Tether Invests in StablR, Boosting Stablecoin Adoption in Europe

Tether partners with StablR to expand stablecoin adoption in Europe (EU) as MiCA regulation is set to come into effect on December 30.

Tether (USDT) recently announced an investment in StablR, a European (EU) stablecoin provider, as part of its strategy to boost the adoption of compliant digital assets in the EU market.

The investment underscores Tether’s growing focus on the European market, especially as regulatory frameworks such as the EU’s Markets in Cryptoassets (MiCA) regulation are set to come into effect later this month.

Earlier this year, StablR received an Electronic Money Institution (EMI) license from the Malta Financial Services Authority, allowing the company to issue fully regulated stablecoins across Europe.

Tether Invests In StablR To Promote Stablecoin Adoption In Europe

Read more: https://t.co/y8HtQXEwjR

— Tether (@Tether_to) December 17, 2024

This partnership underscores Tether’s belief in fully compliant stablecoins for a European digital asset ecosystem, said Tether CEO Paolo Ardoino.

The notable point in this partnership is StablR’s integration with Hadron - Tether’s new real world asset (RWA) platform launched at the end of November, allowing the tokenization of almost any asset from stocks, bonds, fiat currencies... into digital tokens. In addition, Hadron also provides comprehensive compliance tools such as KYC, Anti-Money Laundering (AML), risk management and transaction monitoring.

By using Hadron, StablR aims to expand its stablecoin offerings across multiple blockchain networks, thereby increasing accessibility and liquidity for users.

Super excited for StablR investment!

Tether has become the tech infrastructure provider for European regulated stablecoins with Hadron by Tether @hadron_tether

Hadron is a platform-as-a-service built to tokenize any asset (stablecoins, stocks, bonds, funds, real-estate),… https://t.co/HzKiswUqjc

— Paolo Ardoino 🤖🍐 (@paoloardoino) December 17, 2024

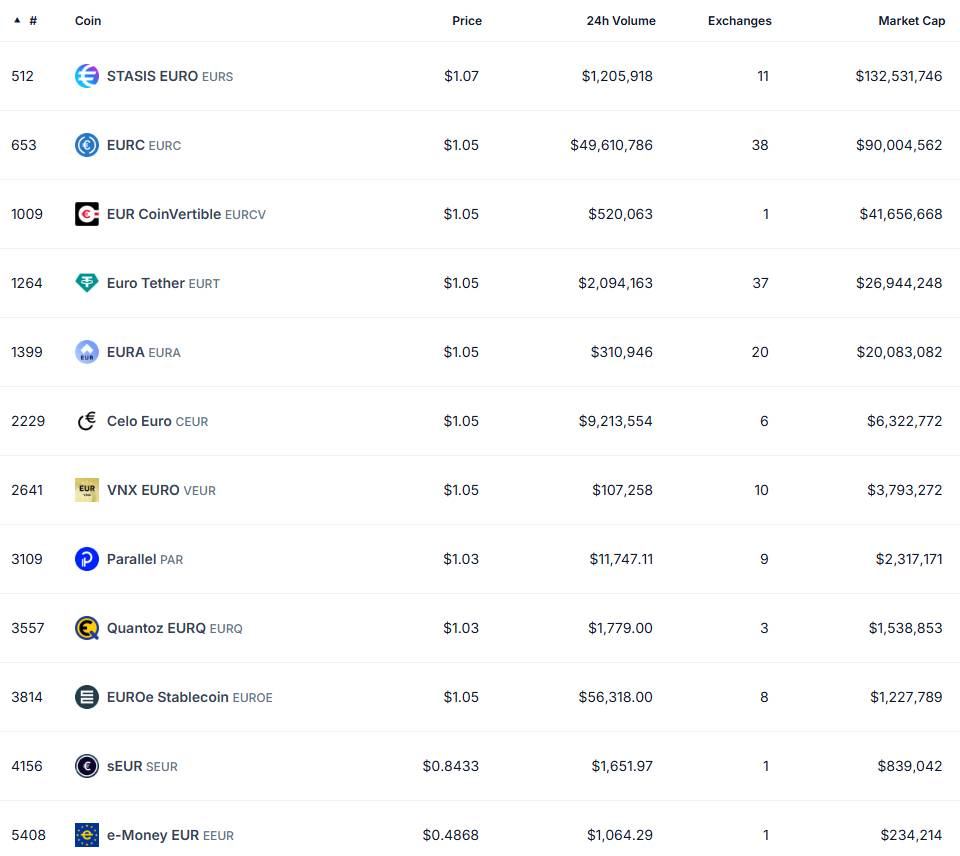

The stablecoin market in Europe, especially Euro-pegged assets, is experiencing significant growth with a market capitalization approaching the $400 million mark.

The EU’s MiCA regulatory framework, which is expected to come into effect on December 30, requires stablecoin issuers and exchanges in the region to adhere to strict standards. This regulatory clarity has facilitated the growth of companies like StablR.

StablR, which recently launched two stablecoins, EURR (euro-pegged) and USDR (US dollar-pegged), offers better liquidity management, lower transaction costs, and significant savings.

Both of StablR’s stablecoins are fully MiCA-compliant and fully reserve-backed, addressing the need for transparent, secure, and easily convertible digital assets. Both stablecoins are issued as ERC-20 tokens on the Ethereum blockchain and are also compatible with the Solana network, ensuring broad interoperability across major blockchain ecosystems.