Binance Announces Latest Proof of Reserves

Binance Announces Latest Proof of Reserves

The world's largest cryptocurrency exchange, Binance, recently announced its proof of reserves, demonstrating transparency and credibility to its users.

Binance, the world’s leading cryptocurrency exchange, has released its latest Proof of Reserves (PoR) report, providing transparency regarding its holdings of various digital assets, including Shiba Inu (SHIB). Published in April 2024, the report details Binance’s SHIB reserves since April 1, 2024, at 00:00 UTC.

Binance holds over 67 trillion Shiba Inu (SHIB) tokens

The PoR report reveals that Binance currently holds a significant amount of SHIB tokens, exceeding 67.67 trillion. This substantial reserve translates into holdings worth approximately $1.96 billion based on the SHIB trading price at the audit time ($0.00002894 USD).

SHIB asset coverage ratio exceeds 100%

Interestingly, the exchange’s SHIB reserves have surpassed the net balance held by users. According to the report, Binance users collectively hold around 65.32 trillion SHIB tokens, equivalent to $1.89 billion. This means the asset coverage ratio stands at 103.60%. In simpler terms, for every 1 SHIB token deposited by users, Binance reserves more than 1 SHIB token.

Related: Deutsche Bank Releases Survey Results on Bitcoin

The implementation of Binance’s PoR system and other major exchanges stems from FTX’s collapse in late 2023. This initiative aims to enhance transparency and rebuild trust within the cryptocurrency community. By publishing monthly PoR reports, exchanges demonstrate that they hold users’ deposited digital assets in a verifiable manner.

Recognizing the increasing popularity of Shiba Inu on its platform, Binance integrated SHIB into its PoR system in February 2023. Currently, the exchange’s PoR system encompasses a total of 31 cryptocurrencies, including the most widely traded digital assets on Binance.

Binance Holdings for Bitcoin (BTC) and Ethereum (ETH)

Binance Por

Binance Por

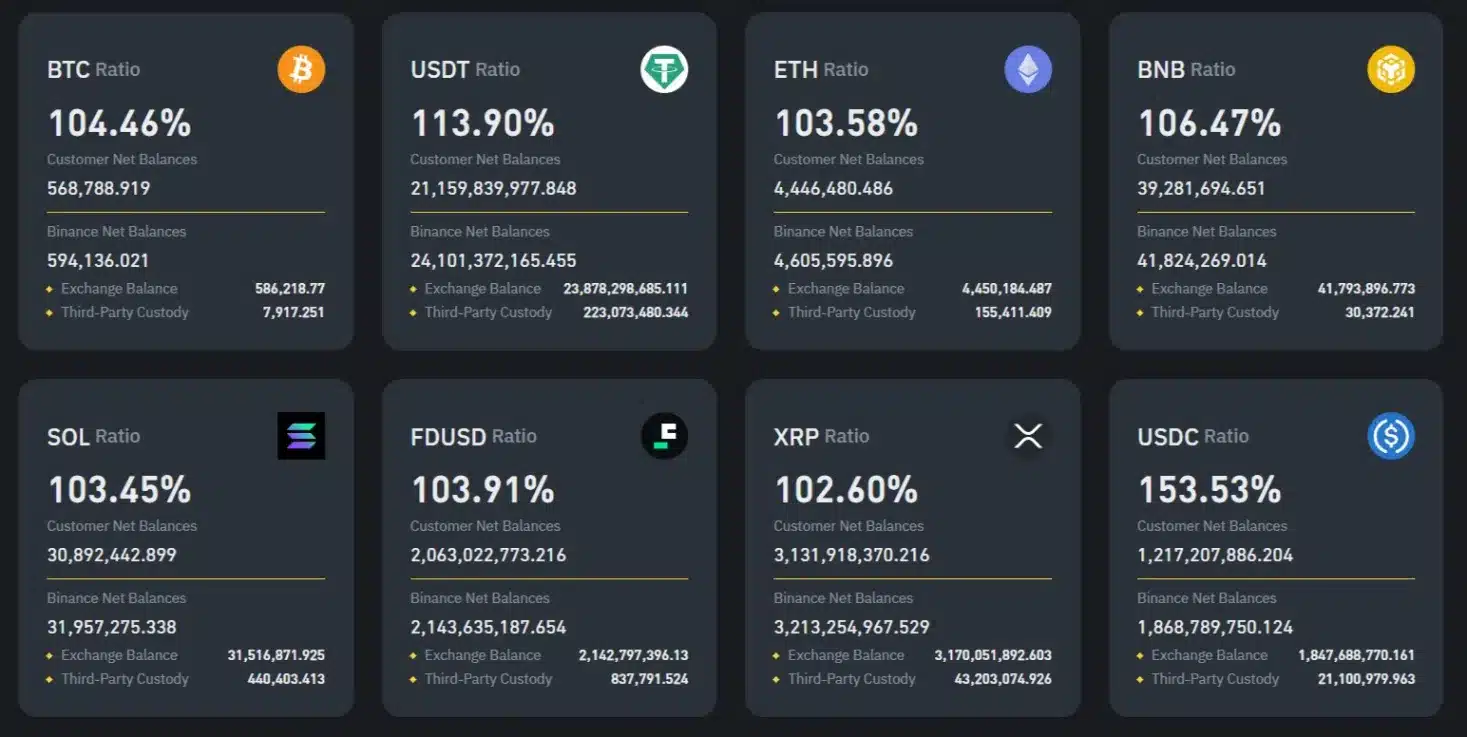

The latest PoR report also sheds light on Binance’s reserves for other prominent cryptocurrencies. Since April 1, 2024, the exchange maintains asset coverage ratios exceeding 100% for both Bitcoin (BTC) and Ethereum (ETH).

For BTC, the asset coverage ratio is 104.46%, with user deposits amounting to 568,788.919 BTC (approximately $41.09 billion USD) and the exchange’s net balance standing at 594,136.021 BTC (approximately $42.92 billion USD).

Similarly, the asset coverage ratio for ETH is 103.58%. Binance users hold 4,446,480.486 ETH (valued at $16.04 billion USD) in deposits, while the exchange boasts a net balance of 4,605,595.896 ETH (approximately $16.61 billion USD).

An important note is that Binance is preparing to implement mandatory Know Your Customer (KYC) policies before April 20, 2024. This policy may impact the custody of cryptocurrencies on the exchange. Users who fail to complete KYC requirements will no longer have access to their sub-accounts on the platform, potentially resulting in changes to the overall asset balances held by Binance.

Binance’s publication of PoR reports aims to enhance transparency regarding the reserves of various cryptocurrencies on the exchange, including the increasingly popular SHIB. As the cryptocurrency market continues to evolve, initiatives like these may play a crucial role in fostering trust and security for investors.

![[LIVE] Engage2Earn: McEwen boost for Rob Mitchell](https://cdn.bulbapp.io/frontend/images/c798d46f-d3b8-4a66-bf48-7e1ef50b4338/1)

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)