Uptober Begins: Bitcoin's Rally Sparks $40K Hopes; Yet $20K Threat Lingers

Up or Down? Bitcoin’s October Saga Unfolds With Poles Apart Price Predictions

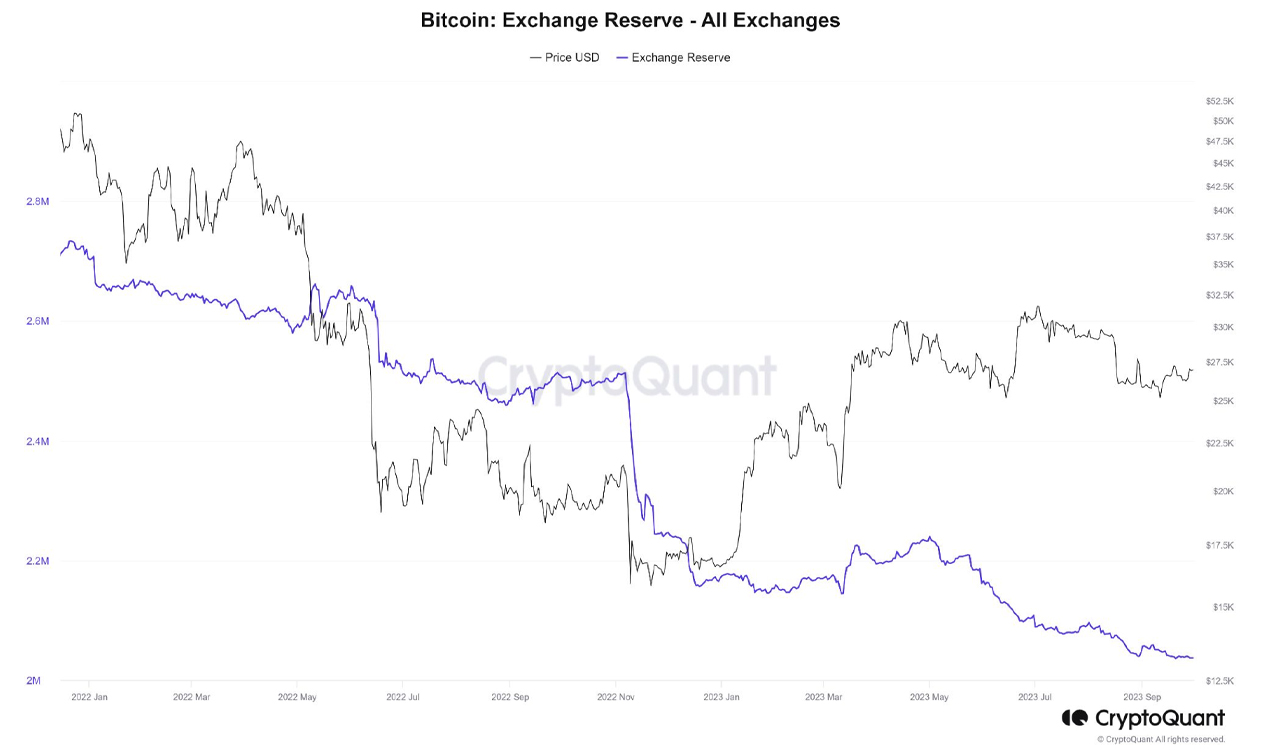

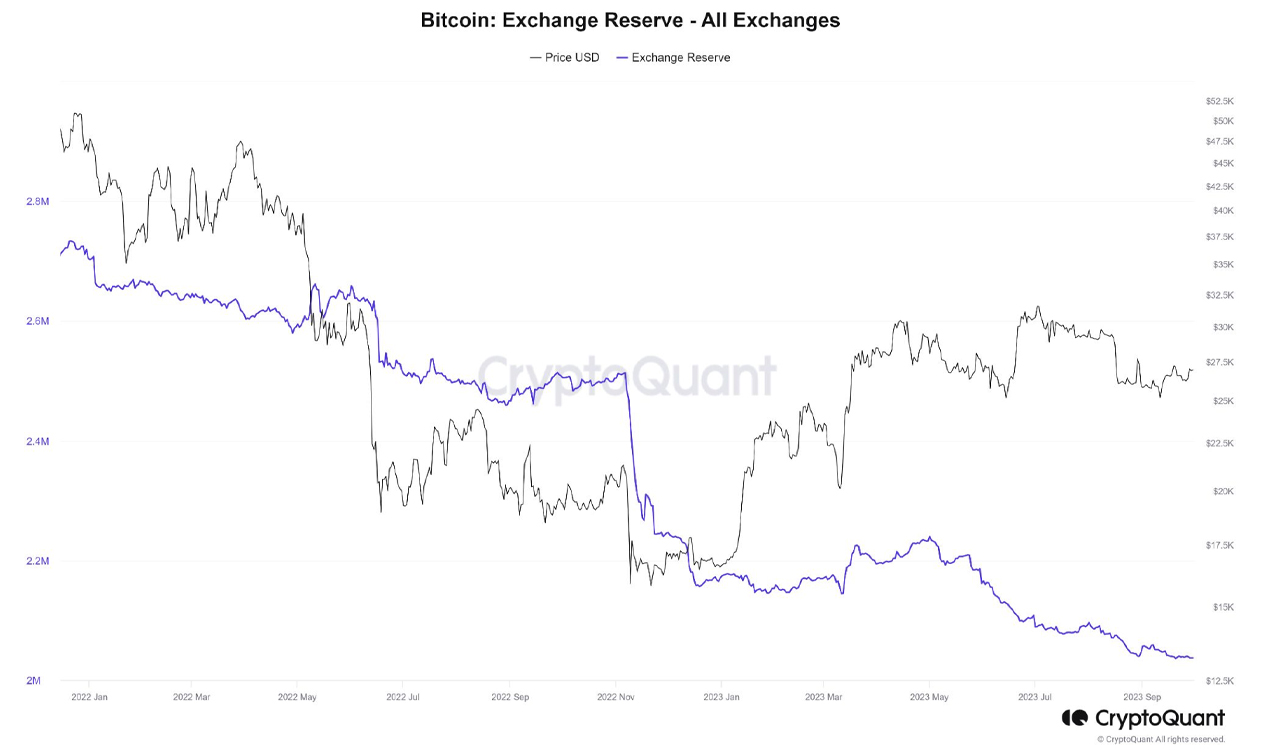

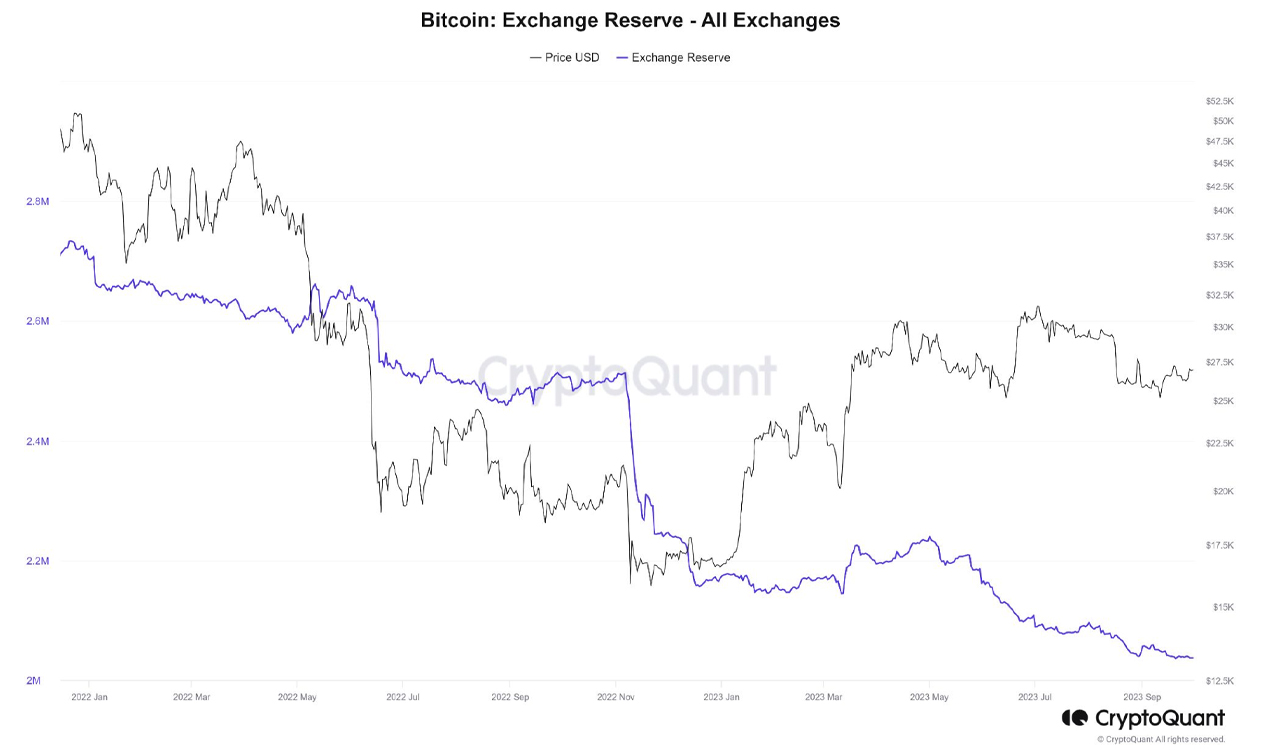

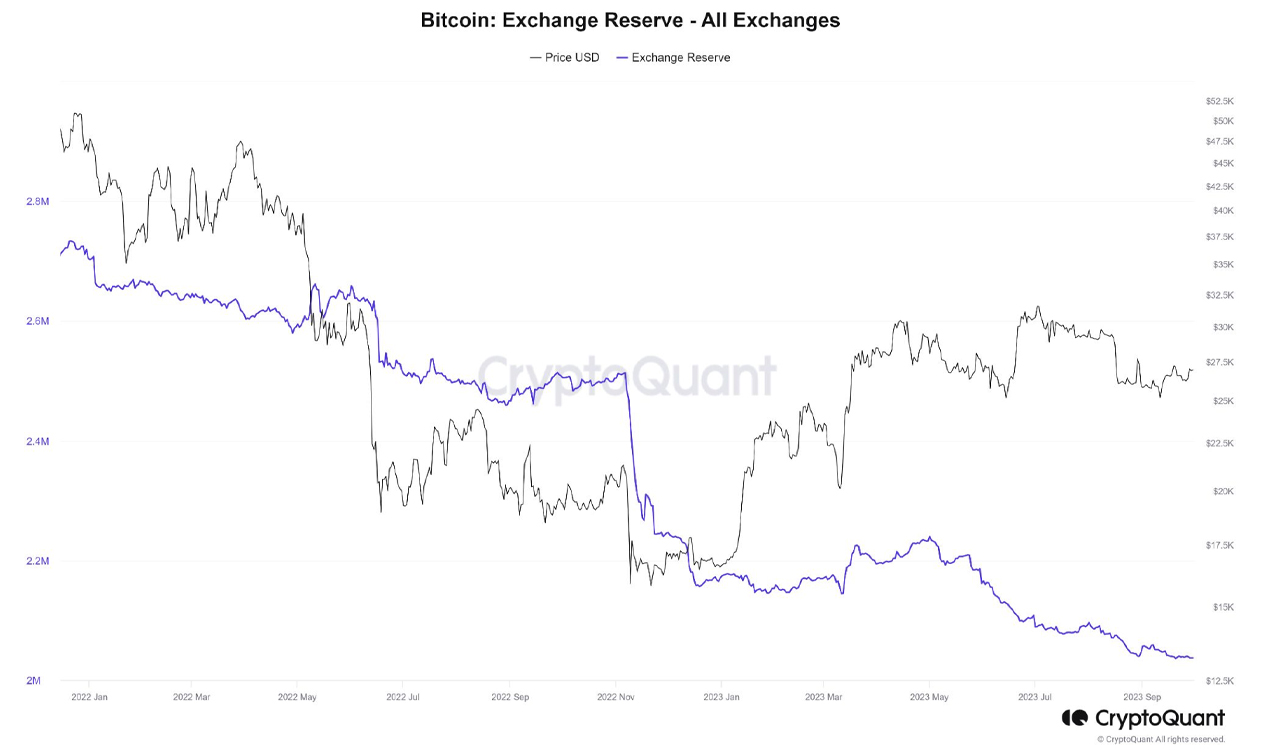

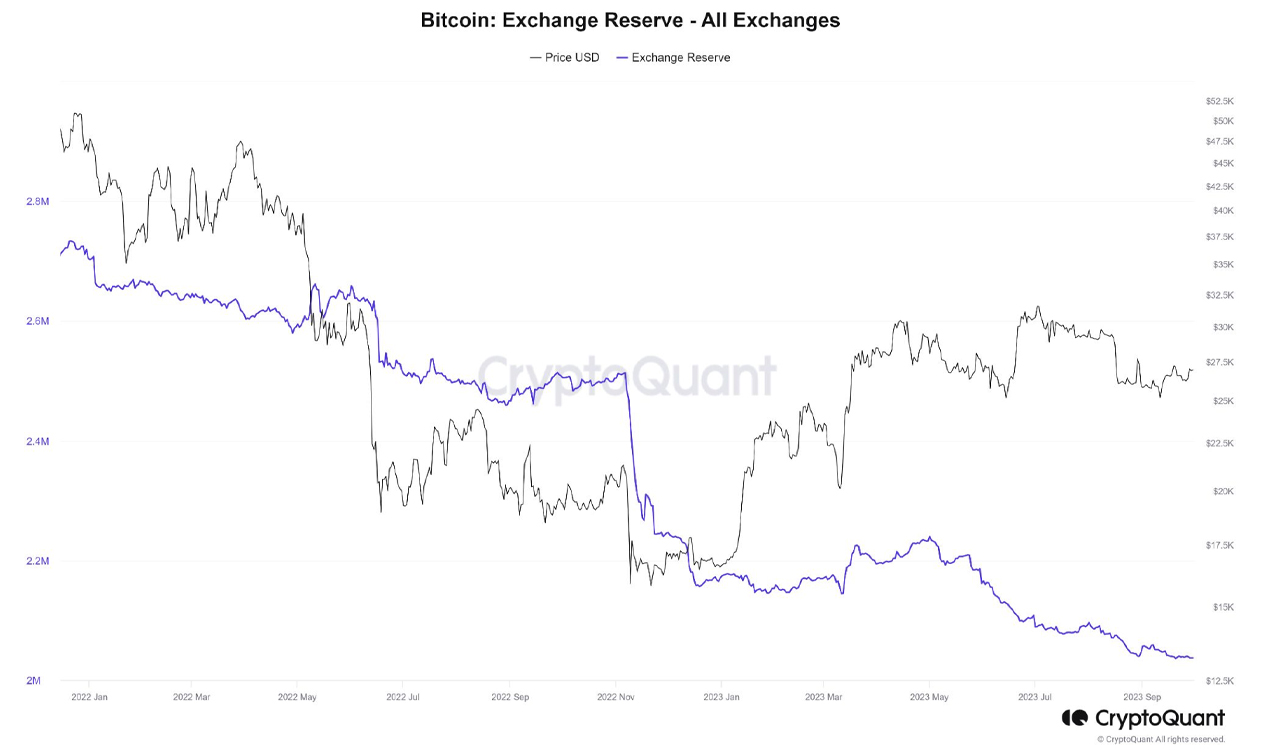

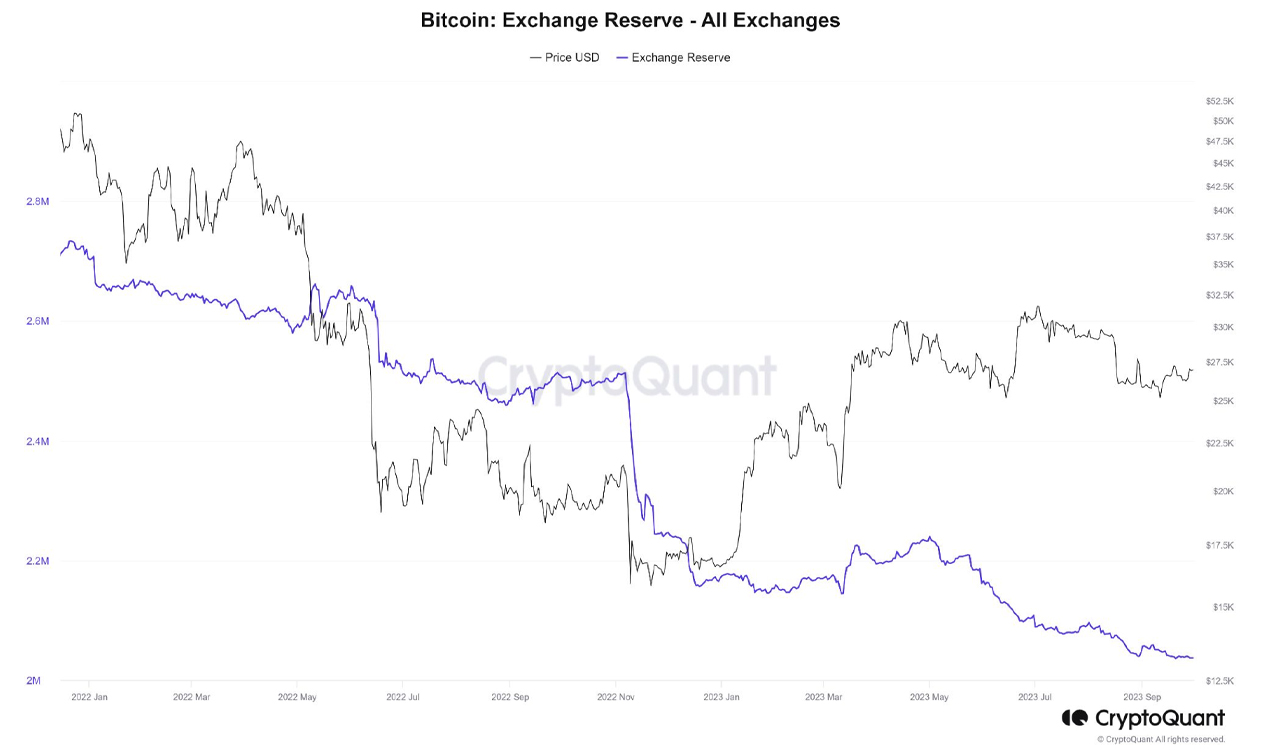

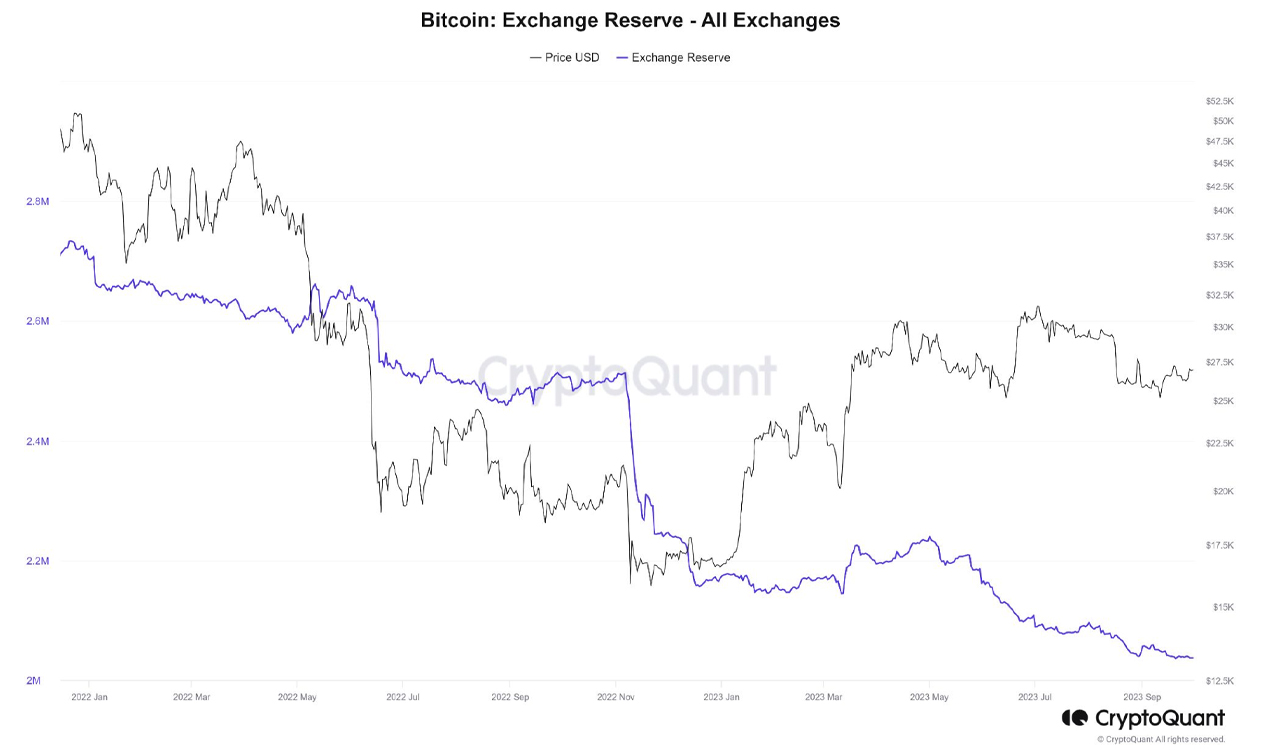

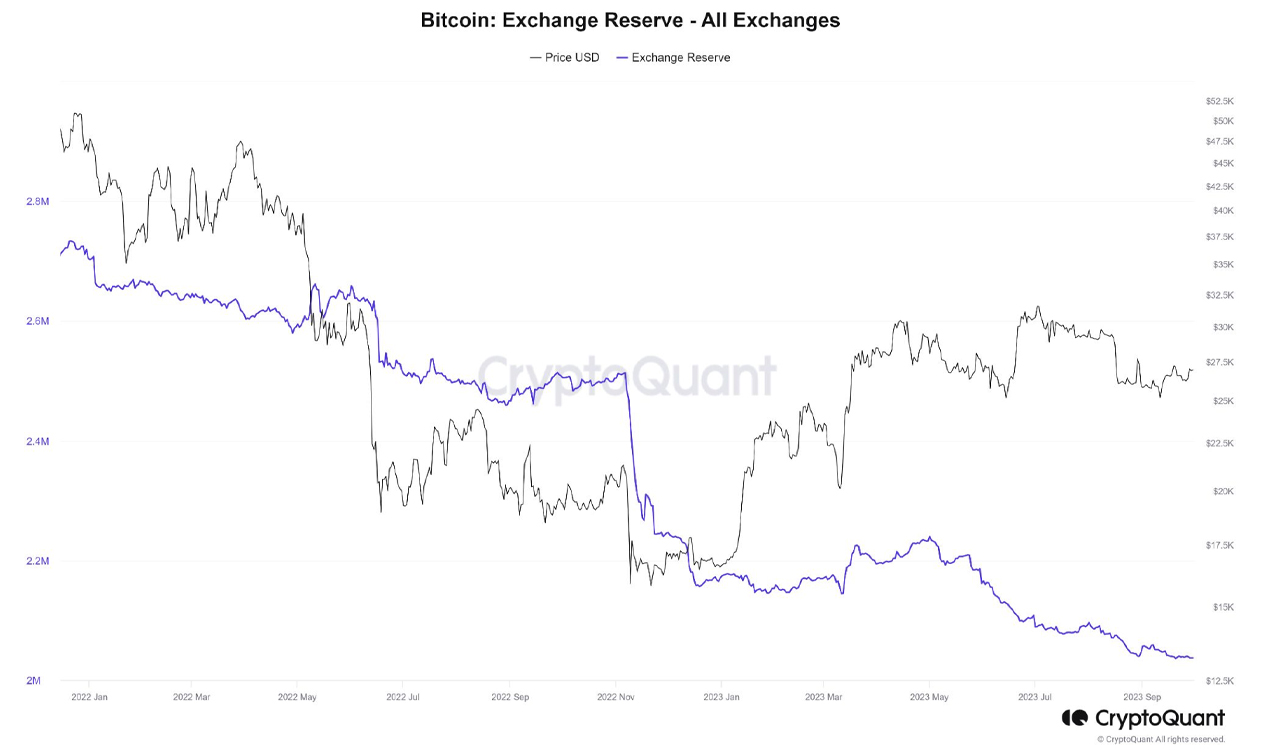

Bitcoin (BTC) began October on a strong note, with many dubbing the month ‘Uptober’ as BTC surged 6% within 30 days and 4.5% in just seven days. A Bitfinex report released on October 2 stated that bitcoin exchange reserves have reached their lowest point in five years, indicating limited supply. The study asserts that long-term bitcoin holders remain in “HODL mode,” with supply older than three years being largely inactive. Conversely, some short-term holders who purchased bitcoins 12-18 months ago seem inclined to cash in their profits, according to Bitfinex analysts. The report anticipates that market volatility will resurface. Options implied volatility surpasses historical volatility, frequently signaling traders’ expectations of increased volatility in the future. The analysts explain September ended on a positive note, which traditionally has led to bullish Octobers for bitcoin.

Conversely, some short-term holders who purchased bitcoins 12-18 months ago seem inclined to cash in their profits, according to Bitfinex analysts. The report anticipates that market volatility will resurface. Options implied volatility surpasses historical volatility, frequently signaling traders’ expectations of increased volatility in the future. The analysts explain September ended on a positive note, which traditionally has led to bullish Octobers for bitcoin. Bitfinex’s Alpha report unveils Cryptoquant data, shedding light on the dwindling number of BTC housed on exchanges, marking a multi-year low. As per Cryptoquant, a mere 2,040,097 bitcoin (BTC) now resides on centralized trading platforms.

Bitfinex’s Alpha report unveils Cryptoquant data, shedding light on the dwindling number of BTC housed on exchanges, marking a multi-year low. As per Cryptoquant, a mere 2,040,097 bitcoin (BTC) now resides on centralized trading platforms.

Various onchain metrics, including low coin days destroyed and high taker buy ratios, suggest investor confidence in bitcoin remaining steady at current prices. Bitfinex Alpha report issue #74 highlights macroeconomic aspects supporting bitcoin’s potential growth. The prospect of a soft U.S. economic landing is reinforced by subdued August core inflation and robust consumer spending.

Nonetheless, market strategists point out persisting challenges such as elevated energy prices, interest rates, and geopolitical tensions that may impede growth. In an analysis published on social media platform X, a trader and analyst known as ‘Cryptobullet’ emphasized that $20K BTC prices remain a possibility. He observed a “giant head and shoulders” pattern, suggesting a climb to $28K followed by a drop to the $20,000 range.

Yet another trader and analyst on social media platform X, Michaël van de Poppe, expressed optimism this week. “Welcome to Uptober,” the trader wrote. “Welcome to Q4, which is leading towards a great quarter, potentially fueled by ETF approvals and the pre-halving rally. Potentially bitcoin to $40,000 is reasonable.” Crypto analytics platform Santiment also offered its perspective.

“[Bitcoin] has blasted back above $28K for the first time since August 17th. With 10-10K [bitcoin] wallets accumulating a combined $1.17B since September 1st, a return to a $30K market value looks more and more likely unless these wallets now start dumping,” Santiment said.

What do you think about bitcoin’s price to start the month of October? Do you predict volatility this month? Share your thoughts and opinions about this subject in the comments section below.he price of bitcoin (BTC) has risen 6% over the previous 30 days, pushed higher by factors such as its finite availability and growing investor confidence, according to this week’s Bitfinex Alpha report. Moreover, on October 1, a popular cryptocurrency trader suggested that $40,000 could be a “reasonable” BTC price in the upcoming fourth quarter; however, another analysis warned of a possible decline to the $20K mark.

Up or Down? Bitcoin’s October Saga Unfolds With Poles Apart Price Predictions

Bitcoin (BTC) began October on a strong note, with many dubbing the month ‘Uptober’ as BTC surged 6% within 30 days and 4.5% in just seven days. A Bitfinex report released on October 2 stated that bitcoin exchange reserves have reached their lowest point in five years, indicating limited supply. The study asserts that long-term bitcoin holders remain in “HODL mode,” with supply older than three years being largely inactive. Conversely, some short-term holders who purchased bitcoins 12-18 months ago seem inclined to cash in their profits, according to Bitfinex analysts. The report anticipates that market volatility will resurface. Options implied volatility surpasses historical volatility, frequently signaling traders’ expectations of increased volatility in the future. The analysts explain September ended on a positive note, which traditionally has led to bullish Octobers for bitcoin.

Conversely, some short-term holders who purchased bitcoins 12-18 months ago seem inclined to cash in their profits, according to Bitfinex analysts. The report anticipates that market volatility will resurface. Options implied volatility surpasses historical volatility, frequently signaling traders’ expectations of increased volatility in the future. The analysts explain September ended on a positive note, which traditionally has led to bullish Octobers for bitcoin. Bitfinex’s Alpha report unveils Cryptoquant data, shedding light on the dwindling number of BTC housed on exchanges, marking a multi-year low. As per Cryptoquant, a mere 2,040,097 bitcoin (BTC) now resides on centralized trading platforms.

Bitfinex’s Alpha report unveils Cryptoquant data, shedding light on the dwindling number of BTC housed on exchanges, marking a multi-year low. As per Cryptoquant, a mere 2,040,097 bitcoin (BTC) now resides on centralized trading platforms.

Various onchain metrics, including low coin days destroyed and high taker buy ratios, suggest investor confidence in bitcoin remaining steady at current prices. Bitfinex Alpha report issue #74 highlights macroeconomic aspects supporting bitcoin’s potential growth. The prospect of a soft U.S. economic landing is reinforced by subdued August core inflation and robust consumer spending.

Nonetheless, market strategists point out persisting challenges such as elevated energy prices, interest rates, and geopolitical tensions that may impede growth. In an analysis published on social media platform X, a trader and analyst known as ‘Cryptobullet’ emphasized that $20K BTC prices remain a possibility. He observed a “giant head and shoulders” pattern, suggesting a climb to $28K followed by a drop to the $20,000 range.

Yet another trader and analyst on social media platform X, Michaël van de Poppe, expressed optimism this week. “Welcome to Uptober,” the trader wrote. “Welcome to Q4, which is leading towards a great quarter, potentially fueled by ETF approvals and the pre-halving rally. Potentially bitcoin to $40,000 is reasonable.” Crypto analytics platform Santiment also offered its perspective.

“[Bitcoin] has blasted back above $28K for the first time since August 17th. With 10-10K [bitcoin] wallets accumulating a combined $1.17B since September 1st, a return to a $30K market value looks more and more likely unless these wallets now start dumping,” Santiment said.

What do you think about bitcoin’s price to start the month of October? Do you predict volatility this month? Share your thoughts and opinions about this subject in the comments section below.he price of bitcoin (BTC) has risen 6% over the previous 30 days, pushed higher by factors such as its finite availability and growing investor confidence, according to this week’s Bitfinex Alpha report. Moreover, on October 1, a popular cryptocurrency trader suggested that $40,000 could be a “reasonable” BTC price in the upcoming fourth quarter; however, another analysis warned of a possible decline to the $20K mark.

Up or Down? Bitcoin’s October Saga Unfolds With Poles Apart Price Predictions

Bitcoin (BTC) began October on a strong note, with many dubbing the month ‘Uptober’ as BTC surged 6% within 30 days and 4.5% in just seven days. A Bitfinex report released on October 2 stated that bitcoin exchange reserves have reached their lowest point in five years, indicating limited supply. The study asserts that long-term bitcoin holders remain in “HODL mode,” with supply older than three years being largely inactive. Conversely, some short-term holders who purchased bitcoins 12-18 months ago seem inclined to cash in their profits, according to Bitfinex analysts. The report anticipates that market volatility will resurface. Options implied volatility surpasses historical volatility, frequently signaling traders’ expectations of increased volatility in the future. The analysts explain September ended on a positive note, which traditionally has led to bullish Octobers for bitcoin.

Conversely, some short-term holders who purchased bitcoins 12-18 months ago seem inclined to cash in their profits, according to Bitfinex analysts. The report anticipates that market volatility will resurface. Options implied volatility surpasses historical volatility, frequently signaling traders’ expectations of increased volatility in the future. The analysts explain September ended on a positive note, which traditionally has led to bullish Octobers for bitcoin. Bitfinex’s Alpha report unveils Cryptoquant data, shedding light on the dwindling number of BTC housed on exchanges, marking a multi-year low. As per Cryptoquant, a mere 2,040,097 bitcoin (BTC) now resides on centralized trading platforms.

Bitfinex’s Alpha report unveils Cryptoquant data, shedding light on the dwindling number of BTC housed on exchanges, marking a multi-year low. As per Cryptoquant, a mere 2,040,097 bitcoin (BTC) now resides on centralized trading platforms.

Various onchain metrics, including low coin days destroyed and high taker buy ratios, suggest investor confidence in bitcoin remaining steady at current prices. Bitfinex Alpha report issue #74 highlights macroeconomic aspects supporting bitcoin’s potential growth. The prospect of a soft U.S. economic landing is reinforced by subdued August core inflation and robust consumer spending.

Nonetheless, market strategists point out persisting challenges such as elevated energy prices, interest rates, and geopolitical tensions that may impede growth. In an analysis published on social media platform X, a trader and analyst known as ‘Cryptobullet’ emphasized that $20K BTC prices remain a possibility. He observed a “giant head and shoulders” pattern, suggesting a climb to $28K followed by a drop to the $20,000 range.

Yet another trader and analyst on social media platform X, Michaël van de Poppe, expressed optimism this week. “Welcome to Uptober,” the trader wrote. “Welcome to Q4, which is leading towards a great quarter, potentially fueled by ETF approvals and the pre-halving rally. Potentially bitcoin to $40,000 is reasonable.” Crypto analytics platform Santiment also offered its perspective.

“[Bitcoin] has blasted back above $28K for the first time since August 17th. With 10-10K [bitcoin] wallets accumulating a combined $1.17B since September 1st, a return to a $30K market value looks more and more likely unless these wallets now start dumping,” Santiment said.

What do you think about bitcoin’s price to start the month of October? Do you predict volatility this month? Share your thoughts and opinions about this subject in the comments section below.he price of bitcoin (BTC) has risen 6% over the previous 30 days, pushed higher by factors such as its finite availability and growing investor confidence, according to this week’s Bitfinex Alpha report. Moreover, on October 1, a popular cryptocurrency trader suggested that $40,000 could be a “reasonable” BTC price in the upcoming fourth quarter; however, another analysis warned of a possible decline to the $20K mark.

Up or Down? Bitcoin’s October Saga Unfolds With Poles Apart Price Predictions

Bitcoin (BTC) began October on a strong note, with many dubbing the month ‘Uptober’ as BTC surged 6% within 30 days and 4.5% in just seven days. A Bitfinex report released on October 2 stated that bitcoin exchange reserves have reached their lowest point in five years, indicating limited supply. The study asserts that long-term bitcoin holders remain in “HODL mode,” with supply older than three years being largely inactive. Conversely, some short-term holders who purchased bitcoins 12-18 months ago seem inclined to cash in their profits, according to Bitfinex analysts. The report anticipates that market volatility will resurface. Options implied volatility surpasses historical volatility, frequently signaling traders’ expectations of increased volatility in the future. The analysts explain September ended on a positive note, which traditionally has led to bullish Octobers for bitcoin.

Conversely, some short-term holders who purchased bitcoins 12-18 months ago seem inclined to cash in their profits, according to Bitfinex analysts. The report anticipates that market volatility will resurface. Options implied volatility surpasses historical volatility, frequently signaling traders’ expectations of increased volatility in the future. The analysts explain September ended on a positive note, which traditionally has led to bullish Octobers for bitcoin. Bitfinex’s Alpha report unveils Cryptoquant data, shedding light on the dwindling number of BTC housed on exchanges, marking a multi-year low. As per Cryptoquant, a mere 2,040,097 bitcoin (BTC) now resides on centralized trading platforms.

Bitfinex’s Alpha report unveils Cryptoquant data, shedding light on the dwindling number of BTC housed on exchanges, marking a multi-year low. As per Cryptoquant, a mere 2,040,097 bitcoin (BTC) now resides on centralized trading platforms.

Various onchain metrics, including low coin days destroyed and high taker buy ratios, suggest investor confidence in bitcoin remaining steady at current prices. Bitfinex Alpha report issue #74 highlights macroeconomic aspects supporting bitcoin’s potential growth. The prospect of a soft U.S. economic landing is reinforced by subdued August core inflation and robust consumer spending.

Nonetheless, market strategists point out persisting challenges such as elevated energy prices, interest rates, and geopolitical tensions that may impede growth. In an analysis published on social media platform X, a trader and analyst known as ‘Cryptobullet’ emphasized that $20K BTC prices remain a possibility. He observed a “giant head and shoulders” pattern, suggesting a climb to $28K followed by a drop to the $20,000 range.

Yet another trader and analyst on social media platform X, Michaël van de Poppe, expressed optimism this week. “Welcome to Uptober,” the trader wrote. “Welcome to Q4, which is leading towards a great quarter, potentially fueled by ETF approvals and the pre-halving rally. Potentially bitcoin to $40,000 is reasonable.” Crypto analytics platform Santiment also offered its perspective.

“[Bitcoin] has blasted back above $28K for the first time since August 17th. With 10-10K [bitcoin] wallets accumulating a combined $1.17B since September 1st, a return to a $30K market value looks more and more likely unless these wallets now start dumping,” Santiment said.

What do you think about bitcoin’s price to start the month of October? Do you predict volatility this month? Share your thoughts and opinions about this subject in the comments section below.he price of bitcoin (BTC) has risen 6% over the previous 30 days, pushed higher by factors such as its finite availability and growing investor confidence, according to this week’s Bitfinex Alpha report. Moreover, on October 1, a popular cryptocurrency trader suggested that $40,000 could be a “reasonable” BTC price in the upcoming fourth quarter; however, another analysis warned of a possible decline to the $20K mark.

Up or Down? Bitcoin’s October Saga Unfolds With Poles Apart Price Predictions

Bitcoin (BTC) began October on a strong note, with many dubbing the month ‘Uptober’ as BTC surged 6% within 30 days and 4.5% in just seven days. A Bitfinex report released on October 2 stated that bitcoin exchange reserves have reached their lowest point in five years, indicating limited supply. The study asserts that long-term bitcoin holders remain in “HODL mode,” with supply older than three years being largely inactive. Conversely, some short-term holders who purchased bitcoins 12-18 months ago seem inclined to cash in their profits, according to Bitfinex analysts. The report anticipates that market volatility will resurface. Options implied volatility surpasses historical volatility, frequently signaling traders’ expectations of increased volatility in the future. The analysts explain September ended on a positive note, which traditionally has led to bullish Octobers for bitcoin.

Conversely, some short-term holders who purchased bitcoins 12-18 months ago seem inclined to cash in their profits, according to Bitfinex analysts. The report anticipates that market volatility will resurface. Options implied volatility surpasses historical volatility, frequently signaling traders’ expectations of increased volatility in the future. The analysts explain September ended on a positive note, which traditionally has led to bullish Octobers for bitcoin. Bitfinex’s Alpha report unveils Cryptoquant data, shedding light on the dwindling number of BTC housed on exchanges, marking a multi-year low. As per Cryptoquant, a mere 2,040,097 bitcoin (BTC) now resides on centralized trading platforms.

Bitfinex’s Alpha report unveils Cryptoquant data, shedding light on the dwindling number of BTC housed on exchanges, marking a multi-year low. As per Cryptoquant, a mere 2,040,097 bitcoin (BTC) now resides on centralized trading platforms.

Various onchain metrics, including low coin days destroyed and high taker buy ratios, suggest investor confidence in bitcoin remaining steady at current prices. Bitfinex Alpha report issue #74 highlights macroeconomic aspects supporting bitcoin’s potential growth. The prospect of a soft U.S. economic landing is reinforced by subdued August core inflation and robust consumer spending.

Nonetheless, market strategists point out persisting challenges such as elevated energy prices, interest rates, and geopolitical tensions that may impede growth. In an analysis published on social media platform X, a trader and analyst known as ‘Cryptobullet’ emphasized that $20K BTC prices remain a possibility. He observed a “giant head and shoulders” pattern, suggesting a climb to $28K followed by a drop to the $20,000 range.

Yet another trader and analyst on social media platform X, Michaël van de Poppe, expressed optimism this week. “Welcome to Uptober,” the trader wrote. “Welcome to Q4, which is leading towards a great quarter, potentially fueled by ETF approvals and the pre-halving rally. Potentially bitcoin to $40,000 is reasonable.” Crypto analytics platform Santiment also offered its perspective.

“[Bitcoin] has blasted back above $28K for the first time since August 17th. With 10-10K [bitcoin] wallets accumulating a combined $1.17B since September 1st, a return to a $30K market value looks more and more likely unless these wallets now start dumping,” Santiment said.

What do you think about bitcoin’s price to start the month of October? Do you predict volatility this month? Share your thoughts and opinions about this subject in the comments section below.he price of bitcoin (BTC) has risen 6% over the previous 30 days, pushed higher by factors such as its finite availability and growing investor confidence, according to this week’s Bitfinex Alpha report. Moreover, on October 1, a popular cryptocurrency trader suggested that $40,000 could be a “reasonable” BTC price in the upcoming fourth quarter; however, another analysis warned of a possible decline to the $20K mark.

Up or Down? Bitcoin’s October Saga Unfolds With Poles Apart Price Predictions

Bitcoin (BTC) began October on a strong note, with many dubbing the month ‘Uptober’ as BTC surged 6% within 30 days and 4.5% in just seven days. A Bitfinex report released on October 2 stated that bitcoin exchange reserves have reached their lowest point in five years, indicating limited supply. The study asserts that long-term bitcoin holders remain in “HODL mode,” with supply older than three years being largely inactive. Conversely, some short-term holders who purchased bitcoins 12-18 months ago seem inclined to cash in their profits, according to Bitfinex analysts. The report anticipates that market volatility will resurface. Options implied volatility surpasses historical volatility, frequently signaling traders’ expectations of increased volatility in the future. The analysts explain September ended on a positive note, which traditionally has led to bullish Octobers for bitcoin.

Conversely, some short-term holders who purchased bitcoins 12-18 months ago seem inclined to cash in their profits, according to Bitfinex analysts. The report anticipates that market volatility will resurface. Options implied volatility surpasses historical volatility, frequently signaling traders’ expectations of increased volatility in the future. The analysts explain September ended on a positive note, which traditionally has led to bullish Octobers for bitcoin. Bitfinex’s Alpha report unveils Cryptoquant data, shedding light on the dwindling number of BTC housed on exchanges, marking a multi-year low. As per Cryptoquant, a mere 2,040,097 bitcoin (BTC) now resides on centralized trading platforms.

Bitfinex’s Alpha report unveils Cryptoquant data, shedding light on the dwindling number of BTC housed on exchanges, marking a multi-year low. As per Cryptoquant, a mere 2,040,097 bitcoin (BTC) now resides on centralized trading platforms.

Various onchain metrics, including low coin days destroyed and high taker buy ratios, suggest investor confidence in bitcoin remaining steady at current prices. Bitfinex Alpha report issue #74 highlights macroeconomic aspects supporting bitcoin’s potential growth. The prospect of a soft U.S. economic landing is reinforced by subdued August core inflation and robust consumer spending.

Nonetheless, market strategists point out persisting challenges such as elevated energy prices, interest rates, and geopolitical tensions that may impede growth. In an analysis published on social media platform X, a trader and analyst known as ‘Cryptobullet’ emphasized that $20K BTC prices remain a possibility. He observed a “giant head and shoulders” pattern, suggesting a climb to $28K followed by a drop to the $20,000 range.

Yet another trader and analyst on social media platform X, Michaël van de Poppe, expressed optimism this week. “Welcome to Uptober,” the trader wrote. “Welcome to Q4, which is leading towards a great quarter, potentially fueled by ETF approvals and the pre-halving rally. Potentially bitcoin to $40,000 is reasonable.” Crypto analytics platform Santiment also offered its perspective.

“[Bitcoin] has blasted back above $28K for the first time since August 17th. With 10-10K [bitcoin] wallets accumulating a combined $1.17B since September 1st, a return to a $30K market value looks more and more likely unless these wallets now start dumping,” Santiment said.

What do you think about bitcoin’s price to start the month of October? Do you predict volatility this month? Share your thoughts and opinions about this subject in the comments section below.he price of bitcoin (BTC) has risen 6% over the previous 30 days, pushed higher by factors such as its finite availability and growing investor confidence, according to this week’s Bitfinex Alpha report. Moreover, on October 1, a popular cryptocurrency trader suggested that $40,000 could be a “reasonable” BTC price in the upcoming fourth quarter; however, another analysis warned of a possible decline to the $20K mark.

Up or Down? Bitcoin’s October Saga Unfolds With Poles Apart Price Predictions

Bitcoin (BTC) began October on a strong note, with many dubbing the month ‘Uptober’ as BTC surged 6% within 30 days and 4.5% in just seven days. A Bitfinex report released on October 2 stated that bitcoin exchange reserves have reached their lowest point in five years, indicating limited supply. The study asserts that long-term bitcoin holders remain in “HODL mode,” with supply older than three years being largely inactive. Conversely, some short-term holders who purchased bitcoins 12-18 months ago seem inclined to cash in their profits, according to Bitfinex analysts. The report anticipates that market volatility will resurface. Options implied volatility surpasses historical volatility, frequently signaling traders’ expectations of increased volatility in the future. The analysts explain September ended on a positive note, which traditionally has led to bullish Octobers for bitcoin.

Conversely, some short-term holders who purchased bitcoins 12-18 months ago seem inclined to cash in their profits, according to Bitfinex analysts. The report anticipates that market volatility will resurface. Options implied volatility surpasses historical volatility, frequently signaling traders’ expectations of increased volatility in the future. The analysts explain September ended on a positive note, which traditionally has led to bullish Octobers for bitcoin. Bitfinex’s Alpha report unveils Cryptoquant data, shedding light on the dwindling number of BTC housed on exchanges, marking a multi-year low. As per Cryptoquant, a mere 2,040,097 bitcoin (BTC) now resides on centralized trading platforms.

Bitfinex’s Alpha report unveils Cryptoquant data, shedding light on the dwindling number of BTC housed on exchanges, marking a multi-year low. As per Cryptoquant, a mere 2,040,097 bitcoin (BTC) now resides on centralized trading platforms.

Various onchain metrics, including low coin days destroyed and high taker buy ratios, suggest investor confidence in bitcoin remaining steady at current prices. Bitfinex Alpha report issue #74 highlights macroeconomic aspects supporting bitcoin’s potential growth. The prospect of a soft U.S. economic landing is reinforced by subdued August core inflation and robust consumer spending.

Nonetheless, market strategists point out persisting challenges such as elevated energy prices, interest rates, and geopolitical tensions that may impede growth. In an analysis published on social media platform X, a trader and analyst known as ‘Cryptobullet’ emphasized that $20K BTC prices remain a possibility. He observed a “giant head and shoulders” pattern, suggesting a climb to $28K followed by a drop to the $20,000 range.

Yet another trader and analyst on social media platform X, Michaël van de Poppe, expressed optimism this week. “Welcome to Uptober,” the trader wrote. “Welcome to Q4, which is leading towards a great quarter, potentially fueled by ETF approvals and the pre-halving rally. Potentially bitcoin to $40,000 is reasonable.” Crypto analytics platform Santiment also offered its perspective.

“[Bitcoin] has blasted back above $28K for the first time since August 17th. With 10-10K [bitcoin] wallets accumulating a combined $1.17B since September 1st, a return to a $30K market value looks more and more likely unless these wallets now start dumping,” Santiment said.

What do you think about bitcoin’s price to start the month of October? Do you predict volatility this month? Share your thoughts and opinions about this she price of bitcoin (BTC) has risen 6% over the previous 30 days, pushed higher by factors such as its finite availability and growing investor confidence, according to this week’s Bitfinex Alpha report. Moreover, on October 1, a popular cryptocurrency trader suggested that $40,000 could be a “reasonable” BTC price in the upcoming fourth quarter; however, another analysis warned of a possible decline to the $20K mark.

Up or Down? Bitcoin’s October Saga Unfolds With Poles Apart Price Predictions

Bitcoin (BTC) began October on a strong note, with many dubbing the month ‘Uptober’ as BTC surged 6% within 30 days and 4.5% in just seven days. A Bitfinex report released on October 2 stated that bitcoin exchange reserves have reached their lowest point in five years, indicating limited supply. The study asserts that long-term bitcoin holders remain in “HODL mode,” with supply older than three years being largely inactive. Conversely, some short-term holders who purchased bitcoins 12-18 months ago seem inclined to cash in their profits, according to Bitfinex analysts. The report anticipates that market volatility will resurface. Options implied volatility surpasses historical volatility, frequently signaling traders’ expectations of increased volatility in the future. The analysts explain September ended on a positive note, which traditionally has led to bullish Octobers for bitcoin.

Conversely, some short-term holders who purchased bitcoins 12-18 months ago seem inclined to cash in their profits, according to Bitfinex analysts. The report anticipates that market volatility will resurface. Options implied volatility surpasses historical volatility, frequently signaling traders’ expectations of increased volatility in the future. The analysts explain September ended on a positive note, which traditionally has led to bullish Octobers for bitcoin. Bitfinex’s Alpha report unveils Cryptoquant data, shedding light on the dwindling number of BTC housed on exchanges, marking a multi-year low. As per Cryptoquant, a mere 2,040,097 bitcoin (BTC) now resides on centralized trading platforms.

Bitfinex’s Alpha report unveils Cryptoquant data, shedding light on the dwindling number of BTC housed on exchanges, marking a multi-year low. As per Cryptoquant, a mere 2,040,097 bitcoin (BTC) now resides on centralized trading platforms.

Various onchain metrics, including low coin days destroyed and high taker buy ratios, suggest investor confidence in bitcoin remaining steady at current prices. Bitfinex Alpha report issue #74 highlights macroeconomic aspects supporting bitcoin’s potential growth. The prospect of a soft U.S. economic landing is reinforced by subdued August core inflation and robust consumer spending.

Nonetheless, market strategists point out persisting challenges such as elevated energy prices, interest rates, and geopolitical tensions that may impede growth. In an analysis published on social media platform X, a trader and analyst known as ‘Cryptobullet’ emphasized that $20K BTC prices remain a possibility. He observed a “giant head and shoulders” pattern, suggesting a climb to $28K followed by a drop to the $20,000 range.

Yet another trader and analyst on social media platform X, Michaël van de Poppe, expressed optimism this week. “Welcome to Uptober,” the trader wrote. “Welcome to Q4, which is leading towards a great quarter, potentially fueled by ETF approvals and the pre-halving rally. Potentially bitcoin to $40,000 is reasonable.” Crypto analytics platform Santiment also offered its perspective.

“[Bitcoin] has blasted back above $28K for the first time since August 17th. With 10-10K [bitcoin] wallets accumulating a combined $1.17B since September 1st, a return to a $30K market value looks more and more likely unless these wallets now start dumping,” Santiment said.

What do you think about bitcoin’s price to start the month of October? Do you predict volatility this month? Share your thoughts and opinions about this subject in the comments section below.ubject in the comments section below.