Solana's Price Surge and Subsequent Liquidations: 2023 Update

Solana price prediction in 2023-2024

Solana (SOL), one of the cryptocurrencies with a large marketcap, recorded a significant increase in the last month.

The price of SOL has increased by around +1,000% or 11 times from US$10 to US$112 since the beginning of 2023. Several possible factors causing this price increase are summarized in the following article, as well as predictions for the price of SOL in 2024.

Solana Recorded a Significant Price Increase

Solana beat the price performance of the top 10 cryptocurrencies based on marketcap in the last month by recording a price increase of +466% from US$21.9 to US $124 (highest price in 2023).

As of 13 November 2023, SOL was trading at US$57.3, having experienced a correction of -10.3% from the highest price of 2023. Starting from the beginning of 2023, SOL has experienced an increase of +1.024%. Image: SOL price chart

Image: SOL price chart

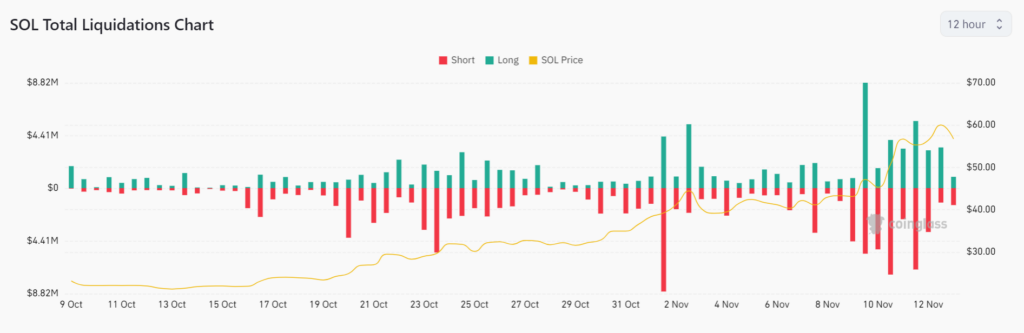

With significant price increases in the last month, traders with SHORT positions in the futures market position recorded liquidation of US$87 million or 42.5%. LONG SOL, namely 57.5% or equal to US$117.7 million in the last month. Meanwhile themarket futures position dominates the liquidation of SHORTexperiencing dominant losses. The

The liquidation ratio between the two positions which is almost close to one indicates that even though the SOL price increased significantly, there was a short and sudden correction that liquidated the position LONG with quite large portions. Figure: Position liquidation rate futures SOL. Source: Coinglass

Figure: Position liquidation rate futures SOL. Source: Coinglass

Several factors cause the increase in SOL prices

The cause of the increase in the price of a crypto asset is uncertain, but the following are findings from Coinvestasi analysts regarding the possible causes of the increase in the price of SOL in the last month.

Increasing Interest in dApps on Solana

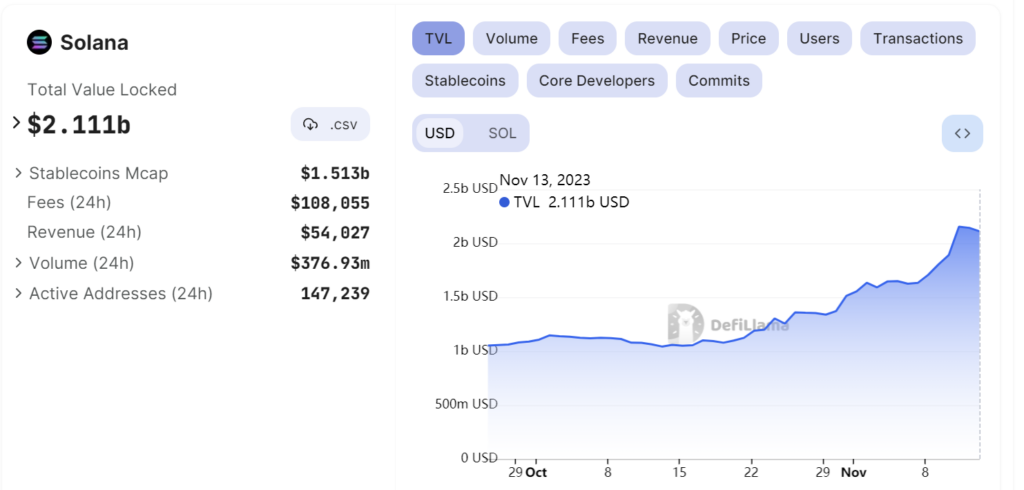

The crypto community's interest in dApps on Solana has increased in the last month. This can be seen from the total value locked (total value locked, TVL) on dApps which almost doubled from US$1.1 billion to US$2, 1 billion. Image: Solana network TVL. Source: DefiLlama

Image: Solana network TVL. Source: DefiLlama

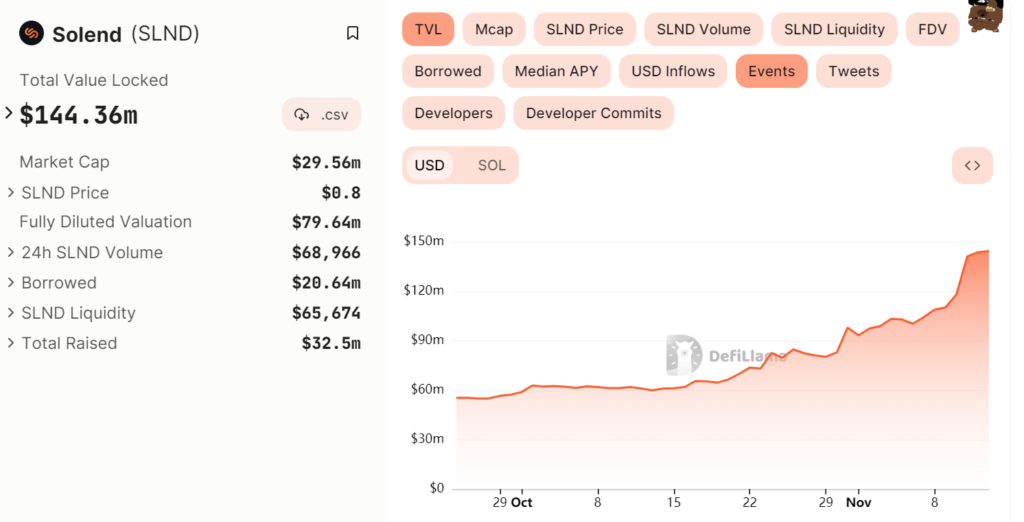

Increasing TVL can contribute to an increase in SOL prices. This is because dApps users lock some assets in the form of SOL, so demand increases. One of Solana's lending dApps, Solend.fi, has a TVL of US $147.4 million with the amount of SOL locked on the platform equivalent to US$109 million. Image: TVL Solend.fi. Source: DefiLlama

Image: TVL Solend.fi. Source: DefiLlama

Increased Network Activity

Apart from being measured by the size and amount of funds/inflow that enter the Solana network, network activity also needs to be considered. In the past month, Solana network activity has also increased. This can be seen from the daily gas fee paid by users, which has increased consistently in the last month.

Daily gas fees in October average around US$45,000. Meanwhile, in the latest data (12/11/23), daily gas fees reached US$108,000, more than double the average in October. a> Gambar: Gas fee harian jaringan Solana. Sumber: DefiLlama

Gambar: Gas fee harian jaringan Solana. Sumber: DefiLlama

The increase in gas fee can be correlated with the increase in the price of SOL because gas fee paid in the form of SOL so the user must buy or have SOL to do the transaction.

As for the activities that are most likely to contribute to the increase gas fees here are several projects on Solana that have the potential to provide airdrop. This causes some people to tend to make transactions to meet the airdrop requirements. Some potential projects airdrop are Jupiter Exchange and < a i=11>Pyth Network.

Today marks the unveiling of the Pyth Network Retrospective Airdrop.

This airdrop is a cross-chain program for the dedicated community of the Pyth oracle ecosystem.

Learn more below:

The program is an expression of deep appreciation for the dedicated Pyth Network stakeholder… pic.twitter.com/8TIzNdMQEN

— Pyth Network 🔮 (@PythNetwork) November 1, 2023

Positive Crypto Market Sentiment and Breaking EMA 50

The fourth quarter of 2023 has positive sentiment towards the crypto market , namely the development of Bitcoin ETF applications from various investment management companies. Not only did the price of Bitcoin rise, but also the price of altcoins including Solana.

Apart from positive sentiment, SOL price movements managed to penetrate and test resistance dynamic EMA 50. In timeframe one day, EMA 50 has become resistance which is difficult for SOL to penetrate from April 2022 to early 2023. RSI indicator also shows that SOL was very oversold when it touched US$7.9 at the end of December 2022. Image: SOL price chart

Image: SOL price chart

SOL price penetrated the EMA 50 in early October 2023 and managed to stay above it consistently until it reached the highest price of US$63.9.

It should be noted that the current conditions (13/11/23) based on the RSI indicator, SOL is showing overbought with an RSI value of 87.8.< /span>

Solana Price Prediction 2024

2023, until this November, has been a very good year for SOL with a price increase of +1,024%. 2024 will most likely also be a good year, but starting with a price correction first. The following is an analysis of the price of SOL in 2024.

SOL price movements which jumped significantly in the last month made the RSI indicator on the daily timeframe graph show a signal overbought , which means SOL is already at the saturation point of the increase. This indicates the possibility of selling pressure causing a price correction.

Based on the history of previous SOL price movements, there is support at the US$65 price level. Support The most extreme is at US$35 where this price is when the FTX collapse event begins in November 2022. If a true correction occurs, then the price level of US$35 is feasible to pay attention. Image: Forecast SOL price chart for 2024

Image: Forecast SOL price chart for 2024

Please remember that next year there will be a Bitcoin halving event. Based on previous events, Bitcoin and altcoins will experience a rally towards the end of the year. For Bitcoin and some altcoins such as Ethereum, it even reached ATH earlier, at the end of the year after the halving.

However for Solana, there is a possibility that the SOL price will not reach the ATH in 2024 because the current price (11/13/23) is still quite far from the ATH , which is -78% of the highest price of US$267.5.

Technically, there is resistance at the price level of US$80 and US$100, so the prediction of the highest price of SOL in 2024 will revolve around the range of US $100 – US$140.

![[LIVE] Engage2Earn: McEwen boost for Rob Mitchell](https://cdn.bulbapp.io/frontend/images/c798d46f-d3b8-4a66-bf48-7e1ef50b4338/1)

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - Is Trump Dying? Or Only Killing The Market?](https://cdn.bulbapp.io/frontend/images/a129e75e-4fa1-46cc-80b6-04e638877e46/1)