Bitcoin Price Prediction: Dips to $43,000 as CBOE Pulls ETF Amid Economic Shift

In the dynamic world of cryptocurrencies, Bitcoin’s price approaches the $43,000 threshold, marking a decline of over 1.25% on Wednesday. This adjustment in price occurs against the backdrop of significant market and regulatory news.

In the dynamic world of cryptocurrencies, Bitcoin’s price approaches the $43,000 threshold, marking a decline of over 1.25% on Wednesday. This adjustment in price occurs against the backdrop of significant market and regulatory news.

The CBOE Exchange has retracted its application for the Global X spot Bitcoin ETF, introducing uncertainty into the market. Simultaneously, economic forecasts by analyst Richard Bove suggest China’s economy may soon outpace the United States, potentially altering the global financial hierarchy and challenging the US dollar’s supremacy as the reserve currency.

Additionally, US Representative French Hill, speaking at the FDD Event, highlighted a potentially supportive legislative future for digital currencies. These developments provide critical context for Bitcoin’s current valuation and offer insight into its future direction.

CBOE Withdraws Global X Bitcoin ETF Application: Impact on Cryptocurrency

After the SEC rejected its application on January 10, the Cboe BZX Exchange withdrew its request to list shares of the Global X Bitcoin Trust as a spot Bitcoin ETF. According to the notice from the SEC, the exchange formally withdrew the plan on January 26.

JUST IN:

Cboe exchange withdraws application to list Global X spot Bitcoin ETF … pic.twitter.com/diEva5Xx6B

— Bitcoin Scoop (@bitcoin_scoop) January 30, 2024

This development follows the recent acceptance of spot Bitcoin ETFs on US exchanges. The withdrawal has had little effect on the price of Bitcoin, although it might be the result of specific considerations for Global X’s ETF.

The prevailing view is that the introduction of Bitcoin ETFs has led to growing institutional interest and potential mainstream acceptance, which could ultimately contribute to an increase in the price of BTC.

Richard Bove Forecasts China’s Economy Overtaking the US: Implications for the Dollar

The cautionary note issued by Richard Bove regarding the depreciation of the US currency and the possible expansion of China’s economy may be advantageous for Bitcoin (BTC).

Investors may look for alternate stores of wealth as Bove highlights the threat posed by the outsourcing of American production and the depreciation of the dollar’s standing as the reserve currency.

Referred to as “digital gold,” Bitcoin has been positioned as a hedge against currency devaluation and economic instability.

Investors may seek to safeguard their capital by using decentralized assets like Bitcoin during periods of economic and geopolitical upheaval.

Famed financial analyst Richard X. Bove predicts the fall of the US economy and says China will take over as the money superpower in his final forecast ahead of his retirement: 'The dollar is finished as the world's reserve currency' https://t.co/3DcIFF71gb pic.twitter.com/tC5YqfWVKn

— Daily Mail Online (@MailOnline) January 29, 2024

Bove’s remarks might support a narrative that encourages more people to adopt and be interested in Bitcoin as a competitive substitute for conventional money and assets.

US Rep French Hill Optimistic on Crypto Legislation: Insights from FDD Event

During a Foundation for Defense of Democracies event, Republican representative from Arkansas, Rep. French Hill, gave a good update on the status of measures pertaining to cryptocurrency.

Hill, the head of the House Financial Services Subcommittee on Digital Assets, voiced hope for the Clarity for Payment Stablecoins Act and the Financial Innovation and Technology for the 21st Century Act.

Chair of digital assets subcommittee hopes to see crypto bills ’coming to fruition’ in 2024

Speaking at an event hosted by the Foundation for Defense of Democracies (#FDD) on Jan. 29, Representative Hill said U.S. lawmakers in the House of Representatives had marked up two bills… pic.twitter.com/zNKU6BG37U

— TOBTC (@_TOBTC) January 30, 2024

In 2023, both proposals made progress after leaving the House Financial Services Committee. A regulatory framework for stablecoins is intended to be established by the Clarity for Payment Stablecoins Act, while the cryptocurrency market structure is addressed by the more comprehensive Financial Innovation and Technology for the 21st Century Act.

Increased regulatory clarity brought forth by changes in crypto legislation may influence uptake and mood, which might have a favorable indirect effect on Bitcoin values.

Bitcoin Price Prediction

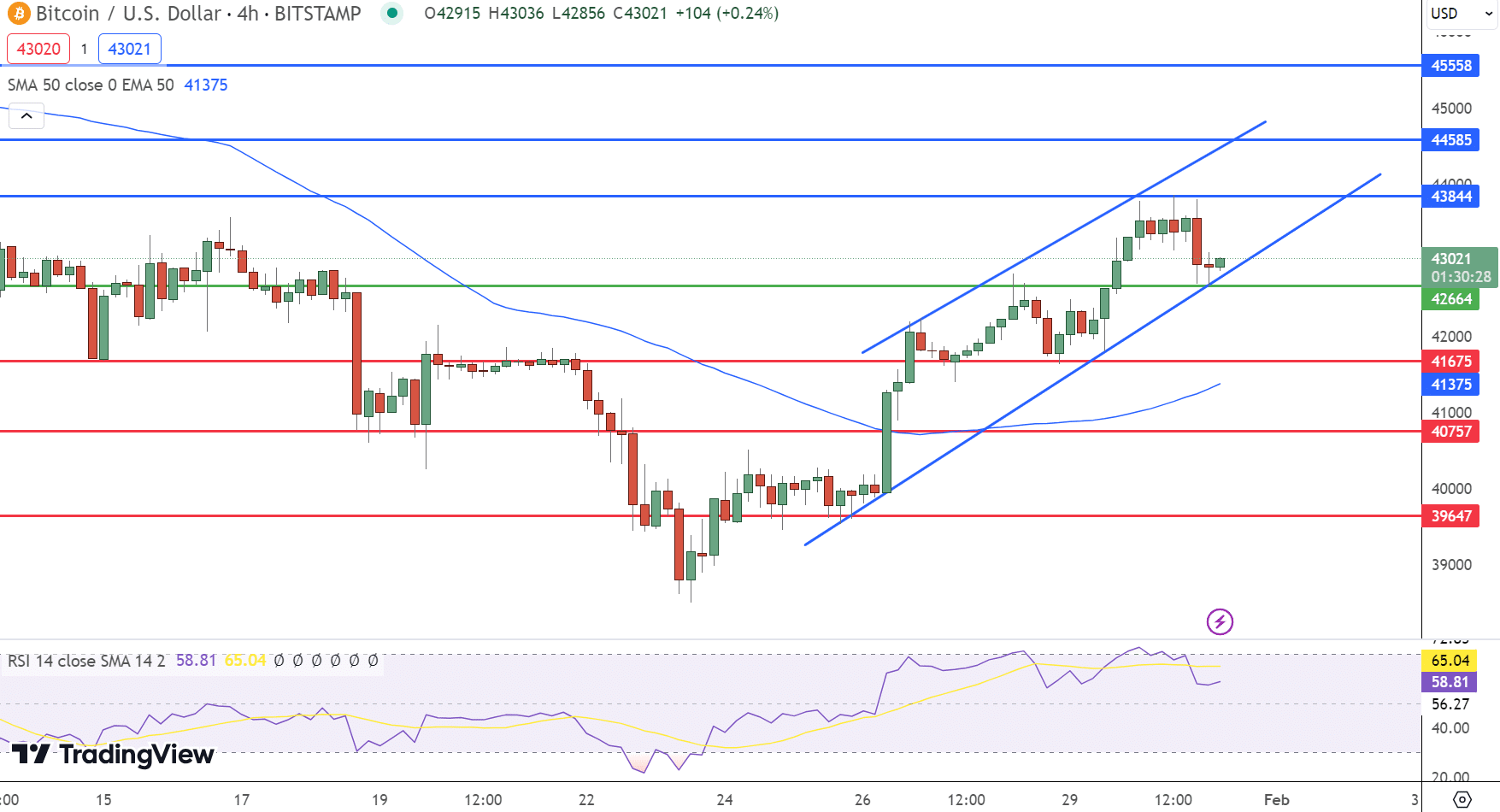

On January 31, Bitcoin exhibits marginal movement, trading at $42,923 with a pivot point of $42,664. Immediate resistance levels are identified at $43,844, $44,585, and $45,558, which could serve as ceilings for any upward momentum.

Conversely, support levels are established at $41,675, $40,757, and $39,647, offering potential floors for price retracements.

Technical analysis reveals an upward channel formation, with Bitcoin’s recent closure of a Doji candlestick just above the pivot point indicating a potential for buying interest.

The possibility of forming a morning star candlestick pattern further bolsters the prospect of a bullish trend. Bitcoin Price Chart – Source: Tradingview

Bitcoin Price Chart – Source: Tradingview

With the Relative Strength Index (RSI) at 58 and the 50-day Exponential Moving Average (EMA) at $41,375, the technical indicators align with a cautiously optimistic outlook.

In conclusion, the overall trend for Bitcoin is bullish above the $42,664 level, suggesting that if prices sustain above this pivot, the market could witness further buying momentum.

Top 15 Cryptocurrencies to Watch in 2023

Stay up-to-date with the world of digital assets by exploring our handpicked collection of the best 15 alternative cryptocurrencies and ICO projects to keep an eye on in 2023. Our list has been curated by professionals from Industry Talk and Cryptonews, ensuring expert advice and critical insights for your cryptocurrency investments.

Take advantage of this opportunity to discover the potential of these digital assets and keep yourself informed.

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.

Global X Exits the Spot Bitcoin ETF Approval Race

Source: DALL·E 3

Source: DALL·E 3

ETF provider Global X, has pulled its application for a spot Bitcoin ETF, an SEC filing on Tuesday showed.

The CBOE BZX Exchange submitted a withdrawal notice for the Global X Bitcoin Trust on Jan. 26, around two weeks after the SEC approved 11 other spot Bitcoin ETFs.

Securing approval for these 11 funds was tough. At first, the SEC had concerns about market manipulation, lack of surveillance-sharing agreements, and monitoring Bitcoin spot markets for fraud.

After facing resistance from the SEC in its initial attempt to launch a spot bitcoin ETF in 2021, Global X faced further delays upon refiling in Aug. 2023.

Global X missed the final list of potential ETFs due to documentation issues, but it’s not the only one that came up short. Pando Asset Management and 7RCC are also waiting for approval for their spot bitcoin ETFs.

Global X didn’t return Cryptonews’ request for comment by press time.

GBTC Outflows are Slowing

The authorized ETFs, including Bitwise, Grayscale, and BlackRock, saw substantial outflows since they opened for trade. These outflows, especially from GBTC, affected Bitcoin’s price due to market selling pressure. Analysts noted that outflows were mainly tied to factors like forced selling related to the FTX estate and profitable investor strategies tied to GBTC’s discount in the past two years.

Analysts noted that outflows were mainly tied to factors like forced selling related to the FTX estate and profitable investor strategies tied to GBTC’s discount in the past two years.

But Bloomberg analyst James Seyffart pointed out that the daily outflows from GBTC fell to $191.7m on Monday. These outflows have been partially balanced by investments flowing into the recently launched spot ETFs.

Global X’s Bitcoin ETF Withdrawal ‘Not Surprising’

Seyffart also said that Global X’s withdrawal was unsurprising as “they were out of the race since at least early December but now its official.”

Official withdrawal request for @GlobalXETFs' #Bitcoin ETF. This is not surprising because we have known they were out of the race since at least early December but now its official. pic.twitter.com/1ghjh3O5Hw

— James Seyffart (@JSeyff) January 30, 2024

A spot Bitcoin ETF enables investors to track the price fluctuations of Bitcoin without needing to possess the cryptocurrency, as the ETF itself holds the Bitcoin.

Goldman Sachs’ head of digital assets, Mathew McDermott, pointed out that investing in Bitcoin through these ETFs is a more cost-efficient option compared to directly owning the crypto. He recently said Goldman has an “incredibly positive” view of the spot Bitcoin ETF approvals’ market impact.

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - Is Trump Dying? Or Only Killing The Market?](https://cdn.bulbapp.io/frontend/images/a129e75e-4fa1-46cc-80b6-04e638877e46/1)

![[FAILED] Engage2Earn: McEwen boost for Rob Mitchell](https://cdn.bulbapp.io/frontend/images/c798d46f-d3b8-4a66-bf48-7e1ef50b4338/1)