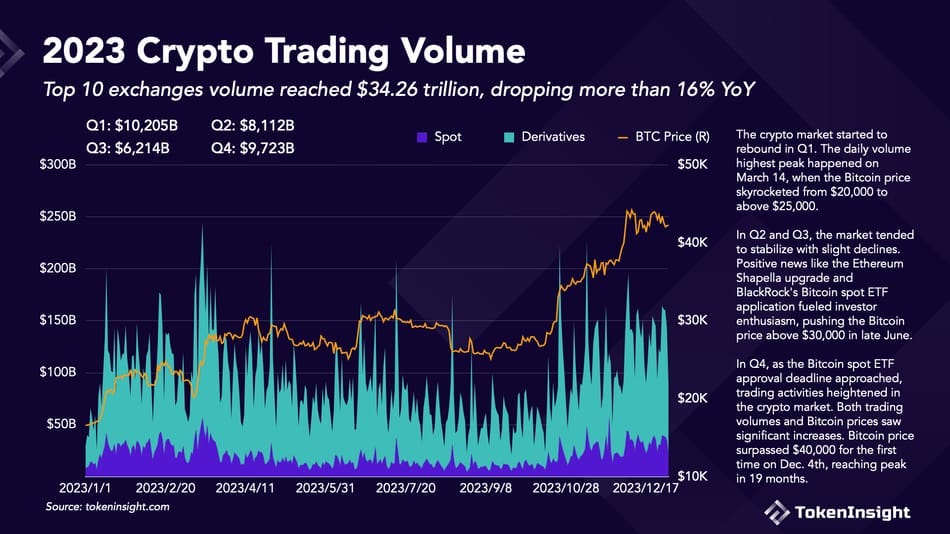

As we delve into the crypto market chronicles of 2023, we witness a narrative that transitions from bearish blues to bullish bliss. Imagine the crypto market as a phoenix rising from the ashes — that’s precisely what occurred.

The Ethereum Shapella upgrade marked a pivotal moment, injecting a dose of optimism into a market that weathered a bearish storm from mid-2022 to early 2023. The metamorphosis wasn’t isolated; it was part of a larger movement.

Enter BRC-20 Ordinal, a catalyst that resonated through the crypto sphere, contributing to the market’s recovery. Numbers don’t lie, and the statistics revealed a shift in sentiment as positive developments catalyzed a bounce back from the bearish lull.

And then, the plot thickened with BlackRock’s strategic move — submitting a Bitcoin spot ETF application. It wasn’t just a chess move; it was a game-changer. The mere submission triggered a chain reaction, instilling confidence and momentarily pushing Bitcoin’s price above $30,000 in late June.

Bitcoin’s Whirlwind Romance

In the grand theater of cryptocurrencies, Bitcoin takes the center stage with a whirlwind romance that had traders and enthusiasts on the edge of their seats. The numbers don’t lie — within a month, Bitcoin’s trading volume soared from a respectable $50 billion to an astounding $150 billion. It’s not just a surge; it’s a meteoric rise, a testament to the dynamic nature of the crypto market.

March 14, a date etched in the crypto chronicles. On this day, Bitcoin showcased peak performance, with a heart-stopping 16.6% surge in just 24 hours. Imagine the excitement of a rollercoaster at its zenith — that’s the adrenaline-pumping sensation experienced by investors witnessing this surge.

But it’s not all about the peaks; stability is the anchor in the volatile seas of the crypto world. In the following quarters, Bitcoin displayed resilience and stability. Positive news, including the successful Ethereum Shapella upgrade and BlackRock’s ETF application, acted as guiding stars, propelling Bitcoin’s price above $30,000 in late June. It’s akin to a rollercoaster finding a moment of tranquility before the next exhilarating plunge.

Binance’s Resilience

Now, let’s shift our focus to Binance, the protagonist navigating the stormy seas of lawsuits, CEO resignation, and regulatory accusations. It’s not just about facing the storms; it’s about weathering them with a resilience that defines a true leader.

In November, Binance encountered a market share rollercoaster, experiencing a sharp 32% drop. But here’s where the plot thickens — by year-end, Binance not only stabilized but regained its ground, holding strong at around 48%. It’s a testament to Binance’s ability to not only survive but thrive amidst challenges.

User confidence, the lifeblood of any exchange. Despite the storms, Binance retained the unwavering trust of its users. It’s not just a platform; it’s a haven where users find stability in the unpredictable world of cryptocurrencies.

How to Launch a Crypto Exchange in 2024?

Embarking on the journey to launch a crypto exchange in 2024 is akin to navigating uncharted waters. It’s not just about having a vision; it’s about having a clear, step-by-step guide to chart your course through the dynamic crypto landscape.

Navigating the Crypto Landscape: A Step-by-Step Guide

The first step in this exhilarating journey is understanding the lay of the land. The crypto landscape is vast, teeming with opportunities and challenges. To navigate it successfully, start with a comprehensive market analysis. Identify trends, study user behavior, and understand the regulatory landscape. It’s not just about launching an exchange; it’s about positioning yourself strategically in a market that’s as unpredictable as it is promising.

Next on the roadmap is creating a solid business plan. What’s your unique selling proposition? How will you differentiate your exchange from the plethora of options already available? This isn’t just about having a plan; it’s about having a blueprint for success in an industry where innovation is the key currency.

Now, let’s talk technology essentials. Building a robust exchange platform requires more than just coding skills; it requires an understanding of the core technologies that underpin successful exchanges. Security is paramount — implement state-of-the-art encryption, two-factor authentication, and cold storage solutions to safeguard user assets. Scalability is the name of the game — your platform should be able to handle the surges in trading volume that characterize the crypto market. It’s not just about building a platform; it’s about building a fortress that can withstand the storms of the digital realm.

Technology Essentials: Building a Robust Exchange Platform

Numbers don’t lie, and the stats tell a compelling story. In 2023, the top 10 exchanges collectively recorded a staggering $34.26 trillion in trading volume. What does this mean for you as a budding exchange owner in 2024? It means understanding the market dynamics, anticipating user needs, and leveraging technology to create an exchange that not only survives but thrives.

Consider user experience as the heartbeat of your exchange. A seamless, user-friendly interface coupled with responsive customer support is the recipe for gaining and retaining users. It’s not just about having a platform; it’s about creating an experience that users will rave about.

Marketing Strategies: Making Your Exchange Stand Out

In the bustling arena of cryptocurrency exchanges, standing out is more than a challenge; it’s a necessity for survival. In a world where options abound, crafting effective marketing strategies becomes the linchpin of success. It’s not just about advertising; it’s about creating a brand narrative that resonates with users.

To begin, leverage the power of social media — a dynamic space where trends flourish. Engage with your audience, share insightful content, and foster a sense of community. Numbers tell the tale: in 2023, the top 10 exchanges collectively traded $34.26 trillion. Imagine tapping into a fraction of that market. Strategic partnerships also play a pivotal role; collaborating with influencers and industry experts can catapult your exchange into the spotlight.

Security First: Safeguarding User Assets

Security isn’t just a feature; it’s the bedrock of user trust. In an industry where the digital realm intersects with financial transactions, safeguarding user assets becomes paramount. It’s not just about implementing security measures; it’s about ensuring users sleep soundly, confident that their investments are shielded from cyber threats.

Utilize cutting-edge encryption technologies, implement two-factor authentication, and employ robust cold storage solutions. The numbers echo the importance — the top 10 exchanges collectively recorded $34.26 trillion in trading volume in 2023. Users flock to platforms that prioritize security, turning your exchange into a fortress amidst the digital landscape.

Customer Experience: The Key to Long-Term Success

Numbers are crucial, but so is the human touch. Beyond the trading volumes and market shares, the success of an exchange hinges on customer experience. It’s not just about transactions; it’s about building relationships that stand the test of time.

Create a seamless, user-friendly interface that caters to both novice and experienced traders. Offer responsive customer support that transcends typical service interactions. In the end, it’s not just about acquiring users; it’s about retaining them for the long haul.

Conclusion

As we reflect on the crypto rollercoaster of 2023, one thing is certain — the landscape is ever-changing, and success requires adaptability. Looking ahead to 2024, the trends and possibilities are as dynamic as the market itself. For crypto enthusiasts embarking on the journey, what lies ahead is an exciting ride filled with challenges and triumphs. It’s not just about the destination; it’s about the exhilarating journey in the world of cryptocurrencies.

Crypto Exchange

Binance 2023

Top 10 Exchange

Crypto

Launch Crypto Exchange

Follow

Follow

Written by Emily George

277 Followers

·

Writer for

Coinmonks

I am an experienced Crypto writer in Blockchain & Cryptocurrency Field.

More from Emily George and Coinmonks

Emily George

Emily George

in

TokenTrends

Upcoming Meme Coin Development Wave: 5 Meme Coins Poised for Explosive Growth in 2024

In the ever-evolving world of cryptocurrency, meme coins are the rollercoasters of the market, and Shiba Inu (SHIB) has been leading the…

14 min read

·

Nov 23, 2023

53

2

Emily George

Emily George

in

Coinmonks

Transforming Finance: The Power of Real-World Asset Tokenization in DeFi

If you’ve been following the exciting world of DeFi, you probably expected it to be a disruptor in the realm of traditional finance…

13 min read

·

Oct 28, 2023

26

Emily George

Emily George

in

Coinmonks

Top 15 NFT Launchpad Development Companies In 2023

Blockchain technology has revolutionized various industries, and one of the most promising applications of this technology is Non-Fungible…

7 min read

·

Aug 8, 2023

1

Emily George

Emily George

in

Web3Prophet

More Brands Will Embrace Web3 to Capture Market Trends in 2024

The retail world is buzzing with activity, and consumers are at the center of this whirlwind. In the quest for consumer attention, brands…

9 min read

·

Dec 19, 2023

Recommended from Medium

Michel Marchand

Michel Marchand

in

Coinmonks

The Bull Is Back? Top 10 Cryptos to Buy on Coinbase in 2024

well . . . I’M back, shouldn’t that be enough?

21 min read

·

Dec 31, 2023

453

8

Unicorn Ultra

Unicorn Ultra

in

Unicorn Ultra

What is BRC-20? How BRC-20 Tokens Are Revolutionizing The Bitcoin Blockchain

The cryptocurrency world has witnessed a significant development with the emergence of BRC-20 tokens, a novel token standard on the Bitcoin…

5 min read

·

Dec 21, 2023

104

Lists

Staff Picks559 stories

Staff Picks559 stories

·

648

saves

Stories to Help You Level-Up at Work19 stories

Stories to Help You Level-Up at Work19 stories

·

423

saves

Self-Improvement 10120 stories

Self-Improvement 10120 stories

·

1227

saves

Productivity 10120 stories

Productivity 10120 stories

·

1122

saves

Financeable

Financeable

12 Side Hustles You Can Do From Your Phone ($600+ Per Day)

Let’s be honest, if you’re reading this article, you probably have a phone or a laptop. And with this thing, you can make as much as $600…

13 min read

·

Dec 25, 2023

6.7K

109

Subhashish C.

Subhashish C.

Top Crypto Gaming Projects Poised for Growth in 2024

The money flow during crypto bull market cycles historically happens in three stages.

8 min read

·

Dec 21, 2023

211

4 0xAnn

0xAnn

in

Crypto 24/7

Making Money Scalping Crypto

“Why do you work 9–5 when crypto trading is basically free money?”

·

7 min read

·

Jan 10

530

11

Captain Crypto

Captain Crypto

These 5 Cryptocurrencies Could Make You A Millionaire By 2024-End

2021 was a monumental year of crypto. The industry empowered many individuals to make their first million through digital assets. 2022…

3 min read

·

Dec 14, 2023

9

![Nekodex – Earn 20K+ NekoCoin ($20) [Highly Suggested]](https://cdn.bulbapp.io/frontend/images/b4f0a940-f27c-4168-8aaf-42f2974a82f0/1)

![[FAILED] Engage2Earn: McEwen boost for Rob Mitchell](https://cdn.bulbapp.io/frontend/images/c798d46f-d3b8-4a66-bf48-7e1ef50b4338/1)

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - OM(G) , My Biggest Bag Was A Scam????](https://cdn.bulbapp.io/frontend/images/99de9393-38a8-4e51-a7ab-a2b2c28785bd/1)