Three Reasons Why FOMO And YOLO Are Portfolio Killers

There are countless stories of crypto investors who have lost considerable amounts of money, or even life savings, to bad crypto assets investments.

In this regard, a Twitter channel named 'Crypto Confessions' is both amusing and educative:

- Anyone can anonymously confess their burdens or experiences and later have them made public on this Twitter (X) channel.

- Fortunately for all of us, we can learn from those confessions to become more aware of the consequences of poor or biased financial decisions.

If you browse the confessions, you may notice that nine crypto users declare regrettable losses for every confession of a crypto user making life-changing profits.

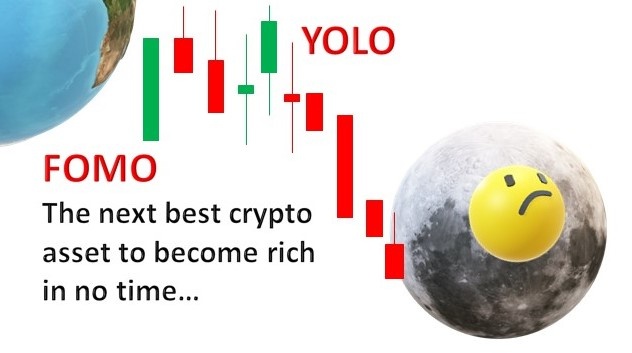

In many cases, what leads to those regrettable losses can be classified into three reasons:

- We are all bombarded with news about (a few) crypto users making high profits. So, out of 'Fear Of Missing Opportunity' (FOMO), people buy crypto assets they do not understand. Assets that tend to perform poorly.

- People can make considerable profits during the bull markets but expect to achieve even higher profits. And out of 'Fear Of Missing Opportunity' (FOMO), people wait too long to sell, and profits and savings are melted during the bear market correction.

- And last, some people adhere to the You Only Live Once (YOLO) principle and ape into meme coins, the latest NFT projects, or the trendiest crypto projects. With regrettable consequences most of the time.

If you want to be one of those who want to make profits and cash them out on time, do not fall for 'We're All Gonna Make It' (WAGMI) daydreams and learn how to defend your portfolio from FOMO and YOLO decisions.

These are the three reasons why FOMO and YOLO are portfolio killers.

FOMO Leads Investors to Impulsive Buy Decisions

FOMO decisions will become more and more common after the April 2024 halving. Once the crypto market enters the bull run.

And many people will start making risky investment decisions, often fueled by the advice of hundreds of influencers that will appear during the bull market.

But please be conscious that every influencer will be right in their predictions during the next bull run only because, like a rising wave raising all the boats, a bull market raises all the crypto assets.

Soon, we will start seeing more and more bold statements on Twitter, YouTube, and other social media platforms:

- Look at my crypto investment profits! - Follow my Patreon channel for alpha about the next 5x crypto project (so I can dump my bags on all of you after you have FOMO into the crypto assets that I will show you and pump them through all your combined buying orders)

- This is how many coins from project <name a project> you need to become a millionaire in 2025 (follow my advice and FOMO so you pump the crypto assets that I have already bought)

- I have made 200% by investing in crypto project A, 500% by investing in crypto project B, and 1500% by investing in crypto project C (I will not tell you that I got wrecked in projects D, E, and F. But to you, I will only highlight those trades where I have made money and promote projects Q and R so you FOMO into them and pump them so I can sell them straight away and earn a considerable profit).

It has happened in past bull runs; people will ape into meme coins and dubious crypto projects promoted by dubious influencers. Only to find out too late that many crypto projects do not have a solid business case and disappear quickly.

Or the projects are rug-pulled because they were created by scammers, or the projects are hacked because amateurs created them, or...

FOMO Makes Investors Reluctant to Sell

If you read enough confessions, you will find several stories such as:

'I turned 10k into 100k in the bull market and watched it reach 0. Crypto broke me. I feel nothing anymore.'

'I've only ever bought a single crypto. Initially, I thought it was a good price, but now it's worth 90% less. I could have paid off my flat during the last bull run but stayed out for greed.'

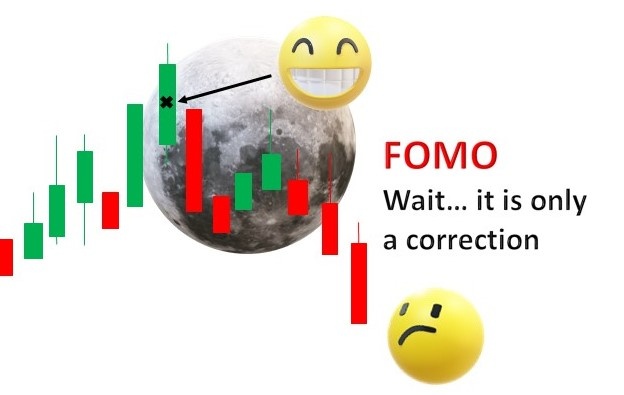

This happens because people do not sell their assets on time out of fear of missing even higher returns (more FOMO).

Almost everyone thought Bitcoin would reach 100,000 USD during the previous bull run.

And it could have happened if it wasn't for the combination of the Terra Luna and FTX black swans that created a liquidation cascade that brought the entire market down.

While those black swaps were happening, people were reluctant to sell their assets because they still had high expectations. And, to fuel the FOMO, many influencers advocated that Bitcoin could never correct below USD 48,000.

But it went lower than USD 48,000, lower than USD 42,000, lower than USD 38,000, lower than... and Bitcoin kept correcting and reaching lower and lower until prizes while investors and influencers kept singing the same 'it cannot go lower' tune for weeks and months.

Who can sell at the top of the cycle? Nearly nobody.

Who makes profits? Those who do not FOMO have a solid profit-taking strategy and stick to it.

YOLO Stands For Risky Investment Decisions

In our article 'The Richest Person In CryptoLand - The Five Laws Of Wealth.' you can have a look at how the 'Five Laws of Gold' from 'The Richest Man in Babylon' can be used as a guide to increase your Crypto Assets Wealth while maintaining your assets safe.

Specifically, the Fifth Law describes:

Crypto flees the person who would force it to impossible earnings, who follows the alluring advice of tricksters and schemers, or trusts it to his inexperience and romantic desires of investment.

But the Fifth Law can easily adapted and become the YOLO Law:

Crypto flees the person who would force it to impossible earnings, who follows the YOLO advice of tricksters and schemers, or trusts it to his inexperience and romantic 'You Only Live Once' desires of investment.

You are the person who knows what is best for you. And maybe you can make risky but profitable investment decisions.

But it will not be harmful to lean back, take a few deep breaths, and think twice before taking a FOMO or YOLO decision.

______________________________________________________________

Congratulations on completing this 5-minute crypto and digital safety power-up.

We hope this 5 minutes read was worth the time and that you have learned some valuable information.