Robinhood CEO: Company Considers Bitcoin Reserve

Robinhood has shown increasing interest in crypto, but CEO Vlad Tenev insists the company has no plans to hold Bitcoin, although the idea is being considered.

In a recent interview, CEO Vlad Tenev revealed that Robinhood has considered the possibility of holding Bitcoin in the future, especially as cryptocurrencies become an increasingly integral part of the company's business strategy.

However, he also frankly said that holding BTC in treasury could mislead investors, causing them to see Robinhood as a "Bitcoin investment company" instead of a comprehensive financial trading platform. Mr. Tenev said that the company currently only holds certain coins for trading for customers but does not consider this a long-term investment. He shared:

“We do not completely reject this idea. But at the moment, Robinhood is not going in that direction, we are focused on providing a trading platform, not long-term investment in cryptocurrencies."

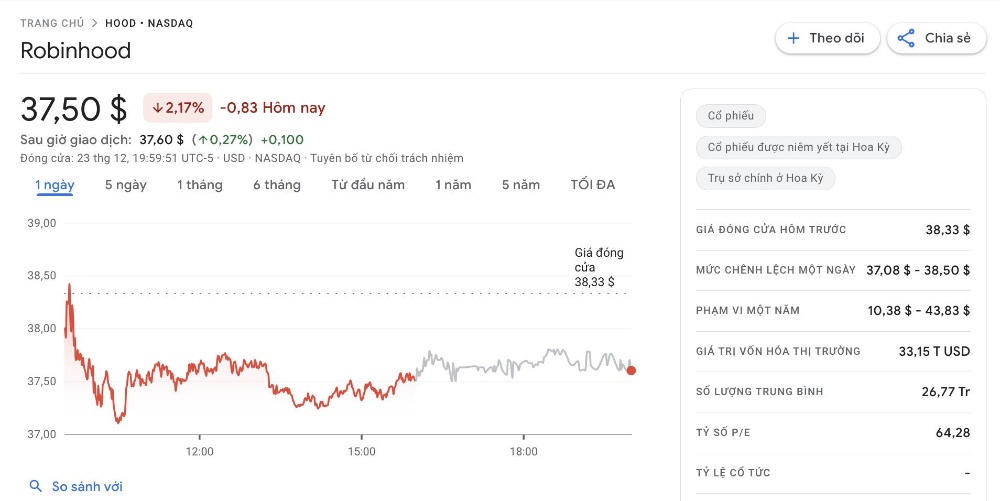

CEO Vlad Tenev emphasized that although the company does not invest in Bitcoin, Robinhood's stock (HOOD) shows a close connection with the price fluctuations of the king coin. Since the beginning of the year, HOOD's stock price has skyrocketed 202%, far surpassing Bitcoin's 110% increase in the same period.

In November, analysts from Bernstein rated Robinhood as the platform that "benefits the most from the loosening of cryptocurrency regulations" after Donald Trump's victory in the 2024 US presidential election. Many experts even predict that Robinhood's cryptocurrency revenue will increase by 20% by the end of 2025, accounting for 38% of the company's total revenue.

However, Robinhood is still quite cautious in its decision to provide cryptocurrency trading services crypto for customers. So far, the company has only offered a few digital asset investment options and listed fewer tokens than competitors such as Coinbase or Kraken. Recently, the platform has relisted 3 coins Solana (SOL), XRP (XRP), Cardano (ADA) for users in the United States after more than 1 year of delisting due to securities allegations from the SEC. In addition, the platform also added Pepe (PEPE) to the listing list, contributing to the rapid push of this memecoin to a new ATH.

In addition, Robinhood is also preparing to complete the acquisition of cryptocurrency exchange Bitstamp for up to 200 million USD, opening a turning point in its market expansion strategy. Through this deal, Robinhood plans to take advantage of Bitstamp's license to launch Bitcoin (BTC) and Ethereum (ETH) futures trading on CME in the United States, while expanding its token trading portfolio in the European market.

If Robinhood decides to hold Bitcoin, it will join the ranks of giants like MicroStrategy and Tesla in the growing race to stockpile Bitcoin. Over the past year, the trend has attracted a number of public companies, with newcomers like Semler Scientific and Metaplanet joining the fray, marking a major shift in how businesses approach digital assets.

![[LIVE] Engage2Earn: McEwen boost for Rob Mitchell](https://cdn.bulbapp.io/frontend/images/c798d46f-d3b8-4a66-bf48-7e1ef50b4338/1)

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - Is Trump Dying? Or Only Killing The Market?](https://cdn.bulbapp.io/frontend/images/a129e75e-4fa1-46cc-80b6-04e638877e46/1)