5 Easy Price Action Strategies

What is Price Action?

Price action is 'you' making trading decisions based on the price on formations & price patterns you see materializing in the market in the 'real time'.

Let's dive into 15 simple strategies!

1) Market Structure and Key Levels

Key resistance levels : Resistance levels are areas above price where price reversed drastically downwards from, which presents short trade oppurtunities when price comes back to these levels.

When price comes up to a recently formed resistance level, it is deemed expensive within that particular moment in time, meaning less buying occurs triggering the reversal downwards.

Key support levels : Support levels are areas below price where price reversed drastically upwards from, which presents long trade oppurtunities when price comes back to these levels.

When price comes up to a recently formed support level, it is deemed cheap within that particular moment in time, meaning value buyers will load up triggering the reversal upwards.

2) Supply & Demand + Multiple Reversals of Price

An area above, where price reverses off of multpile times, is known as a supply zone, and area below, where price reverses off of multpile times, is known as a demand zone.

Supply Zones:

The market is deeming this area of price as expensive, which results in buyers consistenly deciding the close their long positions at this area and sellers choosing to hold this area strong and open for new short oppurtunities.

Demand Zones:

The market is deeming this area of price as cheap, which results in sellers consistenly deciding the close their short positions at this area and buyers choosing to hold this area strong and open for new long oppurtunities.

Example :

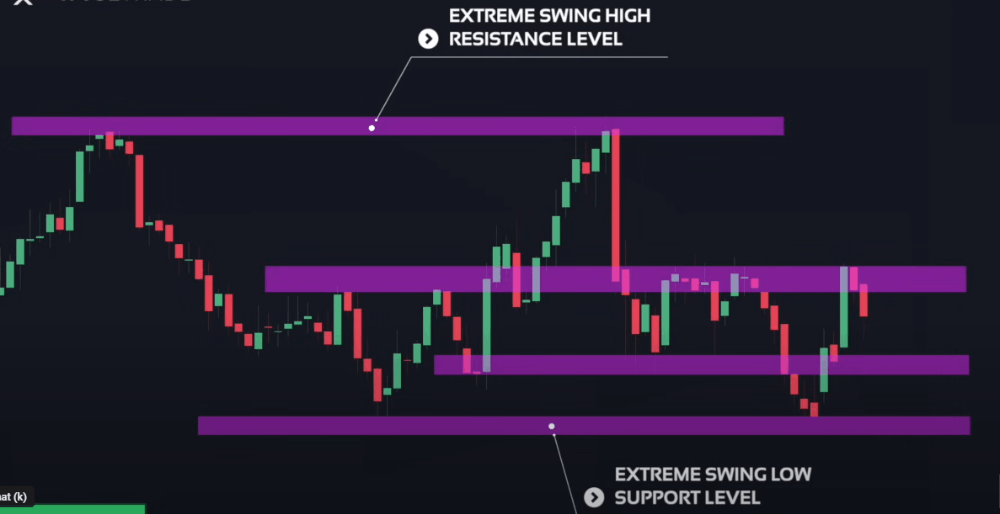

3) Extreme Swing High and Lows

Short trade setups off swing highs are of higher quality, because there is a higher percentage chance of price reversing off the level as price deemed very expensive within that time frame.

Also,

Long trade setups off swing lows are of higher quality, because there is a higher percentage chance of price reversing off the level as price deemed very cheap within that time frame.

4) Higher Time Frame Key Levels

These are the key levels that are visible and visiually obivous on the higher time frames such as weekly and monthly, because they are slower to form, they are high quality meaning price ofthen react to them.

- When you are using the weekly or monthly time frame, many of the key levels you find on the lower time frames are not visible.

- The levels that are visible and obivous on the weekly and monthly time frames known as the major key levels.

- Major key levels are levels where there is a higher chance of price reversing off them.

5) Long Wick Candlesticks

Long wick candles where the wick is sticking out, paired with the key levels of support or resistance is one of the best ways to identify high quality price action trade setups.

For more price action strategies and learn the PA:

https://www.investopedia.com/terms/p/price-action.asp

https://priceaction.com/price-action-university/beginners/what-is-price-action/

I hope this 'great' article helps you know the what PA is! Feel free to show your strategies in the comments!

![[FAILED] Engage2Earn: McEwen boost for Rob Mitchell](https://cdn.bulbapp.io/frontend/images/c798d46f-d3b8-4a66-bf48-7e1ef50b4338/1)

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - Is Trump Dying? Or Only Killing The Market?](https://cdn.bulbapp.io/frontend/images/a129e75e-4fa1-46cc-80b6-04e638877e46/1)