Beyond Bitcoin: Exploring Different Types of Cryptocurrencies

Cryptocurrencies: A Journey Beyond Bitcoin The inception of Bitcoin in 2009 marked the birth of a revolutionary concept that would forever change the landscape of finance. As the pioneer cryptocurrency, Bitcoin introduced the world to decentralized digital currencies, challenging traditional financial paradigms and fostering a new era of financial independence.

- Bitcoin's Groundbreaking Role:

At its core, Bitcoin was conceived as a peer-to-peer electronic cash system, allowing users to transact directly without the need for intermediaries like banks. Its groundbreaking blockchain technology, which serves as a decentralized ledger, ensures transparency, security, and immutability. Bitcoin's decentralized nature and finite supply have made it a sought-after asset for those seeking a hedge against inflation and a store of value.

- The Evolving Landscape:

Over the years, the cryptocurrency landscape has evolved beyond the confines of Bitcoin. While Bitcoin remains the flagship digital currency, a myriad of alternative cryptocurrencies, commonly known as altcoins, have emerged. Each altcoin brings its unique features, use cases, and innovations, contributing to the diversity of the crypto ecosystem.

- Importance of Understanding Variety:

Understanding the multitude of cryptocurrencies is crucial for both seasoned investors and newcomers to the crypto space. Beyond Bitcoin's store of value, different cryptocurrencies serve various purposes – from facilitating smart contracts and privacy-centric transactions to powering decentralized applications and tokenizing assets. As the crypto space continues to expand, grasping the nuances of these diverse digital assets becomes paramount for making informed decisions and navigating the ever-changing landscape.

In this exploration of cryptocurrencies beyond Bitcoin, we will delve into the fascinating world of altcoins, smart contract platforms, privacy coins, stablecoins, exchange tokens, utility tokens, gaming, and Non-Fungible Tokens (NFTs). Together, let's unravel the intricacies of these digital currencies, understanding their roles, potentials, and the collective impact they have on shaping the future of finance. Join us on this journey into the heart of the crypto revolution.

- Altcoins: Beyond the Pioneer

- Altcoins, a Term Defined:

The term "altcoin" is a portmanteau of "alternative" and "coin," encompassing all cryptocurrencies other than Bitcoin. Coined to distinguish them from the pioneering digital currency, altcoins have grown into a diverse ecosystem, each with its unique characteristics and purposes.

- Prominent Altcoins: A Glimpse into Diversity:

As we venture beyond Bitcoin, we encounter a rich tapestry of altcoins, each contributing to the expanding landscape of digital currencies. Among the notable players, Ethereum, Ripple (XRP), and Litecoin stand as stalwarts, shaping the narrative with their distinctive attributes.

- Ethereum: The Smart Contract Pioneer

Ethereum, often heralded as the pioneer of smart contracts, introduces programmability to the blockchain. Its decentralized platform enables developers to create and deploy decentralized applications (DApps). The native cryptocurrency, Ether (ETH), serves both as a medium of exchange and a fuel for executing smart contracts.

- Ripple (XRP): Bridging Traditional Finance

Ripple aims to revolutionize traditional finance by facilitating swift, low-cost cross-border transactions. XRP, the native digital asset, acts as a bridge between different fiat currencies, offering rapid settlement. The Ripple network is designed to enhance the efficiency and liquidity of global payment systems.

- Litecoin: Silver to Bitcoin's Gold

Created as the "silver" counterpart to Bitcoin's "gold," Litecoin emphasizes fast and low-cost transactions. Its algorithm, Scrypt, differentiates it from Bitcoin's SHA-256, promoting quicker block generation. Litecoin serves as a peer-to-peer digital currency, emphasizing accessibility and everyday use.

- Unique Features and Use Cases:

What sets altcoins apart from Bitcoin goes beyond nomenclature. Altcoins often introduce innovative features and serve specific use cases, contributing to the diversification of the crypto market.

- Innovation in Consensus Mechanisms:

Altcoins may employ different consensus mechanisms like Proof of Stake (PoS) or Delegated Proof of Stake (DPoS) to address scalability and energy efficiency concerns.

- Privacy-Centric Altcoins:

Some altcoins, such as Monero and Zcash, prioritize user privacy by implementing advanced cryptographic techniques, allowing for private transactions.

- Specialized Utility:

Altcoins like Chainlink (LINK) focus on providing decentralized oracle solutions, enhancing the integration of smart contracts with real-world data. In essence, altcoins represent the dynamic nature of the cryptocurrency space. Their diversity extends beyond mere alternatives to Bitcoin, offering unique solutions and innovations that cater to specific needs within the decentralized ecosystem. As we journey through the realm of altcoins, we uncover a tapestry of possibilities that shape the future of digital finance.

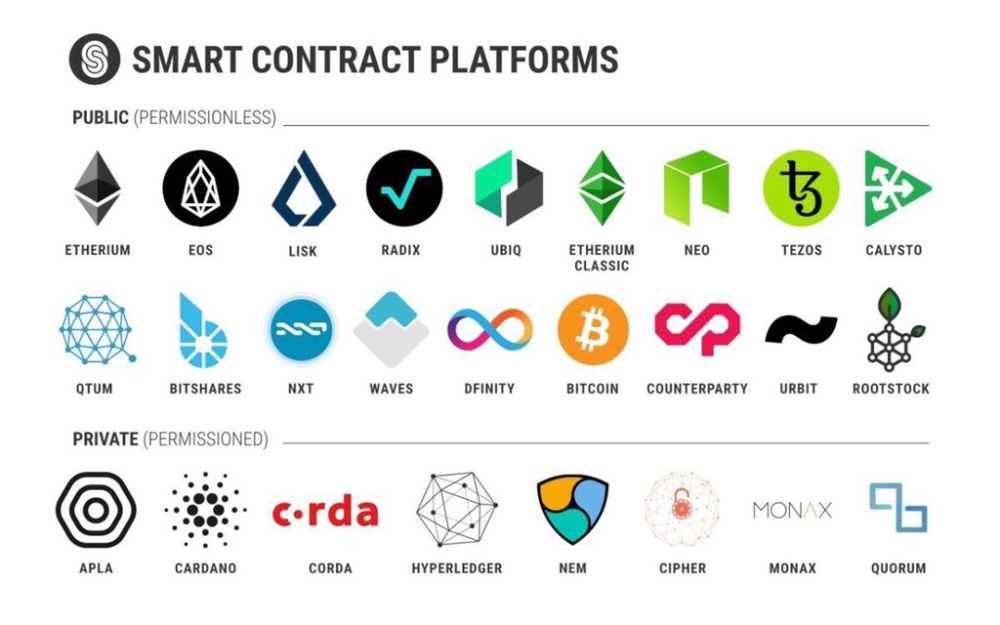

- Introduction to Smart Contracts:

In the ever-evolving landscape of cryptocurrencies, the advent of smart contracts has been a game-changer. Smart contracts are self-executing contracts with coded terms directly written into lines of code. These contracts automate and enforce the execution of predefined actions without the need for intermediaries, offering transparency, security, and efficiency.

- Ethereum: The Pioneer of Smart Contracts:

At the forefront of the smart contract revolution stands Ethereum, a blockchain platform designed explicitly to host decentralized applications (DApps) and execute smart contracts. Ethereum introduced a programming language called Solidity, allowing developers to code and deploy smart contracts on its blockchain.

- Decoding Ethereum's Smart Contract Ecosystem:

Ethereum enables the creation of diverse decentralized applications, from decentralized finance (DeFi) protocols to non-fungible token (NFT) marketplaces. Smart contracts on Ethereum power complex financial transactions, automated agreements, and token issuance.

- Ether (ETH) and Gas Fees:

Ether, the native cryptocurrency of Ethereum, acts as both a medium of exchange and fuel for executing smart contracts. Gas fees, denominated in Ether, cover the computational resources needed to process transactions and smart contracts.

- Challenges and Scalability:

Ethereum has faced scalability issues due to its increasing popularity, leading to network congestion and rising gas fees. The Ethereum community actively explores solutions, such as Ethereum 2.0, to address scalability and energy efficiency concerns.

- Beyond Ethereum: Expanding the Smart Contract Landscape:

While Ethereum remains a leader, numerous blockchain platforms have emerged, offering their take on smart contracts and addressing some of the scalability challenges. Among them, Binance Smart Chain and Cardano are noteworthy contenders. Privacy Coins: Anonymity in the Cryptoverse.

In the realm of cryptocurrency, where transparency is a fundamental feature of blockchain technology, the need for privacy has become increasingly apparent. Privacy coins address the concern of traceability in transactions, offering users the ability to shield their financial activities from prying eyes. As advocates argue for the importance of financial privacy, privacy coins have emerged as a dedicated solution.

- Examining Privacy-Focused Coins:

Several cryptocurrencies have taken up the mantle of providing enhanced privacy features. Three prominent examples are Monero (XMR), Zcash (ZEC), and Dash (DASH), each employing distinct technologies to achieve confidentiality.

- Monero (XMR):

The Untraceable Cryptocurrency Monero utilizes advanced cryptographic techniques, including ring signatures and stealth addresses, to obfuscate transaction details. Ring signatures combine the spender's signature with others, making it nearly impossible to determine the origin of a transaction.

- Zcash (ZEC):

Shielded Transactions with zk-SNARKs Zcash employs zero-knowledge proofs, specifically zk-SNARKs (Zero-Knowledge Succinct Non-Interactive Arguments of Knowledge), to enable private transactions. Users can choose between transparent or shielded transactions, balancing privacy with the option for public visibility.

- Dash (DASH):

PrivateSend for Enhanced Anonymity Dash incorporates a mixing technique called PrivateSend, where transactions are mixed, making it challenging to trace the origin. PrivateSend operates as an optional feature, allowing users to choose between regular and private transactions.

- Balancing Privacy Features with Regulatory Concerns:

While privacy coins provide users with enhanced confidentiality, their very nature has raised regulatory eyebrows. Governments and financial institutions express concerns about the potential misuse of privacy coins for illicit activities, including money laundering and tax evasion.

- Regulatory Scrutiny:

Privacy coins have faced regulatory scrutiny in various jurisdictions, leading to delistings from certain cryptocurrency exchanges and limitations on their use.

- Transparent Transactions:

Striking a balance between privacy and regulatory compliance, some privacy coins offer the option for transparent transactions, allowing users to adhere to regulatory requirements.

- Educating Regulators:

Advocates for privacy coins emphasize the legitimate use cases for enhanced privacy, such as protecting individuals from financial surveillance and ensuring financial freedom.

- Conclusion:

Privacy coins represent a significant advancement in the quest for financial privacy within the cryptocurrency space. As users seek to safeguard their financial information, the development of privacy-focused technologies continues to evolve. However, the delicate balance between privacy features and regulatory compliance remains an ongoing challenge. As the conversation around privacy in the crypto verse unfolds, it prompts us to consider the broader implications of financial transparency and individual autonomy in the digital age. Stablecoins: Bridging the Gap to Mainstream Adoption.

In the often volatile world of cryptocurrencies, stablecoins have emerged as a stabilizing force. Unlike traditional cryptocurrencies like Bitcoin, stablecoins are designed to maintain a stable value by pegging it to an external asset, such as fiat currency or commodities. This characteristic makes stablecoins particularly attractive for users seeking a reliable store of value and a medium of exchange within the crypto ecosystem.

- Examining Popular Stablecoins:

Several stablecoins have gained prominence in the crypto market, each with its unique approach to achieving stability.

- USDC (USD Coin):

Fiat-Collateralized Stability USDC is a fiat-collateralized stablecoin pegged to the US dollar on a 1:1 ratio. Issued by regulated financial institutions, USDC provides users with a transparent and audited backing for its value.

- Tether (USDT):

Dominance Amid Controversy Tether is among the earliest and most widely used stablecoins, pegged to the US dollar. Despite controversies surrounding its reserves, Tether maintains its status as a significant player in the stablecoin market.

- DAI:

Decentralized Stability with MakerDAO DAI distinguishes itself as a decentralized stablecoin, not relying on direct fiat collateral. Created through overcollateralized loans on the MakerDAO platform, DAI maintains its peg through a dynamic system of governance and collateral.

- The Role of Stablecoins in Mitigating Volatility:

Volatility has long been a characteristic of the cryptocurrency market, deterring some users from fully embracing digital assets. Stablecoins offer a solution to this issue by providing a reliable and less volatile medium of exchange.

- Price Stability for Everyday Use:

Stablecoins serve as a reliable unit of account, enabling users to conduct everyday transactions without the fear of value fluctuations. Reducing Exposure to Market Swings: Traders and investors often use stablecoins as a haven during times of market uncertainty, allowing them to exit volatile positions without converting to traditional fiat currencies.

- Facilitating Efficient Trading:

Stablecoins play a crucial role in facilitating trading pairs on cryptocurrency exchanges, offering a familiar reference point for users to assess asset values.

- Conclusion:

Stablecoins play a pivotal role in bringing a sense of stability to the dynamic world of cryptocurrencies. Their ability to maintain a fixed value makes them an attractive choice for a wide range of users, from traders seeking refuge during market turbulence to individuals conducting everyday transactions. As stablecoins continue to evolve and gain mainstream acceptance, they contribute significantly to the broader adoption of cryptocurrencies, acting as a bridge between the crypto and traditional financial realms.

![[LIVE] Engage2Earn: McEwen boost for Rob Mitchell](https://cdn.bulbapp.io/frontend/images/c798d46f-d3b8-4a66-bf48-7e1ef50b4338/1)

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - Is Trump Dying? Or Only Killing The Market?](https://cdn.bulbapp.io/frontend/images/a129e75e-4fa1-46cc-80b6-04e638877e46/1)