The Second and Final Crypto Crash

In anticipation to what would be a hectic week

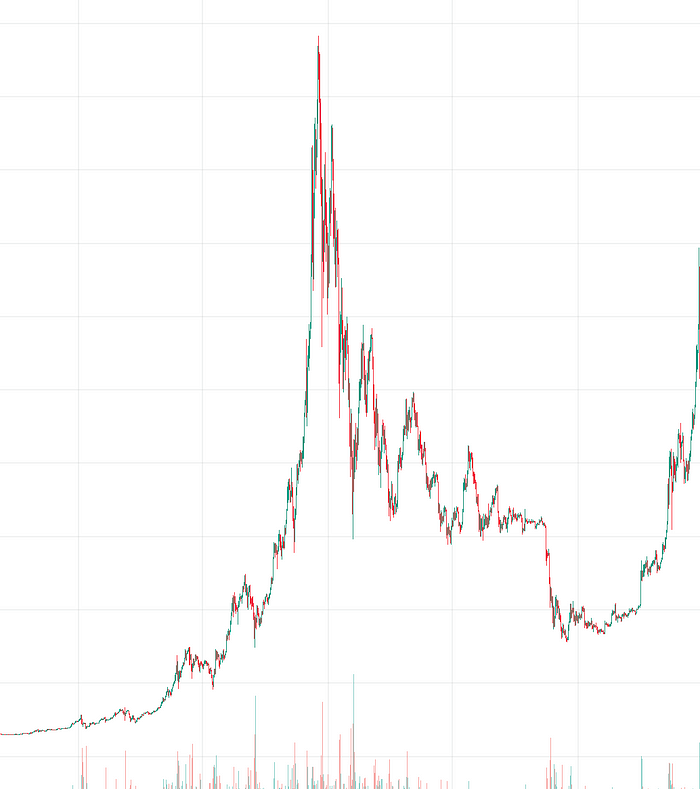

The bear market typically doesn’t conclude until we get that biggest price drop of price worth the legendary status until years later. We had that last cycle in 2018, which was then followed by the 2020 black swan covid crash.

Safe to say we already got the first 2018-style 50% crash back then when FTX blew up and Bitcoin reached a 16k price point back in November 2022. Now we are waiting for the second one.

2018 = 2022, 2020 = ?

There is an eerie similarity between the 2018 and the 2022 crash, in a way that it is more of crypto own-industry induced than says, macro. It is a distinct crypto event and not something caused by a boarder market crash. Yes, it was preceded by the FED raising rates but the final nail in the coffin was presented by none other than our own Sam Bankman.

Both 2018 and 2019 crashes were also the first “shock” after the all-time high. The first lowest of the low. the 2012–2019 post bull crash

the 2012–2019 post bull crash Q4 2022 FTX crash

Q4 2022 FTX crash

Both were also followed by a pump that gives the illusion of “we’re going back” for months, when typically, there’ll be some kind of retest before the bear cycle truly concludes.

In the last bear market, that ‘retest’ was covid crash. And I believe we’re heading to that now. We are waiting for the 2020 equivalent.

For the second crash, I take notes of some characteristics.

- Preceding the crash, there were pumps and a “we’re going back” vibe within the industry. Not only price-wise, but development like institutional adoption (i.e Blackrock bitcoin ETF) was among the vibe.

- The seed of the next bull is starting to get planted. It was DEFI SUMMER in 2019–2020. These days, anything close to resemble DeFi Summer is the INFRASTRUCTURE SUMMER. I believe restaking will play a huge role in this.

- Lastly and more importantly, unlike the first crash, the second crash is influenced by big macro events, totally out of the hand of the crypto

![[FAILED] Engage2Earn: McEwen boost for Rob Mitchell](https://cdn.bulbapp.io/frontend/images/c798d46f-d3b8-4a66-bf48-7e1ef50b4338/1)

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - Is Trump Dying? Or Only Killing The Market?](https://cdn.bulbapp.io/frontend/images/a129e75e-4fa1-46cc-80b6-04e638877e46/1)