BlackRock Bitcoin ETF loses steam: BTC price impact?

- Though earlier inflows were worth billions, the ETF registered a net outflow on the 10th of June.

- Long-term holders were cashing out, suggesting a further decline for BTC.

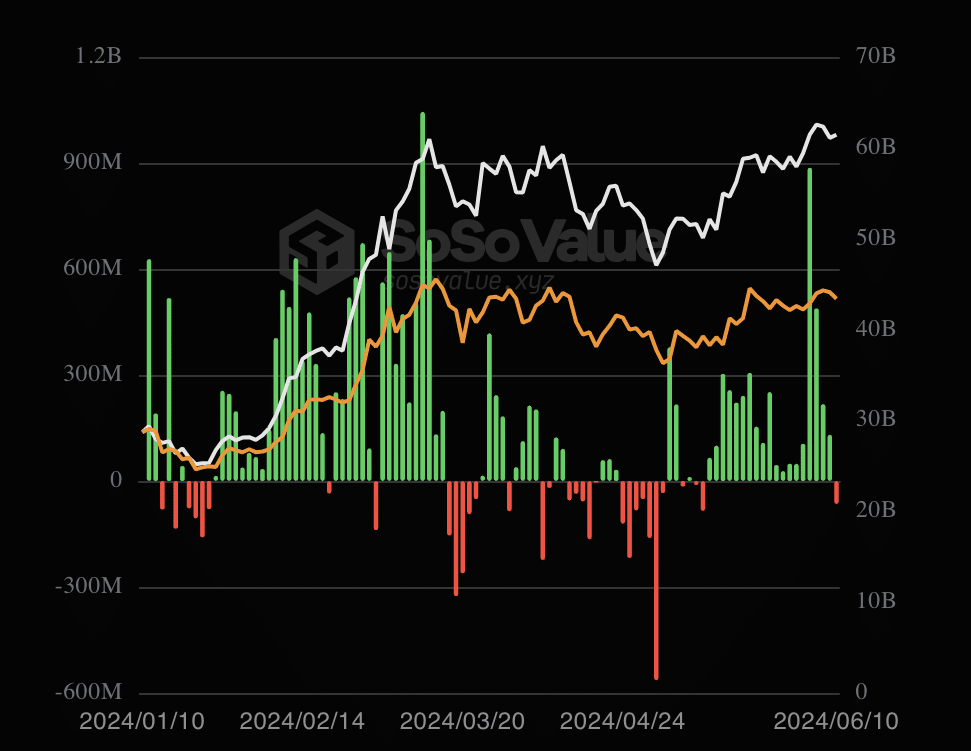

Bitcoin [BTC] ETFs have registered 19 consecutive days of inflows after enduring outflows for a long period. Led by BlackRock Bitcoin ETF, the inflows have been worth almost $3 billion in the last few weeks.

For example, on the 10th of June, BlackRock recorded an inflow of $6.34 million. Bitwise’s IBIT had $7.59 million. However, the tides seem to have changed as Grayscale’s GBTC had a higher outflow at$39.53 million.

As a result of GBTC’s record, the total outflow was higher than the inflow. For the unaccustomed, a Bitcoin ETF is not the same as BTC, the cryptocurrency.

The outflows are taking the top spot

For Bitcoin ETFs, you don’t need to own Bitcoin. Instead, you only need to have exposure to the cryptocurrency as the price impact the Net Asset Value of the ETF.

In the first quarter (Q1) of 2024, the assets, led by BlackRock Bitcoin ETF, recorded billions of dollars in inflows on several days. Because of this, the price of the coin rallied to a new all-time high in March.

Later on, the money stopped coming in, thereby, leading Bitcoin to slip below $60,000 at one point. But the resurgence in the last few weeks ensured that BTC’s correction slowed down.

Also, it was during the same period that BlackRock Bitcoin ETF hit $20 billion in AUM. AUM stands for Assets Under Management. The AUM reflects the inflow and outflow of a fund, and the price performance of the assets.

However, with the recent increase in outflows, Bitcoin’s price might be heading for a decline. At press time, BTC changed hands at $67,539. This represents a 2.63% decrease in the last 24 hours.

Will BTC slip below $67,000?

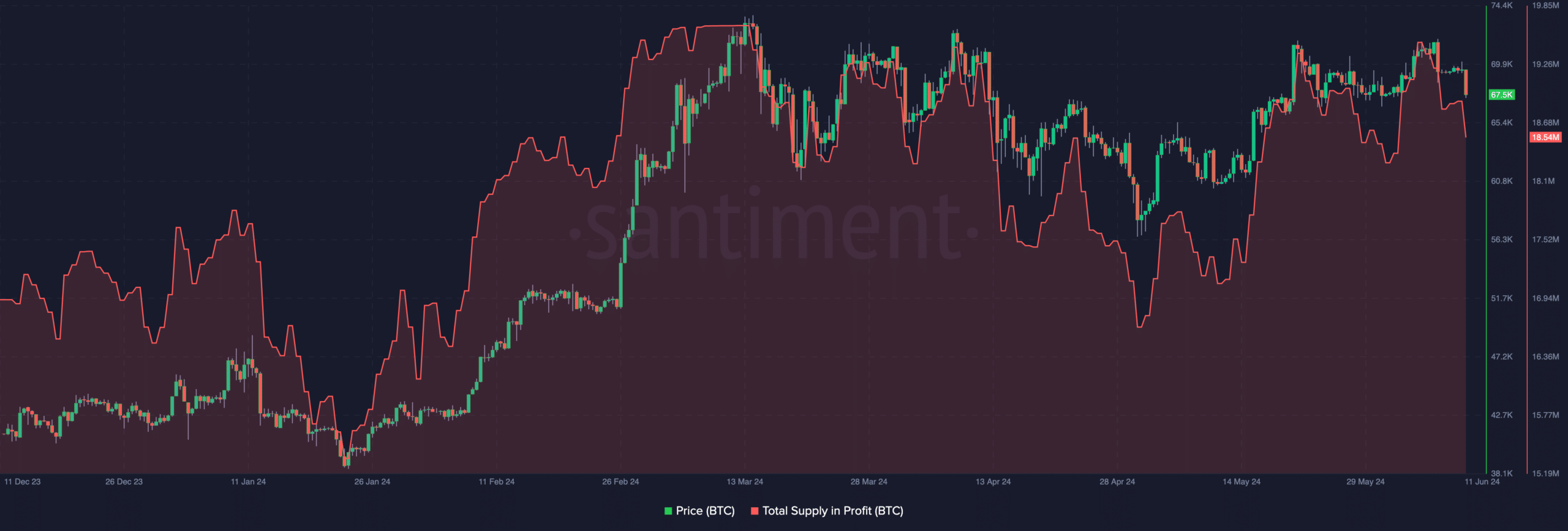

As a result of this, the total supply in profit dropped. According to Santiment, Bitcoin’s total supply in profit has declined to 18.54 million from a ceiling of 19.64 million.

Should Bitcoin price continue to drop, the supply in profit will also head downwards. However, a lower profit supply could be a chance for market participants to buy the coin at a discount. Source: Santiment

Source: Santiment

If this buy signal appears, Bitcoin might rebound toward $70,000 in the short term. However, if selling pressure continues, the price of BTC could decrease to $65,000.

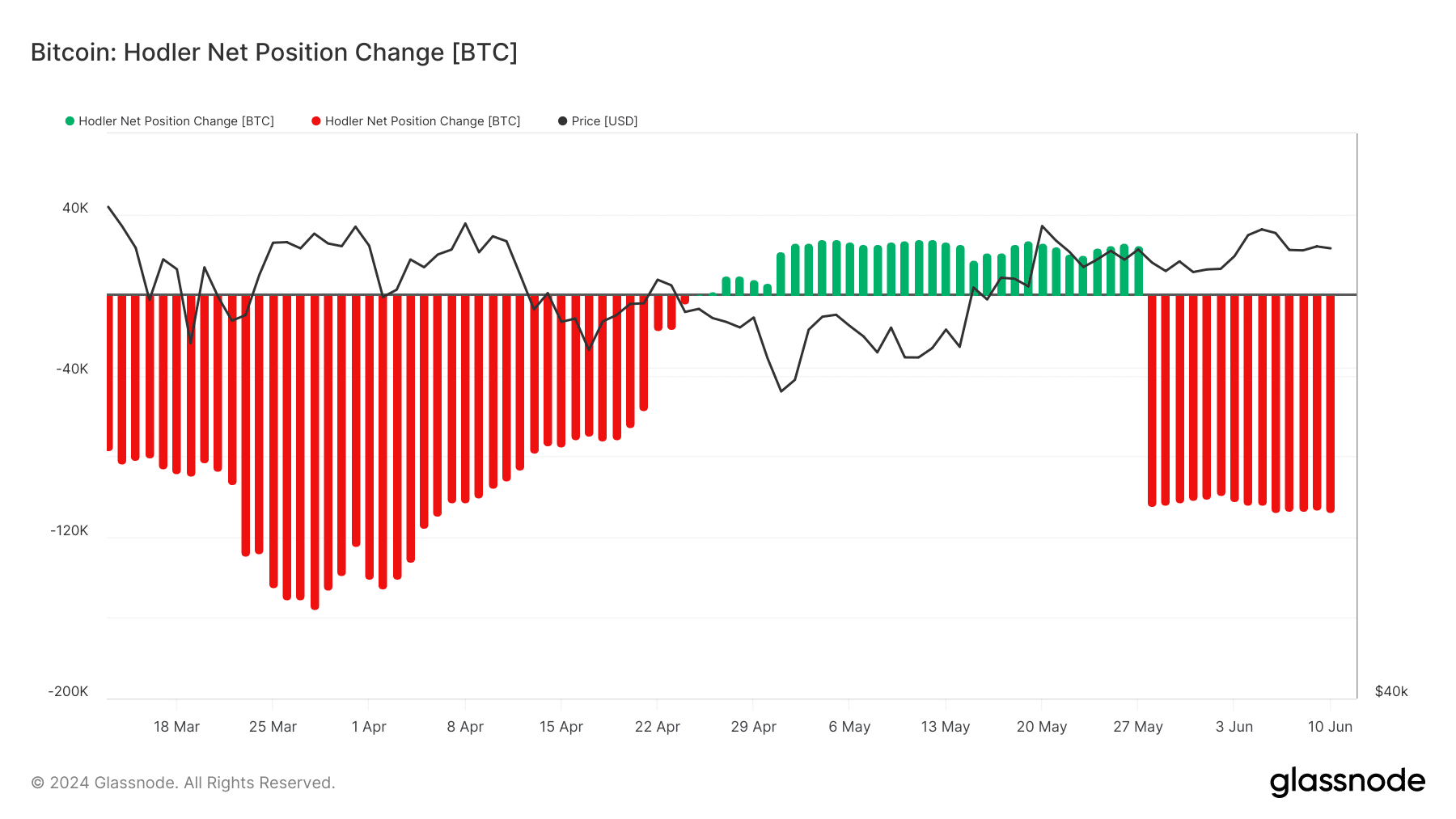

Apart from BlackRock Bitcoin ETF and the metric above, AMBCrypto looked at a crucial indicator. The metric considered was the Hodler Net Position Change.

A positive reading of this indicator suggest that long-term holders are accumulating. On the other hand, a negative value implies an increase in Bitcoin cashed out. Source: Glassnode

Source: Glassnode

Is your portfolio green? Check the Bitcoin Profit Calculator

According to Glassnode, Bitcoin’s Hodler Net Position Change was -107.211 BTC. This implies that HODLers have been booking profits.

As such, Bitcoin’s price could decrease rather than rebound. However, the bearish bias could be invalidated if accumulation starts to come in large numbers.

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - OM(G) , My Biggest Bag Was A Scam????](https://cdn.bulbapp.io/frontend/images/99de9393-38a8-4e51-a7ab-a2b2c28785bd/1)

![Nekodex – Earn 20K+ NekoCoin ($20) [Highly Suggested]](https://cdn.bulbapp.io/frontend/images/b4f0a940-f27c-4168-8aaf-42f2974a82f0/1)

![[FAILED] Engage2Earn: McEwen boost for Rob Mitchell](https://cdn.bulbapp.io/frontend/images/c798d46f-d3b8-4a66-bf48-7e1ef50b4338/1)