Crypto’s Market Cap is not Over $1T: That’s a Good Thing

Remember when crypto’s total market cap almost hit $3T? Or what about now, when the market cap is $1.39T?¹ Market Cap, or market capitalization, has become a major indicator in determining momentum in the market. Looking a little deeper, the market cap isn’t even close to $1.39T. For the upcoming bull market, that’s a good thing. I will show you why below.

Understanding Market Capitalization

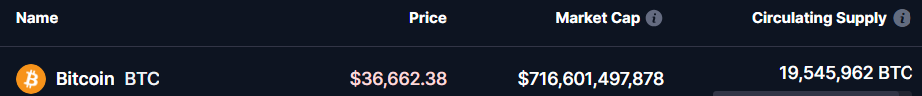

First we need to start with defining market capitalization. A technique used commonly in the stock market, is calculated by multiplying the current price of an asset by its total number of shares. Bitcoin Market Cap

Bitcoin Market Cap

Let’s look at Bitcoin as an example. The price is $36,662.38 and there are 19,545,962 Bitcoin tokens in the market. You multiple those together and you will get $716,601,497,878. The goal of market cap in the stock market, is to show the value of the company. The same applies for most (i.e. BNB, CRO) which are separate from the actual company.

However, this straightforward calculation masks basic economic fallacies and other hidden facts that aren’t talked about.

Economic Fallacies

How much would you pay to buy a dozen eggs? After you buy one dozen, would you pay less or more for another dozen? What about another dozen? Hopefully you said you’d pay less, and you’d be correct. The same is true for normal markets. If you’ve taken Econ 101, you’ve heard of supply and demand. Supply and Demand

Supply and Demand

As quantity increases (i.e. someone is selling tokens), the price would decrease if demand isn’t there. So the basic assumption that someone could sell 1M+ BTC without affecting the price is impossible. Remember what happened when FTX collapsed? SOL dropped by 50% in a few days because everyone wanted to sell and no one wanted to buy. SOL Price Collapse

SOL Price Collapse

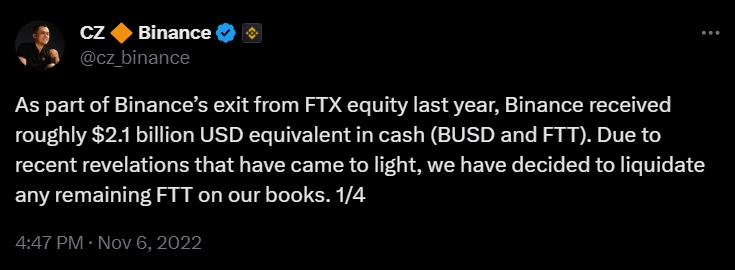

To go a step further, remember why CZ tweeted he was selling FTT? CZ FTX Tweet

CZ FTX Tweet

This was because Alameda Research owned $5.8B or 40% of their $14.6B balance sheet in FTT.² Having $5.8B worth of a token when the circulating supply is only $3.3B,² is a massive problem. CZ found out about this and quickly looked to divest those assets before FTX / Alameda’s loans overtook the value of their companies.

For DeFi, supply and demand is not similar to the stock market in that there is no bid/ask for the assets. Instead, most users use liquidity pools to trade tokens. Liquidity pools (LPs) are algorithms where a pool has a percentage of different types of assets with the most common being two tokens with 50% each. When a user trades a token for the other token, the pool charges a fee to rebalance the pool back to 50–50. As the trade value increases, the fee increases because the pool is becomes unbalanced. For some assets, Curve or other large LPs can handle large volume trades. But in reality, anyone who is making trades in the hundreds of millions or billions is using centralized exchanges or other methods.

Locked Tokens

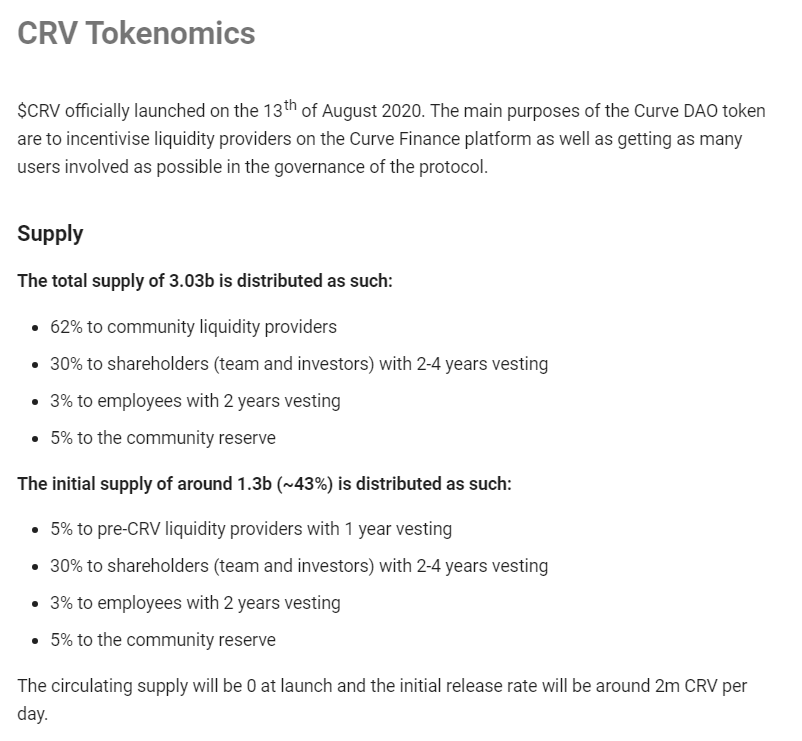

Most of us aren’t early investors in projects but if you are, then you’ve come across locked tokens. These are just tokens that were distributed to the founding teams and associated personnel which have a vesting period. If you work for any major company, the same concept applies with restricted stock options. These coins are usually included in the total market cap.

For example let’s look at Curve Finance. Below is a snip from their docs. The Curve team gave 1.3b tokens with different vesting periods from 1–4 years. This is approximately $0.72B at CRV’s price today. The locked tokens aren’t able to be sold so they do not affect the market price.

The Curve team gave 1.3b tokens with different vesting periods from 1–4 years. This is approximately $0.72B at CRV’s price today. The locked tokens aren’t able to be sold so they do not affect the market price.

Lost Coins

Remember the guy in the U.K. who threw away his computer with 8,000 BTC? These stories are common in crypto because of people losing their private keys. For BTC alone, the estimates range from 3 to 6 million BTC or 15 to 30% of total supply is lost forever.

That’s upwards of $219B that may no longer be accessible…… 1/6 of the total crypto market cap!

This problem is true across crypto and will continue to grow as people make mistakes and lose their private keys.

Leverage

Another hidden problem in crypto is leverage. Yes, TradFi has the same issues… The point here is that leverage can hide the true value of projects as investor think the company is worth more than it really is. One of the most common mechanisms for leveraging is “looping”. This is done when you deposit crypto into a lending protocol (e.g. Aave, Trader Joe), borrow against your collateral, and redeposit back into the protocol. You do this a few times and you have looped or leveraged your position. Lending protocols don’t keep track of who is looping, so they just add the assets to their total value locked to inflate the numbers they have on their books.

This is a problem because then companies who allow leverage, look bigger than they actually are. As a result, their tokens get inflated in value as they are perceived to be larger than they should be.

Why is this all Important?

When we enter the next bull market, there is the idea that as price rises, more and more money will need to enter crypto to continue to make prices rise. This is obviously true. The point is that $1T does not need to enter into crypto to have a requisite increase of $1T in market cap. The number is actually much much lower. Think about how much crypto is hidden away in cold wallets or know people who will never sell their crypto.

Going back to Econ 101, when the quantity is limited and demand increases, price rises.

Remember this point when you are told crypto can’t get to $100k or crypto can’t be a $10T market.

-Just Another Crypto Analyst

Doing this for fun but if you want to leave a tip: 0xa33aE4207466cD866D13fA587067B1F824C06d4A

Sources

[1] CoinMarketCap.com

[2] Samuel Haig. Nov 7 2022. “CZ Cranks up Pressure on FTX with Massive Token Sale.” The Defiant. https://thedefiant.io/binance-ftx-ftt-token-sale.

7

Crypto

Cryptocurrency

Bitcoin

Ethereum

Defi

7

Follow

Follow

Written by Just Another Crypto Analyst

8 Followers

·

Writer for

Coinmonks

Crypto Analyst sharing what I've learned over the years

More from Just Another Crypto Analyst and Coinmonks

Just Another Crypto Analyst

Just Another Crypto Analyst

in

Coinmonks

Navigating Chaos: Why Cryptocurrency is Emerging as a Preferred Asset Class

Introduction

8 min read

·

Nov 13, 2023

Shantanu Gupta

Shantanu Gupta

in

Coinmonks

Which Crypto Will Explode in 2024? Here Are Some Of MyTop Picks.

As we approach the end of the year, investors worldwide are gearing up for the anticipated bull run in the crypto market, eyeing the next…

4 min read

·

Dec 19, 2023

668

2

Velvet.Capital

Velvet.Capital

in

Coinmonks

🚨Velvet.Capital Token Distribution (Airdrop)🚨

🚨 Airdrop Alert🚨: DeFi Asset Management Done right! Everything you need to know for Velvet.Capital’s Token Distribution & Airdrop!

4 min read

·

Dec 30, 2022

38K

1020

Just Another Crypto Analyst

Just Another Crypto Analyst

in

Coinmonks

How to Get the Highest Yield on Your Stablecoins (Oct 2023)

All over the news, we are hearing that money markets, U.S. treasuries, and high interest savings accounts are all offering +5% APYs. And…

8 min read

·

Oct 15, 2023

8

See all from Just Another Crypto Analyst

Recommended from Medium

Scott Galloway

Scott Galloway

2024 Predictions

Each year, we review/make predictions re the past/coming year. Most years, we hit more than we miss. But we do miss — if we made 10…

11 min read

·

Jan 6

8.7K

119

0xAnn

0xAnn

in

Crypto 24/7

What we know about Bitcoin ETFs so far

It’s finally here, so how is the first impression?

·

5 min read

·

5 days ago

94

3

Lists

data science and AI39 stories

·

43

saves

Modern Marketing52 stories

Modern Marketing52 stories

·

368

saves

Generative AI Recommended Reading52 stories

Generative AI Recommended Reading52 stories

·

623

saves

Mike Coldman

Mike Coldman

Top 4 Crypto Gems Set to Explode in 2024 !

Unlock the Secret Strategies of Elite Investors and Transform Your Portfolio Overnight !

·

5 min read

·

Jan 8

170

3 Arthur Hayes

Arthur Hayes

Signposts

(Any views expressed in the below are the personal views of the author and should not form the basis for making investment decisions, nor…

12 min read

·

Jan 5

1K

4

Shawn Forno

Shawn Forno

in

The Startup

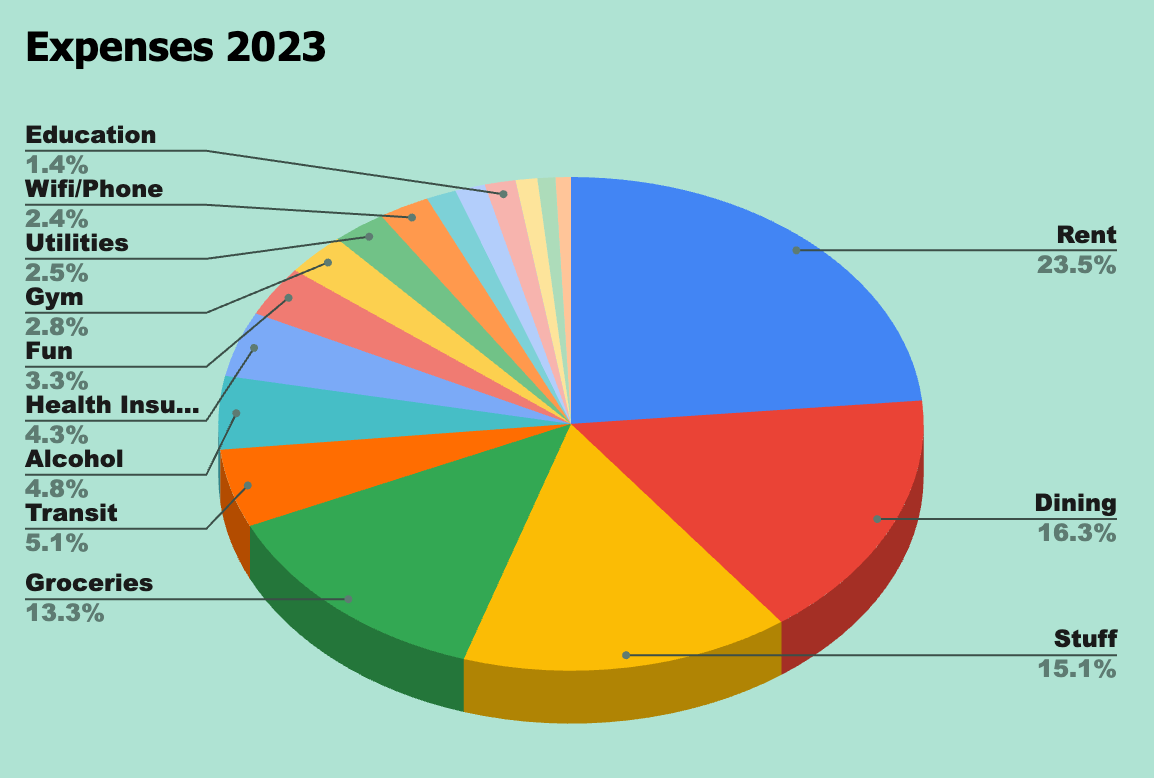

Here’s Exactly How Much it Costs to Live in Spain for One Year

An honest look at our average monthly expenses in Galicia, Spain

·

12 min read

·

Jan 6

2.6K

49

Zoran Spirkovski

Zoran Spirkovski

in

DuckDAO

Welcome to DuckDAO

Everything you need to know about our community in one article

6 min read

·

Jan 1

14

2

![[FAILED] Engage2Earn: McEwen boost for Rob Mitchell](https://cdn.bulbapp.io/frontend/images/c798d46f-d3b8-4a66-bf48-7e1ef50b4338/1)

![Nekodex – Earn 20K+ NekoCoin ($20) [Highly Suggested]](https://cdn.bulbapp.io/frontend/images/b4f0a940-f27c-4168-8aaf-42f2974a82f0/1)

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - OM(G) , My Biggest Bag Was A Scam????](https://cdn.bulbapp.io/frontend/images/99de9393-38a8-4e51-a7ab-a2b2c28785bd/1)