3 key figures about the price of Bitcoin suggest an increase above $48,000.

The price of Bitcoin increased by 2% in the last 24 hours, reaching its daily high of $48,200 on February 9th. Technical indicators, exchange-traded fund (ETF) stock portfolio conversions for Bitcoin, and on-chain data suggest that BTC has the strength to revisit highs above $49,000 upon ETF approval.

The Bitcoin SuperTrend indicator occasionally signals a rare buying opportunity.

On the monthly chart, the SuperTrend indicator flashed a bullish signal, switching from red to green and moving below $44,600 on February 8th.

This indicator overlays on the chart, aligning with the trend of BTC, similar to moving averages. It incorporates real average range in its calculations, assisting traders in identifying market trends.

Previous confirmations from this indicator were respective increases of 1,336%, 1,938.4%, and 713% for Bitcoin in 2013, 2017, and 2021.

According to the indicator, as long as it remains in the green and sustains below this price level, the momentum tends to favor optimistic traders.

Bitcoin ETF stock portfolios continue to rise

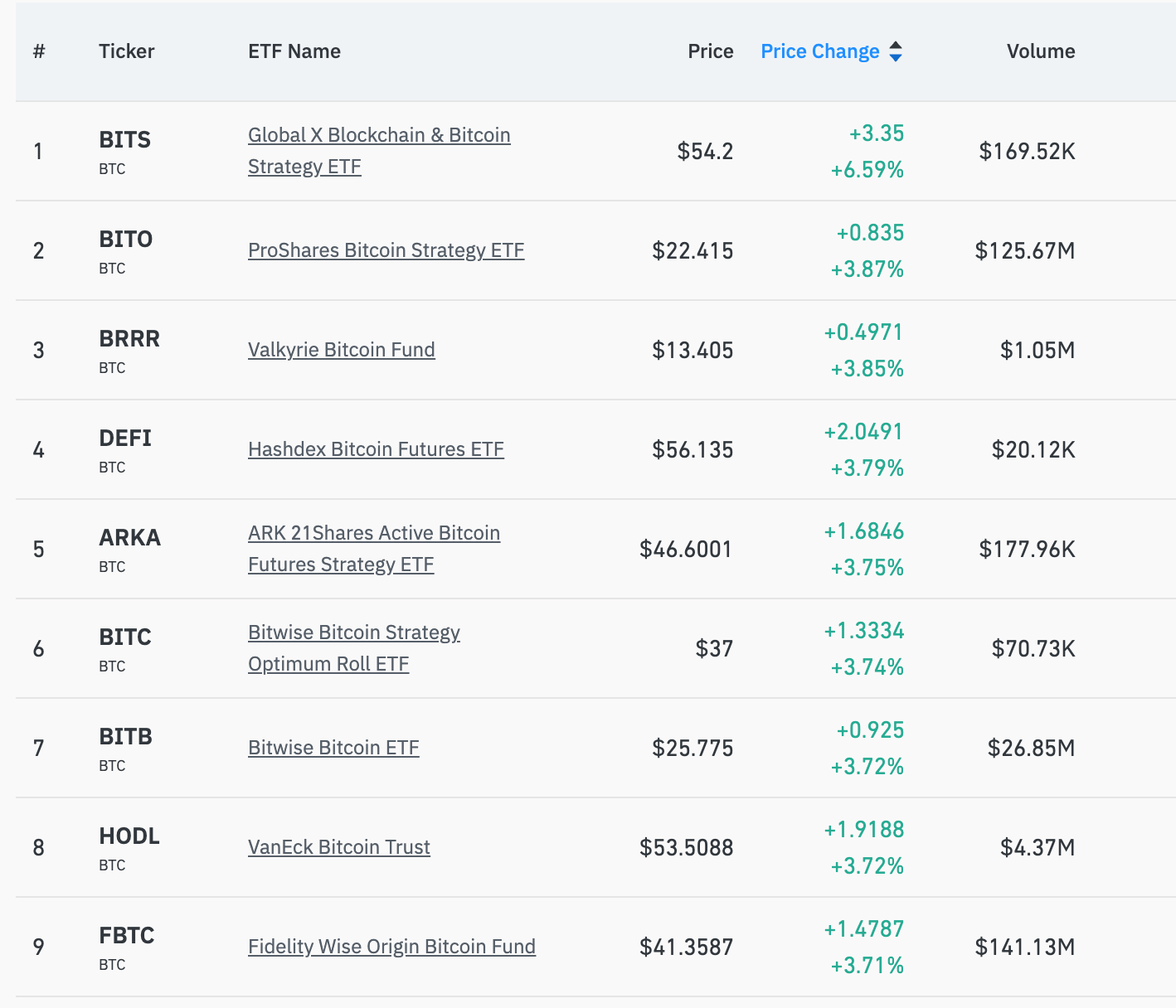

As the price of BTC surpassed $47,000 on February 9th, Bitcoin ETF stocks increased by an average of around 4%.

According to data from Coinglass, the Global X Blockchain & Bitcoin Strategy ETF saw the most significant surge, adding 6.6% in the past 24 hours.

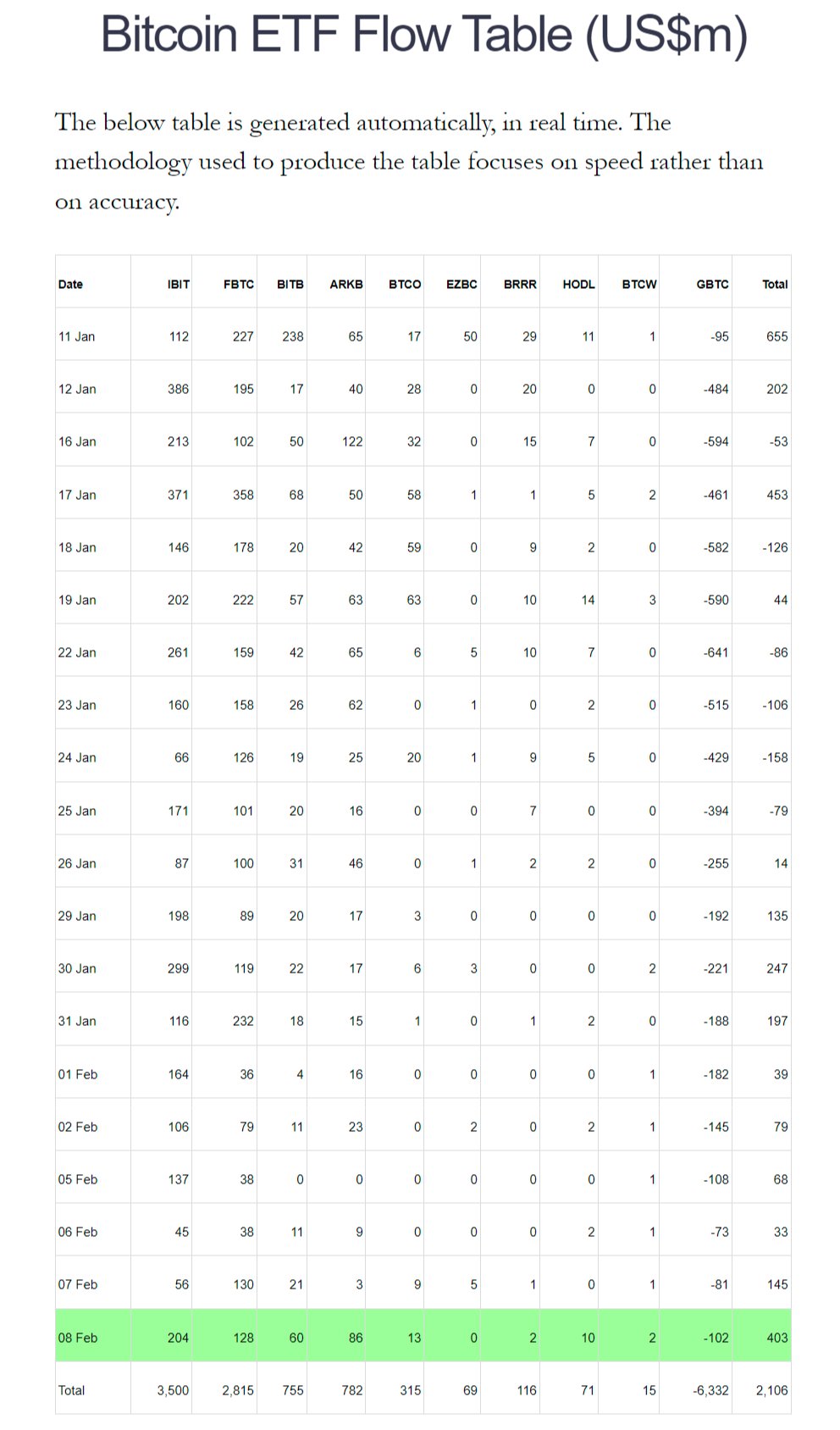

In terms of capital inflow into Bitcoin ETFs, BlackRock's iShares Bitcoin Trust maintains the top position with a total of $3.23 billion as of February 8th, according to Bloomberg data.

Fidelity Wise Origin Bitcoin Fund secures the second position with a total inflow of $2.8 billion. Bitwise Bitcoin ETF and ARK 21Shares Bitcoin ETF rank third and fourth with total inflows of $696 million and $695 million, respectively, as of February 8th.

It's noteworthy that the total capital inflow into BTC ETFs surpasses the outflows from the Grayscale Bitcoin Trust for 9 consecutive days.

The price of Bitcoin ETF stocks is rising, and positive net inflows are emerging as the price of Bitcoin moves, signaling an expected bull run.

Bitcoin finds support around $42,500

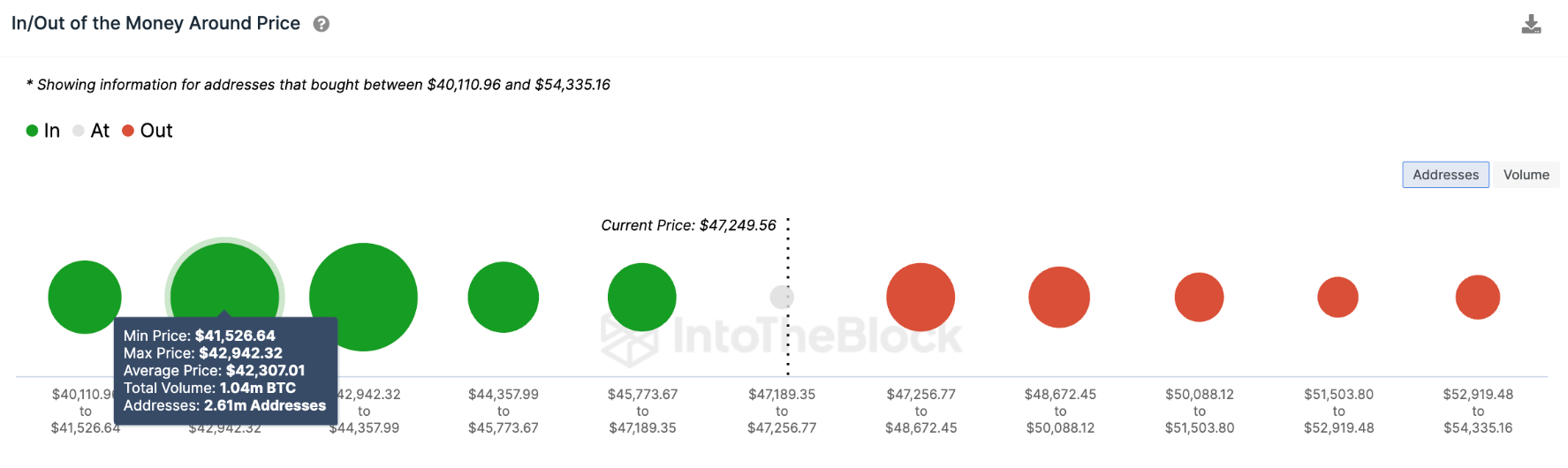

Observing data from IntoTheBlock, Bitcoin is finding support around the $42,500 range. The "In/Out of the Money Around Price" (IOMAP) model provides information about addresses that have bought an asset within a certain price range, indicating that this level is within the range of $41,526 to $42,942. Approximately 2.61 million addresses have previously purchased 1.01 million BTC in this range.

When looking at the daily chart, this is where the 50-day Exponential Moving Average (EMA) is currently situated, making it a robust defensive line for the bullish camp.

From a technical standpoint, the Relative Strength Index (RSI) maintains an upward trajectory, and a price strength of 71 supports the dominance of buyers in the market.

In the short term, it appears that traders are targeting prices in the range of $48,000 to $50,000 for Bitcoin.

Other factors driving the increase in Bitcoin in 2024 include the influx of institutional investors into the space and the anticipated halving event scheduled for April.

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)

![[LIVE] Engage2Earn: McEwen boost for Rob Mitchell](https://cdn.bulbapp.io/frontend/images/c798d46f-d3b8-4a66-bf48-7e1ef50b4338/1)