Ethereum Spot ETF Trades Reach Volume of Rp17.5 Trillion on First Day

Ethereum Spot ETF Trades Reach Volume of Rp17.5 Trillion on First Day

The Ethereum spot Exchange-Traded Fund (ETF) investment product recorded a significant cumulative trading volume of $1.08 billion, or about Rp17.5 trillion, on its first trading day on July 23, 2024.

According to data shared by Bloomberg ETF analyst Eric Balchunas, the Grayscale Ethereum Trust (ETHE) led with the highest trading volume of $458 million. BlackRock iShares Ethereum Trust (ETHA) followed in second place with a trading volume of $248.7 million.

Meanwhile, the Fidelity Ethereum Fund (FETH) ranked third with a trading volume of around $137.2 million. Six other new Ethereum spot ETFs recorded volumes below $100 million, with the 21Shares Core Ethereum ETF Fund (CETH) having the lowest trading volume among them.

Balchunas noted that the total trading volume of these Ethereum spot ETFs represents about 23% of the total volume of Bitcoin spot ETFs on their first trading day in January 2024, which reached $4.5 billion. The difference between ETHE and the "Newborn Eight" is $625 million.

It is worth noting that the Grayscale ETHE is the only Ethereum ETF that has been converted from an existing ETF, unlike the other eight new Ethereum spot ETFs that were just launched.

Funds Are Still Accumulating

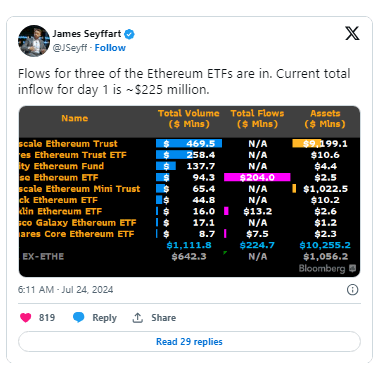

While the trading volume is known, it does not always reflect whether the trades are inflows or outflows of funds. However, recent data from another Bloomberg ETF analyst, James Seyffart, indicates that some Ethereum spot ETFs recorded outflows of $165 million, excluding products from BlackRock and Invesco Galaxy. Meanwhile, the fund inflows for three Ethereum ETFs amounted to $225 million.

Seyffart had previously estimated that the fund flows for Ethereum spot ETFs would range between $125 million and $325 million. For comparison, Bitcoin spot ETFs recorded inflows of $655.2 million on their first trading day, including outflows of $95 million from the converted Grayscale Bitcoin product.

The U.S. Securities and Exchange Commission (SEC) began approving the necessary S-1 forms for the launch of Ethereum ETFs on July 22, 2024. These investment products allow investors to buy or sell Ethereum through conventional stock exchanges, offering an easier way to gain exposure to Ethereum price movements.

As of this article's writing, the price of Ethereum (ETH) has decreased by 1%, standing at around $2,440. However, the daily trading volume of this cryptocurrency has increased by 27%, reaching $24.2 billion, according to data from CoinMarketCap.

Conclusion

The launch of Ethereum spot ETFs has made a significant impact on the market, with a notable trading volume of $1.08 billion on the first day. The Grayscale Ethereum Trust (ETHE) led the trading volume, followed by BlackRock iShares Ethereum Trust (ETHA) and Fidelity Ethereum Fund (FETH). Despite the impressive volumes, there were mixed fund flows, with some ETFs experiencing outflows while others saw significant inflows.

The SEC's approval of Ethereum ETFs marks a crucial development, providing investors a more accessible means to engage with Ethereum through traditional stock exchanges. This milestone is likely to influence the broader adoption and liquidity of Ethereum. However, the market response saw a slight dip in Ethereum’s price, although the trading volume increased substantially. As the market adjusts, the overall impact of these ETFs will become clearer, potentially setting the stage for further financial innovation and integration of cryptocurrencies into mainstream finance.

Read too : 8 Ethereum Spot ETFs to be Traded in the US

*Disclaimer:

This content aims to enrich reader information. Always conduct independent research and use disposable income before investing. All buying, selling, and crypto asset investment activities are the reader's responsibility.

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - I Think I Have Crypto PTSD](https://cdn.bulbapp.io/frontend/images/819e7cdb-b6d8-4508-8a8d-7f1106719ecd/1)