Bitcoin breaks past $42k, hitting a five-day high

Bitcoin breaks past $42k, hitting a five-day high

Bitcoin ETF flows and upgrades to Coinbase's stock rating are likely at play. Mike Dalton

Mike Dalton

Jan. 26, 2024 at 8:56 pm UTC Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Ads by HypeLab

The price of Bitcoin surpassed $42,000 on Jan. 26 amidst significant spot Bitcoin ETF flows and an upgrade to Coinbase’s stock rating.

Bitcoin (BTC) was valued at $42,040.36 with a market cap of $824.4 billion at 8:05 pm UTC on Friday. That marks 5.3% growth over 24 hours.

Bitcoin’s current price also represents a five-day high, as prices were close to $40,000 on Jan. 24 and 25 and as low as $38,678 on Jan. 23

The cryptocurrency market in its entirety was up 4.6% over 24 hours. Other top ten assets saw comparable price gains today: Avalanche (AVAX) was up 7.3%, Solana (SOL) was up 5.9%, XRP was up 3.7%, BNB was up 3.5%, Cardano (ADA) was up 3.3%, and Ethereum (ETH) was up 1.9%.

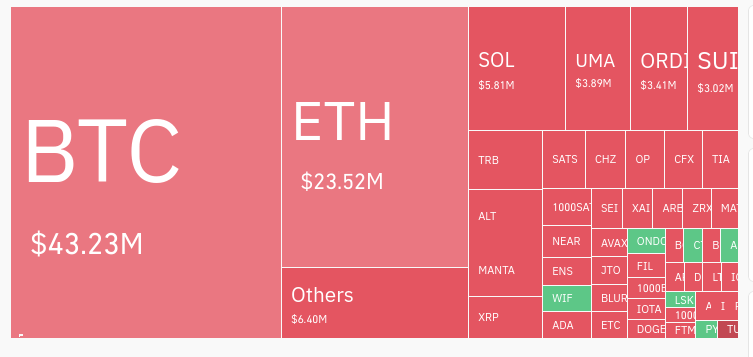

The market saw $116 million in liquidations over 24 hours, according to Coinglass data, with Bitcoin (BTC) accounting for $43.23 million of liquidations and Ethereum (ETH) accounting for $23.52 million of liquidations. Liquidation data for Jan. 26, via Coinglass

Liquidation data for Jan. 26, via Coinglass

Gains may be due to ETF flows, Coinbase rating

Though it is not entirely known why Bitcoin has gained value today, spot Bitcoin ETF inflows and outflows are one major influence on the market.

Outflows from Grayscale’s GBTC ETF are now slowing and may have largely concluded, according to a report from JP Morgan on Jan. 25. High GBTC outflows put more Bitcoin (BTC) onto the market, providing a larger supply in comparison to investor demand. Such outflows likely contributed to falling Bitcoin prices in the weeks following various spot Bitcoin ETF approvals on Jan. 10.

Conversely, inflows into other funds have taken Bitcoin off the market and may be helping to raise prices. Although most spot Bitcoin ETFs have positive inflows, BlackRock’s iShares Bitcoin Trust (IBIT) notably crossed $2 billion in total inflows on Jan. 26. Net inflows for all spot Bitcoin ETFs amount to $744 million.

Other positive developments may have influenced crypto prices as well. Yahoo! Finance analysts noted that Coinbase (COIN)’s stock rating has been upgraded by Oppenheimer & Co. The price of COIN is also up 3.40% today.

AUTHOR

Mike Dalton

Mike Dalton

Journalist at CryptoSlate

Before transitioning to crypto writing in 2018, Mike studied library and information sciences. Currently, he resides on Canada's West Coast.

EDITOR

News Desk

Editor at CryptoSlate

CryptoSlate is a comprehensive and contextualized source for crypto news, insights, and data. Focusing on Bitcoin, macro, DeFi and AI.

@cryptoslate LinkedIn Email Editor

POSTED IN: BITCOIN, ANALYSIS, FEATURED, PRICE WATCH, TRADING

Latest Bitcoin Stories

Bitcoin’s safe-haven status strengthened despite recent price crisis: Kaiko

BlackRock warned SEC lack of in-kind orders for Bitcoin ETF shares could hurt investors

Bitcoin developer Luke Dashjr raises concerns over centralization in Bitcoin mining

Latest Press Releases

Wooooo! Coin Announces Major Milestones with Listings on MEXC and Bitmart

De.Fi Announces $DEFI Airdrop Season 1 Prior To The Token Launch

LiveArt to Launch Chris Levine’s First NFT Collection Featuring Banksy and Other Icons

Disclaimer: Our writers' opinions are solely their own and do not reflect the opinion of CryptoSlate. None of the information you read on CryptoSlate should be taken as investment advice, nor does CryptoSlate endorse any project that may be mentioned or linked to in this article. Buying and trading cryptocurrencies should be considered a high-risk activity. Please do your own due diligence before taking any action related to content within this article. Finally, CryptoSlate takes no responsibility should you lose money trading cryptocurrencies.

From freeze to flourish as Bitcoin hash rate showcases resilience

Bitcoin’s realized price by ‘young supply’ underpins recent price support

RESEARCH1 DAY AGO

In this article Bitcoin

Bitcoin

BTC (24h)

$41,878.27

+4.92%

VOL: $25.42B

MCAP: $821.22B

Bitcoin, a decentralized currency that defies the sway of central banks or administrators, transacts electronically, circumventing intermediaries via a peer-to-peer network.

More about Bitcoin

JPMorgan

JPMorgan

Asset Management, Development Company in North America

JPMorgan Chase & Co is a global leader in financial services, offering solutions to the world’s most important corporations, governments, and institutions in more than 100 countries.

More about JPMorgan

Twitter LinkedIn

Coinbase

Coinbase

Exchange Company in North America

Coinbase is a digital currency exchange and wallet service that allows individuals to buy, sell, and store digital currencies, such as Bitcoin, Ethereum, and Litecoin.

More about Coinbase

Twitter LinkedIn

BlackRock

BlackRock

Asset Management Company in North America

BlackRock, synonymous with global asset management, is an American multinational investment management corporation based in New York City.

More about BlackRock

Twitter LinkedIn

Grayscale Investments

Grayscale Investments

Asset Management, Bitcoin ETF Company in North America

Established in 2013 by Digital Currency Group, Grayscale Investments is a trusted authority on digital currency investing and cryptocurrency asset management.

More about Grayscale Investments

Twitter LinkedIn

Recent Bitcoin Stories

BlackRock’s IBIT ETF now holds almost 50,000 BTC as AUM hits $2 billion

Bitcoin’s safe-haven status strengthened despite recent price crisis: Kaiko

Crypto News

News Topics

Insights

Coin Data

Crypto Sectors

Directory

Alpha

Connect

More

Disclaimer: By using this website, you agree to our Terms and Conditions and Privacy Policy. CryptoSlate has no affiliation or relationship with any coin, business, project or event unless explicitly stated otherwise. CryptoSlate is only an informational website that provides news about coins, blockchain companies, blockchain products and blockchain events. None of the information you read on CryptoSlate should be taken as investment advice. Buying and trading cryptocurrencies should be considered a high-risk activity. Please do your own diligence before making any investment decisions. CryptoSlate is not accountable, directly or indirectly, for any damage or loss incurred, alleged or otherwise, in connection to the use or reliance of any content you read on the site.

© 2024 CryptoSlate. All rights reserved. Disclaimers | Terms | Privacy

qwertyuiop1234567890!@#$%^&*()